MUMBAI, Feb 17 (Reuters) –

- Indian stocks nudged higher, thanks to a rebound in IT names after Infosys’ Anthropic deal. Reliance, however, pulled in the other direction.

- Earnings momentum appears to be stabilising, brokerages say, while AI disruption and trade talks remain in the spotlight.

- First up for beginners: getting a handle on demat and trading accounts, sorting out the fees, and making sure to check for fraud.

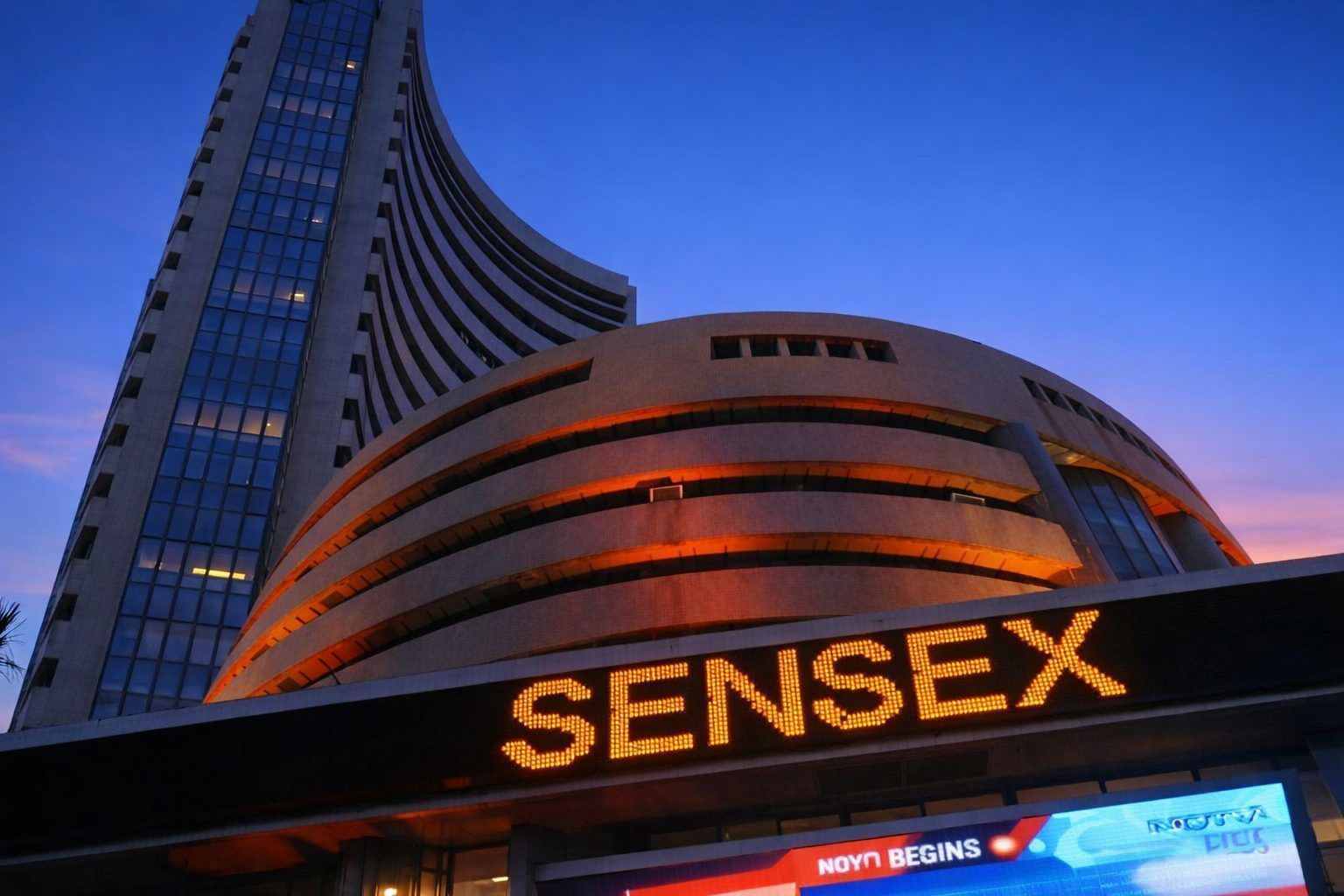

India’s main indexes closed in the green Tuesday, lifted by a surge in IT shares after Infosys announced a partnership with U.S. AI player Anthropic, which helped blunt pressure from a drop in Reliance Industries. The Nifty 50 gained 0.17% to finish at 25,725.40, and the Sensex picked up 0.21% to end at 83,450.96. Both gauges had been off roughly 0.4% earlier. Nifty IT rallied 1% as Infosys jumped 1.9%, snapping back after last week’s steep 8.2% sector slump. Adani Enterprises rose 2.7% following news the Adani Group plans to pour $100 billion into renewable-powered, AI-focused data centers by 2035. Elsewhere, state-run banks advanced 2.1%, while metal stocks slipped 1.1%. (Reuters)

Brokerages are watching for a shift in India’s earnings cycle after a prolonged period of modest profit increases. For the quarter ended Dec. 31, Nifty 50 companies turned in 7.5% year-on-year profit growth, a step up from 1.9% a quarter earlier. BSE 500 firms fared better, posting a 16% profit rise, according to brokerage notes cited by Reuters. J.P. Morgan analysts Rajiv Batra and Rushi Mehta called it a “broad-based earnings recovery.” Motilal Oswal pointed out that just five Nifty 50 names — State Bank of India, Tata Steel, HDFC Bank, Tata Consultancy Services, and Bharti Airtel — made up 78% of the incremental growth, while also noting India’s trade talks with the U.S. and EU as important triggers. (Reuters)

If you’re new to investing in the Indian stock market, days like this make one thing clear: surface stability in indexes doesn’t mean the underlying action isn’t wild. One heavyweight name can tug the benchmark in one direction, just as quickly as a hot sector — AI, banks, commodities — can pull it somewhere else.

Start with the basics: the infrastructure. In India, nearly all securities are kept electronically, according to SEBI. Anyone looking to hold these assets in “demat or electronic form” is required to have a demat account set up through a SEBI-registered depository participant. (SEBI Investor)

Next up: the trading account. This is the spot where you actually put in your orders. NSE calls it “a bridge between your Demat and bank account.” You set this up with a stock broker, shifting funds from your bank into the trading account to buy, and sending them back after you sell. (NSE India)

For most, the process of opening these accounts comes down to paperwork and ID checks—areas where newcomers often stumble. According to a SEBI investor presentation, a fresh investor signs up with a broker and completes forms for both trading and demat accounts, along with the Know Your Client (KYC) form; in-person verification is required, but it can be handled online, including over video. SEBI also points out that anyone planning to trade derivatives—futures or options—needs to provide income proof. As for trade evidence, a contract note serves as both proof and legal record. (SEBI Investor)

Next up: figuring out what to buy, and how to go about it. Direct stock purchases are an option, but so are pooled vehicles—mutual funds and ETFs, for example. The mutual fund industry body, AMFI, defines an ETF as a “marketable security that tracks an index, a commodity, bonds, or a basket of assets,” and points out that these are listed on exchanges and trade like regular stocks throughout the session. ETF units, AMFI notes, are held in demat form. (AMFI India)

Costs often catch new traders off guard, particularly those making lots of trades. On top of brokerage fees, NSE’s investor education points out investors also face several statutory charges and taxes: SEBI turnover fees, stamp duty, GST, and the securities transaction tax (STT), which is a government charge on specific exchange trades. (NSE India)

Fraud isn’t going away, regulators warn. SEBI has flagged a rise in scams exploiting social media and messaging apps to convince people to hand over their money. The watchdog’s advice: stick with registered intermediaries, and only transact via official routes. (sebi.gov.in)

First things first: double-check exactly who’s on the other end before sending any money or following “tips.” SEBI keeps a list of registered stock brokers—look up those details on its site before making a move. (sebi.gov.in)

Still, even when everything seems set up correctly, markets have a way of moving fast—often to the detriment of less experienced investors. Lately, information technology stocks have been dragged down, with Reuters citing worries that AI automation could squeeze revenues and upend the business models of India’s software services players. “Nobody can say with confidence where IT business models will land,” said Hiren Dasani, Whiteoak Capital’s chief investment officer for emerging markets, describing the risks from AI-driven automation as “existential concerns.” (Reuters)

There’s a new macro event for traders to watch: India’s statistics ministry is gearing up to roll out an updated GDP data series by Feb. 27, 2026, the government announced. That release is set to give investors another read on growth trends and what policy might look like ahead. (Press Information Bureau)