NEW YORK, December 31, 2025, 07:41 ET — Premarket.

- D-Wave Quantum shares hovered near their recent levels ahead of the final U.S. trading session of 2025.

- Year-end positioning and early-January conference appearances are in focus for the quantum-computing group.

Shares of D-Wave Quantum Inc were little changed in premarket trading on Wednesday, holding around $26.25. Other U.S.-listed quantum names were mixed, with IonQ and Rigetti Computing edging higher while Quantum Computing Inc slipped.

The quiet start comes after a year of sharp swings for the stock, which is up about 213% year-to-date even after pulling back from a 52-week high of $46.75. About 12% of D-Wave’s free float is sold short — a measure of bearish positioning that can amplify moves when the stock runs. Finviz

Why it matters now is timing: holiday-thinned trading can exaggerate price moves, and the “quantum” trade has been prone to rapid profit-taking after momentum bursts. Investors are also turning to the first week of January for fresh readouts on customer demand and commercial traction.

A market note on Tuesday pointed to “window dressing” as a driver behind D-Wave’s 3.4% rise on Dec. 29 that snapped a three-session slide. Window dressing is the common end-of-period practice where some funds buy recent winners and sell laggards to tidy up holdings before reporting to clients. Finviz

D-Wave has two January events on the calendar. The company said it will sponsor the CES Foundry at Fontainebleau Las Vegas on Jan. 7-8 and will hold its Qubits user conference in Boca Raton, Florida, on Jan. 27-28. “Showcasing quantum computing at CES… signals that the technology is quickly moving into the mainstream,” said Murray Thom, D-Wave’s vice president of quantum technology evangelism. D-Wave Quantum

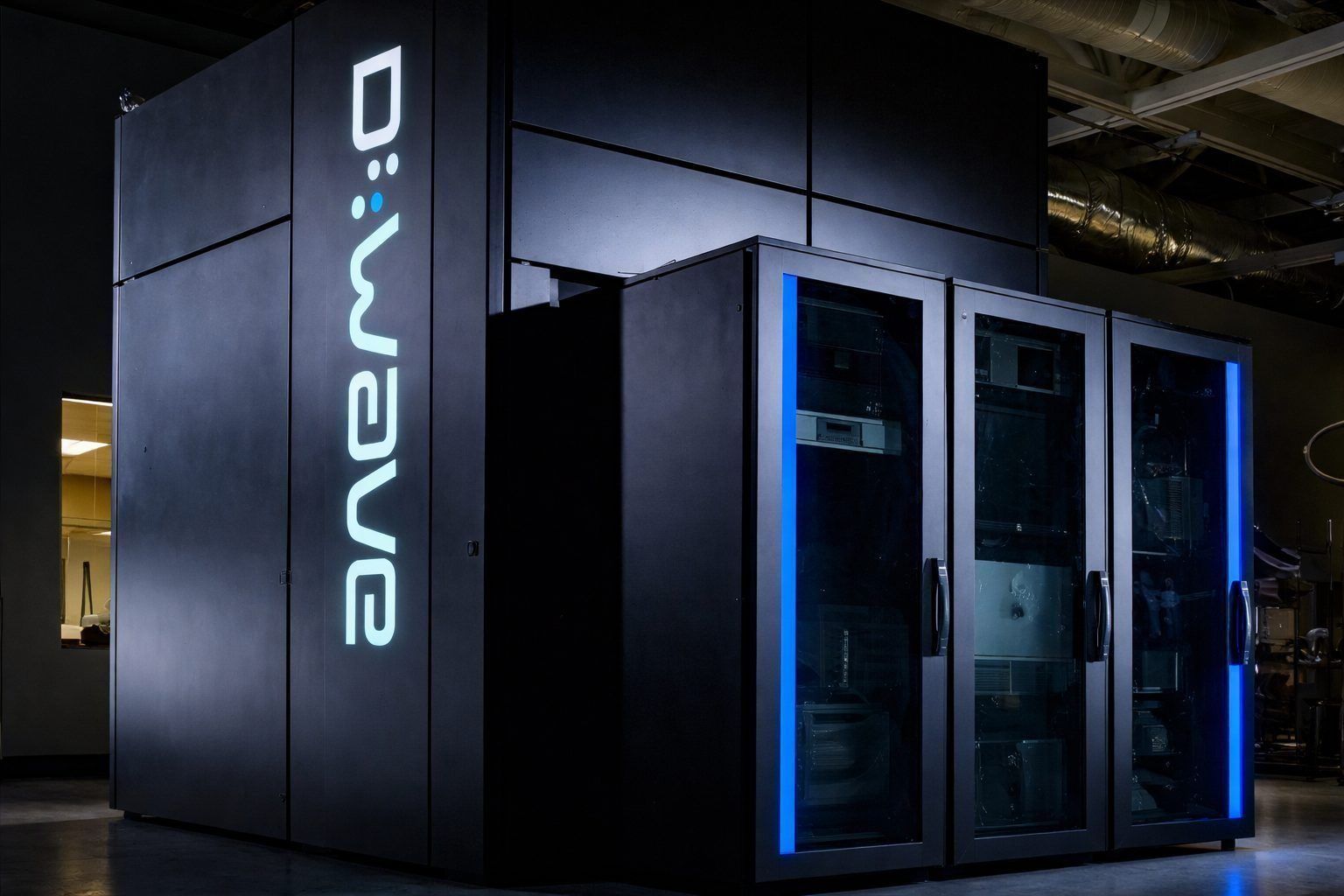

The company’s core pitch is quantum annealing, a form of quantum computing aimed at optimization problems — think finding better schedules, routes, or allocations when there are millions of possible combinations. D-Wave also sells access through its Leap quantum cloud service and offers on-premises systems.

Fundamentals remain small relative to the stock’s market value. D-Wave reported third-quarter revenue of $3.7 million and bookings of $2.4 million — “bookings” are customer orders the company expects to convert into future revenue — and said it ended September with $836.2 million in cash. D-Wave Investor Relations

Traders are likely to scrutinize any January commentary for signs that bookings are turning into repeatable revenue, and whether customer wins are broadening beyond pilots. Public-sector work remains a watchpoint, where procurement cycles can be long but budgets can be sizable.

Attention then shifts to the next earnings update, expected around March 12, 2026, according to Zacks. Investors will be looking for updates on 2026 demand, bookings conversion and cash burn more than headline revenue in a sector still early in commercialization. Zacks