The new trading week at Deutsche Börse begins with a quieter tape but big structural news in the background. On Monday, 1 December 2025, the DAX is slightly weaker after a strong November, Deutsche Börse shares are consolidating recent gains, and the exchange is flipping the switch on dramatically longer Xetra trading hours for retail investors.

Below is a structured overview of what is happening today in Frankfurt, the key corporate story around the Allfunds takeover bid, the new Xetra trading regime, and the latest forecasts and analyses for the DAX and Deutsche Börse AG.

1. Market snapshot: DAX and Deutsche Börse share price today

- DAX index

According to Deutsche Börse’s own market commentary, the DAX was trading around 23,695 points on Monday morning, slightly below Friday’s close of 23,837 points. Börse Frankfurt

TradingEconomics’ DE40 benchmark shows the German blue‑chip index near 23,700 – about 0.5% lower than the previous session as of 1 December. Trading Economics - European context

Reuters reports that the pan‑European STOXX 600 slipped 0.4% to 573.9 points by 08:04 GMT, with Germany’s DAX and France’s CAC 40 each down roughly 0.5%. The main drag came from industrials, especially Airbus, which is dealing with a large software‑related recall, and defence stocks such as Hensoldt and Rheinmetall. Reuters - Deutsche Börse AG (DB1) share

A mid‑morning chart update from finanzen.net shows Deutsche Börse shares at about €229.40, down around 1.2% on the day, after previously trading near €229.00 on Xetra, a drop of roughly 0.7%. finanzen.net

That pullback follows a strong rally last week after news of Deutsche Börse’s takeover bid for Allfunds (see below), where ETF Stream notes the stock had risen roughly 4.6% in response to the deal headlines. ETF Stream

In short: prices are softer, not panicky. The DAX is taking a breather after November’s gains, and Deutsche Börse’s share price is digesting a powerful, deal‑driven move.

2. What’s moving Frankfurt today?

European stocks pause after November’s rally

After a “risk‑on” November, European equities are starting December more cautiously:

- Reuters highlights a broad, modest pullback across Europe, with investors locking in profits after the November run‑up and waiting for fresh macro catalysts. Reuters

- The industrial sector is the biggest weight on the STOXX 600, down about 1.3%, as Airbus fell over 2% following news it must immediately repair around 6,000 jets due to a software issue. Defence names like Hensoldt, Rheinmetall and Leonardo are off more than 3%, dragging on the DAX. Reuters

Global risk mood: Asia soft, yen firmer

Earlier in the day, Asian markets also traded lower. A Reuters global markets update describes investors turning more cautious after a strong November, with the yen strengthening on comments from Bank of Japan Governor Kazuo Ueda that keep the prospect of eventual rate hikes alive. Reuters

Put together, Frankfurt is trading in a classic “risk‑off lite” environment: nothing dramatic, but enough caution to take a bit of shine off the DAX after a strong prior month.

3. The big corporate story: Deutsche Börse’s €5.3–5.5bn Allfunds takeover bid

The dominant stock‑specific theme for Deutsche Börse today is its proposed acquisition of Allfunds Group, a leading European fund distribution platform.

Deal terms and size

- Deutsche Börse has confirmed it is in exclusive talks to acquire Allfunds in a transaction valued at around €5.3 billion, which would be the largest takeover in the group’s history, according to DAS INVESTMENT. DAS INVESTMENT

- The non‑binding offer implies a total consideration of €8.80 per Allfunds share, half in cash and half in new Deutsche Börse shares, plus additional dividends for the 2025–2027 financial years. DAS INVESTMENT+1

- Reuters’ Breakingviews notes this price is similar to the bid Euronext floated in 2023, and values Allfunds at about €5.3bn – roughly in line with Euronext’s earlier €5.5bn approach when adjusted for market moves. Reuters

Why Allfunds matters

Allfunds is a heavyweight in its niche:

- It administers around €1.7 trillion in assets and holds about 30% market share in the cross‑border UCITS fund distribution market across Europe, with particular strength in Italy, Spain and France. DAS INVESTMENT+1

- Deutsche Börse’s fund services are concentrated in Germany, Switzerland and Austria, so the combination would create one of Europe’s largest fund platform groups with complementary regional footprints. DAS INVESTMENT+1

Strategically, the deal would:

- Double the contribution of fund services to Deutsche Börse’s revenue from around 10% to roughly 20%, tilting the group more towards high‑margin, recurring “buy‑side” services and away from cyclical trading volumes. DAS INVESTMENT

- Support the EU’s push to deepen capital markets and cross‑border savings flows, something Reuters and ETF Stream both highlight as a likely selling point for regulators. Reuters+1

Market and analyst reaction

The market has responded positively so far:

- ETF Stream reports Allfunds shares leapt around 21.6%, trading near €8.16 after the bid was revealed, while Deutsche Börse shares rallied about 4.6% on the news. ETF Stream

- Analysts cited by ETF Stream and DAS INVESTMENT see significant cost synergies – UBS estimates potential savings equivalent to about 35% of Allfunds’ 2026 cost base, largely from consolidating technology platforms and joint investments in blockchain infrastructure. ETF Stream+1

- Jefferies estimates the deal could lift Deutsche Börse’s earnings per share by roughly 6% in 2027, assuming those synergies are realised. ETF Stream

- Reuters’ Breakingviews also argues the transaction could deliver an 8% post‑tax return on the purchase price by 2027 if consensus profit forecasts and cost‑cutting assumptions are met – around Allfunds’ estimated cost of capital. Reuters

Regulatory and execution risks

The deal is far from done:

- Completion is subject to due diligence, final transaction documents, board approvals, and – crucially – clearance by EU and national competition authorities. DAS INVESTMENT notes regulators could take up to 12 months to complete their review. DAS INVESTMENT+1

- Brussels has blocked several past Deutsche Börse mega‑mergers (notably with the NYSE and the London Stock Exchange), so investors are wary, even though this deal is smaller and more specialised. DAS INVESTMENT+1

For Deutsche Börse’s stock, this means today’s modest decline is likely short‑term consolidation within a larger, deal‑driven re‑rating story.

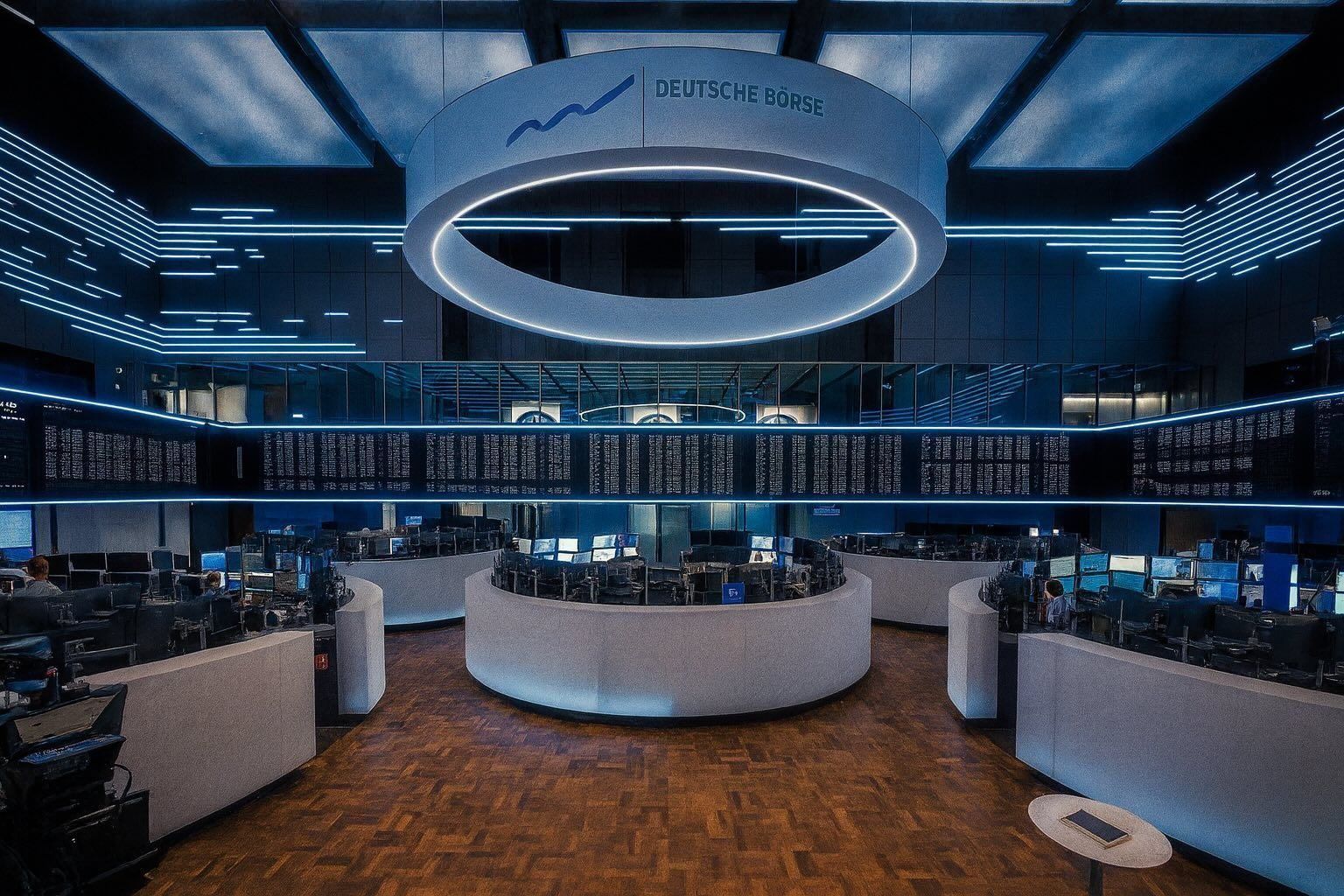

4. Structural change: Xetra moves to a 14‑hour trading day

Away from the Allfunds headlines, 1 December 2025 is a landmark operational day for Deutsche Börse’s cash market.

Extended Xetra Retail Service launches

- From today, Xetra’s trading hours for retail investors are extended from a 9:00–17:30 CET session to a 14‑hour window running from 8:00 to 22:00 CET. ETF Stream

- The new “Extended Xetra Retail Service” covers stocks, ETFs and ETPs and is exclusively available to retail clients via their banks and brokers, with dedicated retail liquidity providers quoting in the extended sessions. ETF Stream+1

Deutsche Börse circulars show that this service, introduced with T7 Release 14.0, adds early and late trading phasesand adjusts trading processes to handle retail flow outside of the traditional continuous session. Deutsche Börse Group+1

Why the trading‑hours change matters

According to ETF Stream and Deutsche Börse:

- The primary goal is to align Frankfurt better with US market hours, allowing retail traders to react to US corporate news and macro data right up to the US close. ETF Stream

- It also responds to strong demand from retail clients who want to trade after work, not just during the standard European working day. ETF Stream

From an investor’s point of view, this could:

- Increase liquidity in German‑listed ETFs and ETPs that track US indices, especially around US market open and close.

- Raise operational and risk‑management challenges for brokers and liquidity providers, who now need to support a much longer trading window.

- Gradually shift intraday volatility patterns in DAX components and ETFs as late‑evening orders interact with US news flow.

T7 Release 14.0 and self‑match prevention

The extended hours go live alongside broader T7 Release 14.0 enhancements, including improved self‑match preventionmechanisms effective from 1 December 2025, according to Deutsche Börse Xetra circulars. Deutsche Börse Group+1

These changes are aimed at helping trading participants avoid unintentionally matching their own orders, which supports market integrity in a longer, more retail‑heavy trading day.

5. Macro backdrop and medium‑term DAX outlook

Deutsche Börse’s own weekly outlook, published this morning, sets the scene for December. Börse Frankfurt

Rate‑cut hopes vs AI bubble fears

Key points from the report:

- US rate‑cut expectations remain central. The probability of a Federal Reserve rate cut on 10 December has risen sharply and is now priced at close to 100% in futures markets, according to Commerzbank analyst Pascal Reichert. If that call is right, he argues, the equity recovery could continue into December. Börse Frankfurt

- At the same time, there is an intense debate over whether equity markets – especially US tech – are in a “KI‑Blase” (AI bubble).

- LBBW’s chief economist Moritz Kraemer warns valuations look stretched and that investor expectations may prove overly optimistic, especially given the extraordinary concentration of US returns in a handful of mega‑cap AI names. He doesn’t predict a crash, but expects muted returns and elevated correction risk in coming years. Börse Frankfurt

- Asset manager DWS takes the opposite side, arguing there is no AI bubble but an ongoing AI boom. It projects the S&P 500 at 7,500, the Euro STOXX 600 at 600 and the DAX at 26,100 points by year‑end 2026, supported by productivity gains and low interest rates. Börse Frankfurt

Consumer data and crypto signals

- DekaBank’s Ulrich Kater points to Thanksgiving and Black Friday sales as key short‑term indicators for the US and global consumer, and thus for equity markets. A very gloomy sentiment backdrop could actually be constructive, because much pessimism may already be reflected in prices. Börse Frankfurt

- Deutsche Börse also flags the striking divergence in cryptocurrencies: Bitcoin has dropped back to around $86,000 after briefly trading above $90,000, leaving it roughly 30% below its all‑time high. Börse Frankfurt

While crypto and the DAX are different beasts, this kind of de‑risking in speculative assets tends to spill over into broader risk appetite, which helps explain some of today’s equity caution.

6. Technical analysis: DAX buy signals vs key support

For traders, today’s DAX action sits on top of a fairly constructive technical picture.

A fresh DAX analysis for Monday, 1 December 2025, published on wallstreet‑online and based on DZ Bank research, highlights “three buy signals” confirming the prevailing uptrend: wallstreet-online.de

- After a gap‑down on 21 November, the index stabilised at the lower Bollinger band, forming what the report calls a base for the resumption of the longer‑term uptrend.

- Since then, the DAX has recorded five consecutive sessions of higher daily highs, a classic sign of an emerging upswing.

- The index has regained both its 20‑day and 200‑day moving averages, turning them back into support rather than resistance.

- A third buy signal comes from the slow stochastic oscillator, which has flipped from oversold to bullish.

Key levels to watch

The same analysis maps out crucial price levels:

- Resistance 1: the 28 November high at 23,881 points, which must be cleared to confirm the short‑term uptrend.

- Resistance 2: the 14 November high at 24,027 points, a more significant hurdle that would re‑open the path towards the all‑time highs.

- Support 1: the 28 November low at 23,710 points.

- Support 2: the 26 November low at 23,444 points; a sustained break below this would invalidate the bullish scenario and signal a potential new down‑leg. wallstreet-online.de

DZ Bank’s pattern statistics suggest:

- After a “gap‑down” like the one on 21 November, there is historically about a 71% probability of a 2% rally within the next 10 trading days, but also a 48% probability of a 2% decline over the same horizon. wallstreet-online.de

Bottom line: technicals still lean bullish, but the DAX is sitting close enough to key support that any negative macro surprise could quickly flip the narrative.

7. Deutsche Börse share: valuations, ratings and forecasts

Current price vs analyst targets

- As noted above, Deutsche Börse shares are trading around €229–230 today. finanzen.net

- Analyst consensus compiled by Investing.com puts the average 12‑month price target in the mid‑€250s to around €260, with individual targets ranging roughly from €225 to just over €290. Investing.com+1

- MarketScreener reports that Deutsche Bank recently reiterated its Buy rating on the stock with a target price of €291, underscoring the upside seen by more bullish analysts. MarketScreener

Given today’s price, the stock is trading meaningfully below the average target range, suggesting that sell‑side models still see room for upside if earnings and the Allfunds integration evolve as expected.

Recommendation consensus

Different aggregators show slightly different labels, but all point to no major “Sell” camp:

- One Investing.com consensus for ticker DB1Gn describes the rating as “Buy”, based on around 14 analysts, with a mix of Buy and Hold and no Sell ratings. Investing.com

- Another Investing.com view and valueinvesting.io’s summary both classify the stock as “Neutral” or “Hold” overall, with most analysts recommending Hold, a substantial minority recommending Buy, and still no outright Sells among the surveyed 15–24 analysts. Value Investing+1

- A finanzen.net overview of recent research notes Neutral and Hold stances from UBS and Jefferies, but Overweight / Buy ratings from Barclays, Deutsche Bank and JPMorgan, again reinforcing a constructive but not euphoric consensus. finanzen.net

AI‑based forecast signals

AI‑driven analytics are also broadly positive, but not screamingly bullish:

- Danelfin assigns Deutsche Börse an AI Score of 6/10 (Hold), estimating a 53.4% probability that the stock will outperform the STOXX 600 over the next three months, versus roughly 49.7% for the average European stock. Danelfin AI

Taken together, the message is: Deutsche Börse is widely viewed as a high‑quality, fairly‑valued franchise with moderate upside, and the Allfunds bid could improve that story if executed well.

8. What to watch next

Going into the rest of December, investors in Deutsche Börse and the wider DAX will be watching:

- Fed decision (10 December 2025)

A rate cut in line with expectations would support the “year‑end rally” narrative; any disappointment could put pressure on risk assets, especially high‑valuation AI names that are already under scrutiny. Börse Frankfurt+1 - Allfunds deal progress

- Confirmation of a binding offer and more detailed synergy targets at Deutsche Börse’s capital markets day in London on 10 December. DAS INVESTMENT+1

- Early signals from EU competition authorities about the transaction’s feasibility and likely conditions.

- Liquidity and spreads in the new Xetra trading regime

- How deep and tight are order books in the new 8:00–9:00 and 17:30–22:00 CET trading windows? ETF Stream+1

- Do ETF and ETP volumes meaningfully migrate into late‑evening trading to track US moves?

- DAX technical levels

- Whether the index can break above 23,881 and 24,027, confirming the uptrend, or instead slips below 23,444 support, which would validate the bearish alternative scenario in DZ Bank’s analysis. wallstreet-online.de

9. Conclusion: A quiet tape masking big structural shifts

On the surface, Monday 1 December 2025 looks like a modestly lower, risk‑off day for Deutsche Börse and the DAX. Indices are a touch weaker, Deutsche Börse’s shares are easing after a deal‑driven pop, and European investors are catching their breath after a strong November.

Under the surface, though, two structural stories are driving the long‑term narrative:

- A transformational Allfunds acquisition, which would make fund platform services a much bigger profit pillar for Deutsche Börse and deepen its foothold in the European buy‑side ecosystem.

- The launch of extended Xetra trading hours, which could permanently change how – and when – German and European retail investors access the market.

Whether December turns into a classic year‑end rally or a choppy consolidation will depend on the Fed, incoming economic data and whether AI‑related valuation worries resurface. But for Deutsche Börse itself, today marks the start of a new phase, with its strategy and market structure evolving even if the index level barely budges.