NEW YORK, Jan 17, 2026, 13:36 (EST) — Market closed.

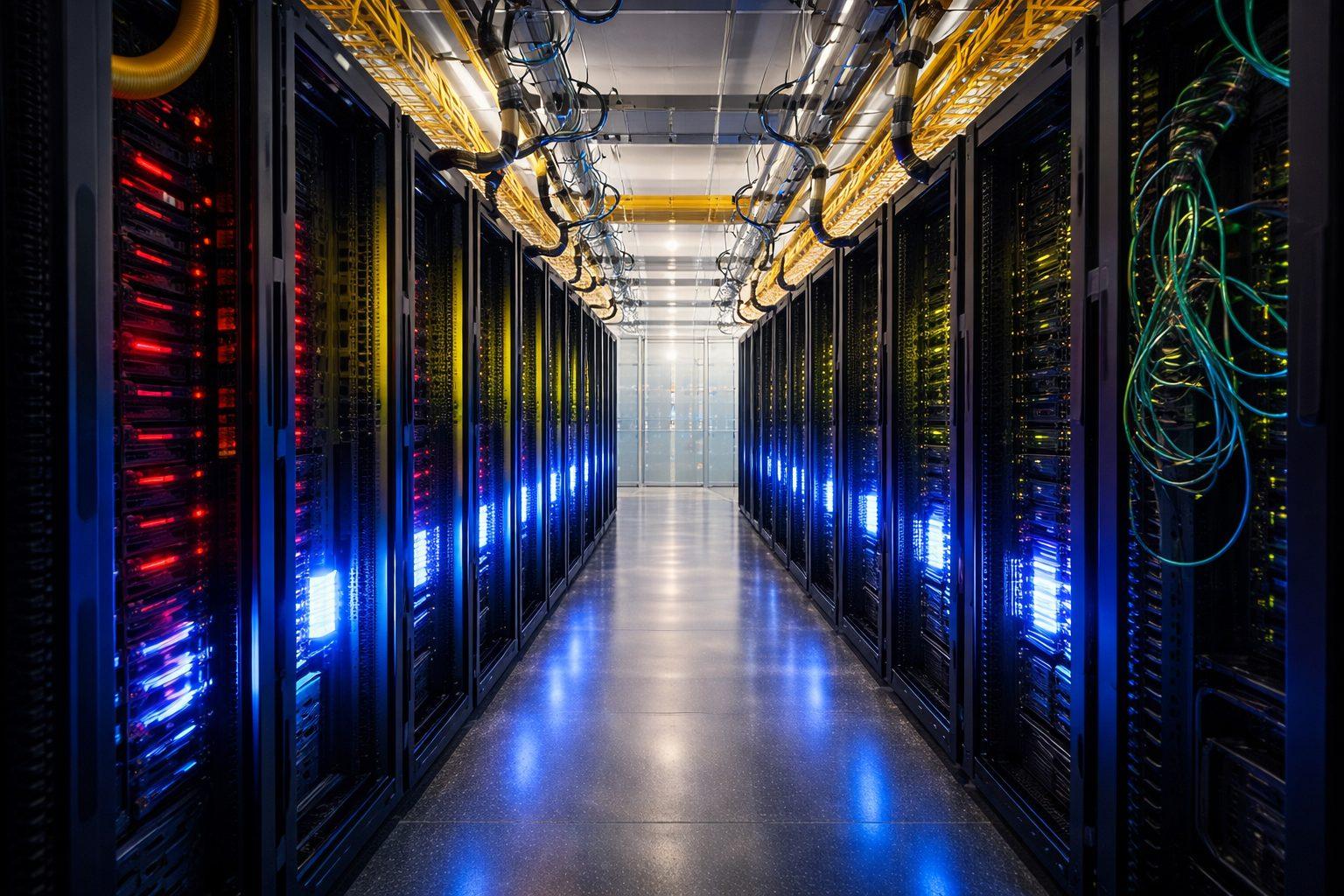

U.S. data center stocks wrapped the week with mixed results as Washington urged PJM Interconnection to conduct an emergency power procurement auction. The goal: add new generation and push more costs onto large data center users. Digital Realty finished Friday up 1.9%, Vertiv climbed 2.5%, and Equinix saw little movement. The Department of Energy’s Energy.gov

The narrative in the sector has shifted away from racks and rent, focusing instead on watts. Power availability and the rising cost of electricity now directly influence how quickly operators can scale up and what it costs to build.

The White House is pushing PJM to speed up to prevent shortages as data center demand outpaces new plant construction. It supports capping what current power plants can charge in PJM’s capacity market. The proposal also forces data centers to pay for new generation built for them, even if they don’t use it — a “bring your own generation,” or BYOG, model. Pennsylvania Governor Josh Shapiro slammed PJM, saying it’s been “too damn slow” to add new generation to the grid. Reuters

PJM, the operator for the grid spanning 13 states plus Washington, D.C., unveiled a parallel strategy: new large power users must either supply their own generation or join a “connect and manage” system that permits early curtailment during peak times. “This is not a yes/no to data centers,” PJM CEO David Mills clarified. Reuters

KeyBanc Capital Markets upgraded Digital Realty to Buy and bumped its price target to $193, dismissing worries about oversupply as premature. They say power constraints should keep pricing and returns steady through 2026 and beyond. The firm also reaffirmed its Buy rating on Equinix, raising the price target to $1,050. They highlighted a possible turning point in adjusted funds from operations (AFFO), a key cash-flow metric for REIT investors. Investing.com

U.S. stocks closed Friday just below the flatline, capping the opening week of earnings season. The S&P 500 slipped 0.1%, while the Nasdaq also dipped 0.1%. AP News

Markets remain closed Monday in observance of Martin Luther King Jr. Day. Investors will return Tuesday focused on power costs and interconnection schedules, key issues for data center-heavy stocks. New York Stock Exchange

The path isn’t straightforward. Stricter cost-allocation rules or the risk of curtailment might delay projects, shift new builds elsewhere, or compress returns if operators can’t pass on rising power and construction expenses.

Digital Realty will release its fourth-quarter results after the market closes on Feb. 5. Equinix plans to hold its fourth-quarter earnings call on Feb. 11 at 5:30 p.m. EST. globenewswire.com