NEW YORK, Jan 16, 2026, 09:54 EST — Market hours underway.

- Grab shares bounced back early Friday, recovering a portion of the ground lost on Thursday.

- A proposed Indonesian decree might limit platform commissions and tack on insurance expenses for drivers.

- Investors are eyeing Grab’s February earnings and hoping for clearer guidance from Jakarta on the regulations.

Shares of Grab Holdings climbed 2.7% to $4.51 in early Nasdaq trading Friday, bouncing between $4.42 and $4.60 beforehand.

The stock took a hit this week after Reuters reported that Indonesia is considering a draft presidential decree to slash the commission cap ride-hailing companies can charge drivers—from 20% down to 10%. The decree would also make these platforms fully responsible for accident and death insurance. It includes provisions for sharing health, old-age, and pension premiums, though the timing and final details remain unclear. Reuters

Commission is the share a platform takes from every trip. When that cut drops, the “take rate” — the portion of each fare turning into revenue — shrinks too, tightening the budget for incentives meant to keep drivers and riders engaged.

Grab’s stock finished Thursday at $4.39, slipping 5.18% amid heavy trading, according to Nasdaq’s market data. Nasdaq

Global stocks hovered close to record highs on Friday as U.S. markets geared up for the Martin Luther King Jr. Day holiday on Monday. This combination often results in thin trading and moves driven largely by headlines. Reuters

Grab announced it will release unaudited fourth-quarter and full-year 2025 results after the U.S. market closes on Feb. 11. A management call is scheduled for 7 p.m. Eastern. investors.grab.com

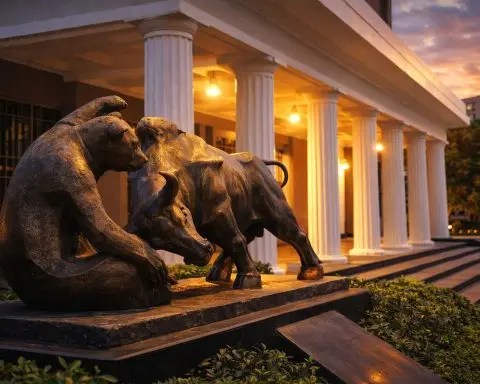

Indonesia stands as a key battlefield for Southeast Asia’s ride-hailing and delivery giants, with Grab and GoTo locked in tight competition. Draft regulations have emerged amid growing political pressure to boost safeguards for app-based drivers.

Still, the policy is only a draft. It might be diluted, postponed, or bundled with offsets that ease the blow to platform economics — and markets often overrate the worst-case on initial reports.

The downside scenario is a swift decree with limited wiggle room. Companies would then have to shoulder higher costs, raise prices, or slash promotional budgets—each step likely to dampen demand and squeeze margins.

Traders await an official update from Indonesian authorities on the timing and scope. They’re also looking to Grab’s Feb. 11 earnings for clues on 2026 cost and profit targets.