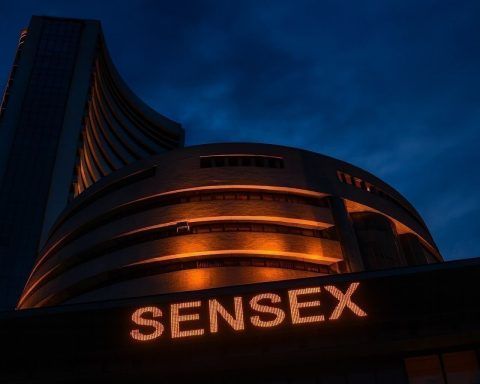

BSE Ltd Share Price Today (10 December 2025): Derivatives-Led Growth, Rich Valuations and What Analysts Expect for 2026

BSE Ltd — the listed entity behind Asia’s oldest stock exchange — remains one of the most closely watched “picks-and-shovels” plays on India’s booming equity markets. On 10 December 2025, the stock is cooling off after a blistering multi‑year rally, even as earnings momentum and derivatives volumes stay strong and broker views turn more nuanced. BSE Ltd share price today: Soft session after a strong run Around midday on 10 December 2025, BSE Ltd shares were trading close to ₹2,650–2,660, roughly 2–3% lower than the previous close of ₹2,715.80 on the NSE.Business Standard+2mint+2Intraday, the stock has largely moved in the