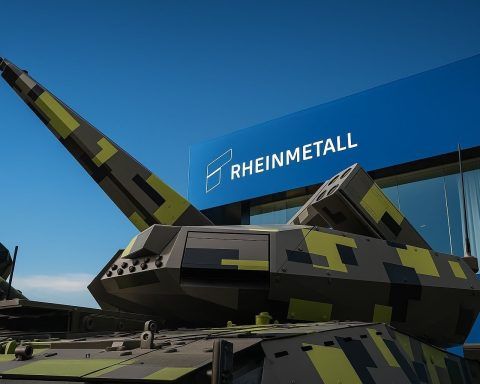

Rheinmetall AG Stock on 1 December 2025: Is the German Defence Champion a Buy After the Pullback?

Rheinmetall shares closed at €1,480–1,500 on 28 November 2025, down about 25% from this year’s highs but still more than double year-ago levels. The stock fell over 3.5% on 1 December as defence names dragged the DAX lower, following sharp declines after Russia-Ukraine peace headlines. Q3 results showed sales up 20% year-on-year to €7.5 billion and a record order backlog.