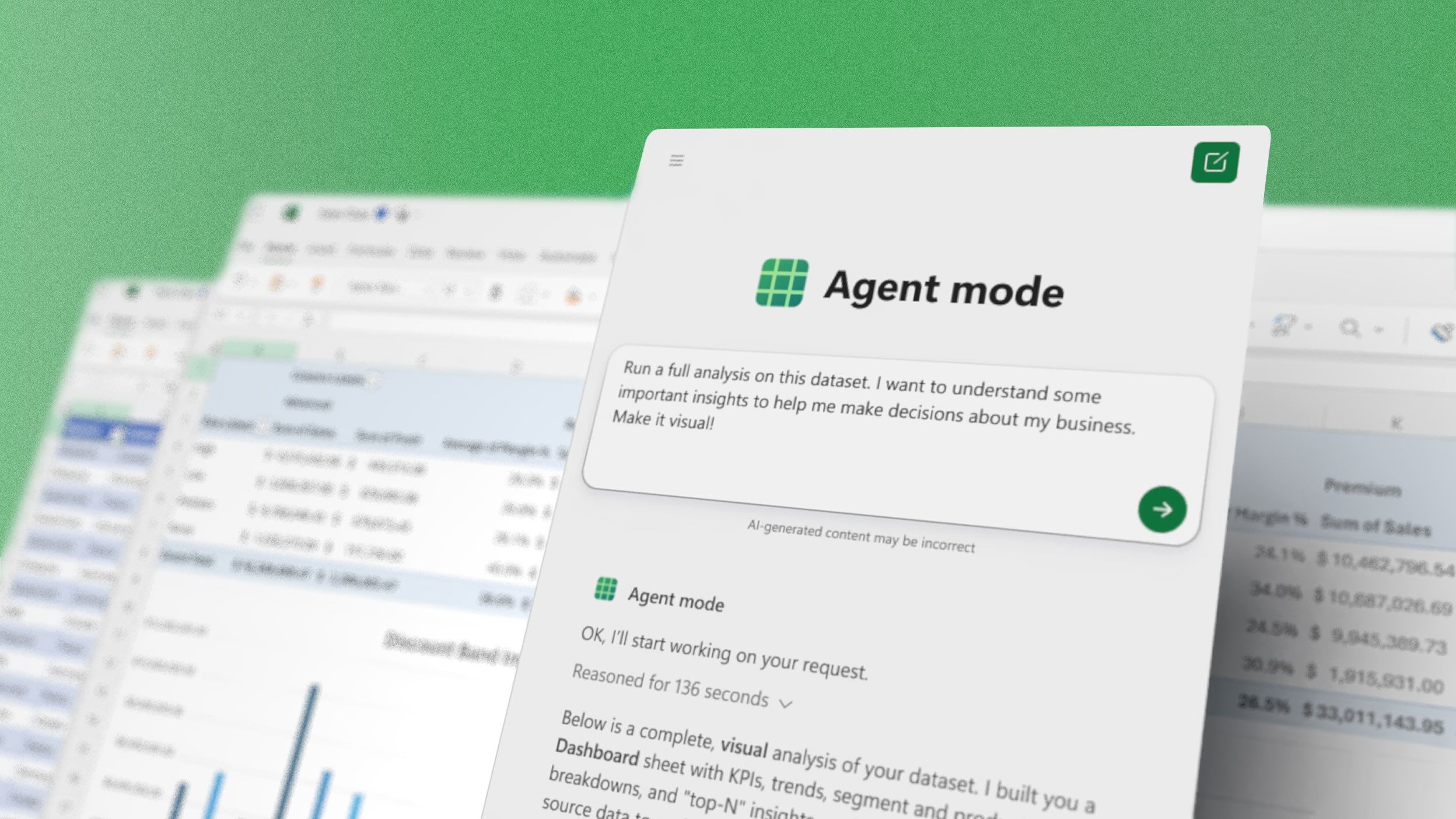

- What’s new: Microsoft has rolled out a preview of “Agent Mode” in Excel and Word and an “Office Agent” in Copilot chat, launching Sept 29, 2025 axios.com microsoft.com. In short, you can now tell the AI what you need in plain language (“vibe working”) and it will build entire documents or spreadsheets for you.

- Excel/Word Agent Mode: Inside Excel and Word (web only for now), Agent Mode uses advanced OpenAI AI (the next-gen GPT-5 models) to “speak Excel” and Word natively. Copilot will iteratively generate outputs, then evaluate results, fix issues, and repeat until the outcome is verified microsoft.com – essentially “like you’re handing off work to an expert,” as Microsoft puts it. For example, you can prompt Copilot to analyze sales data or build a loan calculator, and it chooses formulas, creates charts, and writes summaries automatically. Microsoft says these agents achieve ~57.2% accuracy on a standard spreadsheet benchmark (SpreadsheetBench) – outpacing competing AI (e.g. earlier GPT-based agents and even Claude) though still below human experts’ ~71% 1 .

- Office Agent (Copilot chat): A separate “Office Agent” lives in Copilot’s chat (web only, preview). Powered by Anthropic’s Claude AI models, it can create PowerPoint presentations and Word documents directly from a chat prompt microsoft.com. It first clarifies your goals (length, style, audience), then researches the topic online with chain-of-thought reasoning, and finally produces a polished result – even showing a live preview of slides as it works microsoft.com. Microsoft emphasizes that Office Agent makes slides and docs “tasteful, well-structured” – addressing a known weakness of AI-generated presentations microsoft.com 2 .

- Benchmarks: Microsoft cites its own tests: Excel Agent Mode scored 57.2% on SpreadsheetBench, beating the ~40–50% scored by other AI tools (such as a ChatGPT-based Excel agent or Claude Opus 4.1) theverge.com. (By comparison, Microsoft notes humans hit ~71%.) The company claims Agent Mode can handle tasks “that a first-year consultant would do, delivered in minutes” theverge.com. OpenAI’s recent “ChatGPT Agent” similarly touts the ability to automate things like updating spreadsheets or converting dashboards into presentations openai.com – showing that Microsoft’s Office agents fit into a broader trend toward “agentic” AI in productivity.

- Availability: These features are rolling out now in Microsoft’s Frontier preview program on the web. Agent Mode is available today in Excel and Word on the web for Microsoft 365 Copilot customers (and even personal/family subscribers) theverge.com. Office Agent (chat) is also live today for Personal/Family Copilot users (US only) theverge.com. Desktop support and full enterprise rollout are coming soon. Microsoft says businesses need a Copilot subscription, while consumers with Microsoft 365 Personal/Family plans can try it now (with future plans for a “premium package” tier) 3 .

Microsoft bills this era of AI-assisted work as “vibe working” – akin to its earlier “vibe coding” for apps. As Corporate VP Sumit Chauhan explains, “in the same way vibe coding has transformed software development, the latest reasoning models in Copilot unlock agentic productivity for Office artifacts” theverge.com. In practice, that means you start with a simple prompt (“Create a budget workbook and chart for me…”) and the AI agent orchestrates the multi-step process. The Microsoft blog calls it “the new pattern of work for human-agent collaboration” microsoft.com 4 .

In Excel, for example, Agent Mode can automatically apply financial formulas, build monthly reports, or set up interactive dashboards from a description. “Agent Mode delivers AI that can ‘speak Excel’ natively,” the blog says, democratizing capabilities once only available to experts microsoft.com. It literally builds sheets, fills in data, and creates visuals without you writing any formulas – you just guide it with feedback. Likewise in Word, Agent Mode turns document writing into an interactive chat: you might ask Copilot to “summarize last quarter’s sales report” or “rewrite this email in friendly tone,” and it will draft, refine, and ask clarifying questions as needed microsoft.com. “Writing feels more like a dialogue than a task,” Microsoft says microsoft.com, as Copilot suggests edits and formatting on the fly.

The Office Agent in chat is a bit different: you don’t need to open Word or PowerPoint. Instead you ask Copilot (on the web) to “Make me a 10-slide deck on the athleisure clothing market,” and the agent will: clarify your intent (audience, length, style), research online for up-to-date info, then generate slides with visuals and notes. It even shows its chain-of-thought and a slide preview in real time microsoft.com. This addresses a long-standing AI challenge: slide creation. “PowerPoint is one of the most used tools… but over the last two years AI has often fallen short when creating slides,” Chauhan noted. “Office Agent changes that,” producing “tasteful, well-structured decks” microsoft.com. (Notably, the Office Agent uses Anthropic’s Claude models instead of OpenAI’s; Microsoft says it’s committed to OpenAI but expanding to “the entire family of models” for flexibility 5 .)

Competition and context: Microsoft isn’t alone in adding AI helpers to office apps. Google Workspace has also gained AI features – for example Google recently added the “Whisk” model to generate images and even audio playbacks of docs computerworld.com – and its Gemini AI can draft emails or doc content. However, Google’s approach so far focuses on augmenting user edits (rephrasing, summarizing, adding visuals) rather than a one-shot agent that builds a file end-to-end from a prompt. OpenAI’s own ChatGPT recently introduced an “agent mode” with plugins to browse, run code, and process files, and it highlights similar use cases (“updating spreadsheets with new financial data” or “converting screenshots into presentations” openai.com). Microsoft’s move highlights a race to make AI an active collaborator. As one industry editor observes, Microsoft now lets users generate “complex spreadsheets and documents with just a prompt” theverge.com – in effect promising AI can do the grunt work of analysis and writing.

Expert take: Microsoft emphasizes the productivity angle. As Chauhan told Axios, “Productivity is in our DNA… Others can try and replicate it, but there’s no substitute for the real thing” axios.com. By deeply understanding Office’s data and formatting, these agents aim to deliver “board-ready presentations or documents” very quickly theverge.com. In-theory, that means cutting mundane work and letting people focus on decisions. But observers note caveats: AI still makes mistakes, so oversight is needed. Even so, analysts are excited: McKinsey and others describe this shift as creating “AI superagency,” where workers empowered by AI “supercharge their creativity [and] productivity” mckinsey.com. Microsoft clearly believes agentic AI is the next step. For millions of Office users, that could soon mean handing more of the heavy lifting to an AI partner – and rethinking what “doing your job” looks like.

Sources: Microsoft’s announcements and demos microsoft.com microsoft.com; news coverage and interviews theverge.com axios.com; benchmark results theverge.com; and related industry analysis computerworld.com 6 .