New York, Feb 11, 2026, 11:07 (ET) — Regular session

- JBS N.V. slipped roughly 0.2% by late morning.

- A recent SEC filing pointed to a $150 million equity investment linked to a joint venture in Oman.

- March 25 is the next set date on investors’ calendars: annual results are due.

JBS N.V. slipped around 0.2% to $16.12 late Wednesday morning. Shares moved within a $16.06 to $16.33 range, following Tuesday’s $16.15 close.

Investors are reacting to news of another international push. According to a Feb. 8 filing with the U.S. Securities and Exchange Commission, JBS plans to put $150 million into a joint venture with Oman Food Investment Holding Company, grabbing an 80% share and valuing the business at $167.5 million before the fresh capital. “Production is expected to start within six months for beef and lamb, and within 12 months for poultry,” the document, signed by global CFO and investor relations officer Guilherme Perboyre Cavalcanti, stated.

JBS cast the initiative as a wager on halal demand, pointing to food prepared according to Islamic guidelines and the advantage of moving product from sites closer to buyers. According to the company, the Oman facility is designed to make the country “a center for the production of halal food products” for export. JBS called this its first upstream investment in the Middle East. MarketScreener

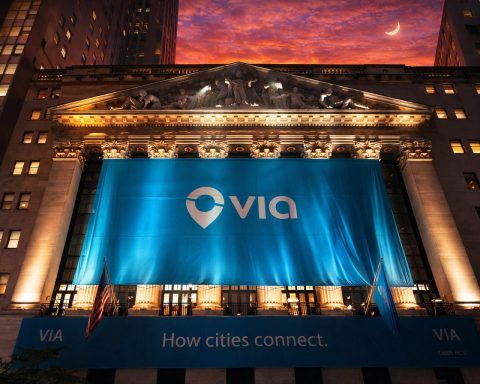

The company’s public story is just getting started. JBS N.V.’s Class A shares hit the New York Stock Exchange in June 2025, following a restructuring that put the Dutch company at the top of the group’s structure.

JBS traded much like the rest of the protein sector on Wednesday. Tyson Foods slipped roughly 0.6%, Hormel Foods dropped 1.7%, while Pilgrim’s Pride edged down 0.2%.

The Oman venture isn’t over the line yet. Everything depends on clearing regulatory hurdles and getting the poultry and red-meat facilities built and running at scale. If anything slips, those launch dates move further out.

At this point, meat processors face the standard set of forces: consumer demand, currency swings, and what they pay for livestock. Things might appear stable, but once input costs shift, margins react fast.

JBS has its next firm date set for March 25, when it plans to release annual financial results covering the year ended Dec. 31, 2025, per its events schedule. The same schedule puts the annual shareholders’ meeting on April 30, and says first-quarter 2026 numbers are due out May 13. Mziq API

Traders are eyeing any word on the Oman deal’s closing date and potential spending shifts, but it’s the March 25 release that could steer JBS shares in the days ahead.