NEW YORK, December 30, 2025, 7:46 PM ET — After-hours

- Caterpillar shares were down about 0.2% in post-market trading, after a quiet year-end session.

- A new SEC filing detailed additional cash-settled “phantom” units credited to CEO Joseph Creed under a deferred-compensation plan.

- Investors kept focus on growing demand for on-site generators tied to artificial intelligence data centers.

Caterpillar Inc (NYSE:CAT) shares were down about 0.2% at $577.39 in after-hours trading on Tuesday, a small move that followed a narrow regular-session range. The stock traded between $575.68 and $580.95.

The muted move still matters into the final U.S. trading day of the year because Caterpillar has become a crowded way to express two themes at once: demand for heavy equipment tied to construction and mining, and a newer wave of spending on power equipment for artificial intelligence, or AI, data centers.

Year-end liquidity is thin, which can amplify swings in widely held industrial names. Traders are also watching whether money continues to rotate away from the biggest technology winners and into more cyclical stocks.

U.S. stocks ended slightly lower, with the Dow down 0.2%, the S&P 500 off 0.14% and the Nasdaq down 0.23% as investors parsed fresh Federal Reserve minutes. “It’s just a healthy rebalancing of allocations,” said Mark Hackett, chief market strategist at Nationwide. Reuters

A Form 4 filed with the U.S. Securities and Exchange Commission showed CEO Joseph E. Creed was credited with 26 phantom stock units on Dec. 26 under a non-qualified deferred compensation plan. The filing said the units generally track Caterpillar’s share price and are settled 100% in cash when the executive retires or separates from service. SEC

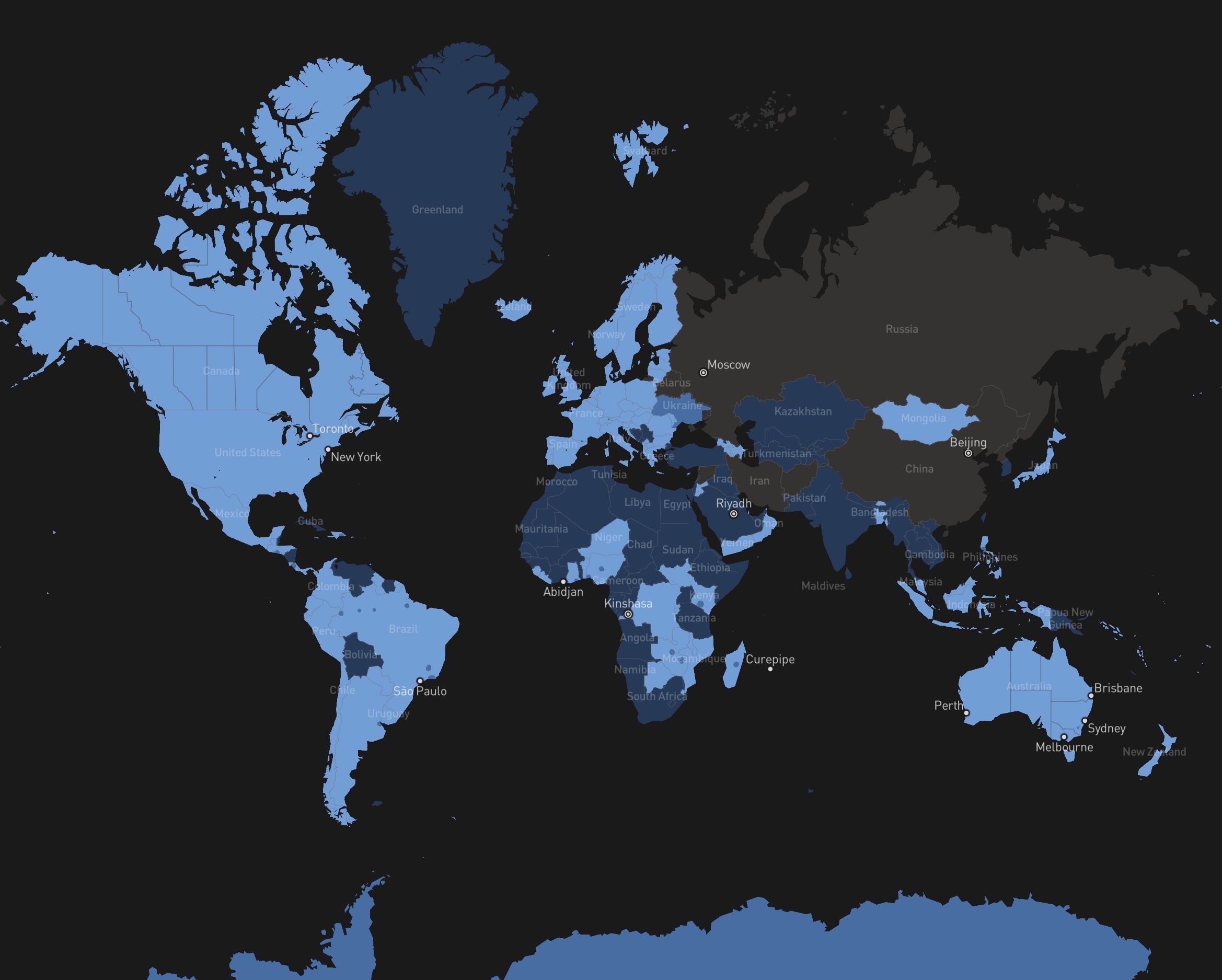

The Wall Street Journal reported earlier Tuesday that a planned Utah data-center campus that could require roughly one-quarter of the state’s current electricity use plans to rely on more than 700 Caterpillar natural-gas generators as developers look to bypass constrained power grids. The paper said the data-center push has helped lift Caterpillar shares about 62% so far in 2025, with generator makers such as Cummins and GE Vernova also seeing gains. The Wall Street Journal

For the broader market, the Fed minutes released Tuesday showed policymakers were divided after the central bank cut rates at its December meeting, keeping the interest-rate path in focus for cyclicals. The Fed meets next on Jan. 27-28, with investors expecting no change in the benchmark rate. Reuters

Borrowing costs matter for Caterpillar because equipment demand can cool when financing gets expensive, particularly for construction fleets and smaller contractors. That makes any shift in the Fed outlook a direct input into how investors model 2026 volumes.

From a trading perspective, the shares finished near the lower end of Tuesday’s range. Technicians often treat the day’s low area as the first near-term support level, with recent highs watched as the next hurdle if buyers step back in.

With one session left in 2025, positioning and tax-related activity may compete with fundamentals in driving late moves. Any sharp shift in Treasury yields can also ripple quickly through industrial shares that are sensitive to growth expectations.

Caterpillar has not confirmed its next earnings date, but Nasdaq’s earnings calendar shows an estimated report on Jan. 29, 2026. That release is the next major company catalyst for investors watching whether data-center power demand can keep offsetting the more cyclical parts of the business. Nasdaq

Investors will be listening for updates on capacity plans for engines, turbines and generator sets, and for commentary on dealer inventory trends. Guidance tone matters because the stock’s 2025 run has left less room for disappointment.

For now, Caterpillar remains both an industrial bellwether and a beneficiary of the AI-infrastructure buildout. That mix has made the stock especially sensitive to power-demand headlines and any change in the interest-rate narrative.