Lumentum Holdings Inc. (NASDAQ: LITE) is back in focus on Tuesday, Dec. 23, 2025, as investors digest a newly disclosed credit facility alongside the broader AI-infrastructure trade that has pushed optical networking names sharply higher into year-end.

By mid-afternoon U.S. trading, Lumentum stock was hovering near the high-$380s, down modestly on the day after a strong multi-session run.

What’s happening with Lumentum stock today

As of the latest available quote (2:38 p.m. ET), Lumentum shares traded at about $386.50, down $3.38 (-0.87%) on the session, with an intraday range of roughly $378.56 to $390.25.

The bigger picture: Lumentum has been trading near record territory in recent sessions, after printing fresh highs around the low-$390s earlier this week. Investing.com

Today’s headline: Lumentum discloses a new $400 million revolving credit facility

The most consequential company-specific development circulating on Dec. 23 is a newly disclosed revolving credit agreement.

In an SEC filing, Lumentum said it entered into a credit agreement effective Dec. 19, 2025, establishing a senior secured revolving credit facility of $400.0 million, including a $23.0 million letter-of-credit sublimit, with Wells Fargo Bank, National Association acting as administrative and collateral agent. SEC+1

Financial outlets and market feeds quickly echoed the filing on Tuesday, helping put the topic at the center of LITE’s news cycle today. TradingView+2TipRanks+2

Key terms investors are watching

Based on the Form 8-K disclosure, the facility’s headline terms include:

- Size and structure: $400.0 million senior secured revolving credit facility, including a $23.0 million letter-of-credit sublimit. SEC+1

- Use of proceeds: working capital and general corporate purposes. SEC+1

- Maturity: Dec. 19, 2030, with an early-maturity feature tied to certain outstanding convertible senior notes if specific liquidity and/or leverage requirements cannot be met at that time. SEC+1

- Pricing: at the company’s option, borrowings accrue interest at either (1) base rate + margin (0.50% to 1.50%) or (2) term SOFR + margin (1.50% to 2.50%), with pricing tied to Lumentum’s secured net leverage ratio. SEC+1

- Commitment fee: 0.15% to 0.35% (again dependent on secured net leverage) on unused availability, paid quarterly. SEC+1

- Financial covenants: secured net leverage ratio ≤ 3.25:1.00 (with a 0.50:1.00 step-up for four fiscal quarters after a “material acquisition”) and interest coverage ratio ≥ 3.00:1.00, tested quarterly. SEC+1

- Collateral and guarantees: guaranteed by certain material domestic subsidiaries and secured by “substantially all” assets of the company and subsidiary guarantors (with customary exceptions). SEC+1

- Draw status at inception: as of the effective date, Lumentum reported no outstanding revolving loans or letters of credit under the agreement. SEC+1

Why a revolver matters even when it’s undrawn

A revolving credit facility can be a routine corporate liquidity tool, even if management doesn’t immediately borrow. The practical reasons investors tend to track revolvers include:

- Liquidity backstop: revolvers can provide flexibility for working-capital swings, especially for companies ramping shipments in fast-moving markets like data center infrastructure.

- Optionality: Lumentum’s agreement includes language allowing potential incremental revolving commitments and/or incremental term loans (subject to conditions, and lenders are not obligated). SEC+1

- Covenants and constraints: the same facility can add guardrails—like leverage and coverage tests and collateral requirements—that may matter if the cycle turns or if the company pursues acquisitions. SEC+1

That “two-sided” nature—more flexibility, but more structure—is one reason the market is paying attention to the filing today. TipRanks

The bigger driver: Lumentum’s AI optics positioning

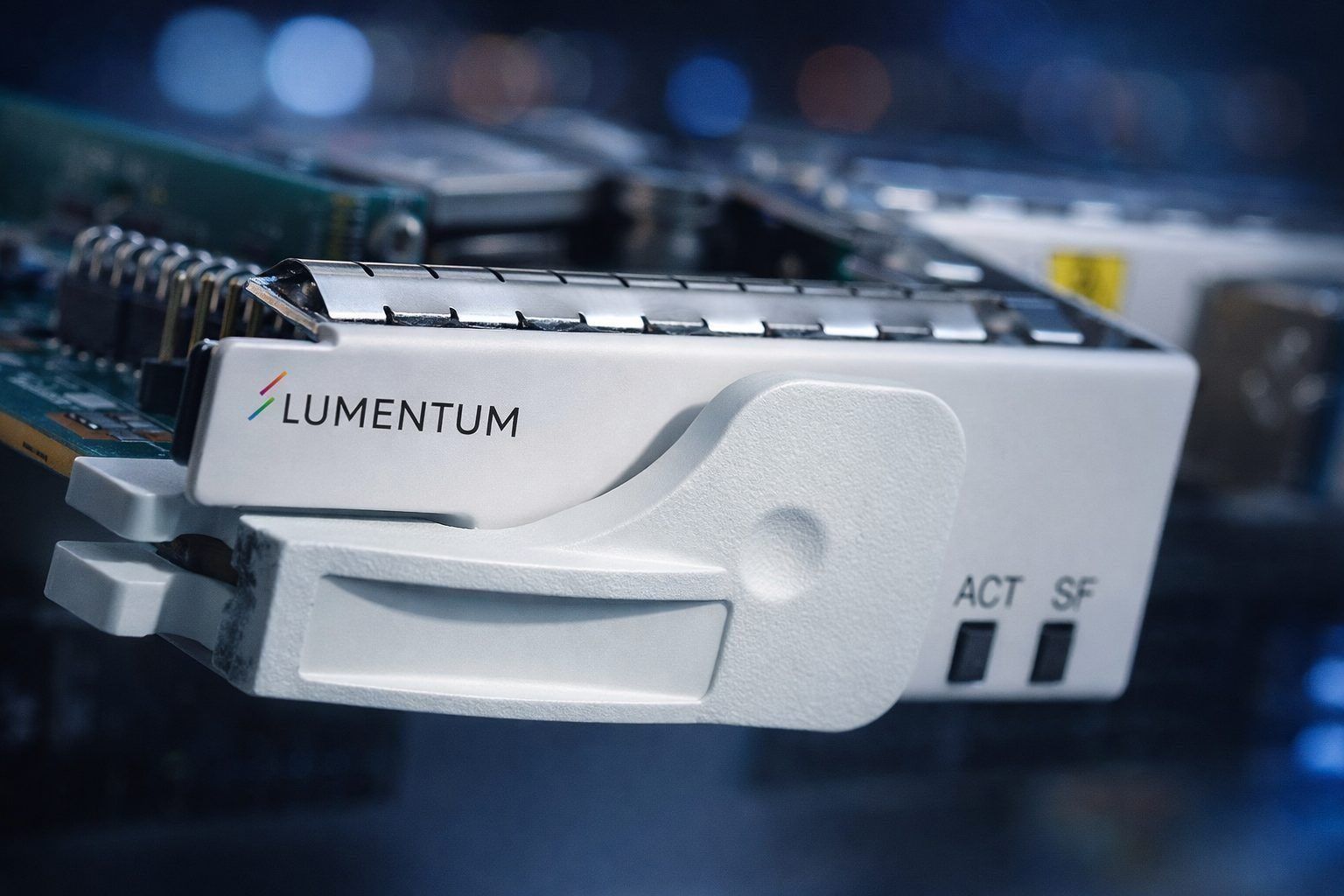

Beyond today’s credit-facility headlines, Lumentum remains one of the market’s most closely watched “AI picks-and-shovels” plays in photonics.

On the business side, Reuters describes Lumentum as a designer and manufacturer of optical and photonic products, with segments that include Cloud & Networking and Industrial Tech. The Cloud & Networking segment supplies optical components, modules, and subsystems used in cloud data center infrastructure (including AI/ML and data center interconnect) and communications networks; Industrial Tech includes multiple categories of lasers used across end markets. Reuters

Fundamentals recap: Q1 FY2026 results and Q2 outlook still shape the narrative

Today’s stock discussion is also anchored to Lumentum’s most recent earnings cycle and forward guidance.

In its fiscal first-quarter 2026 earnings materials (for the quarter ended Sept. 27, 2025), Lumentum reported:

- Net revenue: $533.8 million (up 58.4% year over year, per the company’s tables). SEC

- GAAP profitability: GAAP net income of $4.2 million ($0.05 per diluted share). SEC

- Non-GAAP profitability: non-GAAP net income of $86.4 million, or $1.10 per diluted share. SEC

- Liquidity: total cash, cash equivalents, and short-term investments of $1,121.8 million at quarter-end. SEC

And for fiscal Q2 2026 (the December quarter), Lumentum guided to:

- Net revenue: $630 million to $670 million

- Non-GAAP operating margin: 20.0% to 22.0% SEC

Investors.com highlighted that the company’s December-quarter revenue outlook notably exceeded many published analyst expectations at the time, reinforcing the “AI infrastructure buildout” demand narrative around optical connectivity. Investors

Lumentum stock forecast: what analysts are signaling right now

With LITE trading in the high-$300s, the most important reality for readers is that Wall Street forecasts are unusually spread out—and in many databases, the stock has run ahead of where average targets sit.

Recent notable target changes

- Investing.com reported that Rosenblatt raised its price target to $380 from $280 while keeping a Buy rating, and that Needham also raised its target to $290 from $235 after discussions with company leadership. Investing.com

- Morgan Stanley raised its price target to $304 from $190 and maintained an Equal Weight rating, citing a broadening AI-related trade into optical infrastructure and expectations that it can continue into the first half of 2026. TipRanks

Where consensus targets land

- MarketBeat’s compilation shows an average 12-month price target of $222.13 (with a stated range from $92.00 to $380.00), which—using its displayed “current price”—implies large downside versus where the stock is trading now. MarketBeat

- Yahoo Finance’s “1y Target Est” is shown around $268.43 on its LITE quote page, again well below the current trading zone. Yahoo Finance

One way to interpret the gap: Lumentum’s late-2025 rally has been fast enough that aggregated targets can lag, even when some analysts have been actively raising numbers.

Next catalyst: Lumentum’s next earnings date and what to watch

Looking ahead, the next major checkpoint for Lumentum stock is its upcoming earnings report.

Nasdaq’s earnings page lists Feb. 5, 2026 as the estimated earnings announcement date for LITE. Nasdaq TipRanks also lists Feb. 5, 2026 (before open) as the report date, alongside consensus EPS forecasts for the quarter. TipRanks

What investors typically focus on next, given the current setup:

- Revenue trajectory vs. the company’s $630–$670 million Q2 guidance range. SEC

- Margin performance (the company guided to 20%–22% non-GAAP operating margin). SEC

- Supply/demand commentary in cloud transceivers, plus progress in optical circuit switches and co-packaged optics as longer-run growth vectors. Investors+1

Risks and reality checks after a parabolic run

Even with strong momentum, Lumentum’s setup into year-end leaves little room for complacency. Key risks investors are weighing include:

- Valuation sensitivity: when a stock trades far above the average published price targets in common aggregations, it becomes more vulnerable to any guidance wobble or AI-spending headline that changes sentiment. MarketBeat+1

- Covenant structure: the newly disclosed revolver is secured, includes leverage and coverage tests, and is backed by substantial collateral—factors that can matter if the operating environment changes. SEC+1

- Macro and year-end trading conditions: broader U.S. equities have been buoyant into late December, with Reuters noting the S&P 500 near record highs and lighter holiday trading volumes—conditions that can amplify moves in high-beta AI-linked stocks in either direction. Reuters

Bottom line

On Dec. 23, 2025, the “new” Lumentum headline is straightforward: a disclosed $400 million senior secured revolving credit facility led by Wells Fargo, designed for working capital and general corporate purposes, with pricing and covenant terms tied to leverage and secured by substantial collateral. SEC+2TradingView+2

But the reason LITE remains a market conversation piece goes well beyond today’s filing. Lumentum is being valued as a key optical supplier to AI and cloud data center buildouts—an argument reinforced by its most recent quarterly results and its forward guidance for fiscal Q2 2026. SEC+1

With shares now trading around $386 in mid-afternoon action, the tension for investors is clear: bullish fundamentals and bullish narratives on one side, and a stock price that has outrun many consensus targets on the other. MarketBeat+1

This article is for informational purposes only and does not constitute investment advice. All market prices are subject to change.