New York, Jan 18, 2026, 12:59 EST — Market closed.

- The White House called on PJM to run an “emergency” power auction amid rising electricity demand from data centers

- Shares tied to data centers climbed Friday among infrastructure stocks, while Nvidia slipped modestly.

- Traders are focused on Tuesday’s reopening following the U.S. holiday and Intel’s earnings due later this week

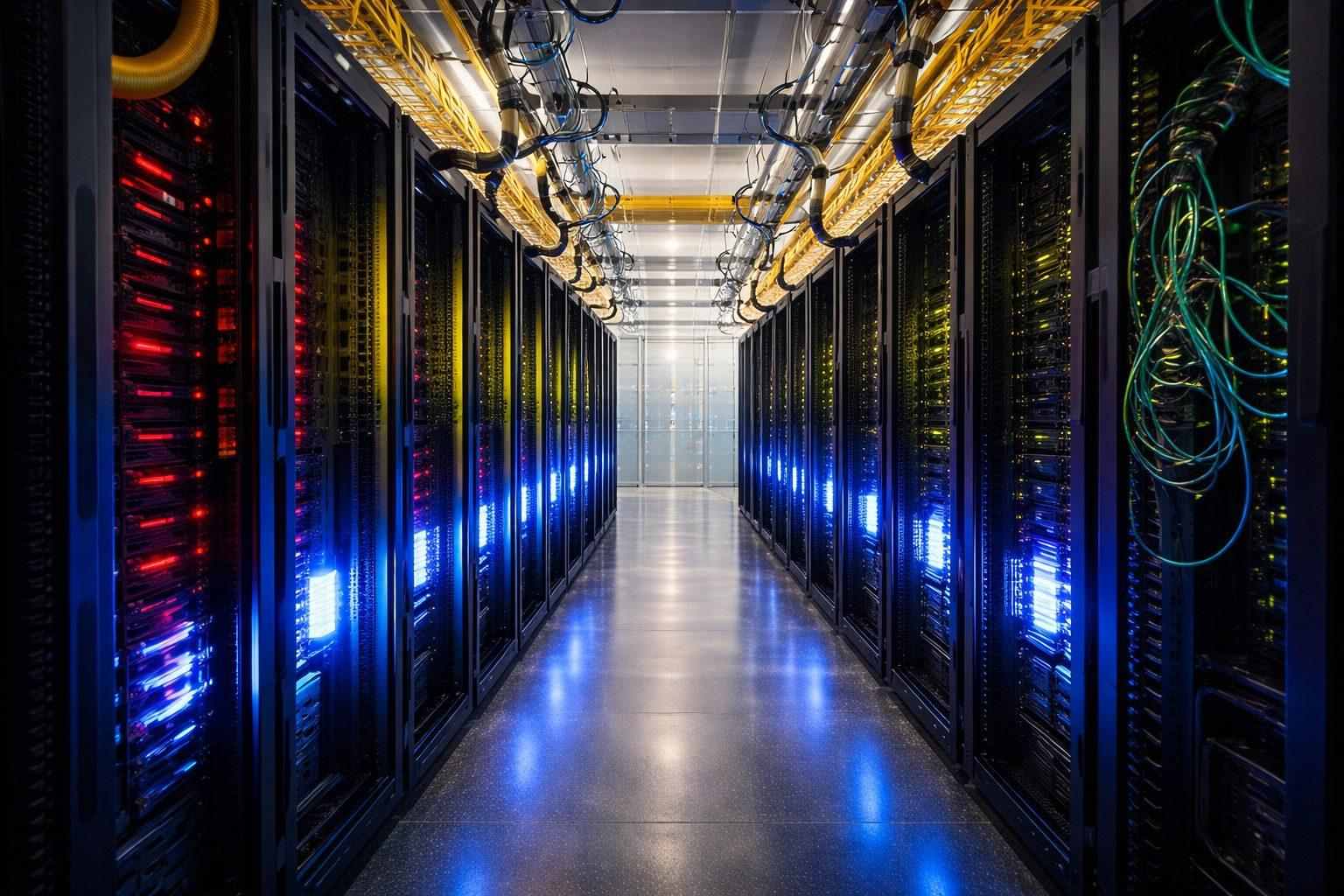

The White House’s push for an “emergency” auction on the largest U.S. power grid is shining a harsher spotlight on data center stocks: power is becoming both political and costly.

Shares tied to data centers wrapped up Friday on a mixed note but saw heavy trading, as AI server and electrical equipment stocks pushed higher ahead of the long weekend.

The timing is key. U.S. markets will be closed Monday for the Martin Luther King Jr. holiday, giving investors an extra two days to weigh how new rules on power costs might squeeze returns in a build-out already limited by the grid.

Electricity isn’t just a detail for data center operators and their suppliers—it’s the core input. When projects have to finance new power generation instead of relying on existing sources, it can disrupt timelines and squeeze margins, even if demand holds steady.

On Friday in Washington, the Trump administration pushed PJM Interconnection to hold an emergency procurement auction as data center power demand outpaces new generation capacity. PJM warned large data centers they might need to “bring your own” generation or face cuts during peak times. The White House-backed plan would force data centers to fund new generation capacity “whether they show up and use the power or not,” termed BYOG, or “bring your own generation.” Pennsylvania Governor Josh Shapiro slammed PJM for being “too damn slow” in adding new supply. Reuters

Shares of Super Micro Computer jumped 11.0% to $32.64 on Friday, leading the pack among U.S.-listed data center builders. Eaton edged up 3.1% to $343.75, and Vertiv rose 2.5% to $176.93. Data center landlords Digital Realty gained 1.9%, closing at $163.60, while Equinix held steady near $801.78. On the downside, Nvidia dipped 0.5% to $186.23 and Arista Networks dropped 0.6% to $129.83.

Broader market moves gave a lift. Chip stocks gained ground on Friday, even though the main indexes finished close to unchanged. Investors held back from big bets ahead of the long weekend and as earnings season expanded beyond banks. “Most investors will take that as a win,” said Anthony Saglimbene, chief market strategist at Ameriprise Financial. But Bruce Zaro of Granite Wealth Management cautioned that mid-January “tends to be pretty choppy.” Reuters

Super Micro’s jump followed the familiar pattern: a quick bounce within the choppy AI-hardware sector. Traders credited Taiwan Semiconductor’s recent earnings for sparking fresh hope around AI server demand, as highlighted in a Nasdaq.com market wrap. Nasdaq

Vertiv, known for its power and cooling equipment inside data centers, unveiled new versions of its prefabricated MegaMod HDX tailored for high-density AI clusters. The updated designs mix direct-to-chip liquid cooling with air-cooled setups. “Today’s AI workloads demand cooling solutions that go beyond traditional approaches,” said Viktor Petik, a senior vice president at Vertiv. Data Center Dynamics

Jefferies analyst Blayne Curtis highlighted Broadcom, Nvidia, and Marvell Technology as top picks for 2026, describing Nvidia as “undervalued” amid the chip sector’s AI-driven demand surge. Barron’s

Data center stocks are caught between two major pressures: the surge in AI-related spending and the hard limits imposed by power availability and permitting on how quickly new facilities can launch. Now, the PJM debate throws in a fresh challenge for REITs that lease space and power, as well as for suppliers of the electrical and cooling gear needed to support increasingly dense racks.

The policy path remains tangled. PJM is still weighing the White House and governors’ proposals. Any “bring your own generation” plan risks pushback from developers, especially if it hikes upfront costs or shifts risks onto operators, potentially slowing down signings.

Intel will release its fourth-quarter and full-year 2025 earnings after the market closes on Thursday, Jan. 22. Investors will be parsing the report for clues on data center and AI demand as trading resumes Tuesday. intc.com