Germany’s blue‑chip DAX 40 index closed sharply lower on Tuesday, 18 November 2025, as the Frankfurt Stock Exchange was hit by a global risk‑off wave, fresh warnings from the European Central Bank (ECB) about bank vulnerabilities, and ongoing concerns over an “AI bubble” in technology stocks.

By the close of Xetra trading at 17:30 CET, the DAX finished at 23,335.07 points, down 1.08% from Monday’s close of 23,590.52, after trading in a relatively tight intraday range between about 23,230 and 23,365 points. Investing.com

DAX 40: Weak Open, Heavy Session, Lower Close

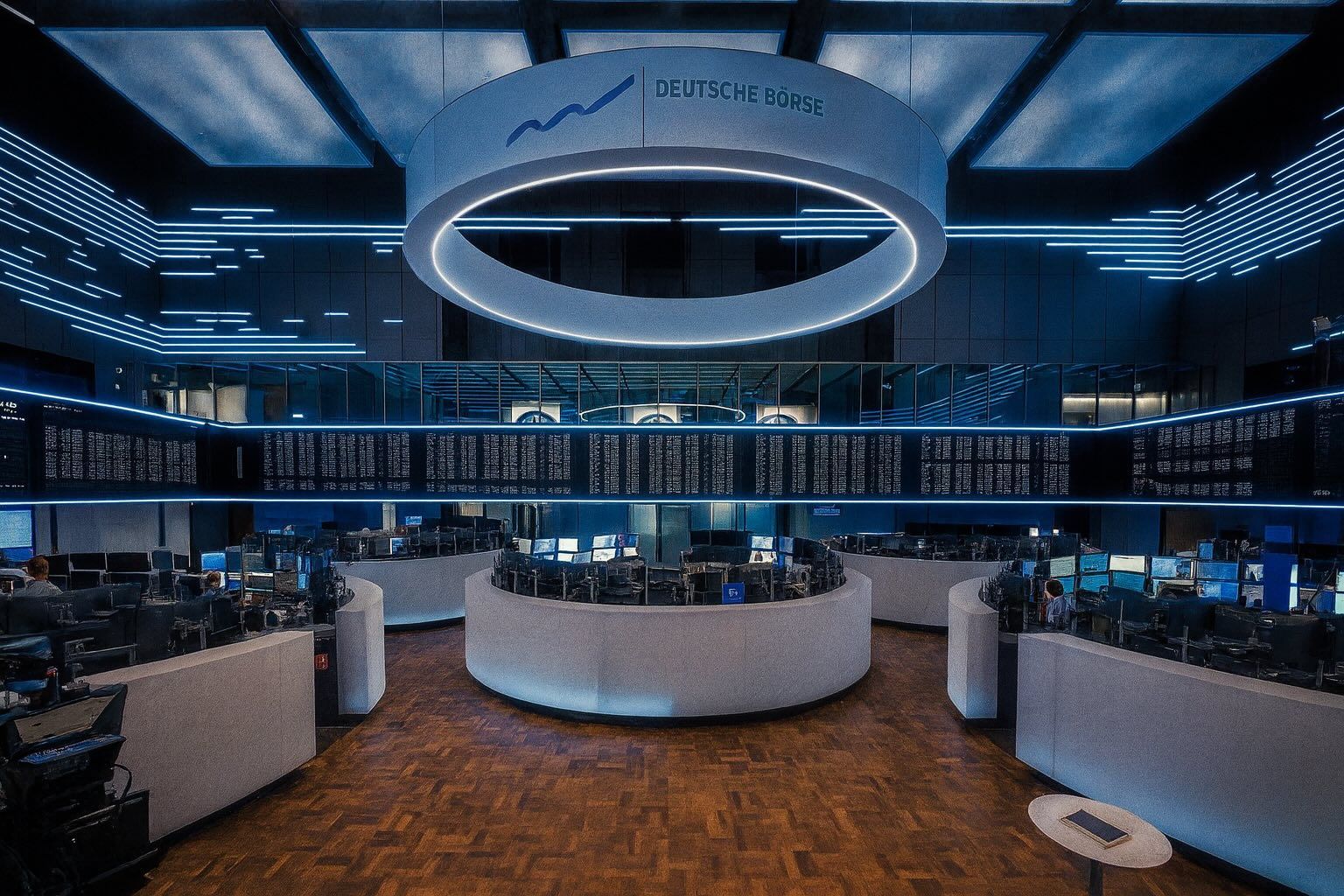

Trading on Xetra, Deutsche Börse’s fully electronic order book and the reference market for German shares and ETFs, runs from 09:00 to 17:30 CET on trading days. Deutsche Börse Group+1 The tone was negative from the opening bell:

- Futures signalled declines after a red session in Asia and on Wall Street. Reuters+1

- According to intra‑day data, the DAX opened around 23,233 points, already more than 1% below Monday’s close. Investing.com+1

Early in the European morning, European equities slid to a one‑week low, with the pan‑European STOXX 600 down about 1.1% by around 08:10 GMT and major indices in Germany and France falling more than 1.2%. Reuters A little later, live market coverage in London reported Germany’s DAX down about 1.3%, alongside similar losses in other eurozone benchmarks. The Guardian

Although the German index clawed back a small part of those early losses into the close, the move still marked another down day in what has become a choppy November for German equities.

Key numbers for 18 November 2025 (Xetra DAX 40): Investing.com

- Close: 23,335.07

- Change: −255.45 points (−1.08%)

- Open: 23,233.18

- High / Low: 23,365.18 / 23,230.19

- Volume: ~7.7 million index‑level shares traded

Why German Stocks Fell Today: Fed Doubts and AI Valuation Jitters

The selling pressure in Frankfurt was part of a global risk‑off move:

- A Reuters European market wrap cited worries about stretched technology valuations and fading expectations of a near‑term U.S. Federal Reserve rate cut as key drivers, with banking shares among the hardest‑hit sectors. Reuters

- A separate “Morning Bid” column from Reuters noted “another sea of red” in Asian markets and highlighted how Nvidia’s upcoming earnings and a delayed U.S. jobs report later in the week are keeping investors on edge. Reuters

- A live business blog from The Guardian described a fourth consecutive day of global stock market losses, driven by fears that an AI‑driven tech boom may be turning into a bubble and by concerns that rate cuts could be slower than previously hoped. The Guardian

For the German stock exchange, this translated into:

- Persistent selling in interest‑rate‑sensitive banks and cyclical stocks,

- Profit‑taking in semiconductors and industrials that had run hard earlier in the year, and

- A wider pullback in risk assets, including cryptocurrencies, with Bitcoin sliding below $90,000 in parallel with the equity sell‑off. The Guardian

ECB Warning Puts German and Eurozone Banks in the Spotlight

One of the most relevant policy headlines for Germany today came from Frankfurt itself.

In a supervisory update, the European Central Bank warned that eurozone banks face an “unprecedentedly high” risk of extreme, low‑probability shocks and must be ready for severe disruptions with far‑reaching consequences for financial systems. Reuters

Key points from the ECB’s communication: Reuters

- Structural vulnerabilities from geopolitics, shifting trade policies, climate risks, demographic change and technological disruption mean shocks are likely to be more frequent and more extreme.

- Banks are urged to maintain strong capital buffers, modern IT infrastructure and “intrusive” risk management, while the ECB plans reverse stress tests to examine how much capital they could lose under hypothetical scenarios.

- Although the ECB said eurozone banks currently enjoy solid capitalisation and profitability, it warned that this “benign environment is unlikely to last”, especially given U.S.–EU trade tensions that could hit sectors like automotive, chemicals and pharmaceuticals—all heavily represented in German indices.

On the DAX 40, this backdrop coincided with renewed pressure on financials. Intraday data from market screens showed Deutsche Bank trading around 3% lower and Commerzbank down more than 1.5% at one point, underperforming the broader index. markets.businessinsider.com+1

Sector Breakdown: Banks, Chips and Autos Drag Frankfurt Lower

Real‑time DAX component data underline how broad‑based today’s correction on the Frankfurt Stock Exchange was: markets.businessinsider.com+1

- Financials:

- Deutsche Bank fell more than 3% intraday.

- Commerzbank dropped around 1.7%.

- ECB commentary about future shocks and trade risks added a fundamental overhang to the sector. Reuters+1

- Semiconductors & Tech‑adjacent names:

- Infineon lost roughly 2.7%.

- Siemens Energy slipped close to 3%.

- These moves came as investors worried that the AI infrastructure boom—a key demand driver for chips and power equipment—might be over‑extended ahead of Nvidia’s results. Reuters+2Reuters+2

- Autos & Industrials:

- Daimler Truck fell just over 3%.

- Mercedes‑Benz Group, Volkswagen and BMW all traded lower, in a session where cyclical exporters were generally shunned. markets.businessinsider.com

- The ECB explicitly flagged that U.S.–EU trade tensions could pressure export‑heavy sectors such as automotive and chemicals, undermining asset quality over time. Reuters

- Defensives & Miscellaneous:

- Stocks such as Rheinmetall bucked the trend intraday with modest gains, but defensive outperformance was not strong enough to offset selling elsewhere. markets.businessinsider.com

In short, German stocks fell across nearly every major sector, with outsized declines clustered in banks, energy‑intensive industry and tech‑linked names.

Deutsche Börse Makes a Strategic Move into Stablecoins

While index levels were sliding, Deutsche Börse, operator of the Frankfurt Stock Exchange and the Xetra trading platform, announced a notable step in its digital assets strategy.

According to a Reuters report, Deutsche Börse plans to integrate Societe Generale’s dollar‑ and euro‑backed public stablecoins—issued through the French bank’s crypto arm SG‑FORGE—into its settlement and custody infrastructure at Clearstream. Reuters

Key elements of the deal: Reuters

- The SG‑FORGE stablecoins, which are fully backed by fiat reserves but have so far seen limited adoption, will be added to Clearstream’s custody services.

- Over time they may be used to settle securities trades and manage collateral, effectively bringing blockchain‑based money closer to the heart of Europe’s traditional financial market plumbing.

- SG‑FORGE’s chief executive described stablecoins as a faster and cheaper way to move money, arguing that the partnership aims to import the speed and efficiency of the crypto ecosystem into regulated markets.

Even though volumes in these specific tokens are still small compared with global leaders such as Tether, the move shows how Germany’s main stock exchange operator is positioning itself for tokenised finance, at exactly the moment when crypto markets are in the midst of a sharp drawdown. Reuters+1

Xetra Share Buybacks: Energiekontor and Cancom Update Investors

Beyond the headline DAX names, mid‑cap corporate actions on Xetra also made news today.

Energiekontor AG: Share Buyback Interim Report #19

Renewable energy developer Energiekontor AG published a post‑admission duties announcement via EQS, confirming progress on its previously announced share buyback programme: TradingView

- Between 10 and 14 November 2025, the company bought back 1,520 shares on Xetra.

- The weighted average purchase prices ranged from roughly €32.09 to €34.11 per share, with daily volumes between 230 and 425 shares.

- Since the programme began on 7 July 2025, Energiekontor has repurchased a total of 22,390 shares.

- All transactions were executed by a commissioned credit institution exclusively via the Frankfurt Stock Exchange (Xetra).

This is the 19th interim report under the ongoing programme and underlines how German mid‑caps are actively using the stock exchange to manage capital structure in a volatile market.

CANCOM SE: 8th Interim Notification in Share Buyback 2025

IT services provider CANCOM SE released its 8th interim notification for its 2025 share buyback programme. TradingView

- From 10 to 14 November 2025, CANCOM repurchased 75,488 treasury shares.

- The volume‑weighted average prices on Xetra ranged from about €23.56 to €26.06 over those five trading days.

- In total, since the start of the programme on 22 September 2025, the company has bought back 619,495 shares.

- As with Energiekontor, the shares were acquired by a mandated bank solely via Xetra.

Together, these disclosures highlight continuing buyback activity on the German stock exchange, even as broader market sentiment turns cautious.

Macro Context: A DAX at a Crossroads

Today’s decline comes against a more complicated medium‑term backdrop for the German stock market.

An analytical piece published this morning by AInvest characterises the DAX as being “at a crossroads”:

- Inflation in the euro area is projected to ease toward around 2.4% in 2025, still slightly above the ECB’s 2% target, leaving monetary policy relatively restrictive. AInvest

- Germany faces trade deficits, high energy costs, labour shortages and an ageing population, all of which weigh on long‑term growth and corporate investment, particularly in manufacturing and energy‑intensive industries. AInvest

- The government has attempted to support heavy industry with targeted energy subsidies, but analysts warn that this underscores structural fragility in the country’s industrial model. AInvest

Earlier this month, survey data from the ZEW economic research institute showed German investor sentiment unexpectedly deteriorating in November, signalling that professional investors are turning more cautious about the outlook for Europe’s largest economy. Reuters

Taken together, elevated macro uncertainty, ECB warnings and global AI‑related valuation jitters help explain why German stocks remain vulnerable to downside shocks, even after strong gains earlier in the year.

What Today’s Move Means for German Investors

For investors watching the German stock exchange on 18 November 2025, several themes stand out:

- Volatility is rising again

- Equity volatility gauges in Europe have climbed, and Germany’s DAX is now experiencing daily swings of more than 1% in both directions. The Guardian+1

- Banks, cyclicals and AI‑exposed names are in the firing line

- ECB supervision priorities and global AI‑bubble concerns are hitting banks, autos, industrials and chipmakers particularly hard. markets.businessinsider.com+3Reuters+3Reut…

- Market structure is evolving even in a sell‑off

- Deutsche Börse’s stablecoin initiative with Societe Generale shows that tokenisation and digital settlement are moving from concept to implementation in Frankfurt, regardless of short‑term price moves. Reuters

- Corporate buybacks provide selective support

- Programmes at companies such as Energiekontor and CANCOM demonstrate that management teams are prepared to lean against volatility where balance sheets allow. TradingView+1

For now, the DAX remains well above its 2024 lows, but today’s decline underlines that the rally is fragile. Investors will be watching:

- Nvidia’s earnings,

- The U.S. jobs report later this week, and

- Any further ECB commentary on banks and financial stability

for clues on whether today’s drop in the German stock market is a short‑lived wobble or the start of a deeper correction.

This article is for informational purposes only and does not constitute investment advice. Investors should conduct their own research or consult a professional adviser before making financial decisions.