New York, January 14, 2026, 15:44 EST — Regular session

- Lumentum shares dropped roughly 9% in afternoon trading, underperforming amid a broader tech sell-off

- The move comes after a strong rally the previous day, as traders focus on the upcoming Feb. 3 earnings report

- As earnings season gains momentum, attention turns to guidance and signs of data-center demand

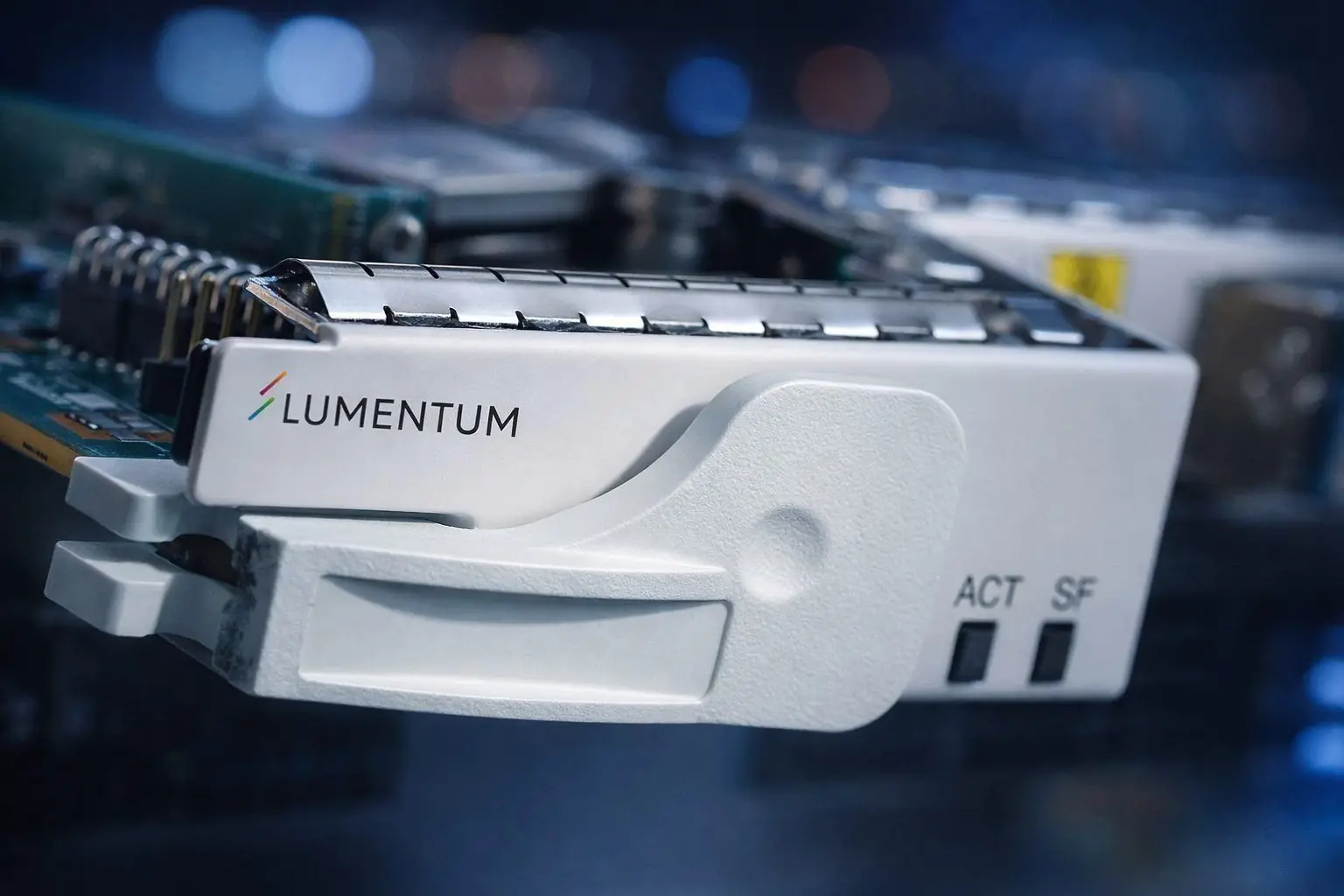

Lumentum Holdings Inc shares dropped 8.6% to $330.40 in late trading Wednesday, slipping further after hitting $363 earlier in the day. The optical components maker continues to see volatile moves.

The selloff is significant since Lumentum serves as a high-beta proxy for data-center expansions, with its shares often swinging wildly when investors pull back from tech. With earnings around the corner, traders are viewing price moves more as shifts in positioning than fresh news.

U.S. stocks dipped Wednesday, with tech and financial sectors dragging the Nasdaq down over 1%, as investors shifted into safer bets, Reuters reported. Michael O’Rourke, chief market strategist at JonesTrading, noted that investors are “looking to rotate out of expensive megacaps.” Reuters

Lumentum slipped after a sharp rise, following Tuesday’s close at $361.33. Yahoo Finance

Lumentum will release its fiscal second-quarter results after the market closes on Feb. 3 and follow up with a webcast at 5 p.m. ET, the company announced earlier this month. Lumentum Investor Relations

The stock has swung dramatically within a wide 52-week range, from about $45.65 up to $402.79, leaving little wiggle room when investor sentiment shifts. MarketWatch

So far, no new company announcement explains Wednesday’s move. Trading appeared more like a risk reset heading into the close, rather than a response to any specific news.

Bulls face a clear threat: if the Feb. 3 outlook doesn’t back up hopes for data-center and telecom demand, the stock could drop sharply—particularly if the broader market remains cautious.

Investors will focus on the guidance and comments about demand from cloud and networking clients. They’ll also look for any shifts in the company’s outlook on the spending cycle for optical components in data centers.

Aside from Lumentum’s earnings, investors are eyeing the Federal Reserve’s upcoming policy meeting on Jan. 27-28. The central bank’s Beige Book, released Wednesday, reported mostly rising economic activity alongside “moderate” price growth. Reuters