NEW YORK, Jan 13, 2026, 08:02 EST — Premarket

- L3Harris shares surged roughly 10% in premarket, following the U.S. Defense Department’s announcement of a $1 billion investment linked to a missile-unit spin-off.

- The company announced plans to list its Missile Solutions business on the stock market in the latter half of 2026.

- Investors await a 9 a.m. ET update call, alongside the company’s earnings report due Jan. 29.

L3Harris Technologies (LHX) shares surged roughly 10% to $376.04 in premarket trading Tuesday following the announcement of its plan to spin off the Missile Solutions unit, supported by a $1 billion U.S. government investment. The defense contractor said it aims for an initial public offering, or IPO, in the latter half of 2026.

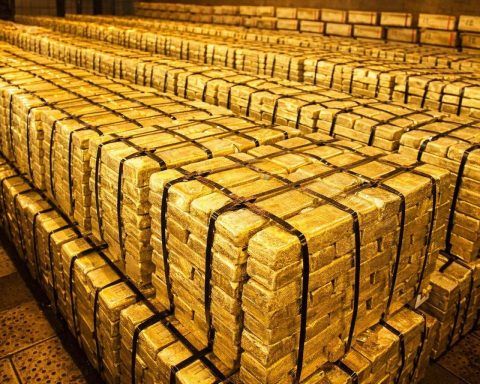

The Pentagon announced funding to boost U.S. solid rocket motor capacity — the engines powering missiles post-launch. It labeled this the first-ever “direct-to-supplier” partnership of its kind, with plans for multi-year procurement deals, contingent on congressional approval and funding. “We are fundamentally shifting our approach to securing our munitions supply chain,” Under Secretary Michael Duffey said. U.S. Department of War

Traders faced a packed premarket session as the news broke. U.S. stock index futures dipped modestly early Tuesday, with inflation figures scheduled for release at 8:30 a.m. ET. The quarterly earnings season got underway, led by reports from major banks. Reuters

L3Harris revealed the government’s backing will be a $1 billion convertible preferred security—a hybrid that can convert into common stock—once the missile division goes public. The company framed this move around its Aerojet Rocketdyne acquisition, anticipating the unit will bolster programs like PAC-3, THAAD, Tomahawk, and Standard Missile. “We’re taking action to build today’s ‘Arsenal of Freedom,’” CEO Christopher Kubasik stated.

The company said J.P. Morgan Securities will serve as financial adviser, with Vinson & Elkins providing legal counsel on the proposed deal. Business Wire

L3Harris ended Monday up 1.46% at $340.68, hitting a fresh 52-week high, MarketWatch reported. RTX climbed 2.84%, while Lockheed Martin added 1.53% during the session, the data showed. MarketWatch

The setup is unusual for defense: the government owning an equity stake in a contractor that routinely competes for federal contracts. This has sparked concerns about conflicts of interest and potential regulatory scrutiny. An IPO might also allow the government to cash in on its investment. Reuters

The Defense Department has inked a letter of intent laying out investment terms, though it still awaits congressional approval, National Defense Magazine reports. Investors are keenly watching for timing specifics and any updates on capacity ramp-up plans — the crucial factor that shifts this from just a headline to serious earnings potential. nationaldefensemagazine.org

Next on the calendar: an investor update call set for 9:00 a.m. ET Tuesday, ahead of L3Harris’ fourth-quarter 2025 earnings report due Jan. 29. investors.l3harris.com