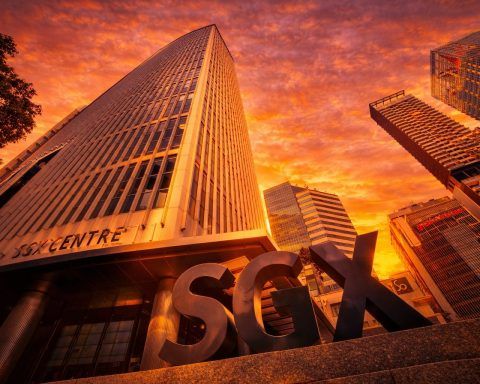

Singapore Exchange (SGX) stock edges down as bond futures plan emerges; Feb 5 results ahead

Shares of Singapore Exchange fell 0.2% to S$17.69 by 3:35 p.m. Wednesday after reports of talks on launching Asian government bond futures. SGX is discussing contracts tied to bonds from India, Indonesia, Malaysia, the Philippines, and Thailand, with a possible launch in early 2026. The next major event is SGX’s first-half FY2026 results on Feb. 5.