On December 8, 2025, Fluence Energy, Inc. (NASDAQ: FLNC) is giving investors a live lesson in volatility.

After a huge rally over the past two weeks, the grid‑scale battery and software specialist is trading around $22–23 per share, down roughly 7–8% intraday as fresh analyst downgrades collide with strong growth guidance and a new UK battery storage milestone. The stock is still up more than 30% year‑to‑date and sits close to its one‑year high in the mid‑$20s, after climbing from a 12‑month low near $3.50. Finviz+1

Key takeaways for December 8, 2025

- Shares are sliding today after Mizuho downgraded Fluence from Neutral to Underperform, even while raising its price target from $9 to $15, citing high valuation and execution risks around data center projects and new battery supply. GuruFocus+2Finviz+2

- Johnson Rice also cut the stock from Buy to Hold, with a $18 target, triggering a gap‑down open and reinforcing a cautious stance after a sharp recent rally. MarketBeat+1

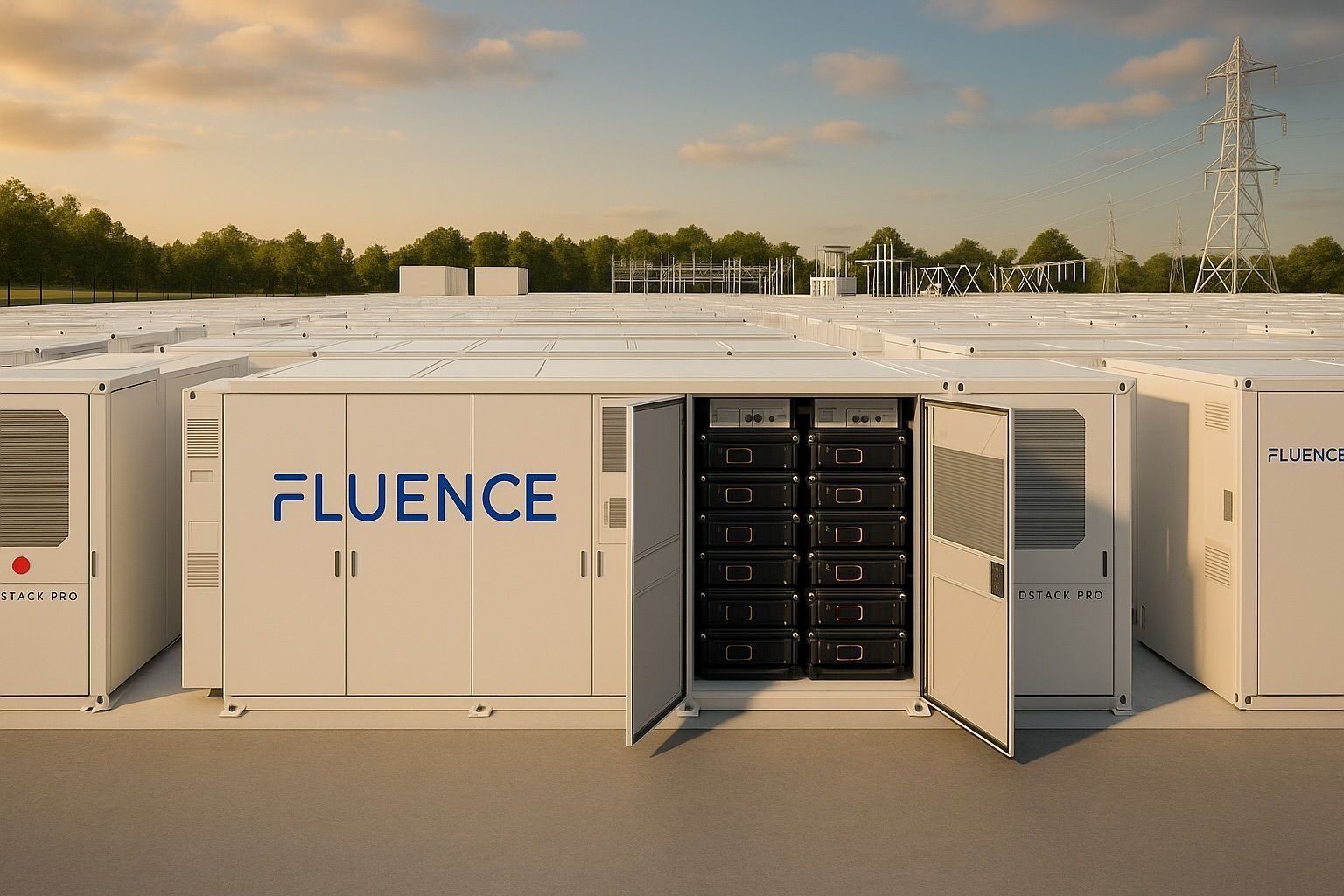

- At the same time, Fluence announced Phase 1 commercial operation and Phase 2 launch of the 142.5 MW “Sizing John” battery project in the UK, underscoring its role in long‑duration storage and grid‑forming technology. GlobeNewswire

- The company’s fiscal 2025 results show revenue of $2.3 billion, improved gross margins, record backlog of $5.3 billion, and 2026 revenue guidance of $3.2–3.6 billion, with about 85% of the midpoint covered by backlog. GlobeNewswire+1

- Wall Street is split: the consensus rating is “Hold/Reduce”, and average 12‑month price targets cluster around $13–16, implying 30–50% downside from today’s price, despite a few bullish narratives tying Fluence to AI data center power demand. MarketBeat+4StockAnalysis+4StockAnalysis+4

Below is a detailed look at the latest news, analyst forecasts and market narrative around Fluence Energy stock as of December 8, 2025.

1. Where Fluence Energy stock stands today

Price, performance and volatility

- Current price: Around $22.24 per share in Monday’s session.

- Intraday range (Dec 8): Roughly $21.85–$24.8 as the stock gapped down at the open and traded lower after the downgrades. MarketBeat

- 52‑week range: About $3.46 (low) to $24.79 (high), according to MarketBeat. MarketBeat

- YTD performance: Up roughly 31–37% in 2025, depending on the reference date, even after today’s pullback. Finviz+1

- Market cap: Just over $4.0 billion at current levels. MarketBeat+1

Both StockStory and Finviz emphasize how wild this ride has been: Fluence has seen 80+ daily moves greater than 5% over the last year, a sign that news and sentiment swings routinely hit the share price hard. Finviz+1

On traditional metrics, MarketBeat currently shows:

- Negative P/E (around ‑53x on trailing earnings),

- Beta around 2.9 (high volatility vs the market), and

- Solid liquidity with current ratio ~1.5 and debt‑to‑equity ~0.7. MarketBeat+1

In short, the market is valuing Fluence like a high‑growth, high‑risk story stock, not a sleepy utility supplier.

2. Why Fluence Energy shares are sliding on December 8, 2025

Mizuho downgrade: “Underperform” on valuation worries

The first blow today came from Mizuho:

- The firm downgraded Fluence from Neutral to Underperform,

- Raised its 12‑month price target from $9 to $15, which still implies significant downside from the low‑$20s,

- Flagged concerns that the stock price reflects “premature enthusiasm” around converting its data center pipeline into actual revenue, and

- Highlighted risks around integrating AESC’s battery cell line and ongoing production challenges, even as margins improve. GuruFocus+2Seeking Alpha+2

Finviz’s recap notes that shares fell about 7.5% in the morning session following the downgrade, with investors reacting more to the rating cut than to the higher target, given how far the stock has already run. Finviz

Johnson Rice: From Buy to Hold, target $18

Johnson Rice added to the pressure:

- Cut its rating from Buy to Hold,

- Set a $18 price target, roughly 18–19% below where the stock traded before the downgrade, and

- Pointed out that the rally had pushed Fluence beyond what its fundamentals and near‑term earnings justify. MarketBeat+1

MarketBeat’s “gap down” alert notes that FLNC closed at $23.96 previously, then opened around $22.58 and traded near $22.1–$22.7 during the session as selling pressure persisted. MarketBeat

Negative sentiment overshadowing positive project news

Ironically, the downgrades landed on the same day as a positive operations update:

- Fluence and UK‑based Varco Energy announced that Phase 1 of the Sizing John battery energy storage system (57 MW / 137.5 MWh) near Liverpool is now in full commercial operation.

- Phase 2 has been launched and will add 85.5 MW / 201 MWh, bringing the total project to 142.5 MW / 348.5 MWh when completed in Q4 2026. GlobeNewswire

- The site uses Fluence’s Gridstack and upcoming Gridstack Pro 5000 systems with grid‑forming capabilities, aimed at stabilizing voltage and frequency in a heavily constrained grid region. GlobeNewswire

As the Finviz/StockStory recap bluntly notes, the negative reaction to the downgrade “overshadowed” this UK project milestone, reminding investors that in the short term, analyst sentiment can matter more than incremental project wins for the share price. Finviz+1

3. How we got here: Earnings, backlog and the AI energy narrative

Fiscal 2025 results: Revenue down, margins and backlog up

Fluence reported fiscal 2025 results (year ended September 30, 2025) on November 24: GlobeNewswire+2Quiver Quantitative+2

- Revenue:

- $2.3 billion for FY 2025 vs $2.7 billion in FY 2024 (about ‑16% year‑on‑year),

- $1.0 billion in Q4 vs $1.2 billion in Q4 2024. GlobeNewswire+1

- Profitability:

- GAAP gross margin improved to 13.1% for the full year and 13.7% in Q4, versus 12.6% and 12.8% a year earlier. GlobeNewswire

- FY 2025 still showed a net loss of $68 million, but Q4 delivered net income of $24.1 million, down from $67.7 million in the prior‑year quarter. GlobeNewswire

- Adjusted EBITDA came in at $19.5 million for the year and $72.2 million for Q4, lower than FY 2024 but still positive. GlobeNewswire+1

- Backlog and orders:

- Record backlog of about $5.3 billion, up from $4.5 billion a year earlier.

- Order intake over $1.4 billion in Q4 alone, the largest quarterly haul in company history. GlobeNewswire+1

- Recurring revenue & liquidity:

- Annual recurring revenue (ARR) of about $148 million,

- Total liquidity around $1.3 billion, also a company record. GlobeNewswire+1

From an earnings‑surprise standpoint, the quarter was not clean:

- Consensus expected roughly $0.19 in EPS; Fluence posted about $0.13, a miss of $0.06.

- Revenue of around $1.04 billion fell short of expectations near $1.39–1.41 billion, and was down more than 15% year‑on‑year. Quiver Quantitative+2MarketBeat+2

That mix – weaker headline numbers but record backlog and improved margins – is central to the debate now playing out in the share price.

2026 guidance: Big growth, heavily pre‑sold

Management’s fiscal 2026 guidance, released alongside earnings, calls for: GlobeNewswire+1

- Revenue:$3.2–3.6 billion (midpoint $3.4 billion), ~50% growth over FY 2025.

- Adjusted EBITDA:$40–60 million (midpoint $50 million).

- ARR: Targeted around $180 million by the end of FY 2026.

Crucially, Fluence says about 85% of that 2026 revenue midpoint is already covered by its $5.3 billion backlog, giving investors unusual visibility – on paper – into next year’s top line. GlobeNewswire+2Simply Wall St+2

A widely cited Yahoo Finance / Simply Wall St piece argued that this combination of record backlog and aggressive 2026 revenue guidance “could be a game changer” for the stock if the company executes and turns the pipeline into profitable revenue. Yahoo Finance+2MarketBeat+2

AI data centers and energy storage: The bull case hook

Several bullish analyses published over the last week lean heavily on the AI infrastructure narrative:

- A Finviz‑hosted “Bull Case Theory” article summarizes a Substack thesis arguing that as AI data center power demand potentially quadruples over the next decade, utility‑scale energy storage will become a critical bottleneck – and Fluence is positioned as a leading supplier of large‑scale battery systems and optimization software. Finviz

- The piece notes that Fluence:

- Has grown rapidly since 2020,

- Is backed by AES and Siemens, which bring customer relationships and manufacturing depth,

- Already counts major tech companies such as Amazon, Meta and Google as customers for data center projects, and

- Has moved early to reshore battery manufacturing to the U.S., potentially benefiting from tariffs and domestic‑content incentives, even though that shift has caused short‑term delays. Finviz+1

In that bullish framing, the author suggests that Fluence could be worth several times its current valuation if growth and margins ramp as expected – but that’s clearly a speculative scenario, not a base‑case Street forecast. Finviz+1

4. Street view: Forecasts, ratings and price targets as of Dec 8, 2025

Despite the recent rally, the dominant theme in today’s sell‑side research is caution.

Consensus rating: Mostly “Hold” or worse

Across multiple data providers:

- StockAnalysis: 18–20 covering analysts, average rating “Hold”. StockAnalysis

- MarketBeat: 4 Buys, 17 Holds, 6 Sells; consensus rating “Reduce”. MarketBeat+1

- GuruFocus: 21 brokerages, average recommendation corresponds to “Hold” (3.0 on a 1–5 scale). GuruFocus

- TipRanks, Public.com, valueinvesting.io all show a non‑bullish consensus, describing the stock as neutral overall. TipRanks+2Public+2

The message: analysts see Fluence as a promising but fully‑priced growth name, not a straightforward bargain, after the latest surge.

Average price targets vs current price

Here’s where it gets stark. Different aggregators show similar patterns:

- StockAnalysis:

- Average 12‑month price target around $13–14, implying roughly 40% downside from current levels. StockAnalysis+1

- TipRanks:

- About 16 analysts, average target $15.97, high $25, low $9 – roughly 30–35% downside vs the low‑$20s. TipRanks

- ValueInvesting.io:

- Average target $10.33, range $2.02–$17.85, with estimated 50–60% downside from recent prices. Value Investing

- MarketBeat:

- Consensus price target about $12.93, again well below the current share price. MarketBeat+1

- GuruFocus:

- Average Street target $14.39 (downside ~40%), but its proprietary “GF Value” estimate suggests a fair value near $27, modestly above where the stock trades now. GuruFocus

Public.com’s forecast page similarly cites a mid‑teens price prediction (around $14–15) with a Hold consensus, reinforcing that most models put fair value well below the current quote. Public+1

Today’s rating moves in context

Recent analyst actions show just how fast the narrative has whipsawed:

- Today (Dec 8)

- Johnson Rice: Strong Buy → Hold, target $18. StockAnalysis+1

- Mizuho: Neutral → Underperform, target raised from $9 to $15. GuruFocus+1

- Earlier in December

- UBS: Maintained Neutral but hiked target from $8 to $22, citing Fluence’s high growth vs peers and improving margin visibility; shares surged ~16–17% on the move. TradingView+1

- Citigroup: Neutral, target lifted from $7.50 to $20. TradingView+1

- Late November cluster (post‑earnings) – as tracked by QuiverQuant and others:

- Morgan Stanley: Target $14, Equal Weight.

- Goldman Sachs: Target $20.

- Jefferies: Upgraded from Sell/Underperform to Hold, target $16.

- Barclays: Target $15, Equal Weight.

- Susquehanna: Target $20.

- RBC: Target $10. Quiver Quantitative+1

Insider Monkey summed this wave up with headlines like “Fluence (FLNC) Soars 17% as 7 Investment Firms Go Bullish” and “Fluence Energy (FLNC) Gains 22% as 7 Analysts Grow Bullish,” highlighting how the stock ripped higher as those targets were reset. Finviz+3Yahoo Finance+3Finviz+3

Today’s downgrades are in many ways the hangover after that party: analysts are not saying the business has imploded; they’re saying the price ran too far, too fast.

5. Competing narratives: Bull vs bear on Fluence Energy

Bull case: Grid‑scale storage winner with AI upside

Supportive research and commentary emphasize several themes:

- Massive structural demand

- Expansion of solar, wind and electrification requires huge amounts of grid‑scale battery storage to balance intermittent generation.

- AI data center build‑out could dramatically increase electricity demand and the need for firm, flexible capacity, favoring storage solutions. Finviz+1

- Strong positioning and backlog

- Fluence is already a global leader in energy storage and optimization software across the Americas, Europe, and Asia‑Pacific. GuruFocus+1

- The $5.3 billion backlog and 85% coverage of 2026 revenue guidance suggest a robust pipeline of contracted projects. GlobeNewswire+2Simply Wall St+2

- Improving margins and recurring revenue

- Gross margins have crept above 13%, and ARR is nearing $150 million, with guidance for further growth, pointing toward a higher‑quality revenue mix over time. GlobeNewswire

- Strategic partnerships and technology

- Backing from AES and Siemens provides balance‑sheet strength, customer access and technical credibility. GlobeNewswire+1

- Projects like Sizing John in the UK showcase longer‑duration storage and grid‑forming capabilities, positioning Fluence for higher‑value grid‑stability use cases. GlobeNewswire

In some bullish theses, these factors justify very high earnings multiples and the possibility that today’s valuation will look cheap if Fluence scales profitably. Finviz+1

Bear case: Rich valuation, execution risk and extreme volatility

The more skeptical side – which today’s downgrades reinforce – focuses on:

- Valuation vs earnings power

- Several sources note lofty forward P/E multiples, in some cases above 70–90x projected earnings, depending on the forecast used. StockAnalysis+2Finviz+2

- Many aggregated models put fair value in the low‑ to mid‑teens, implying substantial downside from current prices. MarketBeat+3StockAnalysis+3TipRanks+3

- Earnings quality and guidance risk

- The latest quarter missed consensus expectations on both revenue and EPS, and revenue actually declined year‑on‑year, despite the positive guidance for 2026. MarketBeat+2MarketBeat+2

- Execution risk is high: Fluence must convert backlog into revenue on schedule, manage supply‑chain and tariff challenges, and profitably scale domestic manufacturing. Simply Wall St+3GlobeNewswire+3Simply Wall…

- Data center pipeline uncertainty

- Both Mizuho and TipRanks flag concerns that the data center opportunity may be over‑discounted into the share price, with limited visibility on how much of the pipeline will translate into firm, profitable contracts. GuruFocus+2TipRanks+2

- Stock behavior and risk profile

- With 88+ daily moves greater than 5% in a year, FLNC behaves more like a speculative growth stock than a steady infrastructure play. Finviz+1

Simply Wall St, for instance, estimates a fundamental “fair value” around $11–12 per share, suggesting roughly 50% downside from recent levels, even while acknowledging long‑term growth potential. Simply Wall St+1

6. What to watch next for FLNC

For investors tracking Fluence Energy (whether as a potential opportunity or a risk case), several catalysts matter after today:

- Execution vs 2026 guidance

- Quarterly updates through 2026 will show whether the company stays on track to hit $3.2–3.6 billion in revenue and $40–60 million in adjusted EBITDA, and whether margins continue to creep higher. GlobeNewswire+1

- Backlog conversion and project timing

- Watch how quickly projects like Sizing John Phase 2 and other large storage installations move from backlog to revenue, especially in markets facing tariff and policy uncertainty. GlobeNewswire+2Simply Wall St+2

- Data center wins

- Concrete announcements of large, multi‑year AI data center storage contracts would help validate the more optimistic AI‑energy thesis and could shift the Street’s valuation framework. Finviz+1

- Analyst revisions

- After today’s resets, further target changes and rating shifts will show whether the consensus slowly moves closer to the stock price – or the stock price drifts back toward consensus targets. GuruFocus+3StockAnalysis+3MarketBeat+3

- Macro and policy backdrop

- Fluence is sensitive to interest rates, clean‑energy incentives, trade policy and domestic‑content rules, all of which affect customer financing and project timing. Recent coverage highlighted that policy clarity has improved, but investors remain cautious on end demand. Investing.com Philippines+2Investing.com+2

Final thought

As of December 8, 2025, Fluence Energy sits at the intersection of structural growth (renewables and AI power demand) and very real execution and valuation risk. The stock’s violent swings – rallies on bullish targets, sell‑offs on downgrades – reflect that tension more than any single data point.