- Stock price: As of Oct 13, 2025 BITF trades around $4.50 USD (≈C$5.9)ts2.tech, up roughly 148% year-to-datets2.tech. On Oct 13 the stock briefly hit $5.39 intraday (up 28%)marketbeat.com. Trading has been extremely heavy (e.g. 150M shares traded on Oct 13 vs ~37M averagemarketbeat.com).

- Recent surge: BITF has climbed from about $1 at the start of 2025 to multi-year highs (TSX high ~C$7.12 in Sept)ts2.techts2.tech. The 6-month gain is ~440%ts2.tech. Bitfarms’ beta (~5) and expanded Bollinger bands reflect a high-volatility, parabolic uptrend.

- Q2 2025 results: Revenue was $78.0M (+87% YoY) but net loss was $29M (–$0.05/share)ts2.tech. Gross mining margin was ~45%. Bitfarms mined 718 BTC in Q2 (cost ~$48.2K each)investor.bitfarms.com. Cash flow (non-IFRS) was stronger – adjusted EBITDA ~$14M (18% margin)investor.bitfarms.com.

- Balance sheet: Mid-2025 liquidity ~$230M (≈$85M cash + 1,402 BTC (~$145M)investor.bitfarms.com). Debt is modest (debt/equity ≈0.11marketbeat.com) and current ratio ~3.1marketbeat.com. Management repurchased ~4.9M shares (~10% of float) at ~$1.24 (avg) under a buyback started in Julyinvestor.bitfarms.com.

- Crypto tailwinds: Bitcoin is near $118–124K in early Oct 2025ts2.tech, powered by massive ETF inflows (BlackRock’s IBIT ETF now holds >800,000 BTCtradingview.com). Ether is ~ $4.5Kts2.tech. Such momentum “underscores persistent structural demand” for BTCtradingview.com, which bodes well for miner revenues.

- Key events: In Oct 2025 Bitfarms converted a $300M Macquarie debt facility to project financing for a 350 MW HPC/AI data center (Panther Creek, PA), drawing another $50M (total $100M) to accelerate buildoutinvestor.bitfarms.comtheminermag.com. It has acquired 181 acres in Pennsylvania and 3 acres in Washington for HPC/AI developmenttheminermag.com. Bitfarms is exiting its halted Argentina mine (halting May 2025) and recovering a ~$3.5M deposittheminermag.com.

- Analysts & forecasts: Wall Street is cautiously bullish. Most analysts rate BITF “Moderate/Strong Buy” (6 analysts, average target ~$3.7–$4.0)ts2.techmarketbeat.com, though that is below today’s price. Northland’s target is $7.00marketbeat.com. Benzinga notes key technical resistance ~ $6.50–$7.00, with a potential path to ~$12 if breakout occursbenzinga.com. However, the stock is overextended (RSI ~80)ts2.techgurufocus.com, and some metric-based sites give a ~$3.3 mid-term targetgurufocus.com.

Stock Price & Recent Trend

Bitfarms (BITF) stock has exploded higher in 2025, reflecting the crypto rally and its AI pivot. As of Oct 13, 2025 BITF trades in the mid-$4 range (USD)ts2.tech. According to TechStock² and MarketBeat, the stock surged ~28% on Oct 13 (reaching $5.39 intraday)marketbeat.com. This capped a $1 → ~$4.68 move (through Oct 10) triggered by news of the Macquarie financingts2.tech. YTD the gain is ~148%ts2.tech, and BITF even rose over 440% in the past six monthsts2.tech. The NASDAQ and TSX charts now show BITF at multi-year highs (TSX peaked ~C$5.28 intraday Oct 7)ts2.tech.

Trading has been frenzied. MarketBeat reports Oct 13 volume was ~150M shares (307% above normal)marketbeat.com. On Oct 8 alone about $430–440M tradedts2.tech. BITF’s beta (~5.0)ts2.tech means it amplifies market moves. In short, the stock’s recent run-up is parabolic – a bullish breakout from years of consolidation, but highly volatile. Any short-term pullback is likely in the cards given the overbought momentum.

Recent News & Developments

- Q2 2025 Earnings (Aug 12): Bitfarms reported $78.0M revenue (+87% YoY)ts2.tech, but a net loss of $29.0M (–$0.05/sh)ts2.tech. Mining operations produced 718 BTC at an average direct cost ≈$48.2K/BTCinvestor.bitfarms.com. Cash G&A (~$18M) was higher as Bitfarms integrated recent acquisitions and hired staffinvestor.bitfarms.com. Adjusted EBITDA was $14M (18% margin)investor.bitfarms.com, up from $11M last year. Management highlighted a strong balance sheet (∼$230M liquidityinvestor.bitfarms.com) and noted it had already bought back 10% of shares (4.9M shares)investor.bitfarms.com.

- AI/HPC Pivot – Macquarie Financing (Oct 10): Bitfarms converted its $300M Macquarie facility into a project loan for Panther Creek, PA HPC/AI data centersinvestor.bitfarms.comtheminermag.com. This allows Bitfarms to draw the full $300M. It immediately drew an extra $50M (total $100M) to fund equipment and constructioninvestor.bitfarms.comtheminermag.com. CEO Ben Gagnon says this “accelerates our construction timelines” for the 350 MW HPC campus. Macquarie’s MD Joshua Stevens praised the move, calling Pennsylvania “a new AI infrastructure hub” and saying Bitfarms is “well-positioned” to deliver digital infrastructure thereinvestor.bitfarms.com. On this news Oct 10, BITF spiked ~12–16% intraday to ~$4.68ts2.tech.

- Land Acquisitions (Aug 2025): Bitfarms bought key land for its AI/data-center buildout. In early August it acquired 181 acres in Panther Creek, PA ($3.5M) and 3 acres in Washington state ($1.9M)theminermag.com. These sites are designated for high-performance computing (HPC) development. Bitfarms noted the PA plot is “more than sufficient for multiple phases of HPC/AI development”theminermag.com. These moves reflect a strategy to diversify beyond pure Bitcoin mining.

- Argentina Mine Exit: Bitfarms is shuttering its Rio Cuarto, Argentina facility after power supply issues. The energy supplier halted power in May 2025, and Bitfarms agreed (Aug 2025) to exit by Nov. 11, 2025theminermag.com. This deal recovers about $3.5M in prepaid energy deposits and removes a $2.8M site retirement liabilitytheminermag.com. Management attributed the exit to prolonged supply uncertainty and economic conditions.

- Share Buyback: In late July 2025 Bitfarms started a 10% stock repurchase programinvestor.bitfarms.com. By Aug 8 it had bought 4.9M shares at ~$1.24 eachinvestor.bitfarms.com. This non-dilutive capital return underscores management’s belief that BITF was undervalued.

- Crypto Market Events: The broader crypto market has been surging. Notably, U.S. spot Bitcoin ETFs (e.g. BlackRock’s IBIT) have accumulated unprecedented inflows: by Oct 2025 IBIT held >800,000 BTC (~3.8% of supply)tradingview.com. Bitcoin briefly touched ~$120K in early Octoberts2.tech. These flows and price gains have lifted miner stocks in general (BITF “rallied to a new all-time high” amid the rallyts2.tech).

Fundamental Analysis: Financials & Operations

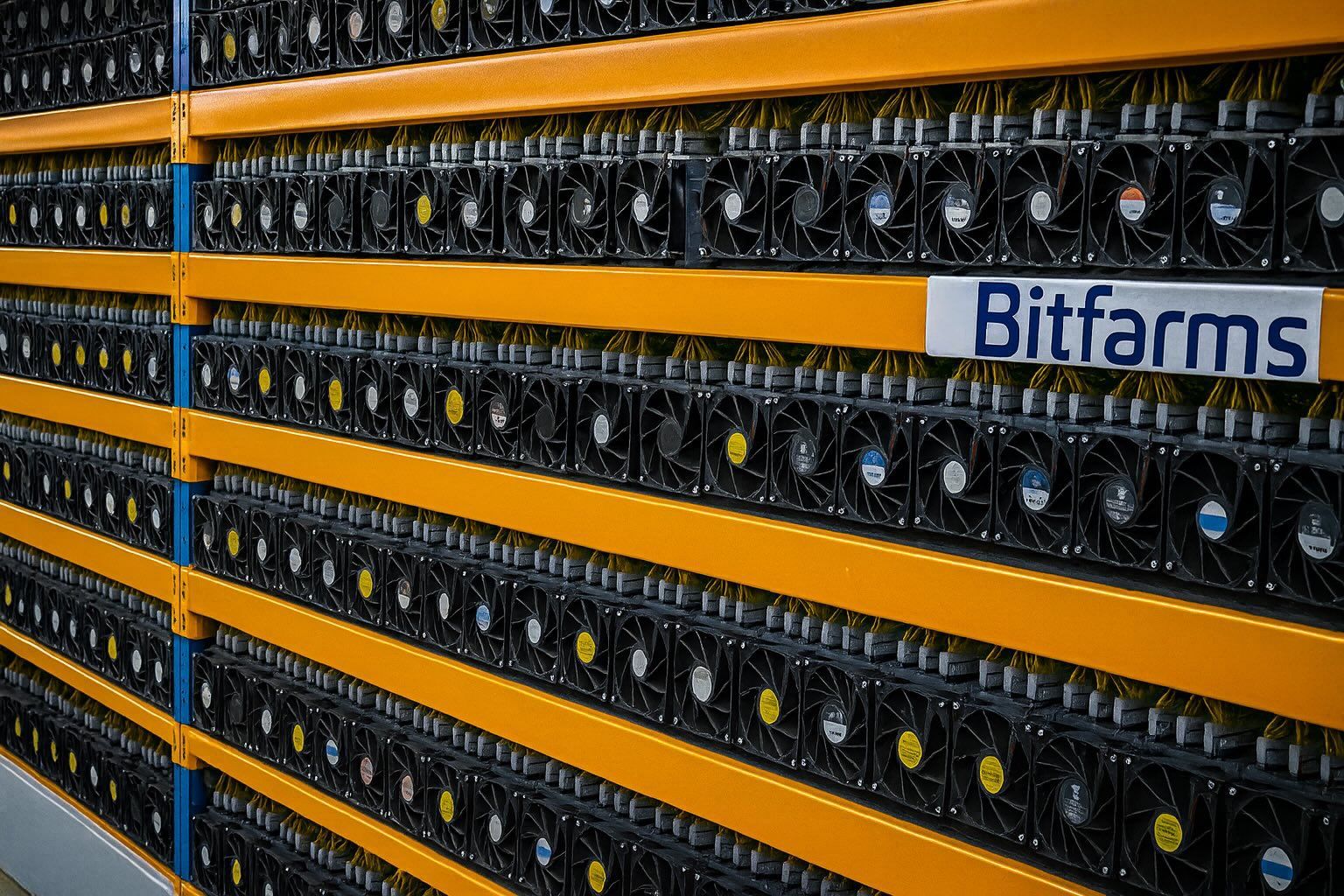

Bitfarms operates multiple North American mining and data-center sites. (Above: example of a large-scale crypto mining facility.) Fundamentally, Bitfarms is still in growth/investment mode, so GAAP profits remain negative. In Q2 2025 it incurred a $29M loss on $78M revenuets2.tech. This loss reflects heavy non-cash charges and depreciation from new equipment (including a $15M Argentina impairment)investor.bitfarms.com. On the plus side, adjusted EBITDA was $14M (18% of revenue)investor.bitfarms.com, indicating mining operations are solidly cash-generative when ignoring accrual accounting effects.

Bitfarms mined 718 BTC in Q2 (≈17.5 BTC/day) at an average direct cost of ~$48,200 eachinvestor.bitfarms.com. Including all cash costs (electricity, hosting, admin), that was ~$77,100 per BTCinvestor.bitfarms.com. The company ended Q2 holding 1,402 BTC on its balance sheetinvestor.bitfarms.com (worth ≈$145M at current prices) plus about $85M cashinvestor.bitfarms.com, for total liquidity ~$230M. Debt is very modest (debt/equity ~0.11marketbeat.com) and the current ratio ~3.1marketbeat.com, indicating ample liquidity. In short, Bitfarms’ financial position is healthy – it can fund expansion without immediate funding needs.

On the operations side, Bitfarms runs ~13 sites across North and South America. Total active hashing was ~17.7 EH/s at quarter-endinvestor.bitfarms.com (down from 19.5 EH/s in Q1 due to winding down Argentina). Active energy capacity is ~410 MW, with more under development. Crucially, Bitfarms has amassed a 1.3 GW multi-year pipeline (80% U.S.) of potential energy hookupsinvestor.bitfarms.com. This North American focus (Quebec, Washington, Pennsylvania, etc.) gives it access to cheap, reliable power – a big advantage now that global Bitcoin difficulty is sky-highcointelegraph.com. In an industry where on-chain difficulty and hashrate are at all-time highscointelegraph.com, efficiency matters. Bitfarms is positioning itself with modern ASIC fleets and large-scale sites to stay competitive.

Technical Analysis

BITF’s price charts are very bullish but overextended. Weekly charts show BITF decisively breaking above a long-term resistance band around $4.00–$4.50benzinga.com. This signals a reversal from the prior downtrend. On the daily chart, the stock has surged off its ~$1 early-2025 base and cleared all major moving averagesbenzinga.com. The 20-day SMA is now well above the 200-day SMAts2.tech, a classic bull-market indicator. Momentum indicators are extremely strong: for example, the 14-day RSI is in the 70–80 range (overbought)ts2.tech. Bollinger Bands are expanding as price rides the upper bandbenzinga.com – a sign of accelerating volatility.

Key support/resistance levels: On the upside, BITF faces immediate resistance around $5.50–$6.00benzinga.com. A clean breakout above $6.50–$7.00 would clear a multi-year downtrend line, at which point some analysts see a path to $12.00 (the old all-time high)benzinga.com. On the downside, the post-surge support base is raised; potential support zones are roughly $1.90–$3.25 (USD)benzinga.com. Overall, the chart pattern is parabolic: buyers are in control, but RSI conditions warn of a likely short-term pullback. Traders should watch for consolidation or profit-taking around $6–7, while the intermediate trend remains firmly up.

Industry & Crypto Market Context

The macro crypto environment is extremely bullish. Bitcoin is in a historic bull run – trading around $118–124K in early Oct 2025ts2.tech – driven by institutional demand. U.S. spot Bitcoin ETFs have seen massive inflows: BlackRock’s IBIT has now amassed over 800,000 BTC (nearly 4% of all Bitcoin)tradingview.com. This eight-day ETF inflow streak is “absurd” (Bloomberg’s Eric Balchunas) and “underscores persistent structural demand” for BTC (BRN’s Tim Misir)tradingview.com. Ethereum and other altcoins are similarly strong (ETH ~$4.5Kts2.tech). In short, the entire crypto mining sector has rallied. As Yahoo Finance notes, BITF is very “sensitive to Bitcoin prices” (most of its revenue is BTC)ts2.tech. So Bitcoin’s surge to near-record levels is a huge tailwind for Bitfarms’ outlook.

On the mining industry side, competition is fierce. Cointelegraph reports that 2025’s Bitcoin network hashrate and difficulty are at record highscointelegraph.com. This means miners must run extremely efficient equipment and cheap power to profit. Bitfarms’ North American footprint helps here: the company has long-term energy contracts and a mostly contracted capacity, insulating it from variable spot power costs. It also reflects a broader strategy in the sector. Many miners are diversifying beyond pure Bitcoin mining to deal with margin pressuretheminermag.com. For example, in mid-2025 Bitfarms acquired large land tracts in the U.S. for high-performance computing (HPC) developmenttheminermag.com. This pivot to AI/data-center services mirrors moves by peers, leveraging overlaps between crypto mining and AI computing.

Regulatory factors are relatively neutral at present. There is no new law specifically impacting mining this week; rather regulators have largely shifted focus to stablecoins and crypto markets. (Bitfarms, being a Canadian-domiciled issuer, must follow US/Canada securities rules, but its cross-listing on NASDAQ keeps it compliant.) The key point is that in the current regime, Bitcoin and miner-friendly policies (e.g. support for data centers in PA/Washington) are helping firms like Bitfarms. Industry watchers note that Bitfarms’ U.S. GAAP transition and second NYC office (announced Aug 2025) further integrate it into favorable marketsinvestor.bitfarms.com.

Analyst Commentary & Forecasts

Wall Street and crypto analysts are cautiously optimistic. Analyst ratings skew bullish: MarketBeat notes 6 analysts covering BITF have an average rating of “Moderate Buy” (no sells) with a consensus target about $4.35marketbeat.com. Notable targets include Northland Securities’ $7.00marketbeat.com. However, many of these targets are actually below or near BITF’s current price, indicating skepticism that the rally can be sustained. For example, TipRanks’ consensus target was ~$3.45ts2.tech, and Gurufocus cites a median target of only $3.38, calling the stock overbought (RSI ~82.6)gurufocus.com. A Weiss Ratings analyst even reiterated a “Sell (D-)” on Oct 8marketbeat.com. In sum, traditional forecasts assume some mean reversion from today’s lofty levels.

Expert quotes highlight both bullish and cautious views. ATB Capital analyst Martin Toner (Sept 2025) praised Bitfarms’ “disciplined finances and HPC pivot”ts2.tech, noting its ~1.3 GW U.S. energy pipeline as a key moat. From the investor side, Macquarie’s Joshua Stevens remarked that Pennsylvania is “quickly emerging as a new AI infrastructure hub” and that Bitfarms is “well-positioned to deliver state-of-the-art digital infrastructure” thereinvestor.bitfarms.com. These comments underscore optimism about Bitfarms’ AI/data center strategy. By contrast, industry data services warn that BITF’s valuation is already rich: Gurufocus notes the stock’s price/sales ratio (~10.6) is near 3-year highs and its RSI (82.6) signals overbought conditionsgurufocus.com. In other words, some analysts think the move may have gone too far this quarter.

Price targets & forecasts: The median near-term outlook is modest. MarketBeat’s $4.35 target (for ~12 months)marketbeat.com is much lower than current ~$5 levels, implying possible consolidation or pullback. On the other hand, some technical analysts point to much higher levels if the uptrend holds. For instance, Benzinga’s chart analyst notes that a confirmed break above ~$7 could send BITF toward $12.00 (matching its prior USD high)benzinga.com. Longer-term, BITF’s trajectory likely depends on crypto prices. Standard Chartered’s bullish bitcoin forecast (~$135K BTCts2.tech) would certainly bolster miner profits and potentially push BITF higher. If Bitcoin and the AI/crypto narratives remain strong, BITF could revisit double-digit prices in the next 1–2 years. Conversely, if crypto prices slip or Bitfarms’ tech transition lags, the stock may retrench toward its ~$3–4 fair-value range implied by fundamentals.

Conclusion: Bitfarms is at the center of two powerful trends – the historic crypto bull run and a shift into AI/HPC computing. Its stock has soared on these catalysts, but much of the rally is already baked in. In the short term, technicals warn of pullbacks, and analysts’ price targets are below the current level. In the medium/long term, success depends on continued crypto strength and Bitfarms executing its US pivot. If both hold, BITF’s former highs (~$12) could be tested; if not, expect volatility and possible consolidation around the low-$4 range.

Sources: Authoritative financial and crypto news sites, company filings, and market analysis reports have been used throughout ts2.techmarketbeat.comts2.techinvestor.bitfarms.combenzinga.comgurufocus.comtradingview.com, including TechStock² (ts2.tech), MarketBeat, Benzinga, TheMinerMag, The Block/TradingView, Cointelegraph, and official Bitfarms releases. All data is as reported through Oct 13, 2025.