Fluence Energy (NASDAQ: FLNC) is in focus after fresh institutional buying headlines, a major UK battery storage milestone, and sharply divided analyst price targets. Here’s what’s driving the stock on Dec. 14, 2025.

December 14, 2025 — Fluence Energy, Inc. (NASDAQ: FLNC) is drawing renewed attention from investors this weekend as a cluster of developments reshapes the near-term narrative: a newly disclosed institutional position, ongoing debate over the stock’s valuation after a volatile move in recent sessions, and a drumbeat of project wins that reinforce Fluence’s role in grid-scale battery storage. MarketBeat

With U.S. markets closed on Sunday, the latest widely cited data points still reflect Friday’s close — but the conversation around FLNC continues to evolve, especially as analysts and market commentators try to reconcile a growing global backlog story with execution, pricing, and policy risks. Barron’s

Fluence Energy stock price today: where FLNC stands as of Dec. 14, 2025

Fluence Energy shares last closed at $22.19 on Friday, December 12, 2025, down 13.96% on the day after swinging sharply earlier in the week. StockAnalysis

That one-day drop followed an outsized short-term run that saw the stock close at $25.79 on December 11 before reversing lower on December 12 — a snapshot of how quickly sentiment has been shifting around the name. StockAnalysis

From a range perspective, MarketBeat’s December 14 update lists a 12‑month low of $3.46 and a 12‑month high of $25.85. MarketBeat TradingView’s profile similarly notes the stock’s all‑time low of $3.46, reached on April 21, 2025. TradingView

What’s in today’s headlines (Dec. 14, 2025): institutional buying and a fresh UK-focused analysis

Two widely circulated pieces dated December 14, 2025 are shaping the weekend read-through for FLNC:

1) Caxton Associates discloses a new FLNC position

MarketBeat reported that Caxton Associates LLP disclosed a new position of 530,633 shares, valued at roughly $3.56 million, representing about 0.29% of Fluence Energy based on the filing snapshot. MarketBeat

The same report highlights other notable institutional moves mentioned in the coverage — including increased stakes by major holders — and reiterates that institutional ownership remains a meaningful part of FLNC’s shareholder base (MarketBeat cites 53.16% institutional ownership). MarketBeat

2) Simply Wall St connects UK grid wins to the broader “global leadership” debate

A Simply Wall St analysis published today frames Fluence’s recent UK momentum — including the Sizing John project milestone — as part of a broader positioning story. It argues that the bull case hinges on grid-scale storage and software adoption continuing to grow, while warning that the investment narrative still depends heavily on policy stability, project timing, tariff uncertainty, and competitive pricing pressure. Simply Wall St

Simply Wall St also underscores the dispersion in valuation views, pointing to community estimates spanning roughly $12 to $22.94 per share, and presenting a separate internal fair value estimate and scenario-based projections (including a revenue and earnings outlook through 2028). Simply Wall St

The operational catalyst: Fluence’s UK “Sizing John” battery storage project reaches Phase 1 operations

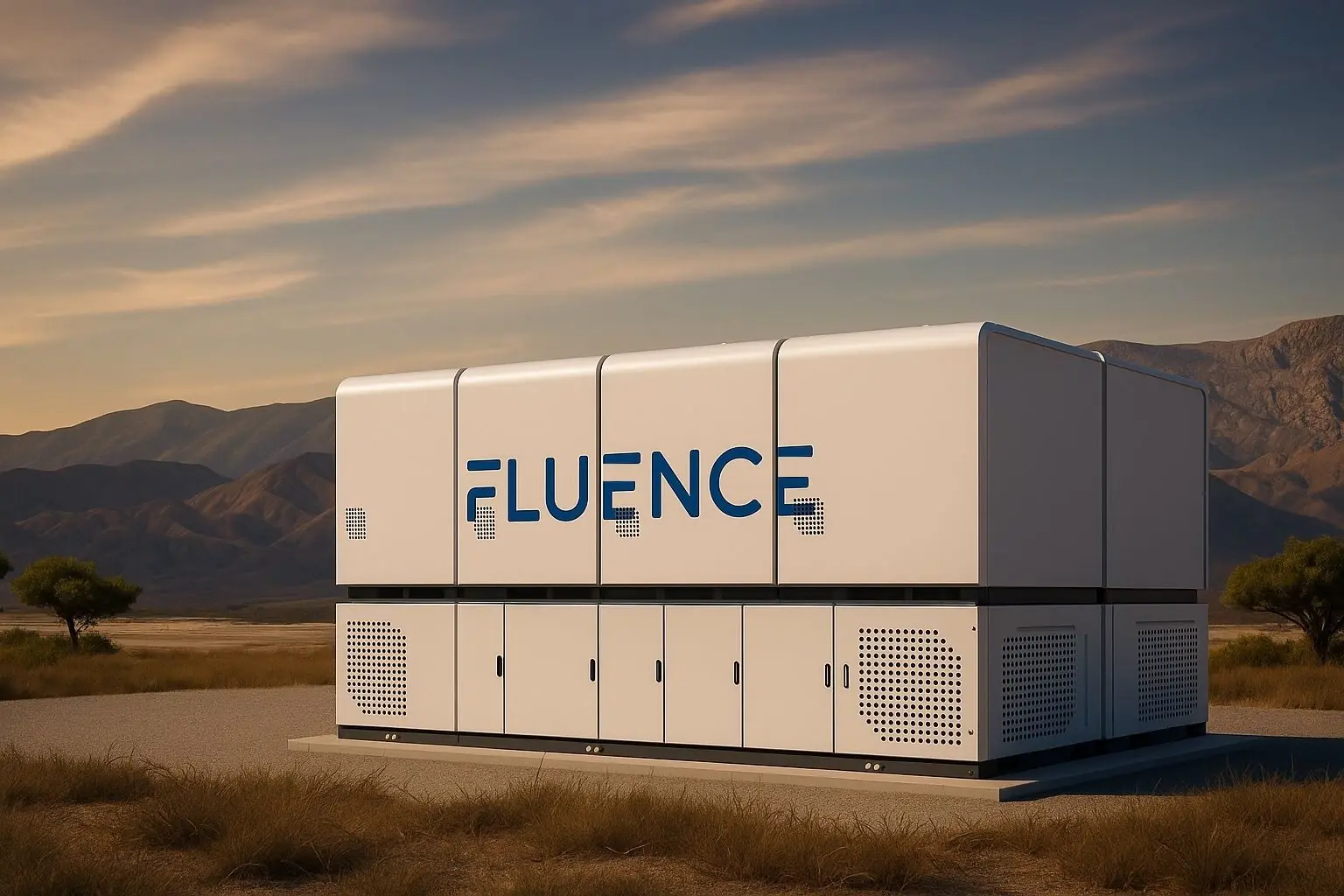

One of the most concrete recent operational updates came via a December 8 GlobeNewswire release: Phase 1 of the Sizing John Battery Energy Storage System (BESS) near Liverpool entered full commercial operations at 57 MW / 137.5 MWh, while Phase 2 construction commenced to expand the site to a combined 142.5 MW / 348.5 MWh. GlobeNewswire

Beyond scale, the update matters because Fluence and its partner emphasized grid-forming capabilities planned for Phase 2 via Fluence’s Gridstack Pro 5000, positioned as a tool to actively regulate voltage and frequency — functions that become increasingly important in grids with higher renewable penetration and fewer traditional synchronous generators. GlobeNewswire

The same release states Phase 2’s expected commercial operation date is Q4 2026, making Sizing John a multi-year execution story rather than a near-term revenue “flip.” GlobeNewswire

Project scale is rising: Europe’s “gigascale” storage buildout adds to the backdrop

Fluence’s pipeline isn’t only UK-based. In November, Fluence announced an agreement with LEAG Clean Power to build what it described as Europe’s largest battery energy storage system — a 1 GW / 4 GWh project in Jänschwalde, Germany — powered by Fluence’s Smartstack platform. GlobeNewswire

For FLNC stock watchers, projects like this typically feed into two parallel debates:

- Growth visibility: large contracted systems can support multi-year revenue potential.

- Execution risk: the bigger the project, the more investors focus on delivery timing, margins, and supply chain reliability.

Both themes show up repeatedly in recent analyst and commentary coverage around Fluence. Barron’s

Fluence’s business in one paragraph: what the company actually does

Fluence is positioned as a global provider of energy storage systems, related services, and optimization software. MarketScreener’s company profile describes Fluence as operating across 47 markets and offering modular storage solutions (including products such as Gridstack, Gridstack Pro, and others) alongside software platforms like Fluence OS and cloud-based products. MarketScreener

That combination — hardware systems plus software and services — is central to how bulls argue for a higher long-term multiple, and how skeptics argue the stock should be valued more conservatively when margins or project timing disappoint. Simply Wall St

Earnings recap and 2026 guidance: strong backlog signals, but analysts remain split

The most important fundamental “anchor” for FLNC in late 2025 has been the company’s fiscal-year update and outlook.

Barron’s reported that Fluence issued a fiscal 2026 revenue outlook of $3.2 billion to $3.6 billion, implying substantial growth at the midpoint, and said Fluence indicated roughly 85% of the midpoint was already secured in backlog as of Sept. 30. Barron’s

Barron’s also highlighted:

- $5.3 billion backlog at fiscal year-end and $1.4 billion in new orders in the quarter Barron’s

- Record adjusted gross profit margin of 13.7% for the year and $1.3 billion in liquidity, described as a company record Barron’s

- A quarter where revenue came in around $1.0B versus higher consensus expectations in the reporting discussed, keeping the “execution vs. growth” tension alive Barron’s

In the company’s earnings release coverage on Nasdaq, Fluence also described a focus on expanding recurring software revenues, including an annual recurring revenue figure and a longer-term ARR target tied to its guidance framework. Nasdaq

Meanwhile, Reuters’ market profile data lists Fluence’s 2025 revenue at about $2.26B, reinforcing the scale of the growth implied by the 2026 outlook range being discussed by market coverage. Barchart

FLNC stock forecast: where Wall Street price targets land (and why they vary so much)

Analyst forecasts for Fluence Energy remain unusually dispersed for a company of its size — and that dispersion is part of the story.

MarketBeat’s consensus view: “Reduce,” with a target below the current price

MarketBeat’s forecast page (updated data set) shows:

- Consensus rating: “Reduce” (based on 27 analyst ratings)

- Average 12‑month price target:$13.28

- High / low targets:$25.00 / $2.00 MarketBeat

That average target implies meaningful downside versus where shares last traded, at least based on the same page’s “current price” reference. MarketBeat

The Mizuho downgrade that shook sentiment

One of the most-cited catalyst downgrades in early December came from Mizuho, which cut FLNC to Underperform (from Neutral) while raising its price target to $15. TheFly/TipRanks summarized the rationale as concern that the shares were pricing in “premature enthusiasm” around pipeline conversion and execution items, despite acknowledging improving demand and margins. TipRanks

Other notable calls: Johnson Rice and mixed revisions

MarketBeat reported that Johnson Rice reiterated a Hold rating with an $18 target in coverage dated December 8. MarketBeat

At the same time, MarketBeat’s December 10 recap notes several firms raised targets after the earnings cycle while the overall consensus still leaned cautious — a mix that captures the current push-pull around FLNC’s valuation. MarketBeat

Bottom line: On December 14, 2025, FLNC is a stock where you can easily find credible-sounding arguments on both sides — and the spread between low and high targets shows the market is still debating what “normalized” profitability and delivery execution should look like. MarketBeat

Ownership and insider activity: what filings are signaling (and what they aren’t)

Institutional flows: a sentiment tailwind, but not a guarantee

The Caxton position disclosure is the most prominent “today” ownership headline, but it’s best read as a data point — not a catalyst on its own. Institutional entries can reflect a view on valuation, momentum, or hedged exposure, and they often don’t translate into immediate price support if broader sentiment turns risk-off. MarketBeat

Insider filings: exercises and tax-related share surrenders

This week also included insider Form 4 activity covered through Reuters/Refinitiv distribution via TradingView. For example, CEO Julian Nebreda’s filing described an option exercise followed by a share surrender connected to covering exercise cost and/or tax obligations, with updated ending holdings shown in the filing summary. TradingView

A similar pattern appears in an officer filing summarized the same way. TradingView

Separately, an aggregation of Fluence Form 4 data shows multiple December 8 transactions categorized as exercises and tax withholding events across several executives — activity that is structurally different from an open-market buy made as a discretionary “bullish bet.” Sec Form 4

What matters next for Fluence Energy stock: catalysts and risks into early 2026

As of December 14, 2025, investors appear to be triangulating around a few clear questions:

1) Can Fluence turn backlog into profitable delivery — on time?

Even bullish coverage emphasizes that the story depends on converting backlog into revenue and margin without repeated timing slips. Simply Wall St

2) Will large projects validate “technology leadership” (or expose complexity)?

Sizing John’s grid-forming expansion (Phase 2) is a technology showcase, but it’s also a multi-year execution commitment with a stated target of Q4 2026 for commercial operations. GlobeNewswire

3) Pricing pressure, tariffs, and policy stability

Simply Wall St flags tariff uncertainty, competitive pricing pressure, and project timing risk as persistent factors that can disrupt conversion from backlog to revenue. Simply Wall St

4) The valuation debate isn’t going away

With the stock near recent highs before Friday’s sharp pullback, and with analyst targets ranging widely, valuation is likely to remain the “center ring” issue whenever new orders, margins, or guidance are updated. MarketBeat

The takeaway for Dec. 14, 2025

Fluence Energy stock enters the week ahead with a paradox that’s becoming familiar to investors following the clean energy and grid infrastructure space:

- Operational momentum is real — highlighted by UK commercial operations and high-profile growth projects. GlobeNewswire

- The growth outlook is ambitious — with 2026 revenue guidance that implies a step-change year if execution holds. Barron’s

- But conviction is divided — as shown by cautious consensus ratings and wide-ranging price targets, plus continued emphasis on timing, margin, and policy sensitivity. MarketBeat

For Google News and Discover readers tracking FLNC stock, the near-term storyline is less about a single headline and more about whether Fluence can keep turning grid-scale wins into consistent, profitable delivery — while navigating the macro and policy variables that can derail timelines for large storage deployments.