New York, Feb 8, 2026, 13:34 EST — Market closed

- Vertiv surged 10% on Friday. Equinix climbed 5%, while Digital Realty closed out the session up 4%.

- Vertiv and Equinix earnings coming up midweek are next up on traders’ radar, as they watch for signals on AI-fueled data center demand.

- Investors will be watching next Friday’s U.S. CPI and jobs numbers—those reports could move rate expectations that directly impact how data-center REITs are valued.

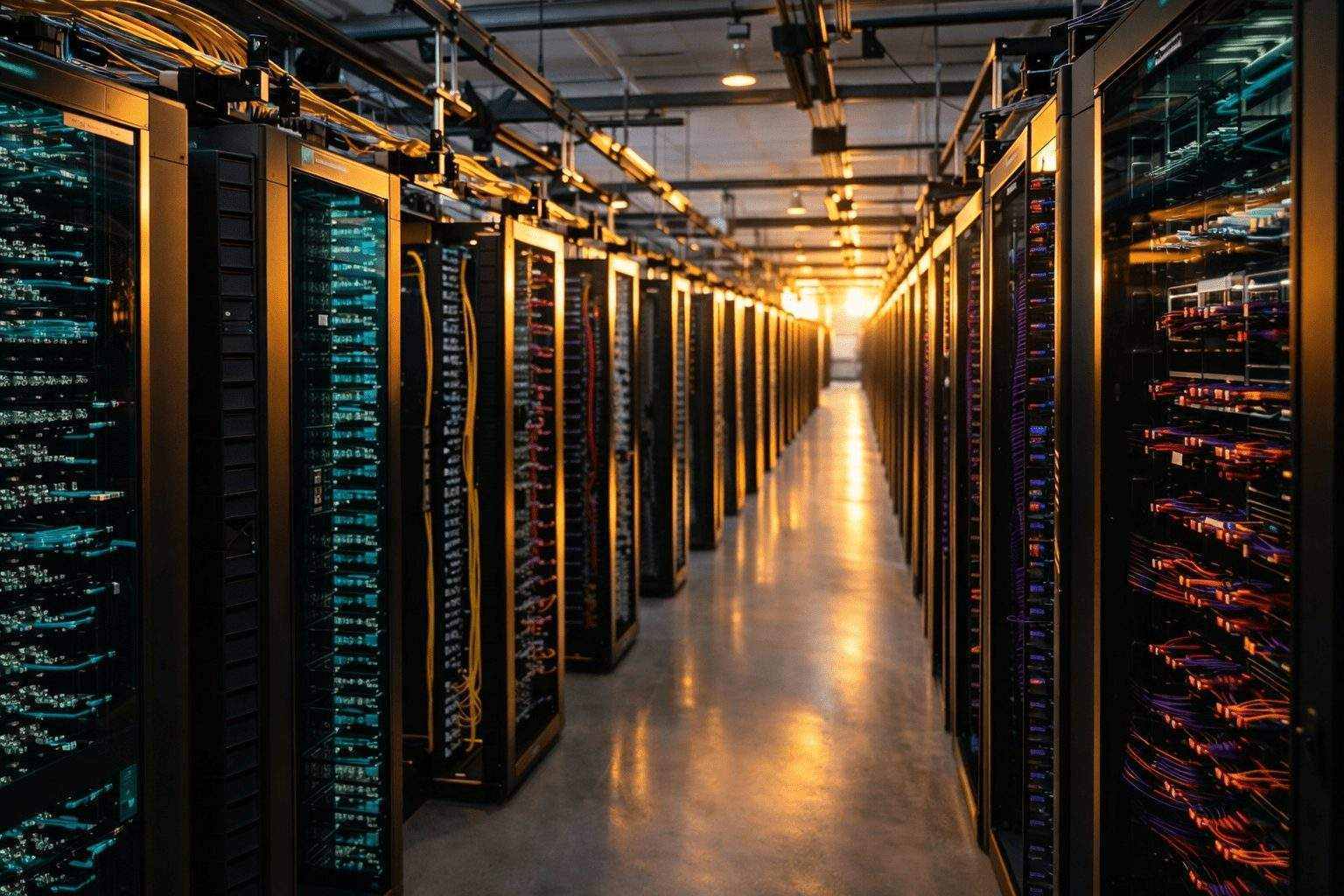

Vertiv surged 10% on Friday, pacing a strong rally in U.S. data center shares. Equinix tacked on 5%, Digital Realty picked up 4%, and Iron Mountain finished the session just under 8% higher. Server farm infrastructure names caught a strong bid.

This shift followed a rough stretch for certain AI-related stocks, but the broader market rebounded sharply. The Dow broke through 50,000 to close above that mark for the first time, while the S&P 500 added close to 2%. Chip makers led the charge, as investors rotated back towards AI’s infrastructure plays. Reuters

Amazon set an early tone, despite its stock slipping, when it signaled a planned increase in capital expenditures of over 50% for this year, according to Reuters. Alphabet echoed that message earlier in the week. The sense that the investment cycle isn’t done yet has left “picks-and-shovels” stocks squarely in focus. Reuters

“This trade has been volatile,” said Ross Mayfield, an investment strategy analyst at Baird. He pointed to demand and ongoing spending needs as setting a “floor” that tends to attract buyers. That dynamic played out Friday, as shares linked to building and operating data centers caught another wave of bids. Reuters

Earnings are up next. Vertiv drops numbers premarket Wednesday, with Equinix following after the bell that evening; Arista Networks and Applied Materials both hit Thursday after the close. Investors will be zeroing in on order flows and watching closely for any hints of cooling demand. Kiplinger

Under the tape, the push and pull continues. On Sunday, a Reuters analysis quoted Tim Murray of T. Rowe Price noting that while the AI-fueled selloff “may have paused,” there’s been a sharp pivot into lower-priced stocks. At the same time, skepticism is rising about whether heavy spenders can justify their investments. Reuters

Thierry Wizman, who handles global FX and rates strategy at Macquarie Group, flagged “strong doubts” swirling about hyperscalers’ ability to actually turn those new capital spending plans into profits. Should investors start to think that payback is slipping further out, the most crowded AI-adjacent trades could unwind sharply. Reuters

Rates matter, particularly for data center REITs like Equinix and Digital Realty—names that often react to changes in borrowing costs. After new indicators of labor market strain nudged up bets on easier policy, traders shifted toward expecting more cuts, according to Reuters. Reuters

The macro calendar’s got a definite marker: both the U.S. Employment Situation for January and the January CPI land at 8:30 a.m. on Friday, Feb. 13, according to the Bureau of Labor Statistics schedule—a double release that could shake up bond yields and risk appetite right before the weekend. Bureau of Labor Statistics

The threat here isn’t hard to spot: any upside surprise in inflation, or a spike in yields, puts pressure on rate-sensitive REITs. On the tech side, if cloud customers slow their expansion plans or pull back on capital spending, names like Vertiv and the networking suppliers could feel it fast.

The data center names head into Monday riding momentum, though eyes are on the next set of triggers midweek: Vertiv reports before the bell Wednesday, Equinix after the close, then Arista and Applied Materials follow on Thursday.