NEW YORK, February 11, 2026, 14:49 (EST) — Regular session

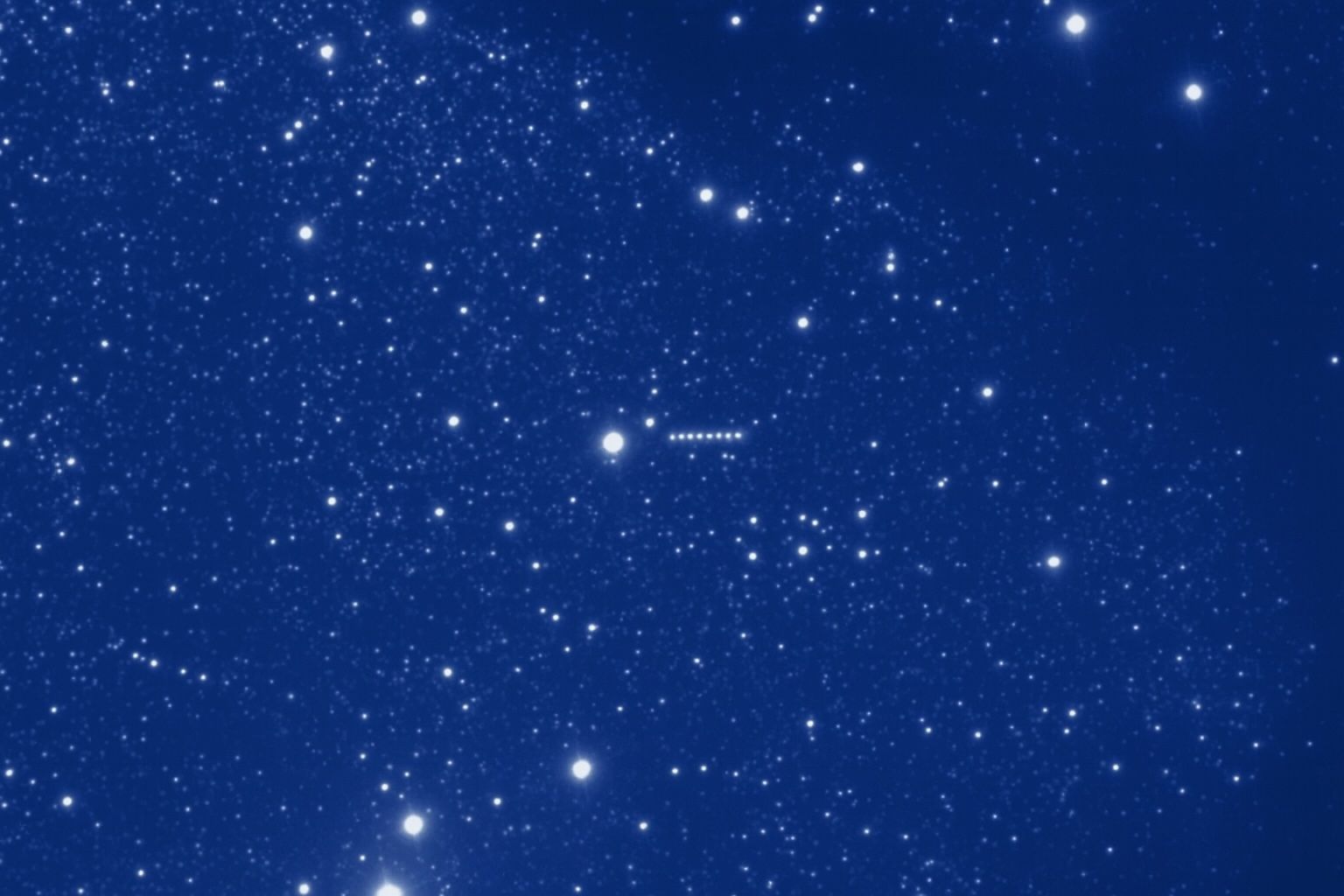

Marsh & McLennan Companies shares slipped 0.71% to $174.09 by 2:39 p.m. EST Wednesday. The stock moved in a $172.01 to $175.91 range, with roughly 3.0 million shares traded. Investing.com

Since Monday, Marsh has basically stood in for the whole brokerage sector, with traders using it as a bellwether after stocks got hammered on fears that AI might drive customers to buy policies directly. The catalyst: Insurify’s new ChatGPT-powered comparison tool. That set off a sharp slide—Willis Towers Watson tumbled 12%, while shares of Arthur J. Gallagher and Aon each lost about 10%, according to Bloomberg. Bloomberg.com

Wolfe Research’s Tracy Benguigui and her team described the selloff as “overblown since this ChatGPT development is on the personal lines side and the brokers we cover focus more on commercial lines.” The analysts made clear: consumer-oriented tech is a separate issue from what happens in business insurance. Still, they pointed out, there’s a longer-term threat — disintermediation could eventually squeeze out the brokers. Investing.com

On Wednesday, Marsh put in a preliminary prospectus supplement for a planned senior notes offering—these are unsecured corporate bonds. Details like the offering’s size, coupon, or maturity weren’t disclosed in the document. Proceeds, according to the filing, are tagged for general corporate purposes. Citigroup, J.P. Morgan, Wells Fargo Securities, RBC Capital Markets, and Scotiabank are tapped as joint book-running managers. Marsh’s senior unsecured debt stood at roughly $19.3 billion at the end of December 31, 2025. SEC

The company on Tuesday filed an S-8 with the SEC, registering as many as 9 million shares under its 2020 incentive and stock award plan. That form typically covers shares for employee pay packages; it doesn’t always mean dilution is imminent. SEC

Marsh tumbled 7.51% by the close on Feb. 9, then clawed back 2.45% the next day as bargain hunters moved in following the AI-triggered selloff. The stock flirted with Monday’s $170.78 low after another drop Wednesday. Investing.com

Shares trade on the New York Stock Exchange as MRSH—previously listed as MMC—according to its investor relations page. Marsh

This week, Reinsurance News reported that Spain’s Tuio has rolled out an insurer-developed feature within ChatGPT, capable of producing personalized home insurance quotes—and eventually, of enabling users to buy a policy straight in the chat. Analysts, among them Goldman Sachs, called the broker selloff an “overdone” reaction to these early tests aimed at consumers, according to the outlet. ReinsuranceNe.ws

Still, the retreat puts the group to the test. Should AI tools expand into business insurance—or if regulators and carriers ease the way for direct distribution—broker commissions might start feeling the squeeze.

Marsh investors are keeping an eye out for the final terms on the upcoming note sale, as well as signs that the recent swings in broker shares might calm down. The big date circled for now: April 16, which is when the company will release its next earnings report. Zacks