NEW YORK, January 3, 2026, 06:38 ET — Market closed.

- Denison shares surged on Friday after the uranium developer updated plans and costs for its Phoenix project.

- The company said it is ready to make a final build decision once remaining approvals are in hand.

- Investors are now focused on the Canadian regulator’s decision and permitting milestones in early 2026.

Denison Mines Corp (DNN) jumped about 13.1% to $3.03 in Friday’s U.S. session after the company said it is ready to move its flagship Phoenix uranium project into construction once final approvals arrive. The stock traded between $2.67 and $3.07 and logged about 68.4 million shares in volume. Uranium peers also rose, with Cameco up about 7.7%, Uranium Energy up about 12.2% and NexGen Energy up about 11.4%.

The move matters because Phoenix, part of Denison’s Wheeler River property, is the company’s key development bet. Shifting from engineering into a “go build” decision can compress the timeline to first revenue and reset what investors expect for cash spending.

Uranium miners have been volatile around permitting and capital-cost inflation. Markets tend to reward projects that clear regulatory gates and can credibly hit late-decade production windows.

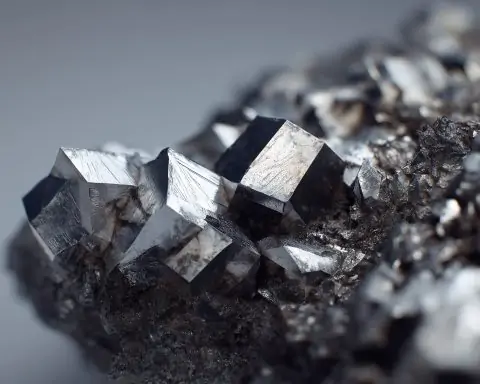

Phoenix is planned as an in-situ recovery, or ISR, mine — a method that extracts uranium by circulating a solution through ore underground and pumping it to the surface, rather than conventional digging. Denison’s update put the spotlight on whether Phoenix can move from a plan to a build.

In a statement, Denison said it is ready to make a final investment decision, or FID — the point when a company commits funding to build — and commence construction of Phoenix pending final regulatory approvals. It reaffirmed an expected two-year construction timeline and said first production remains targeted for mid-2028, while lifting post-FID initial capital costs to $600 million, a 20% increase versus its inflation-adjusted 2023 feasibility study. CEO David Cates said, “Denison stands ready to make a final investment decision and commence construction of the Phoenix ISR mine.” SEC

Denison said the project’s base-case economics were largely unchanged despite the higher budget, citing an adjusted after-tax net present value, or NPV, of $1.57 billion and an internal rate of return, or IRR, of 73%. NPV estimates the value today of future cash flows, while IRR is a percentage measure of projected profitability.

The company said the updated capital estimate reflects inflationary adjustments, cost increases, project refinements and tighter estimating, and includes contingency funds. Denison also pointed to a balance sheet that it said can fund initial capital needs, including more than $700 million of cash, physical uranium and investments as of Sept. 30.

Permitting remains the swing factor. Denison said the Canadian Nuclear Safety Commission’s public hearing process concluded in December and that it is awaiting a decision, while Saskatchewan has approved the project’s environmental assessment and granted initial permission for certain early earthworks.

Friday’s rally suggests traders prioritized the prospect of a near-term permitting catalyst over sticker-shock from the cost update. The next test is whether follow-through buying holds as investors dig into what the revised control budget implies for timelines and execution risk.

In Toronto, Denison’s TSX-listed shares rose 11.4% on Friday after the company’s update, Reuters reported. Reuters

The company’s update was also included in a Form 6-K filed with the U.S. Securities and Exchange Commission on Jan. 2, a filing showed. SEC

Before the next U.S. session, investors will be watching for any indication of timing around the CNSC decision and remaining approvals that would allow a construction start in the first quarter. Traders will also look to see whether the stock can hold above the $3 level after touching $3.07 on Friday.

For the broader uranium tape, the Sprott Uranium Miners ETF reported its net asset value rose 7.4% as of Jan. 2, a sign of sector-wide momentum heading into 2026. Denison is listed among the fund’s larger holdings. Sprott ETFs