- Global EV battery pack prices fell about 20% in 2024, dropping from roughly $149/kWh in 2023 to the low $100s by year-end.

- In 2024, LFP cell prices were just under $60/kWh, and some Chinese LFP packs were produced for well under $90/kWh, enabling price parity with ICE for certain models.

- In 2024, a NMC811 pack cost about $103/kWh in China and above $100/kWh in other regions, showing higher costs for nickel-based chemistries.

- As of 2025, mass-market solid-state batteries are not yet in production, with Toyota planning limited production in 2025 for hybrids and MG launching a semi-solid-state pack delivering 1,000+ km range.

- CATL’s sodium-ion “Naxtra” cells reach about 175 Wh/kg, offer around 500 km range, claim over 10,000 charge cycles, with mass production planned by end-2025.

- As of 2025, LFP accounts for about 40–45% of global EV battery capacity, NMC about 50–55%, and solid-state and sodium-ion remain near zero share.

- By 2025, the United States uses the IRA’s Section 45X to provide $35/kWh credits for batteries made in the U.S. and $10/kWh for modules, enabling up to roughly $3,375 in credits for a 75 kWh pack and spurring more than $70 billion in new battery plant investments.

- Europe is expanding local production and embracing LFP, with a CATL-Stellantis €4.1 billion JV to build an LFP gigafactory in Spain by 2026 and the 2023 Battery Regulation promoting recycling and carbon-footprint rules.

- China houses roughly 70%+ of global EV battery cell capacity in 2025, with 2024 pack prices down about 30% year-on-year and LFP representing around 75% of Chinese battery production by late 2024.

- Nickel-based NMC/NCA cells can exceed 200–250 Wh/kg at the cell level, LFP sits around 160–180 Wh/kg, and pack-level energy density is increasingly close due to cell-to-pack designs, while solid-state could reach 350–400 Wh/kg and sodium-ion about 160–170 Wh/kg in 2025 demos.

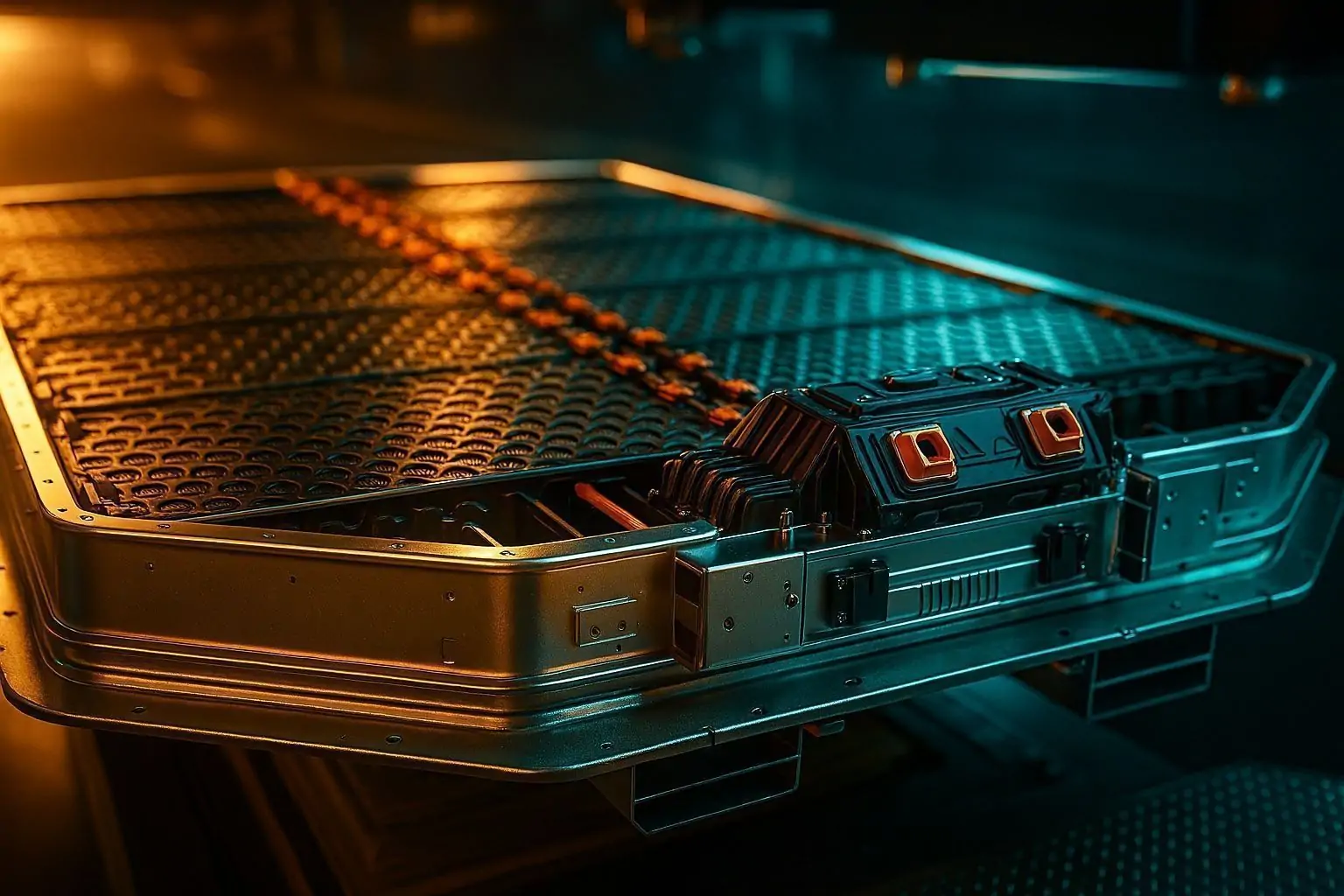

Electric vehicles (EVs) are entering 2025 with unprecedented momentum, driven by falling battery costs and rapid advances in battery technology. EV sales are surging globally, and behind this growth is a rapidly evolving battery market that is reshaping the automotive industry’s competitive dynamics batterytechonline.com. This report provides an accessible yet detailed overview of the state of EV batteries in 2025 – from the plummeting cost per kilowatt-hour (kWh) that is bringing EVs to price parity with gasoline cars, to the breakthroughs in battery chemistries (like LFP, NMC, solid-state, and sodium-ion) that are set to define the next generation of energy storage. We’ll compare the leading battery types in terms of cost, performance, and adoption, share expert insights from industry analysts and executives, and examine how regional market forces (in the U.S., China, and Europe) and policies are influencing battery economics.

EV Battery Cost Trends in 2025

Over the past decade, the cost of EV batteries has fallen dramatically, bringing EVs closer to being cost-competitive with internal combustion engine (ICE) vehicles. After a slight uptick in 2022 due to soaring raw material prices, battery prices resumed their decline. In fact, global average battery pack prices fell by around 20% in 2024, the steepest drop since 2017 batterytechonline.com. Industry estimates indicate the average pack price dropped from about $153/kWh in 2022 to $149 in 2023, and is projected around the low $100s by the end of 2024 goldmansachs.com. This sharp decline has been driven by two main factors: technology improvements (including higher energy-density cells and more efficient pack designs) and lower commodity prices for key metals like lithium and cobalt goldmansachs.com. According to Goldman Sachs, if current trends continue, battery costs could approach $80/kWh by 2026, a level at which EVs achieve purchase-price parity with gasoline cars in the U.S. even without subsidies goldmansachs.com.

Cost Parity Milestones: Hitting the long-awaited $100/kWh threshold at the pack level is widely seen as the tipping point for EV-ICE parity. S&P Global notes that this target has already been achieved in certain cases: for example, lithium iron phosphate (LFP) battery packs made in China are now well below $100/kWh, enabling several Chinese EV models (especially smaller cars) to be priced on par with ICE vehicles spglobal.com. In contrast, higher-energy nickel-based batteries still cost more – an NMC811 pack in 2024 remained around $103/kWh in China (and above $100 elsewhere) spglobal.com. In other words, some EVs in 2025 can match gasoline cars on upfront price, particularly in markets like China with low-cost LFP packs, while others (using pricier chemistries) are slightly above parity. Analysts expect that as battery prices continue to drop and manufacturing scales up, unsubsidized parity will expand to more vehicle segments. One expert predicts that by 2026, EVs will reach full ownership cost parity, even accounting for fuel savings and resale values, marking the start of a “consumer-led adoption phase” driven purely by economics goldmansachs.com goldmansachs.com.

Recent Price Trends: It’s worth noting that 2022 saw a rare price increase (about +7% from 2021) due to “greenflation” in critical minerals iea.org. However, by 2023 those input costs fell back dramatically – lithium carbonate prices in late 2023 were roughly 50% below their peak, and cobalt prices fell to 2015 levels iea.org batterytechonline.com. The result was a significant cost reduction for batteries between 2022 and 2024. The International Energy Agency (IEA) reports that battery pack costs dropped ~14% from 2022 to 2023 as mineral prices normalized iea.org, and another ~20% drop in 2024 as a supply surplus of metals like lithium kept prices low batterytechonline.com. This commodity-driven windfall, combined with intense competition among manufacturers, especially in China, has squeezed profit margins but delivered cheaper batteries for consumers batterytechonline.com batterytechonline.com. Industry observers do caution that today’s very low lithium and nickel prices may not last forever – a future upswing could slow cost declines, and underinvestment due to low prices now could even lead to shortages by 2030 batterytechonline.com. Overall, though, the 2025 landscape sees EV battery costs at their lowest point in history, putting EVs closer to cost parity with ICEs than ever before.

Total Cost of Ownership: Beyond sticker price, EVs in 2025 already often win on total cost of ownership (TCO). Lower charging (fuel) costs and reduced maintenance give EVs an edge over time. As battery prices drop further, the upfront premium shrinks and payback periods shorten. Goldman Sachs analysts note that in high-fuel-cost environments, TCO parity for EVs in markets like the U.S. is likely to be achieved by 2026 goldmansachs.com. This means that consumers will not only enjoy lower running costs but soon won’t have to pay extra upfront for an EV compared to a gas car – a milestone that could turbocharge EV adoption. In summary, 2025 marks a turning point: battery costs are nearing levels that make EVs broadly competitive on price, fulfilling a decade of predictions about the <$100/kWh pack. While short-term fluctuations may occur, the long-term cost trajectory is one of flattening or modest decline, rather than the steep exponential drops of the 2010s spglobal.com, as the industry matures.

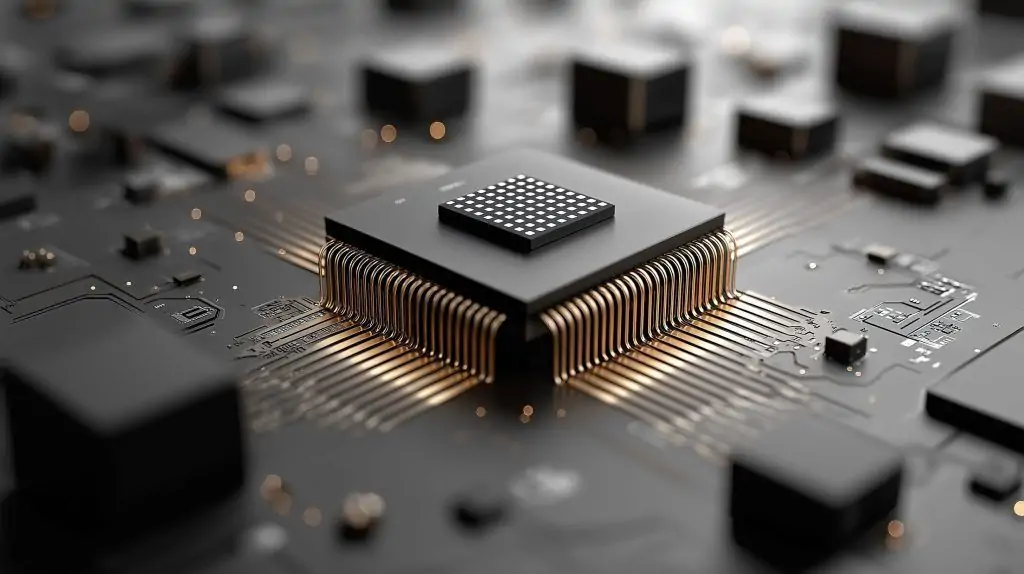

Breakthroughs in Battery Chemistries

Battery cost improvements have come hand-in-hand with technical breakthroughs in battery chemistry and design. Automakers and cell producers are not only relying on economies of scale – they are rapidly innovating the batteries themselves to store more energy, last longer, and use cheaper materials. In 2025, two lithium-ion chemistries dominate EVs: one based on nickel, manganese, and cobalt (like NMC or similar high-nickel cathodes) and one based on lithium iron phosphate (LFP). At the same time, a wave of next-generation batteries is on the horizon, including solid-state lithium batteries and sodium-ion batteries. This section discusses recent breakthroughs and the status of each major chemistry:

Lithium Iron Phosphate (LFP) – Resurgence of Iron-Based Batteries

Lithium iron phosphate (LFP) is an older chemistry that has roared back to the forefront of EV battery technology in recent years. Known for its low cost, strong safety, and long cycle life, LFP had been initially sidelined in favor of higher-density NMC batteries – but that’s changing fast. Technological improvements have overcome many of LFP’s historical limitations. For instance, innovations like cell-to-pack integration and doping of the cathode with manganese have boosted LFP’s energy density and range. Chinese battery makers pioneered a design called the “Blade Battery” (by BYD) – an elongated LFP cell that is directly integrated into the pack structure, eliminating modules and increasing pack-level energy density and stiffness mckinsey.com. Thanks to such advances, the average pack energy density of top-selling LFP EVs in China climbed from ~80 Wh/kg in 2014 to ~140 Wh/kg in 2023 mckinsey.com – a 75% improvement that has narrowed the range gap with NMC batteries. Today, an LFP pack can comfortably deliver over 500 km (300+ miles) of range in a standard-size EV mckinsey.com, erasing what used to be a major advantage of nickel-based cells.

The biggest breakthrough, however, is in cost reduction and material sustainability. LFP uses no cobalt or nickel – instead it relies on abundant iron and phosphate – making it significantly cheaper and less geopolitically fraught. By 2024, producing an LFP cell cost roughly 20% less per kWh than producing an NMC cell under the same conditions mckinsey.com. Industry data from S&P Global in 2024 showed LFP cell prices just under $60/kWh, more than 20% below NMC cell prices spglobal.com. This cost advantage has only grown as LFP manufacturing scales up. “I think lithium iron phosphate has a new life… It has a clear and long-term advantage for the electric vehicle industry,” said Mujeeb Ijaz, a battery startup founder, reflecting on LFP’s comeback reuters.com. The International Energy Agency likewise noted that LFP batteries have reached performance levels sufficient for most EV needs, making their lower cost a key advantage batterytechonline.com batterytechonline.com. In practical terms, for standard-range and mass-market EVs, LFP’s ~10-15% lower energy density compared to NMC is no longer a deal-breaker, while its lower cost, excellent safety (thermal stability), and high cycle life are huge pluses.

Another important LFP breakthrough is its exceptional longevity. LFP cells can tolerate many more charge-discharge cycles. It’s common for modern LFP batteries to endure well over 2,000 full cycles with minimal degradation, and some LFP packs are rated for 3,000+ cycles (translating to perhaps 800,000 – 1,000,000 km of driving). This makes LFP ideal for vehicles that rack up high mileage (like taxis or buses) and for stationary energy storage. Unlike nickel-based cells, LFP batteries also prefer a 100% charge and don’t mind being kept at full charge, simplifying charging habits for consumers. Automakers have taken notice: all major carmakers are now deploying LFP batteries in some models to cut costs. Tesla, for example, equips its Standard Range Model 3 and Y with LFP packs; Ford announced LFP options for its EVs; and many Chinese brands use LFP in the majority of their lineups. Importantly, 2024 marked the expiration of key Western patents on LFP technology iea.org, enabling battery firms outside China to produce LFP without licensing barriers. This has spurred new LFP factory plans in Europe and the U.S., aiming to localize production of this chemistry that China currently dominates spglobal.com iea.org.

In summary, LFP’s breakthrough lies in proving that an “old” chemistry can be made cutting-edge. By 2025 LFP offers adequate energy density, superior safety, long life, and the lowest cost per kWh on the market. It has transformed from a niche option into a rising global standard for affordable EVs and grid storage.

Nickel-Based Batteries (NMC/NCA) – High Energy Density and Evolving Formulas

Nickel-cobalt-manganese (NMC) batteries – and their close cousins like nickel-cobalt-aluminum (NCA) – have been the workhorse of long-range EVs for the past decade. Their key strength is high energy density: nickel-rich cathodes can pack more energy per kg, enabling greater vehicle range. In 2025, nickel-based chemistries still power most premium and long-range EV models, thanks to energy densities that can exceed 200–250 Wh/kg at the cell level (roughly 10–30% higher than LFP cells) mckinsey.com. This translates to perhaps a 5–20% range advantage at the pack level under real-world conditions mckinsey.com. The latest NMC formulations (such as NMC811) use 80% nickel and only about 10% cobalt, drastically reducing reliance on expensive cobalt. These high-Ni cathodes have been a breakthrough in themselves: compared to older NMC (like 1:1:1 ratios), NMC811 offers higher energy content and lower cobalt cost, albeit at the expense of some cycle life and stability challenges that engineers have worked to mitigate.

Several innovations are improving nickel-based batteries in 2025. One area of progress is in extending cycle life and safety despite the high reactivity of nickel-rich cathodes. Manufacturers have developed better electrolytes and additives to reduce degradation, and some are moving towards single-crystal cathode materials and advanced coatings that resist cracking, yielding longer lifespans. Another trend is increasing the manganese content in certain formulations as a way to cut cost while maintaining reasonable energy density iea.org. For instance, some companies are exploring NMx cells with less nickel and more manganese (since manganese is cheaper and abundant). While these “high-manganese” batteries have slightly lower energy density than NMC811, they could hit a sweet spot on cost if developed successfully. Additionally, like LFP, nickel-based batteries are benefiting from pack-level engineering breakthroughs: cell-to-pack (CTP) designs eliminate the module intermediate step, improving packing efficiency and slightly reducing weight and cost goldmansachs.com goldmansachs.com. Tesla’s new 4680 cells, for example, are large-format NCA cells designed for structural integration into the vehicle battery pack (a form of cell-to-chassis concept) to reduce overhead weight and cost.

Despite these advances, nickel-based chemistries face headwinds. They remain more expensive to produce than LFP – roughly 20% higher cell cost per kWh as of 2024 mckinsey.com – partly due to materials. Nickel itself is pricey and subject to supply risk (e.g. geopolitical events affecting major nickel producers). Cobalt is expensive and ethically problematic, though its fraction in cells is being minimized. Furthermore, NMC batteries tend to have shorter cycle life than LFP; a well-managed NMC pack might sustain ~1,000–1,500 full cycles before significant degradation (sufficient for most car lifetimes, but lower than LFP’s potential). Thermal stability is another concern: high-nickel cells can be more prone to overheating or thermal runaway if not carefully managed by battery management systems and cooling – this is why NMC/NCA packs often need more robust cooling, adding weight/cost.

However, nickel-based batteries are far from stagnant. They continue to dominate segments where maximum energy in a limited space is the priority – for example, long-range SUVs, high-performance cars, or vehicles operating in very cold climates (where NMC’s inherent cold-weather performance is an advantage batterytechonline.com). Automakers typically reserve NMC for premium models: as one comparison, the Tesla Model 3 Standard Range uses a ~55 kWh LFP pack for ~450 km range, whereas the Long Range version uses an ~82 kWh NMC pack for ~630 km range mckinsey.com. Similar dual-chemistry strategies are emerging across the industry.

In short, the breakthroughs in nickel-based batteries are incremental but important – higher nickel content, reduced cobalt, improved lifespan, and leveraging new pack architectures – all aimed at retaining their crown for energy density while trimming cost. These batteries will continue to improve and remain indispensable for applications demanding top performance. But as we’ll see in the next section, their dominance is being challenged by the rapid rise of LFP in many markets.

Solid-State Batteries – The Next-Generation Game Changer (Still Coming Soon)

Solid-state batteries (SSBs) are often hailed as the “holy grail” of battery technology, promising a step-change in performance and safety. In a solid-state battery, the liquid electrolyte is replaced with a solid electrolyte (ceramic, glass, or polymer), and this typically allows the use of a metallic lithium anode. The potential benefits are huge: higher energy density (because a lithium metal anode can store far more lithium than a graphite anode), fast charging, improved safety (non-flammable electrolyte), and long cycle life with minimal degradation from dendrites. Laboratory prototypes have demonstrated energy densities 20–50% higher than the best current lithium-ion cells, along with charging times under 15 minutes for 80% capacity. For example, Toyota has hinted at solid-state cells enabling 745 miles of range with <10 minute charge times in future EVs forbes.com kbb.com, and a Chinese EV maker (SAIC’s MG brand) is launching a semi-solid-state battery car in 2025 that reportedly achieves 1,000+ km (620 miles) of range and charges at up to 400 kW (adding ~250 miles in 12 minutes) insideevs.com insideevs.com.

The breakthrough in solid-state technology is essentially the material science of the electrolyte and interfaces. After years of R&D, companies have developed solid electrolytes (like sulfides, oxides, or polymers) that conduct ions almost as well as liquids. They’ve also learned to mitigate lithium dendrite formation – a major challenge where whiskers of lithium can grow and short-circuit the cell. In 2025, multiple firms (Toyota, QuantumScape, Solid Power, Samsung, and others) have solid-state prototypes and are building pilot production lines. Toyota claims it is on track to begin limited production of solid-state batteries in 2025 for use in hybrid vehicles as a test, with full EV implementations later greencarreports.com. QuantumScape, a Silicon Valley startup, has reported delivering sample 24-layer solid-state cells for testing, aiming for commercialization around 2025–2026.

However, mass-market solid-state batteries have been delayed compared to initial optimistic timelines. “Solid state was initially supposed to come out by now, and it’s been pushed out to the later part of this decade because of challenges in moving from lab scale to mass production,” explains Nikhil Bhandari, a clean-tech analyst at Goldman Sachs goldmansachs.com. Scaling up solid-state tech has proven difficult – manufacturing solid electrolytes and lithium-metal anodes at high volume and yield is non-trivial, and early prototypes can suffer from short lifespans or high costs. As of 2025, no automaker has an SSB in a mass-produced EV for sale (though Mercedes, BMW, VW, Honda, Nissan, and others have development programs, often in partnership with battery startups). The first applications will likely be “semi-solid” batteries or limited-run high-end models where cost is less critical. Indeed, the MG example above is a semi-solid pack (meaning some liquid electrolyte remains, but with solid elements) – a bridging technology.

Experts are nonetheless excited about what solid-state will eventually bring. “In the future, we’ll be talking about solid state batteries, which could be a real game changer,” says Bhandari, noting the potential for materially higher energy density and inherently safer design goldmansachs.com. Industry watchers originally expected solid-state and sodium-ion batteries to grab perhaps 5–10% of the EV battery market by mid-decade, but that hasn’t happened yet goldmansachs.com. Now the consensus is that post-2025 is when solid-state might finally enter commercial EVs in a significant way – possibly around 2027–2028 for the first models, and in the 2030s for larger adoption. When it does arrive, solid-state could enable lighter EVs with 800+ km ranges and ultra-fast charging that truly eliminate range anxiety. Until then, the existing lithium-ion chemistries are improving quickly, raising the bar that solid-state must clear to justify its complexity. In summary, solid-state batteries are the breakthrough technology on the horizon, but 2025 finds them mostly in the R&D and prototype phase, with high hopes tempered by the reality of manufacturing challenges.

Sodium-Ion Batteries – Low-Cost Alternative on the Horizon

Among emerging chemistries, sodium-ion batteries have gained considerable attention as a potential game-changing alternative to lithium-ion. Instead of lithium, these batteries use sodium (a far more abundant and inexpensive element) to carry charge. The appeal is clear: sodium-ion cells could be much cheaper – sodium salts cost a fraction of lithium chemicals – and would ease the resource strain on lithium, cobalt, and nickel. They also promise good safety and performance in cold temperatures (sodium-ion cells tend to handle sub-zero conditions better than Li-ion). The question has been whether sodium-ion technology can achieve sufficient energy density and longevity to be viable for EVs.

In 2025, sodium-ion batteries are transitioning from lab to market. Chinese battery giant CATL announced a major breakthrough with its new “Naxtra” sodium-ion battery pack and plans to mass-produce sodium-ion EV batteries by the end of 2025 chargedevs.com. “Sodium-ion battery technology is no longer a research achievement in laboratories,” said Gao Huan, CATL’s CTO for EV business, “we have achieved a breakthrough in terms of energy storage density and cost” chargedevs.com. CATL’s latest sodium-ion cells reach 175 Wh/kg specific energy chargedevs.com – remarkably, that’s almost on par with the ~185 Wh/kg of LFP cells used in many Chinese EVs today. In practical terms, a sodium-ion pack can deliver similar range to an LFP pack: CATL claims its sodium-ion passenger EV battery offers around 500 km range, and critically, it can achieve over 10,000 charge cycles chargedevs.com. That ultra-high cycle life, if realized, would far exceed typical lithium-ion durability and could be transformative for applications like taxis, commercial fleets, or stationary storage (10,000 cycles could equate to several million kilometers driven).

Early deployments are starting: in 2023, Chinese automaker Chery became the first to put CATL’s sodium-ion batteries into a small EV, and more models are expected once mass production ramps up chargedevs.com. Performance benefits of sodium-ion include excellent cold-weather performance (CATL’s cells can operate from -40 °C to +70 °C chargedevs.com) – a big advantage for EVs in frigid climates where lithium batteries lose efficiency. They also charge fairly quickly and, of course, do not rely on lithium, cobalt, or nickel.

The trade-offs: sodium-ion cells currently have lower energy density than the best lithium cells (they’re closer to LFP levels, and still below high-nickel NMC). This means a heavier battery is needed for the same range. Additionally, sodium-ion technology is just entering scale production, so costs, while theoretically low, may be higher initially until manufacturing is optimized. Some analyses project that if scaled, sodium-ion could be ~20% cheaper than lithium-ion packs iea.org, making them very attractive for low-cost EV models and stationary storage. But lithium prices are a swing factor – during times of lithium shortage and high prices (like in 2022), sodium-ion looks extremely appealing, whereas if lithium is cheap (as in 2023–2024), there’s less immediate cost pressure to switch. Indeed, the current lull in lithium prices has slightly slowed investment in sodium-ion expansion, illustrating that this technology’s rise may ebb and flow with commodity cycles.

Nonetheless, major players are investing: aside from CATL, BYD announced sodium-ion battery plans, and Europe’s Northvolt is exploring the chemistry as well iea.org. By the late 2020s, we may see sodium-ion batteries in affordable city EVs, small trucks, or as part of hybrid battery packs (there’s talk of using a mix of sodium-ion and lithium-ion cells in one vehicle to combine strengths). In summary, sodium-ion’s breakthrough is offering a practically lithium-free battery with decent performance and ultra-low cost. 2025 marks the dawn of commercialization for this chemistry. While it won’t displace lithium-ion overnight, it adds a promising new tool to meet the world’s growing battery needs with less supply-chain strain. As one industry publication put it, sodium-ion could “mitigate demand for critical minerals” and enhance energy security if scaled up iea.org. Keep an eye on late-2025, when the first mass-produced sodium-ion EV batteries roll out – a potential milestone in battery economics.

Comparing Battery Chemistries: Cost, Performance, and Market Share

With multiple battery types now vying for use in EVs, it’s useful to compare their cost, energy density, lifespan, and current adoption. The table below summarizes key metrics for the leading and emerging chemistries as of 2025:

| Battery Chemistry | Approx. Cost (2024) | Energy Density (Wh/kg) | Cycle Life (to 80% capacity) | 2025 Market Share (est.) |

|---|---|---|---|---|

| LFP (Lithium Iron Phosphate) | ~$60/kWh (cell cost) spglobal.com; Lowest cost per kWh | ~160–180 Wh/kg (cell); ~140 Wh/kg pack mckinsey.com | 2,000–4,000+ cycles (very long life) | ~40–45% (rapidly growing) goldmansachs.com goldmansachs.com |

| NMC (Nickel Manganese Cobalt) | ~$75/kWh (cell cost) (≈20% higher than LFP) mckinsey.com | ~200–250 Wh/kg (cell); ~170 Wh/kg pack mckinsey.com | 1,000–2,000 cycles (good, but less than LFP) | ~50–55% (largest share, but declining) goldmansachs.com goldmansachs.com |

| Solid-State (Li-metal anode) | N/A (pre-commercial; high prototype cost) | 300+ Wh/kg potential (future target; ~ +50% vs. Li-ion) | Unknown (early tests show high potential, e.g. >1,000 cycles) | 0% (no mass production yet; expected late-decade) goldmansachs.com |

| Sodium-Ion | Potential ~20% lower than Li-ion (if scaled; currently pilot scale) | ~160 Wh/kg (latest cells) chargedevs.com | 2,000+ cycles (CATL claims 10,000) chargedevs.com | <1% (pilot production in 2025) goldmansachs.com |

Cost: LFP is clearly the most cost-effective today at around $60/kWh for cells spglobal.com. Nickel-based cells cost roughly 20% more (in part due to pricier materials) mckinsey.com, putting NMC cell costs in the ~$75/kWh range. At the pack level, averages vary by region and manufacturer, but many automakers are approaching the magic $100/kWh level. Solid-state and sodium-ion costs are harder to pin down – solid-state is still in R&D, but analysts believe once matured it could eventually drop below $100/kWh. Sodium-ion is expected to be very cheap (raw materials for some cells are quoted as low as ~$10/kWh yahoo.com, though that likely excludes full pack costs), and some in the industry foresee sodium batteries costing up to 20% less than equivalent LFP packs if mass produced. For now, lithium-ion economies of scale give LFP and NMC the edge, but by the late 2020s we may see sodium-ion packs undercut even LFP in cost.

Energy Density: Nickel-based chemistries still lead in energy density. An advanced NMC811 cell can store ~240 Wh per kg (and even more in some lab settings), whereas LFP cells are around 160–180 Wh/kg. However, clever packing (like cell-to-pack designs) has narrowed the pack-level gap – the difference in energy per kg of the entire battery pack is often only ~10–15% between NMC and LFP in modern EVs mckinsey.com. As noted, solid-state could boost energy density by 50% or more, potentially reaching 350–400 Wh/kg and enabling much lighter packs. Sodium-ion, meanwhile, has achieved ~160–170 Wh/kg in 2025 demo cells chargedevs.com. This is on par with older LFP cells – good, but about 30% less than state-of-the-art NMC. For vehicles where space and weight are at a premium (luxury cars, long-range SUVs), the higher energy of nickel batteries (and in future, solid-state) remains advantageous. But for many mass-market cars, LFP’s energy is now “good enough” – as the IEA noted, LFP performance has reached a level sufficient for most EV applications batterytechonline.com batterytechonline.com. In coming years, if solid-state delivers on promises, we may see a leap in density that shifts this balance again.

Lifespan: All these chemistries have different longevity profiles. LFP is the champion of durability – it can handle lots of full charge cycles with minimal degradation. Many LFP batteries can go well beyond 2,000 cycles; for example, Tesla reports very low degradation on its LFP Model 3 taxis even after 100,000+ miles. NMC batteries typically handle 1,000 or so full cycles before dropping to ~80% of original capacity (this is still equivalent to ~200,000 miles for a long-range pack, sufficient for most owners). Companies are improving NMC cycle life with additives and better management – some now claim 1,500+ cycles. Solid-state batteries are expected to have excellent cycle life (no liquid means less electrolyte breakdown and possibly self-healing interfaces), but real data is scarce until they are tested at scale. Sodium-ion cells in theory should also have good longevity; CATL’s claim of 10,000 cycles for its new sodium-ion pack chargedevs.com is astounding – if accurate, it could far exceed even LFP for longevity (though that figure might refer to partial depth-of-discharge cycles or a specific use-case). In any event, long lifespan is increasingly important for secondary use (repurposing EV packs for grid storage) and sustainability. LFP and sodium-ion offer a clear edge in cycle life, which complements their low cost.

Market Share: As of 2025, nickel-based Li-ion and LFP are the two dominant chemistries in the EV market. Nickel-rich batteries (NMC, NCA and related) still account for an estimated 55–60% of global EV battery capacity goldmansachs.com, especially in Europe and North America where most EVs use NMC. LFP, however, has surged to about 40–45% of the market goldmansachs.com goldmansachs.com (up from virtually zero share in the West a few years ago). In China – the world’s largest EV market – LFP now outsells NMC: by late 2024, LFP made up 80% of EV battery sales in China in some months batterytechonline.com batterytechonline.com. This regional difference is stark: China embraced LFP for its cost and local supply chain, whereas Western markets initially stuck with NMC for range – but that is changing as more LFP models hit American and European showrooms in 2025. Solid-state and sodium-ion currently have effectively 0% share – they’re still in pilot phases. Industry forecasts don’t expect those to exceed a few percent of the EV battery mix until later in the decade. Even by 2030, lithium-ion (LFP and NMC) will likely remain the workhorses, while solid-state ramps up slowly and sodium-ion finds footholds in niche segments.

To sum up: LFP and NMC/NCA will collectively power nearly all EVs in the immediate future, with LFP rapidly gaining ground due to cost advantages. Solid-state and sodium-ion represent the next wave of innovation – their true impact will be seen in coming years as they move from prototypes to production.

Regional Market Trends and Policy Impacts

Battery economics in 2025 are heavily influenced by regional market dynamics. The U.S., China, and Europe – three major EV markets – each have distinct policies, supply chain strengths (or weaknesses), and market conditions that affect battery costs and adoption. Below, we analyze each region:

United States: Incentives and Building a Domestic Supply Chain

The U.S. is experiencing a battery manufacturing boom fueled by strong policy support. The landmark Inflation Reduction Act (IRA) of 2022 has radically altered U.S. battery economics by offering generous production tax credits to make domestic battery production competitive energypolicy.columbia.edu energypolicy.columbia.edu. Specifically, the IRA’s Section 45X provides a $35 per kWh credit for U.S.-made battery cells and $10 per kWh for battery modules energypolicy.columbia.edu. This means a U.S.-assembled 75 kWh pack could earn its manufacturer up to ~$3,375 in credits – effectively subsidizing a significant portion of the cost. These credits (uncapped and available through 2032) directly reduce the cost of making batteries in America, narrowing the gap with cheaper Asian imports. As a result, since the IRA’s passage, over $70 billion of investment has been announced for new U.S. battery plants, often in joint ventures with Asian firms energypolicy.columbia.edu energypolicy.columbia.edu. By early 2024, U.S. battery cell manufacturing capacity had roughly doubled from 2022, exceeding 200 GWh/year, with hundreds more GWh under construction batterytechonline.com. The IEA notes that if current trends continue (supported by the IRA), U.S. battery capacity will overtake Europe’s by the end of 2024 iea.org.

Beyond supply-side incentives, the U.S. also revamped consumer EV tax credits to favor domestic battery content. New rules (from 2023) tie a $7,500 EV purchase credit to batteries built with North American assembly and critical minerals sourced from U.S. or free-trade partners. This has pushed automakers to localize battery supply chains – for instance, Tesla is sourcing cathode materials domestically and partnering on U.S. cell plants, GM and LG built Ultium Cells factories in Ohio/Tennessee/Michigan, Ford is bringing LFP cell production stateside (licensing CATL tech in a new Michigan plant), and numerous new entrants (Panasonic, SK On, Samsung, Redwood Materials, etc.) are setting up facilities. The overall effect is that battery production costs in the U.S., once higher than elsewhere, are being offset by credits and economies of scale. Without incentives, making a battery cell in the U.S. can be ~20% more expensive than in China iea.org, partly due to less integrated supply chains and a reliance on imported materials. But with the IRA credit (essentially $45/kWh total), U.S. plants might actually produce at a lower net cost than imports, at least for the next few years.

Market-wise, the U.S. is seeing a rapid expansion of EV sales (expected to hit ~20% of new car sales by 2025) and a corresponding demand for batteries. However, one challenge is that American EVs have tended to favor larger, longer-range models (trucks, SUVs) which use big NMC battery packs – and these are costly. The IRA’s consumer incentives, by lowering effective prices, aim to stimulate mass-market EV adoption to boost volume. In the near term, U.S. battery prices may remain slightly higher than global averages (due to higher labor and energy costs), but the net cost to consumers is mitigated by incentives. Analysts warn that the U.S. must maintain consistent policy support; sudden changes or the scheduled phase-out of credits after 2030 could affect the industry’s trajectory batterytechonline.com batterytechonline.com. But for now, America’s battery economics are defined by subsidies and scaling up: the focus is on building a domestic ecosystem to reduce reliance on Asian imports (currently, Korean firms supply a large share of U.S. battery capacity, though new plants by U.S. and European players are coming too iea.org iea.org). In summary, the U.S. is racing to catch up in battery manufacturing, using public incentives to drive down costs and encourage the adoption of cheaper chemistries like LFP in mainstream models.

China: Scale, Cost Leadership, and Chemistry Innovation

China is the undisputed leader in the battery world – in production volume, supply chain control, and increasingly in technology deployment. By 2025, China hosts roughly 70% or more of global EV battery cell manufacturing capacity and an even larger share of the refining and processing capacity for battery materials iea.org. This dominance has enabled Chinese battery prices to be the lowest in the world. In 2024, battery pack prices in China fell nearly 30% year-on-year, far outpacing the ~10–15% declines seen in Europe and the U.S. batterytechonline.com batterytechonline.com. The IEA attributes China’s cost edge to “fierce competition (squeezing margins), high manufacturing efficiency and yields, access to a large skilled workforce, and full supply chain integration” domestically batterytechonline.com batterytechonline.com. Essentially, Chinese battery makers like CATL and BYD operate at massive scale and thin profit margins, leveraging proximity to local cathode, anode, and cell component suppliers. As a result, some Chinese LFP battery packs are reportedly being produced for well under $90/kWh, enabling ultra-affordable EV models. It was noted earlier that Chinese EV makers are selling small urban EVs at price parity with ICE largely thanks to these sub-$100 LFP packs spglobal.com.

Chemistry trends: China has led the way in adopting LFP at scale. By late 2024, nearly 3/4 of all EV batteries in China were LFP batterytechonline.com batterytechonline.com, a stunning reversal from a few years prior when NMC reigned. Government policy played a role: earlier in the 2010s, China’s subsidies favored higher energy density (nudging makers toward NMC), but when those subsidies ended and LFP improved, the market swung back to cheaper LFP mckinsey.com mckinsey.com. Now, even upscale Chinese EVs (like high-end versions of XPeng and NIO models, and Tesla’s MIC Model Y) use LFP for standard ranges. China’s CATL and BYD have also been frontrunners in new tech: launching innovations like CTP packs (CATL’s “Qilin” pack and BYD’s Blade pack) to maximize LFP performance spglobal.com spglobal.com, introducing fast-charging LFP cells (e.g. CATL’s Shenxing cell can add 400 km range in 10 minutes, an LFP fast-charge record iea.org iea.org), and now pushing sodium-ion batteries towards production. In fact, China is home to virtually all sodium-ion cell manufacturing in 2025, with announced capacity about ten times that of the rest of world iea.org. This indicates China’s strategic drive to explore alternatives and avoid raw material bottlenecks.

Chinese government policy continues to support the EV and battery industry, albeit in evolved ways. Direct purchase subsidies for EVs, which totaled over $14 billion by 2022, were phased out, but in 2023 China introduced a new NEV purchase tax break worth up to ¥30,000 (~$4,200) per EV for 2024-2025 reuters.com. This tax exemption (tapering to half for 2026-2027) is a ~$72 billion package aimed at sustaining EV sales momentum reuters.com reuters.com. It particularly helps lower-priced EVs (mostly made by domestic brands) stay affordable, which in turn supports continued large-scale battery orders for those models reuters.com. China also maintains a credit system (the NEV mandate) requiring automakers to produce a certain fraction of EVs, effectively penalizing those who fall short – this creates a strong incentive for all manufacturers in China to source batteries and sell EVs in volume. Furthermore, Chinese firms have secure access to critical minerals (often through overseas investments in mines), and the government has facilitated a robust raw materials refining industry at home, keeping cathode and anode ingredient costs lower iea.org iea.org. All these factors make China the benchmark for battery low-cost production.

One risk in China is overcapacity. Reports indicate China’s battery manufacturing capacity far exceeds current demand – by 2023, Chinese factories were utilizing less than 40% of their output capacity on average iea.org iea.org. This oversupply contributes to price competition (good for pushing costs down), but it could lead to consolidations or financial strain for some players operating on razor-thin margins iea.org. Still, Chinese manufacturers are mitigating this by aggressively seeking export markets – China exported about 12% of the batteries it made in 2023 iea.org iea.org, and that share is likely rising as they ship cells and packs to automakers in Europe, Southeast Asia, and elsewhere.

In summary, China’s battery economics in 2025 are defined by scale and integration: It produces at the lowest cost, rapidly adopts the cheapest viable chemistries (hence LFP’s dominance), innovates on pack design, and is first to market with new chemistries like sodium-ion. Local policies like tax breaks and manufacturing incentives continue to bolster demand and supply. This gives China a formidable competitive advantage, widening the gap with higher-cost regions batterytechonline.com. Chinese companies like CATL and BYD not only enjoy a huge home market but increasingly export their cost advantage by supplying foreign automakers – a dynamic that competitors in the West are scrambling to respond to.

Europe: Transition, Local Manufacturing, and the LFP Pivot

Europe enters 2025 with ambitious electrification goals and a growing (though still maturing) battery industry. The EU has legislated an effective ban on new ICE car sales from 2035 (all new cars must be zero-emission by then), creating a powerful demand signal for EVs and batteries. In the near term, EU regulations on automaker fleet CO₂ emissions are forcing manufacturers to sell more EVs or pay hefty fines. This policy environment, coupled with high consumer environmental awareness, has driven EV sales to strong levels in countries like Norway, Germany, France, and the UK. However, Europe historically relied on imported battery cells (primarily from Asia). In 2025, that is starting to change: European battery production is scaling up via local startups and foreign investors. Sweden’s Northvolt, for example, has begun producing cells and plans multiple gigafactories; France and Germany have projects (like ACC – a consortium including Stellantis and Total/Saft – building plants); and Asian giants have built plants in Europe too (LG in Poland, SK and Samsung in Hungary, CATL in Germany). By 2023, Europe’s cell production reached ~110 GWh (with Poland accounting for ~60% and Hungary ~30% of that) iea.org iea.org. The IEA notes that still about 20+% of Europe’s EV batteries were met by imports in 2023 iea.org iea.org, but the gap is closing as new factories come online.

One notable trend is Europe’s newfound interest in LFP chemistry to reduce costs and dependence on nickel/cobalt. For years, European EVs exclusively used NMC/NCA cells (since range was a priority and many models were premium). In 2022, LFP had only ~6% share in the European EV battery market reuters.com. But patents expiring and cost pressures have led European OEMs to reconsider. The IEA reported that by 2023, a few percent of European EV sales were already LFP, and that share, while still single-digit, is expected to grow in 2025 and beyond iea.org. Audi’s CEO in 2022 hinted that “we will see LFP in a larger portion of the fleet in the medium term” in response to raw material constraints reuters.com. European battery manufacturers are also partnering to produce LFP locally – for example, CATL and Stellantis announced a €4.1 billion JV to build an LFP cell gigafactory in Spain by 2026 spglobal.com, and LG Chem is exploring an LFP plant in Europe spglobal.com. These moves show Europe aligning with the global shift toward iron-based chemistries for cost-effective models.

Costs in Europe, however, remain relatively high. Energy prices in Europe are higher than in Asia, labor costs are substantial, and the battery supply chain (mining/refining of lithium, etc.) is underdeveloped locally. The IEA noted that Europe’s battery production cost is still above China’s, and even above the U.S. in some cases iea.org. Many European cell plants rely on imported materials or even imported sub-components, which adds cost. Additionally, Europe’s industry had setbacks – for instance, Northvolt (a flagship European startup) faced financial challenges and had to delay an IPO, and Britishvolt (a UK aspiring battery maker) went bankrupt. That said, the European Union and national governments have provided support through programs like the European Battery Alliance and Important Projects of Common European Interest (IPCEI) funding for battery innovation, totaling billions in subsidies and loans. These supports aim to create a self-sufficient battery ecosystem in Europe, from raw material processing (e.g. new lithium refineries in Germany) to cell manufacturing to recycling.

Europe also emphasizes sustainability and recycling in battery economics. The EU’s new Battery Regulation (approved in 2023) will enforce rules on battery carbon footprint, responsible sourcing, and end-of-life recycling requirements for batteries sold in Europe. This could marginally increase production costs (manufacturers must use cleaner processes, etc.) but also stimulates a secondary industry in battery recycling (companies like Umicore and BASF are active here). In time, recycled materials might supply a significant portion of Europe’s battery raw material needs, partially insulating from global price swings.

In terms of market trends, European EV demand remains strong, but cost-sensitive segments need cheaper batteries to hit price points. This is why LFP introduction is crucial – vehicles like the Dacia Spring or base models of Tesla and MG (a Chinese-owned brand selling well in Europe) with LFP batteries have been very popular. The competitive gap with China is a concern: Chinese EVs, often with LFP batteries, are starting to be exported to Europe at low prices, challenging European automakers. EU policymakers are watching this closely – in 2023 the European Commission even launched an investigation into Chinese EV import pricing. If Europe can get its own battery costs down (through scale and possibly its own subsidies, as a response to the IRA), it will help European carmakers compete.

In summary, Europe in 2025 is a region in transition: moving from battery import-dependence to building domestic capacity, pivoting from exclusively high-end chemistries to also embracing cost-effective LFP, and balancing aggressive EV mandates with the practical challenge of securing affordable batteries. Policy support in Europe is strong on the demand side (regulations ensuring a market for EVs) and is increasing on the supply side (funding factories, trade measures, etc.), all with the goal of making Europe a major player in the battery value chain. European battery costs are gradually falling (down ~10–15% in 2024 batterytechonline.com), but still trail the global lows set by China. The next few years – with new mega-factories coming online – will determine how close Europe can get to cost-parity in production. One positive sign: by late 2024, Chinese LFP cells are even being considered for assembly in European cars, and if local LFP plants come up by 2026, Europe could tap into the same low-cost chemistry that has powered China’s EV revolution.

Conclusion

By 2025, the world of EV batteries has hit pivotal milestones in cost and technology. Battery pack prices flirting with the $100/kWh level mean that the long-elusive goal of price parity between EVs and gasoline cars is finally within sight – in some markets and segments it’s already a reality spglobal.com. This dramatic cost decline, driven by innovation and scale, is accelerating the transition to electric mobility globally. At the same time, we are witnessing a turning point in battery chemistry: lithium iron phosphate has risen to challenge nickel-based batteries on cost-effectiveness, new chemistries like solid-state and sodium-ion are emerging from labs promising leaps in performance or security of supply, and automakers now have a more diverse toolkit of battery options than ever before.

The competitive landscape is shaped by regional strategies – from China’s low-cost manufacturing might and rapid chemistry adoption, to America’s subsidy-fueled battery renaissance, to Europe’s concerted push for self-reliance and sustainability in batteries. These regional efforts will determine who leads in the next phase of the EV battery race. As experts often say, battery technology is the new oil: it’s a strategic industry that will define economic and environmental winners in the 21st century.

Looking ahead, the industry expects more breakthroughs (e.g. lithium-metal solid-state cells hitting production, or further cost reductions perhaps towards $50/kWh by late decade) and also recognizes challenges (ensuring raw material supply, building enough factories, recycling end-of-life batteries). But the trends are overwhelmingly positive for consumers and the climate. EV batteries in 2025 are cheaper, better, and more abundant than ever before – setting the stage for mass-market EVs to outperform and outnumber their combustion-engine predecessors in the years to come. The cost-parity milestone is either here or just around the corner, and alongside it, chemistry breakthroughs are ensuring that electric vehicles will only continue to improve in range, affordability, and sustainability.

Sources: BloombergNEF and IEA reports on battery costs and EV outlook; S&P Global Mobility analysis of battery price trends spglobal.com; Goldman Sachs Research interview on battery price projections goldmansachs.com goldmansachs.com; International Energy Agency Global EV Outlook 2024–2025 for chemistry adoption and regional insights batterytechonline.com batterytechonline.com; Reuters and industry news on policy incentives and battery plant investments energypolicy.columbia.edu reuters.com; statements from battery industry experts and automaker executives on technology breakthroughs and strategy goldmansachs.com reuters.com. Each of these sources has informed this comprehensive overview of EV Battery Economics 2025.