New York, Jan 12, 2026, 18:29 EST — After-hours

- Lumentum shares fell about 3.4% to $339.87 in late trading on Monday

- The stock swung between $323.24 and $343.50 in the session

- Investors are looking to U.S. inflation data and Lumentum’s Feb. 3 earnings for the next catalyst

Lumentum Holdings Inc. shares slid about 3.4% to $339.87 in after-hours trading on Monday, after ending the regular session lower. In after-hours trading, stocks can keep moving after the 4 p.m. close as investors react to news and reposition. (Source: https://www.marketwatch.com/investing/stock/lite)

The move comes as investors head into a busy stretch that can jolt higher-growth tech names: U.S. inflation data due Tuesday and the opening wave of corporate earnings.

U.S. stocks finished at record highs on Monday, with investors mostly brushing aside fresh political noise around the Federal Reserve and turning their attention to earnings and economic data. “The news that Powell is being investigated by the Justice Department was basically telegraphed by Trump, and so I think the market is taking it in stride for now,” Peter Cardillo, chief market economist at Spartan Capital Securities, said. (Source: https://www.reuters.com/business/finance/wall-st-futures-slip-worries-over-fed-independence-financial-stocks-slide-2026-01-12/)

For Lumentum, the next clear marker on the calendar is earnings. The company said it will report fiscal second-quarter results after the market closes on Feb. 3. (Source: https://investor.lumentum.com/financial-news-releases/news-details/2026/Lumentum-to-Announce-Fiscal-Second-Quarter-2026-Financial-Results-on-February-3-2026/default.aspx)

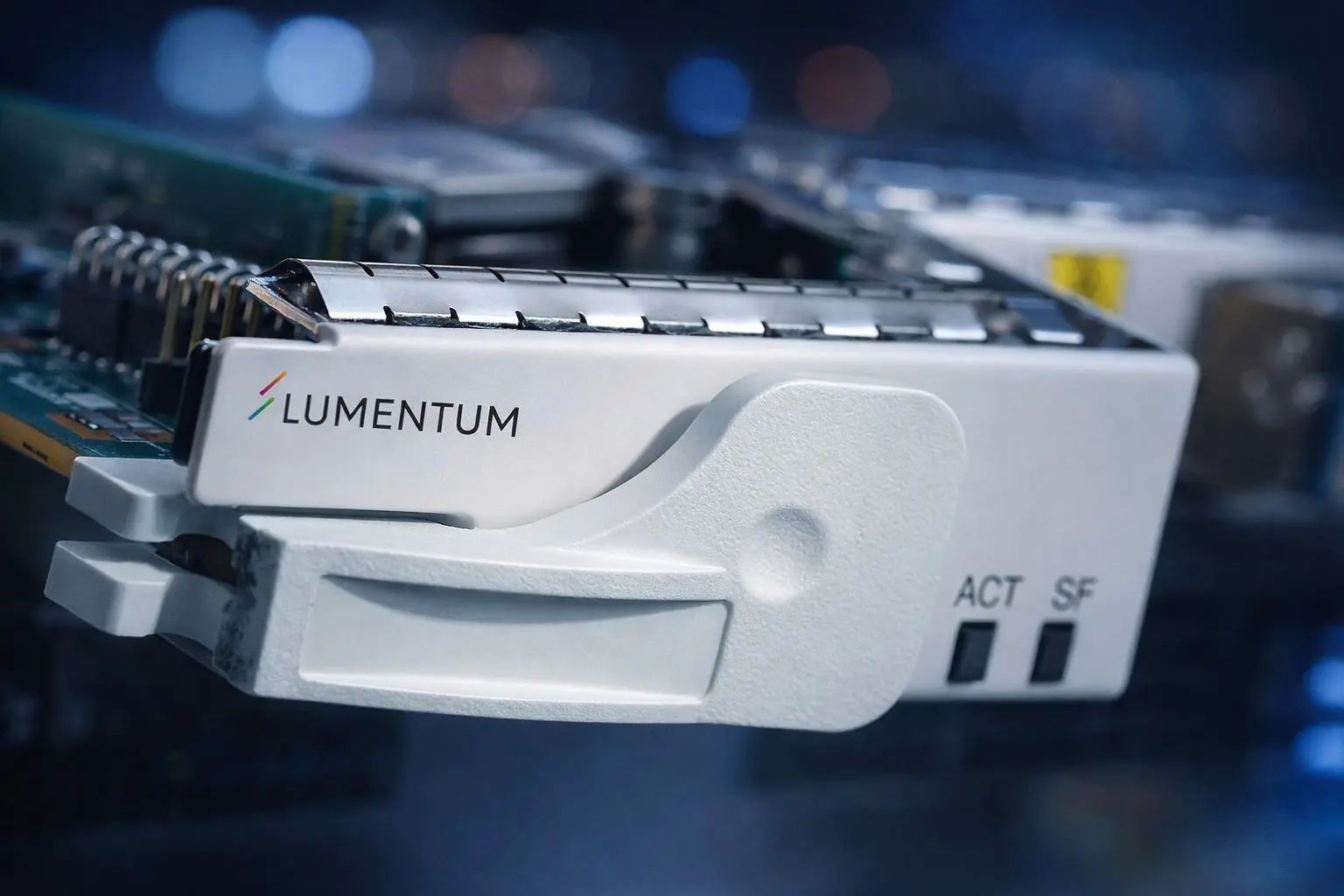

Lumentum, which sells optical and photonics gear used in networks and data centers, has been prone to sharp swings this month. The stock has traded through wide daily ranges in January, reflecting the push-pull between risk appetite and the cost of capital for richly valued hardware names. (Source: https://www.investing.com/equities/lumentum-holdings-inc-historical-data)

Monday’s slide left the stock down about $11.80 from its prior close, after a session that saw it dip below $325 before paring some losses, according to market data.

Traders will also be watching whether Tuesday’s U.S. consumer price index shifts rate expectations. Hotter inflation can push bond yields up, which often weighs on long-duration stocks whose valuations lean on profits further out.

A risk for bulls is that the stock’s recent volatility cuts both ways into earnings: any disappointment on demand or margins can be amplified when positioning is crowded and liquidity thins after the close.

Lumentum’s next catalyst is the U.S. CPI report on Tuesday, followed by its fiscal second-quarter results after the bell on Feb. 3.