Nvidia Stock, the AI Bubble Debate, and the Data Center Gold Rush: What December 1, 2025 Really Looks Like

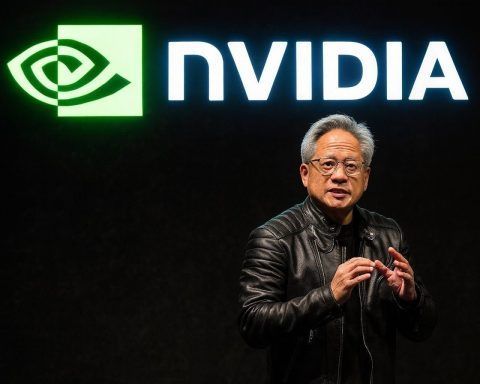

Nvidia’s stock is limping into December after a volatile November, even as CEO Jensen Huang insists the artificial intelligence boom is not a bubble. Meanwhile, data center spending, short sellers, and macroeconomists are all treating Nvidia as a proxy for the future of the U.S. economy itself. Here’s what the latest reporting and analysis up to December 1, 2025 tell us about Nvidia, AI chips, and the risk of an AI-driven crash. Nvidia’s Rough November — and Why December Still Matters Nvidia shares finished November on the back foot. A recent Barron’s piece notes that the stock fell again on