NEW YORK, January 1, 2026, 4:38 PM ET — Market closed

- Lumentum ended the last session of 2025 down 0.7% at $368.59.

- The stock’s roughly 339% rise over the past year has pushed expectations higher heading into February results.

- U.S. indexes finished 2025 lower on Dec. 31, with optical peers also retreating.

Lumentum Holdings Inc. shares were unchanged on Thursday with U.S. stock markets shut for New Year’s Day, after the optical components maker closed down 0.7% at $368.59 in the final session of 2025. MarketBeat

That year-end dip comes with the stock still up about 339% over the past 12 months through Dec. 31, leaving little room for disappointment as investors reset positioning for 2026. Trefis

Wall Street ended 2025’s final session lower, with the S&P 500 down 0.74% and the Nasdaq off 0.76%, as traders took profits after an AI-fueled run that pushed major indexes to record highs during the year. Reuters

Other optics and networking names also eased: Coherent fell 1.2%, Ciena dropped 1.9% and Applied Optoelectronics slid 3.2% on the day, according to market data.

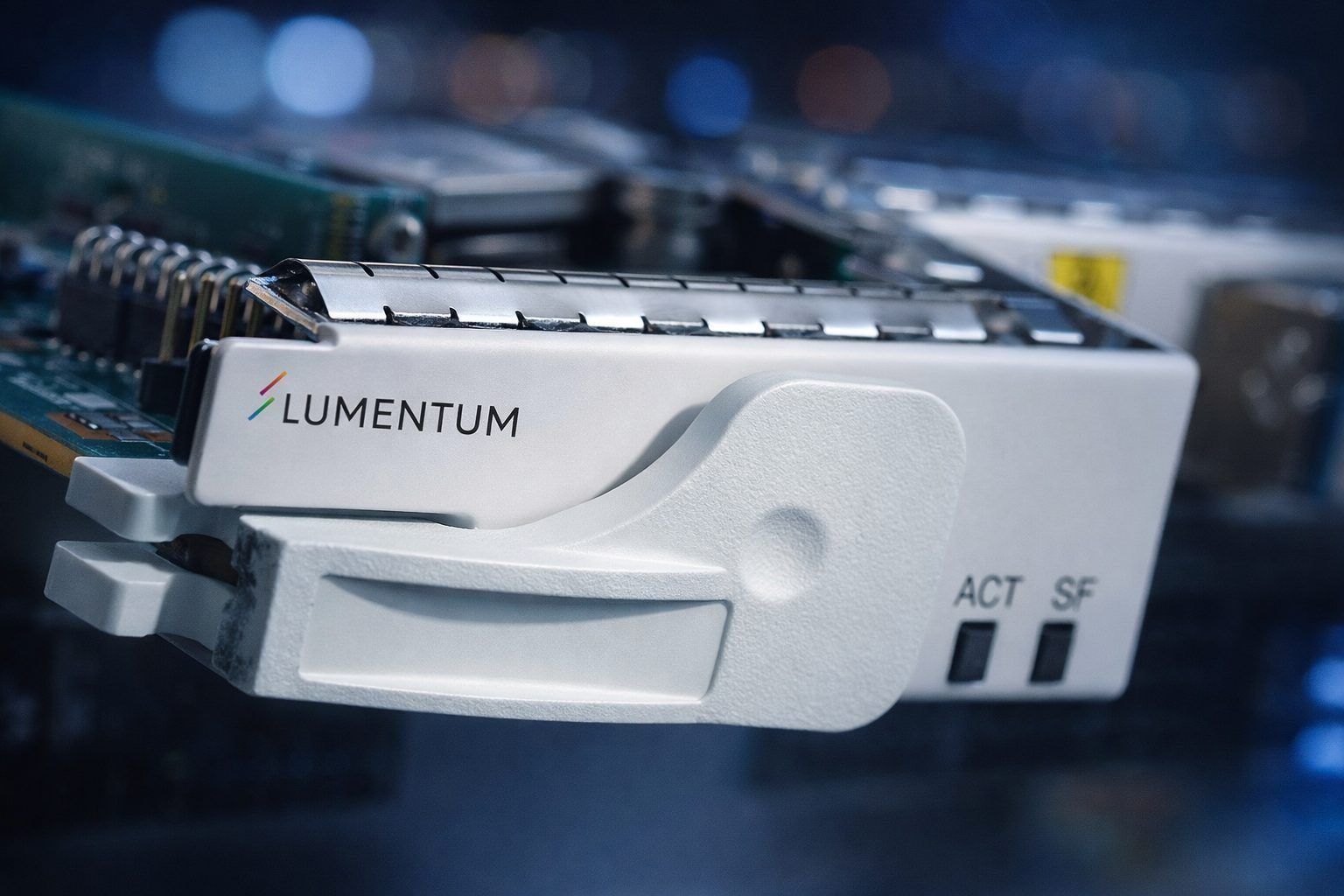

Lumentum designs optical and photonic products used in cloud and communications networks and laser applications, with a Cloud & Networking segment that includes products for AI/ML and data-center interconnect uses, Reuters company information shows. Reuters

Investors have been rotating out of crowded growth trades into year-end, with volatility amplified by lighter holiday trading. “It’s just a healthy rebalancing of allocations more so than an emotionally driven sell-off,” Mark Hackett, chief market strategist at Nationwide, said this week. Reuters

Lumentum traded between $367 and $379.12 in Wednesday’s regular session on volume of about 1.6 million shares, and remains below its 52-week high of $401.60, market data show. Investing

Macro backdrops are also in play for high-multiple tech. The Federal Reserve’s next policy meeting is scheduled for Jan. 27-28, and investors have been leaning toward a hold on rates, Reuters reported. Reuters

Company-specific attention is on the next earnings report, with Wall Street calendars estimating results around Feb. 5 after the close. Investors will be listening for updates tied to cloud-networking demand and margins. MarketBeat

Before next session: U.S. stock markets are scheduled to reopen on Friday, Jan. 2, after the New Year’s Day holiday closure. Nasdaq

Before next session: The next major U.S. macro catalysts land next week, led by the December employment report on Jan. 9 and the December CPI report on Jan. 13, the Bureau of Labor Statistics schedule shows. Bureau of Labor Statistics

Before next session: For Lumentum, traders will be watching whether the stock can hold above Wednesday’s $367 low, with the prior 52-week high near $402 the obvious upside reference point if risk appetite returns. Investing