NEW YORK, Jan 9, 2026, 10:13 EST — Regular session

Karman Holdings Inc. shares were up 5.9% at $107.25 in morning trade on Friday, after touching an intraday high of $107.70. Evercore ISI analyst Amit Daryanani lifted his price target to $110 from $75, StreetInsider reported. StreetInsider.com

The move comes after Karman agreed to buy Seemann Composites and Materials Sciences for $220 million — $210 million in cash and about $10 million in stock — the company said. Chief executive Tony Koblinski said maritime defense is a long-planned push that “has been on our strategic roadmap for years.” Karman said it expects the deal to be “immediately accretive” in 2026 — expected to lift earnings per share — and to close in the first quarter of its fiscal 2026. Securities and Exchange Commission

The backdrop has helped too. Defense stocks have pushed higher since President Donald Trump called for a sharp jump in the 2027 U.S. military budget. RBC Capital Markets analysts, meanwhile, said “there is significant uncertainty associated with a final defense budget.” reuters.com

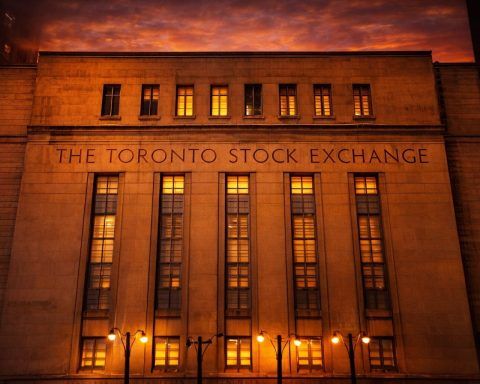

Karman, a Huntington Beach, California-based defense and space systems maker, listed on the New York Stock Exchange in February 2025 after raising $506 million in an upsized IPO, Reuters reported. The company sells systems tied to space and missile-defense work and has benefited from a wider bid for smaller defense names. reuters.com

The Seemann and Materials Sciences deal still isn’t closed. A filing showed it remains subject to customary conditions, including the expiration or termination of any waiting period under the Hart-Scott-Rodino antitrust law, and Trump’s budget plan would still need congressional approval. Securities and Exchange Commission

Coming up, Karman will host an investor conference call and webcast on Jan. 21 at 4:30 p.m. ET to go over the transaction and a boost to its fiscal 2026 outlook. investors.karman-sd.com