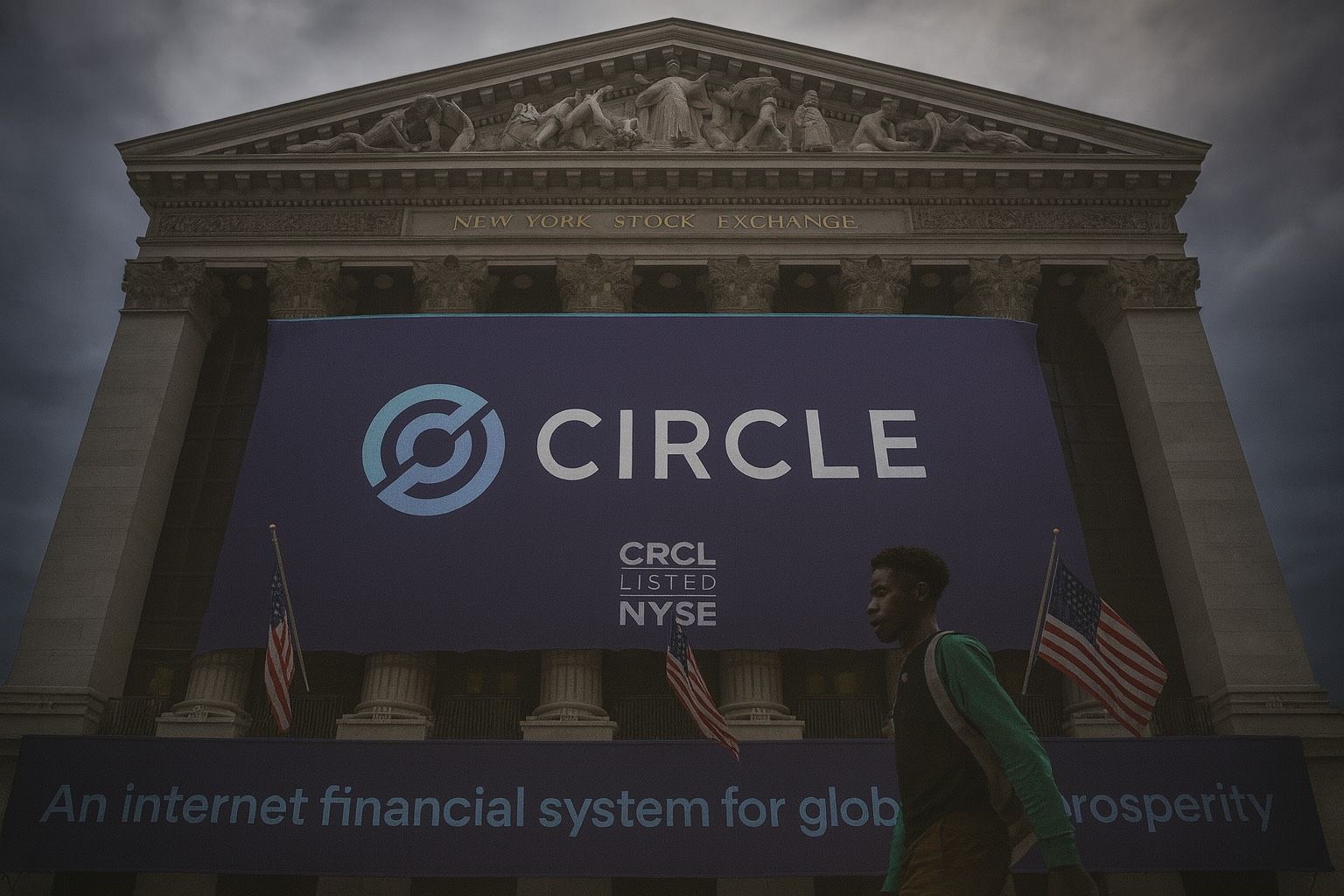

Key Facts: Circle Internet Group (NYSE: CRCL) is a fintech firm behind major digital currencies (US Dollar Coin USDC and Euro Coin EURC). It went public in June 2025 at $31 per share and quickly surged about 6× to ~$200 after U.S. stablecoin legislation passed reuters.com. Today it ranks as the second-largest stablecoin issuer (USDC market cap ~$73B) investing.com. The company has formed high-profile partnerships – e.g. teaming with Kraken (Sep ’25) to boost USDC/EURC trading circle.com and an MOU with Deutsche Börse (Sept 2025) to integrate stablecoins into European markets circle.com. Founder/CEO Jeremy Allaire (ex-Goldman exec) leads a small management team focused on expanding a global payments network. CRCL stock has climbed ~80% over the past six months investing.com and jumped 17.7% on Oct 2, 2025 after news of strategic deals stockstotrade.com. As of early October 2025, analysts remain divided – e.g. Rothschild Redburn set a Neutral rating (target $136) investing.com while Citi initiated coverage at Buy ($243 PT) investing.com – reflecting big potential but also lofty valuations.

Current State – Finances, Operations & Strategy

Circle’s core business is issuing regulated stablecoins and building blockchain-based payment infrastructure. In Q2 2025 it reported roughly $1.67 billion in revenue (mainly interest on reserves) but also a net loss (~$482 million), as it invests heavily in growth stockstotrade.com. The company nonetheless has a strong balance sheet: total assets were ~$64.2B with ~$63.1B in cash and equivalents stockstotrade.com. Circle’s strategy is to expand USDC/EURC usage through new products. This summer it launched Arc, a dedicated Layer-1 blockchain for stablecoins, and has built a Circle Payments Network (CPN) to let banks and institutions settle transactions in USDC/EURC in real time. For example, at a Circle conference in Sept 2025 it announced partners Arf and Huma will join CPN to provide on-demand USDC credit (reducing the need for large prefunding) arf.one. Leadership is led by co-founder Jeremy Allaire (CEO) and a small team; Allaire emphasizes working within regulation (Circle was the first major stablecoin issuer to comply with Europe’s MiCAR rules circle.com) and targeting both crypto and traditional finance clients.

Stock Performance & Valuation Trends

Since its June 2025 IPO (and a ~$31 per-share price), CRCL shares have soared. After debuting up 168% (to ~$82) in early June investopedia.com, a pro-crypto stablecoin law in mid-June sent the stock to about $200 – roughly 6× the IPO price reuters.com investopedia.com. By Oct 2025 the rally moderated but remained strong: CRCL traded in the mid-$140s and had climbed roughly 80% over six months investing.com. In late Sept/early Oct, the stock saw sharp spikes: on Oct 2 it surged ~17.7% intraday (around $150) after news of major partnerships stockstotrade.com. Analysts note the valuation is rich given the firm’s losses, but also point to booming demand: for context, Citi analysts reported that Circle’s shares had already returned 117% over the prior six months (despite high volatility) investing.com. Price targets vary widely: Citi’s early coverage (Jun ’25) gave a $243 target on bullish assumptions investing.com, while Rothschild Redburn (Oct ’25) set a neutral $136 target investing.com. Circle’s market capitalization is on the order of $40–45 billion investing.com, reflecting lofty growth expectations.

Recent News & Developments (Late Sept – Oct 3, 2025)

Circle has been in the spotlight with a flurry of announcements. On Sept 17, 2025, it announced a partnership with crypto exchange Kraken: Kraken will expand liquidity and access for USDC and EURC (its new euro stablecoin) on the Kraken platform, giving Kraken users lower fees and new stablecoin options circle.com. On Sept 30, Circle’s press release revealed a Deutsche Börse collaboration: Circle and the German exchange operator signed an MoU to integrate USDC/EURC into Deutsche Börse’s infrastructure (including listing on its 360T/3DX platforms and using Clearstream custody) circle.com. Also on Sept 30 (at its Singapore forum), Circle announced that fintech firms Arf and Huma will join its Circle Payments Network (CPN) to provide credit services and liquidity in USDC arf.one. These moves dovetail with Circle’s August launch of the Arc blockchain (a new Layer-1 aimed at stablecoin finance). Financial partnerships are also driving news: Circle struck a June 2025 collaboration with Fiserv (payment processor) to integrate USDC into banking rails investing.com, and rumors of digital asset projects (like Interactive Brokers exploring stablecoins) keep the industry abuzz.

On the analyst front: on Oct 3, 2025, Rothschild & Co (through Redburn) initiated coverage of CRCL with a Neutralrating and $136 target investing.com. Around the same time, circle remained a favorite with some peers: analysts at Bernstein and others were positive – Bernstein’s team reiterated an Outperform rating (with a $230 target) amid competition for USDC investing.com. The Circle board also saw changes: long-time advisor David Orfao announced his resignation (non-contentious) investing.com. Overall, the past few days have seen Circle’s stock react strongly to these partnerships and coverage changes – for example, StocksToTrade noted the stock “surged 17.7% after a major partnership announcement fueled investor optimism” stockstotrade.com.

Market Sentiment & Expert Commentary

Investors and analysts are generally upbeat about Circle’s prospects. Many highlight the massive potential of stablecoins: Rothschild’s report noted that stablecoin volume is only about 1.2% of US money supply, implying an addressable market that could span all digital money transfers investing.com. Zacks Investment Research’s strategist Andrew Rocco commented on legislation, saying the new stablecoin bill “can accelerate [stablecoin] demand” reuters.com. Bernstein analysts famously declared that once U.S. law is passed, stablecoins could become the “money rail of the internet” rather than just crypto reuters.com. These bullish views contrast with caution about profitability: many experts remind that Circle is not yet profitable (June quarter loss ~$482M stockstotrade.com) and that its distribution costs (mainly payments to partners like Coinbase) are high. For example, Rothschild notes Circle pays 60% of its interest income on reserves as distribution (mostly to Coinbase) but expects costs to decline over time investing.com. In public commentary, Circle’s CEO Jeremy Allaire has sounded optimistic: he tweeted after the Senate bill that “history is being made” and that stablecoin regulation will boost U.S. competitiveness reuters.com. Overall, the market sentiment is a mix of excitement – driven by growth stories and partnerships – and caution over regulation and competition.

Industry & Sector Context

Circle sits at the intersection of fintech, crypto, and even energy/climate trends. In financial tech, stablecoins and blockchain are booming: global regulators (like the U.S. and Europe) are moving to legitimize digital currency rails, and big banks are exploring crypto. Industry data show stablecoin adoption is skyrocketing; U.S. stablecoin law (the “GENIUS Act”) passed the Senate in June 2025 reuters.com, and Circle’s USD Coin underpins much of crypto’s current transaction volume. Compared to legacy finance, stablecoins aim to make cross-border payments faster and cheaper – Circle touts its Circle Payments Network for real-time settlement using USDC/EURC.

On the energy/climate side, blockchain is increasingly used for carbon markets. Climate-tech analysts note that tokenizing carbon credits is a trillion-dollar trend: McKinsey forecasts voluntary carbon markets surpassing $100B by 2030 (partly via blockchain). Circle is targeting this intersection. As CarbonCredits.com observes, “Circle Internet Group (NYSE: CRCL)… plays a pivotal role” in modernizing carbon markets, using its trusted stablecoin rails to make tokenized carbon credits more transparent and accessible carboncredits.com. For example, Circle has partnered with Toucan Protocol and KlimaDAO to bring USDC into carbon trading on-chain. In this way, Circle’s business touches energy markets by facilitating financing of renewable projects through its crypto network. (Circle is also positioning Arc and USDC as lower-energy blockchain solutions compared to Bitcoin’s heavy power use – its Arc chain is based on a high-speed consensus that is far more energy-efficient.)

Forecasts & Outlook

Analysts’ forecasts for CRCL vary widely but mostly hinge on stablecoin adoption. High-end projections assume Congress and regulators fully green-light digital currencies. For instance, Citi’s report (June ’25) was extremely bullish, arguing Circle is a “leading enabler of stablecoin adoption” and setting a $243 price target investing.com (citing scarce supply, network effects, and legislative tailwinds). Similarly, Bernstein’s optimistic stance and $230 target presumes stablecoins scale dramatically investing.com. On the other hand, firms like Rothschild are more conservative, warning of volatility and setting a far lower target investing.com. In the near term, most experts expect continued volatility: the stock may swing on each new crypto partnership or regulatory clue. Medium-term, if stablecoins become widely used by banks and businesses, Circle’s revenues (based on interest spreads and transaction fees) could climb sharply. As one analyst put it, stablecoins could go from a crypto niche to the backbone of internet finance reuters.com. That would bode well for Circle. However, risks remain: any delays in U.S. legislation or technical competition (e.g. from other blockchains or payment networks) could slow growth.

Sources: Company press releases and financial filings; Reuters, Investing.com, and StocksToTrade financial analysis; sector reports and expert commentary circle.com circle.com reuters.com investing.com carboncredits.com. Each fact and quotation above is drawn from the cited sources.