Key Facts:

- Oil surges on supply shocks: Brent crude jumped above $70 a barrel after Ukraine’s drone strikes slashed Russian fuel exports and Moscow imposed a partial diesel export ban reuters.com reuters.com. Analysts say the conflict’s escalating “drone attacks…are beginning to add up” in tightening supply reuters.com.

- Record-breaking precious metals: Gold spiked 2.5% this week, touching an all-time high near $3,791/oz amid safe-haven demand and Fed rate-cut bets reuters.com. U.S. inflation data in line with forecasts reinforced expectations for more Fed easing reuters.com. Silver and platinum also hit 14-year and 12-year highs, respectively reuters.com, as investors flock to cheaper alternatives.

- Copper outlook tightens: A major disruption at Indonesia’s Grasberg mine flipped the 2025 copper balance from surplus to deficit reuters.com reuters.com. Goldman Sachs hiked its price targets into the $10,200–$10,500/ton range and now sees $12,000 in 6–12 months (base case) amid constrained supply reuters.com reuters.com.

- Grain markets rattled by trade shifts: Chicago soybeans fell for a second straight week as China snubbed U.S. crops, snapping up ~40 Argentine cargoes during a brief tax holiday agcanada.com agcanada.com. U.S. November soybeans ended around $10.14/bu (–1.1% on the week) agcanada.com, while corn and wheat sagged on harvest pressure and ample global supply agcanada.com agcanada.com.

- Livestock supply shocks: U.S. lean hog futures hit contract highs (Oct. hogs >101¢/lb) after a “smaller-than-expected” pig herd sparked fears of a winter pork shortfall producer.com producer.com. Meanwhile, cattle markets steadied near record levels as U.S. herds remain the smallest in decades, even as feedlots show tentative signs of rebuilding producer.com producer.com.

- Soft commodities diverge: Arabica coffee prices hovered near 7-month peaks (~$3.70+/lb) after a 50% U.S. import tariff on Brazilian beans upended trade flows reuters.com reuters.com. Brazil’s exports to the U.S. plunged 46% in August reuters.com, fueling a speculative frenzy with “no ceiling” in sight reuters.com. In contrast, sugar sunk to 2½-month lows (~15¢/lb) as Brazil’s bumper crop and India’s looming export surplus bolstered global supplies tradingview.com tradingview.com.

Energy: War Drives Oil Higher, Gas Steadies, Renewables Reshuffled

Oil – War and Output Cuts: Crude markets rallied sharply to close the week, propelled by geopolitics. Brent oil settled at $70.13/bbl (▲1.0%) while WTI ended at $65.72 (▲1.14%), with both benchmarks posting their biggest weekly gain since June reuters.com. Traders pinned the surge on escalating war disruptions: Ukraine’s stepped-up drone strikes have knocked out portions of Russia’s refining capacity, forcing Moscow to halt diesel exports through year-end and extend a gasoline ban reuters.com. “Markets continued to be focused on the situation between Russia and Ukraine,” said John Kilduff of Again Capital. “These drone attacks by Ukraine are beginning to add up” in curtailing Russian supply reuters.com. Russian officials confirmed some regions are now facing fuel shortages, underscoring the impact reuters.com.

Analysts noted additional bullish catalysts. NATO’s warning that it would respond to further airspace violations by Russia has “ratcheted up tensions” and raised the prospect of new sanctions on Russian oil, according to ANZ’s Daniel Hynes reuters.com. At the same time, a breakthrough in Iraq-Turkey relations is set to resume oil flows from Iraq’s Kurdistan region for the first time in 2.5 years reuters.com, which could add supply if sustained. “The market will be watching Kurdish production to see what that will add to supply,” noted Andrew Lipow of Lipow Oil Associates reuters.com. Lipow added that U.S. policy moves are also shaping the market: “President Trump continues to pressure U.S. allies to reduce Russian imports… We might see India and Turkey reduce some of their Russian imports,” he said reuters.com reuters.com. Indeed, Washington this week told India that curbing its re-export of Russian oil is key to progressing trade deals reuters.com, highlighting oil’s role in diplomacy.

On the demand side, a surprisingly strong U.S. economy is providing a tailwind. Revised data showed U.S. GDP grew an annualized 3.8% last quarter reuters.com. “U.S. economic data has been OK. And with the Fed easing interest rates, that will contribute to demand,” Kilduff noted reuters.com. The Fed delivered its first rate cut since December last week (25 bps), and although robust growth could make officials cautious about further easing reuters.com, traders are betting on more stimulus that could boost fuel consumption.

Natural Gas – Strikes vs. Supply: European natural gas prices ended the week firm but range-bound hellenicshippingnews.com. The benchmark Dutch TTF contract hovered around €32.7/MWh (≈$11.20/mmbtu) after inching up ~€0.3 on Friday hellenicshippingnews.com. The gradual end of Norway’s North Sea maintenance season is finally lifting pipeline flows – up an estimated 640 GWh/day this week hellenicshippingnews.com – which analysts say was “badly needed” to avoid premature storage draws hellenicshippingnews.com. However, early colder-than-normal weather and unexpected LNG disruptions offset the extra Norwegian supply hellenicshippingnews.com. In France, strikes led operator Elengy to declare force majeure at key LNG import terminals, halting cargoes until at least Oct. 2 hellenicshippingnews.com. That combo of chillier temperatures, low wind power, and crippled LNG deliveries means Europe will start pulling from gas storage in the coming days hellenicshippingnews.com. Storage sites are about 82% full (vs 93.8% a year ago) as winter approaches hellenicshippingnews.com. Analysts at Energy Aspects cautioned that even with healthy stocks by end-October, “significant upside price risk” remains if a cold snap hits later in winter hellenicshippingnews.com. On the policy front, EU ministers this week debated fast-tracking limits on Russian LNG imports under U.S. pressure reuters.com reuters.com, even as Russia’s pipeline gas now accounts for only ~13% of Europe’s supply (down from 45% pre-war) reuters.com.

Renewables – Policy Whiplash and Consolidation: In the clean energy space, U.S. policy shifts are reshaping the industry landscape. The Trump administration’s recent pivot away from green incentives – encapsulated in the new “One Big Beautiful Bill Act” – slashed longstanding solar and wind tax credits, dramatically shortening project eligibility windows reuters.com reuters.com. This aggressive “energy dominance” agenda (prioritizing oil, gas, coal and nuclear over renewables) has jolted the sector. “The Trump administration’s rapid retreat from renewable energy has kicked off consolidation and asset sales among smaller U.S. solar and wind companies as they scramble to stay afloat,” Reuters reports reuters.com. With investment credits eliminated, many marginal players are seeking buyers or partners. Clean energy M&A has exploded – 63 deals worth $34 billion in the first half of 2025 alone, versus just $7 billion in the second half of 2024 reuters.com. “There’s likely to be consolidation due to [these] federal moves…including the recently passed tax bill which eliminates investment tax credits,” said Altus Power CEO Gregg Felton reuters.com.

Private equity firms, utilities, and even oil companies are bargain-hunting for distressed renewable assets. By contrast, larger, well-capitalized players see opportunity in this shakeout to expand their clean energy portfolios. The policy U-turn also has short-term climate impacts: U.S. solar and wind installation rates are expected to dip as subsidies wane, though some of that slack may be picked up by nuclear and fossil projects prioritized under Trump’s plan reuters.com. On a positive note for green investors, corporate dealmaking signals long-term confidence in renewables despite Washington’s stance. Analysts predict the most efficient solar and wind firms will weather the storm, positioning for growth if political winds shift again.

Oil prices rallied as Ukraine’s attacks on Russian infrastructure and export bans tightened supplies, pushing Brent crude above $70 reuters.com reuters.com. Geopolitical risks and OPEC+ policy will remain key for energy traders.

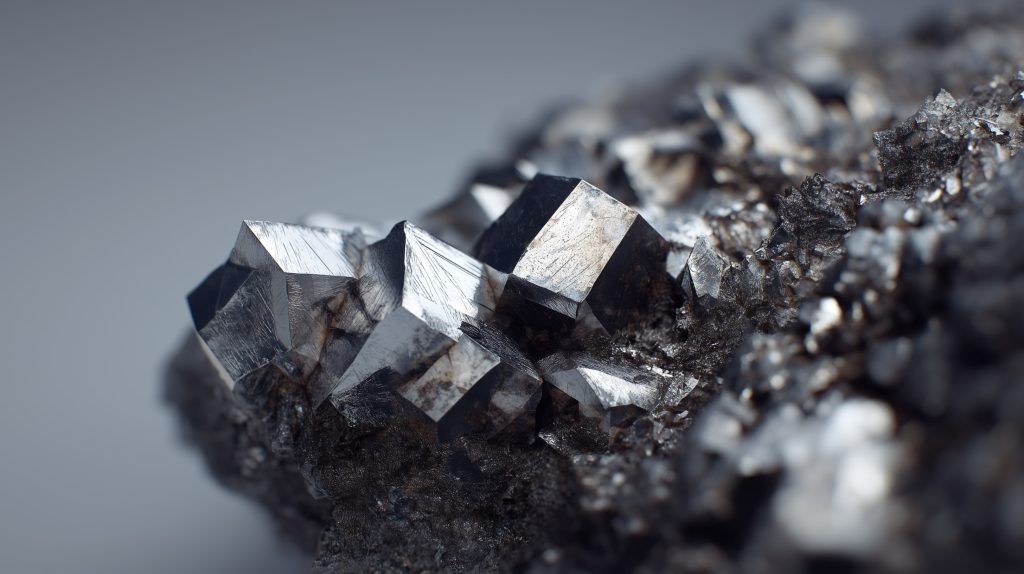

Metals: Precious Records & Base Metal Bullishness

Gold & Precious Metals – Glittering Heights: It’s been a historic week for gold, which soared to record highs amid a perfect storm of bullish factors. Spot gold settled around $3,779/oz Friday after briefly kissing $3,790.82 – an all-time peak reuters.com reuters.com. The rally was fueled by hopes that U.S. rate cuts are on the horizon. Fresh data showed the Fed’s preferred inflation gauge, core PCE, rose 2.7% in August – exactly as expected reuters.com. With price pressures moderating, traders now see an 88% chance of a Fed rate cut in October (and ~65% odds of another in December) reuters.com. “Nothing from this data will prevent the Fed from carrying on with another cautious rate cut at the October meeting,” said independent metals trader Tai Wong reuters.com. Lower interest rates burnish bullion’s appeal by reducing the opportunity cost of holding non-yielding assets reuters.com.

Safe-haven demand is also robust. Ongoing geopolitical tensions – from Eastern Europe to U.S.-China trade frictions – have investors seeking refuge in tangible assets. Gold has now climbed ~100% since late 2022, and some analysts predict it could test the $4,000 mark next year once a near-term correction runs its course reuters.com. U.S. futures closed even higher than spot, with December gold at ~$3,809 reuters.com, reflecting bullish sentiment going into year-end.

Other precious metals piggybacked on gold’s rise. Silver surged 2.6% Friday to ~$46.41/oz – its highest in over 14 years reuters.com. With gold at stratospheric levels, investors have turned to silver as a more affordable haven, boosting its momentum reuters.com. Industrial demand plays a role too: silver is a key component in solar panels, and China’s new pledge to cut carbon emissions 7–10% by 2035 has spurred extra silver buying for solar manufacturing reuters.com. Platinum also rocketed up 2.5% to ~$1,568/oz, marking a 12-year high reuters.com. The autocatalyst metal is seeing renewed interest as well, with traders noting that at these price extremes “investors [are] turning to more affordable alternatives” like platinum and silver reuters.com. Even palladium caught a bid (up ~2.8% to $1,285 reuters.com), aided by a tighter supply outlook – top miner Norilsk has flagged lower output, and inventory drawdowns continue.

Base Metals – Copper’s Tight Squeeze: In the industrial metals arena, copper is the talk of the town with a fundamentally tightening backdrop. A mid-September accident at Freeport-McMoRan’s Grasberg mine in Indonesia (the world’s #2 copper mine) has proven more disruptive than initially thought reuters.com. A Sept. 8 mudflow incident trapped workers and forced Freeport to declare force majeure on shipments reuters.com. Now the fallout is evident: Goldman Sachs slashed its global copper supply forecast, estimating a hefty 525,000-ton reduction in mine output across 2025-2026 due to Grasberg’s troubles reuters.com. The bank expects Grasberg’s own production will plummet ~250k tons this year and ~270k next year reuters.com. This supply shock is so large it will nearly erase growth in world mine output – Goldman cut its 2025 production growth forecast from +0.8% to a mere +0.2% year-on-year reuters.com. In fact, 2025 is now seen moving into deficit (~55,000-ton shortfall) whereas a surplus had been expected pre-accident reuters.com reuters.com.

The prospect of a tighter market has put a firm floor under prices. London copper is already trading around $10,290/ton (LME 3-month) reuters.com – near 5-month highs – and forecasts are being revised higher. Goldman signaled upside risk to its late-2025 target of $9,700/ton, suggesting prices could average $10,200–$10,500 by December 2025 as the deficit bites reuters.com reuters.com. Citi went a step further, hiking its 3-month and Q4 copper targets to $10,500 (from $10,000) and predicting a rally to $12,000/ton within 6–12 months in its base case, or even $14,000 in a bullish scenario reuters.com. Driving these calls is the expectation of a sizeable 400k ton deficit in 2026 if demand holds up reuters.com. Freeport aims for a phased Grasberg restart by mid-2026 reuters.com, but in the interim the market must cope with razor-thin supply cushion.

Other base metals are relatively mixed. Aluminum and nickel saw range-bound trading this week, balancing China’s tepid economic signals against energy-driven cost pressures. Iron ore remains near $120/ton in China as stimulus hopes support steel demand. Zinc prices eased amid high smelter output and rising inventories. But broadly, the looming energy transition continues to underpin metals like copper, nickel and lithium in the medium term. Investors are increasingly positioning for structural deficits in “green metals” as EV production, grid expansion and renewable builds accelerate globally. The copper market’s sudden swing to shortage this year underscores how quickly the narrative can flip – and why many strategists remain long-term bullish on base metals despite short-term volatility reuters.com reuters.com.

Agriculture: Harvest Pressures, Trade Wars & Weather Whiplash

Grains – Trade War Turbulence: The global grains complex faced a whirlwind of developments from trade policy to harvest weather. In soybeans, U.S. farmers saw another setback as their biggest customer, China, largely shunned American beans this season. Instead, China swooped into the Argentina market, capitalizing on Buenos Aires’ temporary suspension of export taxes last week. During the brief tax-free window, some 40 Argentine soybean cargoes (2.66 million tons) were booked for shipment in Nov-Dec – “mostly headed to China,” traders told Reuters agcanada.com agcanada.com. These sales directly cut into peak U.S. export season, dealing a blow to American soy prices. Chicago soybean futures did manage a slight bounce on Friday, with November beans up 1½ cents to ~$10.13¾ per bushel agcanada.com. But that wasn’t enough to erase earlier losses – soybeans still posted a second weekly decline, down ~1.1% agcanada.com.

Traders say the Argentine news has largely been digested now that the tax waiver expired and export taxes were reinstated on Thursday agcanada.com. “That news has been digested…and the taxes have been implemented, so soybeans should have seen the bulk of selling from that,” said Brian Hoops of Midwest Market Solutions agcanada.com. Attention is turning back to U.S. fundamentals. The U.S.–China trade war remains a drag – Beijing’s retaliatory tariffs still effectively price U.S. soybeans out of the Chinese market agcanada.com. When asked if China might return to U.S. purchases, a Chinese ministry spokesperson flatly said Washington needs to remove those “unreasonable” tariffs first agcanada.com. Without a resolution, U.S. exporters are relying on alternate buyers (EU, Mexico, SE Asia) and domestic crushing to absorb the harvest.

Meanwhile, the Midwest harvest is ramping up under mostly favorable conditions. Recent heavy rains in parts of the Corn Belt caused some short-term delays and muddy fields admis.com admis.com. But forecasts for the next two weeks call for warm, drier-than-normal weather across the Plains and Midwest, which should “open a wide window” for corn and soy harvesting, Hoops noted agcanada.com agcanada.com. Early yield reports are mixed – soy yields look decent, but there are “doubts over the size of corn yields” after summer drought, which has lent some underlying support to corn futures agcanada.com. Chicago December corn still fell to $4.22¼/bu (–3¾¢) on Friday amid harvest selling agcanada.com, and December wheat dropped to $5.19¾ (–7¼¢) as world supplies remain ample agcanada.com agcanada.com. Wheat traders noted large Russian exports and a strong Canadian crop are keeping wheat prices in check, offsetting concerns about dry conditions in parts of the U.S. Plains and Russia’s winter wheat areas. Looking ahead, two major USDA reports next week – Monday’s harvest progress and Tuesday’s quarterly grain stocks – could fuel volatility if they surprise expectations agcanada.com. Traders will be watching if corn stocks tighten or if the agency’s soybean stock estimates reflect any demand rationing from high prices earlier this year.

Soft Commodities – Coffee Tariffs & Sugar Highs/Lows: The coffee market has been buzzing, caught in a geopolitical crossfire that sent prices to multi-year highs. Since early August, arabica coffee futures in New York have exploded roughly 30% higher, reaching about $3.74 per pound reuters.com reuters.com (not far from the 2011 record of $3.00+ or ~ $4.29 in late 1990s terms). The catalyst? A steep U.S. tariff hike on imports from the world’s top producer, Brazil. On Aug. 6, the Trump administration slapped a punitive 50% tariff on Brazilian coffee (and other goods) amid a political spat with Brazil’s President Lula reuters.com reuters.com. Brazilian coffee became essentially unviable for U.S. buyers overnight, upending global trade routes. Marcio Ferreira, head of Brazil’s Cecafe exporters council, said the tariff “created an environment of uncertainty and drove coffee prices up globally – and there may be no ceiling” reuters.com reuters.com. U.S. importers scrambled to source from alternative origins like Colombia and Central America, often paying hefty premiums over exchange prices reuters.com. Many are also quietly buying Brazilian beans rerouted through Europe to dodge the U.S. duty (the U.S. charges lower tariffs on roasted coffee or re-exports from third countries) reuters.com.

For Brazil, the immediate impact was a collapse in exports to the U.S. – shipments plunged 46% in August compared to a year prior, when exports had hit a record reuters.com. Through mid-September, volumes sank another 20% from that reduced August level reuters.com. The U.S. has ceded its place as Brazil’s top coffee buyer, replaced by eager takers in Europe and Asia reuters.com reuters.com. “As U.S. purchases shrink, exports to other countries are growing,” Ferreira noted, citing a remarkable 578% jump in Brazil’s coffee exports to Colombia in August reuters.com. (Ironically, Colombia – a major arabica grower itself – is importing Brazilian robusta to blend or re-export as finished coffee to the U.S.) Even Italy and the UK have upped orders to capitalize on discounts, but the U.S. market is too large to fully replace reuters.com reuters.com. Brazilian farmers are benefitting from the higher world prices in the short term – some are hoarding stock, betting prices will revisit last year’s record peaks before they sell reuters.com. “We have a very high stock level for this time of year… Last year we didn’t even have half of this in September,” said the manager of Cooabriel co-op in Espírito Santo reuters.com. But exporters and roasters are suffering. Consumers worldwide may soon feel the pinch via pricier lattes: Brazilian officials warn that if the tariff standoff isn’t resolved, U.S. coffee drinkers could acquire a taste for other origins, permanently denting Brazil’s market share reuters.com. “It’s time to get the kids out of the room and get the adults in to negotiate,” Ferreira quipped, expressing hope after a cordial Trump–Lula meeting at the UN that the dispute can be settled reuters.com reuters.com.

In sugar, the recent story has been one of abundant supply. Global sugar prices pulled back to around 15.2¢/lb, down sharply from 12-year highs (~24¢) seen last year tradingview.com. The driver is Brazil – the world’s top sugar producer – which is coming off a record-large cane harvest. Notably, Brazilian mills have favored producing sugar over ethanol biofuel given high sugar profitability, a trend that “continued this month, adding to supplies” of the sweetener tradingview.com tradingview.com. On Friday, raw sugar futures did tick up 0.1%, rebounding from a 2½-month low of 15.10¢, as traders covered shorts tradingview.com. But headwinds remain: favorable weather in Asia is boosting output prospects in India, Thailand, and other key exporters tradingview.com. India – which had restricted exports in the past year – now expects a surplus that could allow it to return to the export market in the new 2025/26 season starting October ecofinagency.com foodbusinessmea.com. Indian mills have struggled to fill even a modest 1 million ton export quota this season due to low prices and Brazilian competition foodbusinessmea.com. They’ve shipped only ~775k tons and may ask the government to roll over the rest foodbusinessmea.com. With world sugar prices at a four-year low and Brazilian sugar trading $25/ton cheaper than Indian sugar, India’s competitive edge in Asia has eroded foodbusinessmea.com foodbusinessmea.com. All told, 2024 is likely to see more sugar flowing onto the market. Some analysts, however, warn of volatility ahead – while supply looks ample now, any weather shock (e.g. if El Niño causes a bad Indian monsoon or Brazilian drought) or energy market shift (making ethanol more attractive) could swing the sugar balance back to deficit. For now, though, the “sugar high” of last year’s prices has well and truly crashed back down to earth.

Cocoa offers an interesting coda in softs. After skyrocketing to record highs above $12,000/ton late last year amid West African crop failures reuters.com convenience.org, cocoa prices have eased this month on hopes of improved output. London cocoa futures slid to a two-month low ~£4,874/ton, and New York cocoa fell to ~$6,896/ton, as traders wager on a substantial global surplus for the upcoming 2025/26 season tradingview.com tradingview.com. Timely rains in Ivory Coast and Ghana are fueling optimism for the main crop. There is also a regulatory twist: the EU’s strict new anti-deforestation import rules for cocoa, due to start soon, may be delayed, which the market views as bearish because it means less risk of supply disruptions into Europe tradingview.com. Additionally, top grower Côte d’Ivoire just set a higher farmgate price to incentivize production. That said, some experts caution that cocoa’s structural issues (diseases, aging trees, farmers switching crops) haven’t vanished. The recent pullback may be a breather after which the market remains prone to tightening in late 2025. For now, chocolate makers are breathing a sigh of relief as cocoa trades ~15% below its peak convenience.org reuters.com, though still well above historical averages.

Livestock – Hogs on a Tear, Cattle Elevated: U.S. livestock markets saw hog prices explode higher this week on a surprise supply shock. Lean hog futures in Chicago leapt to life-of-contract highs after USDA’s quarterly Hogs and Pigs report (released Thursday after market close) showed a “shockingly” small pig herd. As of Sept 1, the U.S. hog inventory totaled 74.5 million head, down 1.3% from a year ago – analysts had expected a slight increase (+0.3%) producer.com producer.com. This was the first year-over-year decline in several quarters and implies significantly tighter pork supplies ahead. Notably, the breeding herd was smaller and farrowings (births) are lagging, suggesting a shortfall in market hogs from December through next spring producer.com producer.com. “This type of supply story, which we only thought would be short term, is now extended into the long term,” said Rich Nelson, strategist at Allendale producer.com producer.com, indicating the squeeze could last well into 2026. In reaction, CME October lean hogs surged to 101.675¢/lb, a contract record, before finishing at 101.5¢ (▲1.4¢ on the day) producer.com. The December hog contract jumped 3.9% on the week, hitting ~91.5¢ at its high producer.com. Cash hog prices have been strong, providing additional support to futures producer.com. Hog traders are now factoring in fewer slaughter-ready hogs in coming months, which could keep wholesale pork prices firm. If feed costs remain moderate and demand (domestic and export) holds up, hog producers may finally see improved margins after many months of losses.

In the cattle market, prices are historically high but showed some consolidation this week. December live cattle futures hovered at $2.343/lb (234.3¢) on Friday, roughly flat on the day producer.com. That’s just below the record highs set earlier in September, as the market digests a years-long supply crunch. The U.S. cattle herd is at its smallest in over 50 years following drought-driven herd liquidation from 2020–2022 producer.com. The latest USDA Cattle on Feed report showed feedlot inventories at 11.1 million head (Sept 1), down about 1.0% from last year producer.com – a slightly larger drop than expected, confirming cattle numbers remain very tight. This has supported live cattle and beef prices throughout 2025. However, unlike hogs, the cattle industry is starting to rebuild. With pastures recovering from drought and profitability returning, ranchers are retaining more heifers for breeding. USDA and industry analysts project a calf crop increase in 2024, which would begin expanding beef supply by late 2025. Indeed, feeder cattle placements have been lighter as ranchers hold back young stock to grow the herd. This week, feeder cattle futures (October) actually rallied to $3.57/lb (357¢) producer.com producer.com, up 0.8% for the week, reflecting optimism that feedlots will pay up for scarce feeder calves in the near term. But longer-dated live cattle contracts have eased off peaks on expectations the herd will gradually grow. Additionally, beef demand has shown some seasonal softness and packer profit margins are thinning, which tempered further gains. Notably, USDA announced it will not use direct payments to incentivize herd rebuilding producer.com, instead relying on better range conditions and market signals to do the job. One wild card: disease threats. Traders are edgy about a recent case of New World screwworm – a destructive livestock parasite – detected in Mexico ~70 miles from Texas producer.com. U.S. authorities are monitoring aggressively, as an outbreak north of the border could impede cattle production.

In summary, commodity markets across the board saw high drama to close September. From oil fields to crop fields, a potent mix of war, weather, and policy is generating big price moves and new risks. Producers and consumers alike are bracing for more volatility ahead. As one veteran analyst quipped, “There’s never a dull moment in commodities – and 2025 is proving that in spades.” The short-term outlook calls for continued choppiness, but also opportunity: shockwaves in supply, whether from geopolitics or nature, are keeping traders on their toes and the era of complacency at bay.

Sources: Bloomberg; Reuters reuters.com reuters.com reuters.com agcanada.com producer.com; Financial Times; CNBC; OilPrice.com; AgWeb; EIA; USDA; IEA; IMF. (Compiled September 26–27, 2025)