December 10, 2025

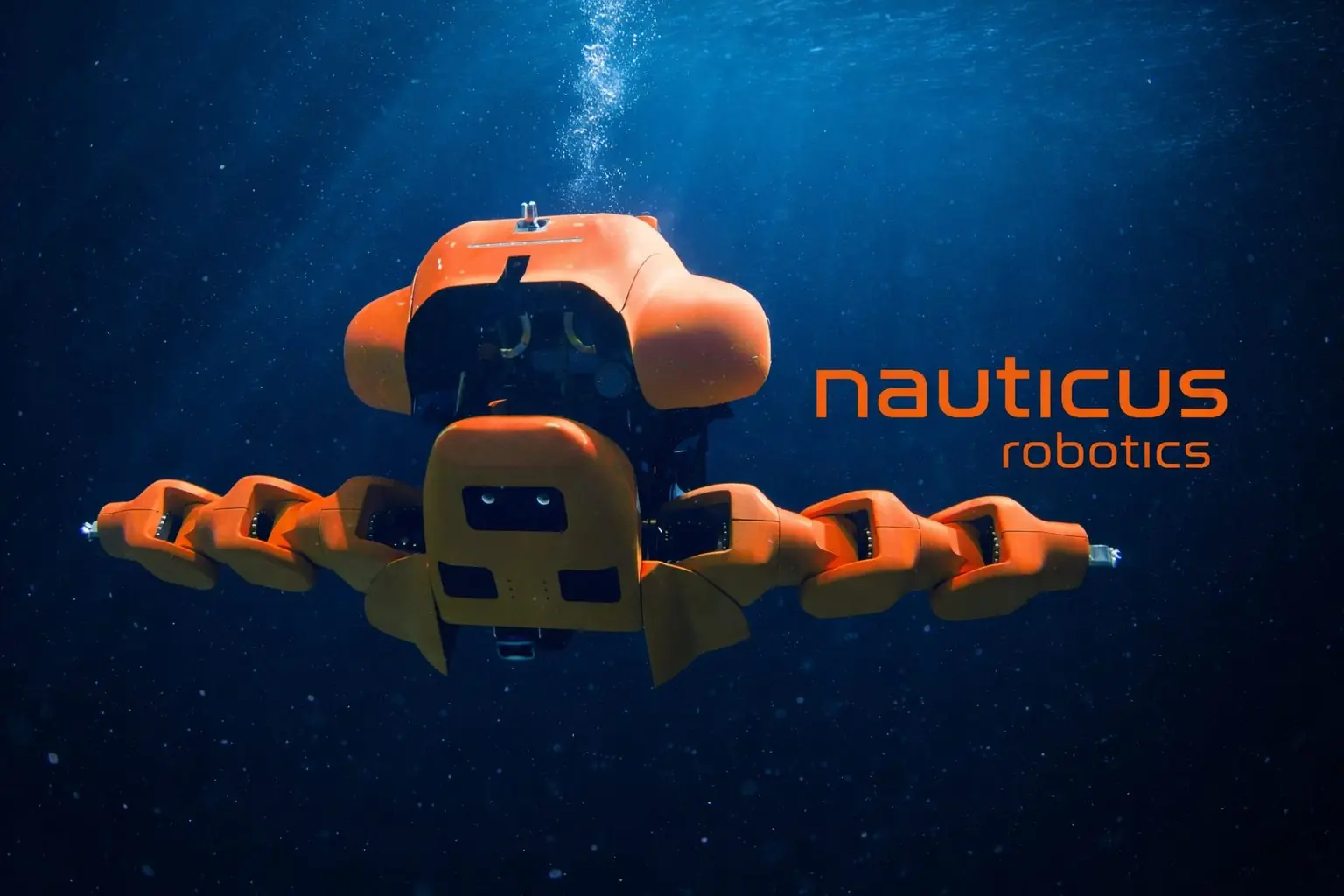

Nauticus Robotics, Inc. (NASDAQ: KITT) – the tiny subsea robotics company behind the Aquanaut autonomous underwater drone – is back in the headlines after another complex capital-structure move that swaps debt for preferred equity.

As of December 10, 2025, KITT trades around $1.06–$1.21 per share, with a market capitalization in the mid‑teens of millions of dollars and a 52‑week range of $0.71 to $54.36 – a price history that screams “high risk, high volatility.” StockAnalysis+2Walletinvestor.com+2

At the same time, the company is trying to:

- Clean up a leveraged balance sheet

- Fix a Nasdaq listing deficiency

- Pivot into deep‑sea rare‑earth mineral exploration

- Scale up commercial deployments of its Aquanaut robots and ToolKITT autonomy software

Here is how today’s news fits into the broader Nauticus Robotics stock story.

KITT Stock Today: Micro‑Cap, Extreme Volatility

Data from several market trackers show that KITT:

- Recently closed at about $1.06 and has traded intraday up toward $1.20–$1.21 on December 10, 2025. StockAnalysis+1

- Has a market cap roughly between $12–16 million, placing it firmly in micro‑cap / penny‑stock territory. StockAnalysis+1

- Has a 52‑week trading range of $0.71 to $54.36, reflecting a massive boom‑and‑bust arc over the past year. StockAnalysis

- Has delivered a one‑year share price decline of about 85–90%, according to multiple technical and quant platforms. TradingView+1

Recent trading has been frenetic. One technical site notes daily price swings above 30–40% inside a single session and weekly volatility above 50%, describing the stock as “very high risk.” StockInvest

In other words: KITT behaves more like a speculative trading vehicle than a sleepy industrial stock.

Today’s Headline: Series C Preferred Stock Issued in Exchange for Debt

The most important fresh development as of December 10, 2025 is a new debt‑for‑equity exchange.

According to Nauticus’ latest Form 8‑K and coverage of that filing: Investing.com+2Stock Titan+2

- On December 3, 2025, Nauticus entered Amendment and Exchange Agreements with several institutional investors.

- Portions of its secured convertible term loans and original‑issue‑discount senior secured convertible debentures due 2026 were exchanged into a new class of Series C Convertible Preferred Stock.

- Nauticus issued 3,814 shares of Series C Convertible Preferred Stock to three institutional investors in this initial closing.

- To enable the deal, the company filed a Certificate of Designations in Delaware that defines the rights and preferences of the new Series C preferred and represents a material modification to security holder rights.

Legally, the exchange relies on Section 3(a)(9) of the Securities Act, which allows certain exchanges of existing securities without a new public registration. Stock Titan+1

What this means in practice

Economically, Nauticus is:

- Reducing some of its debt‑like obligations by converting them into preferred equity.

- Pushing risk up the capital structure: preferred stock is junior to debt but senior to common equity.

- Setting up a new class of securities that can eventually convert into common shares, creating potential future dilution for common shareholders.

Coverage of the deal points out that the company carries a debt burden of roughly $30+ million against a mid‑teens million market cap, highlighting how heavily leveraged it remains even after the exchange. Investing.com+1

From a stock‑market perspective, these kinds of transactions are a double‑edged sword:

- Positive: lower interest burden, longer runway, lenders willing to stay at the table.

- Negative: more complex capital stack, potential dilution, and a concrete reminder that the balance sheet is still strained.

Big Shareholder Exit: Transocean Sells Down Its KITT Stake

Another notable December data point: Transocean International Ltd, previously a 10% owner, has largely exited its Nauticus position.

A Form 4 summarized by Investing.com shows that Transocean: Investing.com

- Sold 2,161,720 KITT shares between November 28 and December 3, 2025.

- Collected about $2.16 million in proceeds at prices from $0.74 to $1.02 per share.

- Now directly holds only 6,421 shares of Nauticus common stock.

The same report notes that KITT had gained over 70% in the preceding week and yet remains down more than 80% over the past year, underscoring both the extreme volatility and the longer‑term destruction of shareholder value. Investing.com

Institutional selling by a former 10% holder doesn’t automatically mean doom, but it reinforces the perception of risk and may weigh on sentiment among retail traders.

October 2025: $250 Million Equity Line and Rare‑Earths Pivot

The December debt swap builds on a pair of major October announcements that reshaped the Nauticus story.

1. $250 million Equity Line of Credit

On October 27, 2025, Nauticus disclosed a $250 million Equity Line of Credit (ELOC) – essentially the right to sell new shares over time to a financing partner, subject to conditions. Stock Titan+1

According to the company’s release:

- The facility is intended to fund strategic acquisitions and support a major push into deep‑sea rare‑earth and mineral exploration.

- Management frames this as a way to leverage its autonomous subsea robotics, AI and automation capabilities for critical‑minerals supply chains.

- The ELOC is positioned as providing flexible growth capital rather than immediate balance‑sheet repair.

Traders loved the headline. Multiple outlets reported that the stock spiked 70–75% intraday when the ELOC and rare‑earth strategy were announced, driven by momentum traders and speculative interest in subsea mining. StocksToTrade+3Stock Titan+3Stocktwits+3

But structurally, an equity line of this size can be both a growth enabler and a dilution machine, depending on how aggressively the company taps it and at what share prices.

2. $3.7 million debt converted to equity

That same day, Nauticus also announced an agreement to convert $3.7 million of existing debt into common equity. Stock Titan

The company said the transaction would:

- “Substantially deleverage” the balance sheet.

- Be complemented by debtholders’ willingness to swap additional outstanding debt into preferred equity if needed to help with Nasdaq listing compliance.

Again, the theme is consistent: turn creditors into shareholders, reduce near‑term cash interest, and hope that future growth justifies the larger base of equity claims.

Nasdaq Delisting Risk and September Reverse Stock Split

Nauticus is fighting on another front: keeping its Nasdaq listing.

On October 23, 2025, the company disclosed that it had received a Nasdaq delisting notification dated October 16 for failing to maintain the required $35 million Market Value of Listed Securities (MVLS) under Rule 5550(b)(2). Stock Titan

Key points from that notice:

- The letter has no immediate effect on trading.

- Nauticus plans to request a hearing before the Nasdaq Hearings Panel, which automatically pauses any suspension or delisting until the process plays out.

- Management is evaluating “corporate or market‑based actions” to regain compliance, including alternative equity requirements under Rule 5550(b)(1). Stock Titan

Before this MVLS issue, Nauticus had already executed a 1‑for‑9 reverse stock split effective September 5, 2025, specifically to boost its share price and address Nasdaq’s minimum bid price requirements. PR Newswire

So far, that split has not prevented the company’s market value from sliding below the exchange’s thresholds.

Q3 2025: Revenue Momentum, Big Losses, Deep‑Water Milestones

Fundamentally, the latest detailed snapshot of Nauticus comes from its third‑quarter 2025 results, released on November 14. Nauticus Robotics, Inc.+1

Highlights from the quarter ended September 30, 2025:

- Revenue:

- $2.0 million, up from $0.4 million in the year‑ago quarter and roughly flat with $2.1 million in Q2 2025.

- Net loss:

- -$6.6 million, or -$2.60 per share, compared with a net income in the prior‑year period (driven by non‑recurring items) and a -$7.5 million loss in Q2.

- Operating expenses:

- About $7.9 million, higher than a year earlier but modestly lower than the prior quarter.

- Cash:

- $5.5 million in cash and equivalents at quarter‑end, up from $2.7 million at June 30, 2025, helped by financing activity. PR Newswire

Operationally, management emphasized some impressive – if early‑stage – technical achievements:

- The first Aquanaut robot completed ultra‑deepwater testing down to 2,300 meters, likely among the deepest tests ever performed by an untethered subsea drone of its class. Nauticus Robotics, Inc.+1

- The SeaTrepid acquisition gave Nauticus access to a fleet of conventional ROVs, which are now being retrofitted with the ToolKITT™ autonomy software and used in paid commercial work. Nauticus Robotics, Inc.+2Stock Titan+2

- A second Aquanaut has moved to a Florida test lake as Nauticus prepares for the 2026 offshore season and longer‑term, multi‑year customer contracts. Nauticus Robotics, Inc.

In short, revenue is small but growing, and the tech appears credible, yet losses are still large relative to the company’s size.

What Other Analysts and Trading Desks Are Saying

Because KITT is a micro‑cap with a complex story, coverage is fragmented and often comes from trading‑oriented platforms rather than traditional Wall Street research.

Momentum and “hidden gem” narratives

A recent article on StocksToTrade, dated December 4, 2025, framed Nauticus as a potential “hidden gem” while acknowledging that the stock was down about 12.5% on the day and exhibits wild volatility. StocksToTrade

That piece and a similar October 27 article (“KITT Stock: Will the Surge Last?”) stress:

- Substantial negative profitability metrics (deeply negative EBIT and EBITDA margins, high cash burn). StocksToTrade+1

- Very high gross margins, which could support future profitability if scale is achieved. StocksToTrade+1

- The role of trading momentum and news catalysts – not fundamentals alone – in driving short‑term spikes of 60–70% or more. StocksToTrade+1

These analyses read more like trader playbooks than long‑term investment theses: they treat KITT as a volatile momentum stock, not a stable value or growth name.

Short‑Term Technical Forecasts: Mostly Bearish

Several algorithmic and technical‑analysis sites provide short‑term forecasts for KITT. They agree on one thing: risk is very high.

StockInvest.us: -70% in the next 3 months?

One high‑profile technical site argues that: StockInvest

- KITT sits in the middle of a “very wide and falling” short‑term trend channel.

- Its models point to a potential -70% decline over the next three months, with a 90% probability of ending that period between $0.14 and $0.40 per share.

- At the same time, the stock shows conflicting signals – a short‑term moving‑average buy signal and a long‑term sell signal – which nets out to a negative overall evaluation.

- Daily volatility in recent sessions has exceeded 30–40% intraday, leading the site to explicitly label KITT as “very high risk.”

Intellectia.ai: Strong‑Sell and a 1‑Month Drop

Intellectia’s pattern‑matching model (as of December 8, 2025) forecasts: Intellectia

- A 1‑month price around $0.83, implying a ~26% decline from recent levels.

- A “Strong Sell” conclusion based on a mix of technical, moving‑average, short interest and seasonality factors.

- Historical performance stats: the model notes that KITT’s stock price fell about -81.7% in 2023, -92.8% in 2024, and remains down sharply again in 2025.

In other words, the quantitative short‑term models largely treat KITT as a downtrend with occasional explosive rallies, not a steady recovery story.

Long‑Term Quant Models: Multi‑Bagger Potential on Paper

At the other end of the spectrum, some long‑term forecasting sites paint an almost absurdly optimistic picture – with the usual caveats that these are purely model‑driven and highly uncertain.

Examples:

- WalletInvestor estimates that KITT, quoted around $1.06 on December 10, 2025, could climb to roughly $3.6 by late 2030, implying a +240% gain over five years. Walletinvestor.com

- StockScan.io projects a path where KITT’s average price could reach roughly $7–8 by 2030 and potentially $30+ by 2040, before fluctuating in the mid‑teens by 2050 – translating to four‑digit percentage returns versus today’s price. StockScan

Those numbers sound spectacular, but they’re generated by extrapolating historical price patterns and basic fundamentals, not by detailed bottom‑up analysis of subsea robotics, rare‑earth geology, or future contract wins.

The key takeaway: long‑term algorithmic forecasts suggest enormous upside but offer no guarantee, especially for a micro‑cap where one bad financing or failed project could be existential.

Investment Case: Key Upside Drivers vs. Major Risks

For readers trying to understand the risk/reward profile rather than get a simple “buy” or “sell,” Nauticus Robotics’ story breaks down into a few crucial themes.

Potential Upside Drivers

- Differentiated technology

Aquanaut and ToolKITT give Nauticus a credible shot at being a leader in autonomous subsea robotics, with demonstrated ultra‑deepwater capability down to 2,300 meters and early commercial deployments on retrofitted ROVs. Nauticus Robotics, Inc.+2PR Newswire+2 - Growing (but small) revenue base

Quarterly revenue has grown from under $0.5 million a year ago to around $2 million, showing early traction with offshore and defense‑adjacent customers. PR Newswire - Strategic optionality in rare‑earth minerals

The $250 million ELOC and deep‑sea rare‑earth exploration strategy, if executed responsibly, could plug Nauticus into a geopolitically important supply chain at the intersection of energy transition, defense and advanced electronics. Stock Titan+2Stock Titan+2 - Balance‑sheet repair underway

Repeated debt‑to‑equity conversions – including the October $3.7 million deal and the new Series C exchange – show creditors willing to take equity risk rather than push for an immediate exit. Stock Titan+2Stock Titan+2

Major Risks

- Severe dilution and complex capital structure

Reverse splits, preferred stock, equity lines, debt conversions – all of these moves shift value among different classes of capital and often dilute common shareholders. Future financing could amplify that effect. - Nasdaq listing at risk

The MVLS deficiency notice and tiny market cap mean KITT must either grow its valuation or meet alternative equity tests to stay on Nasdaq. Failure could push it onto an over‑the‑counter market, which typically reduces liquidity and institutional interest. Stock Titan+1 - Ongoing heavy losses and cash burn

Even with improving revenue, Nauticus is still losing $6–7 million per quarter with only a few million in cash and heavy reliance on external financing. PR Newswire+2Investing.com+2 - Execution risk in new markets

Deep‑sea rare‑earth exploration is technically, politically and environmentally challenging. Turning that strategy into sustainable, profitable revenue will likely take years, not quarters. - Large shareholder selling

The recent $2.16 million share sale by Transocean, leaving only a token stake, is a reminder that sophisticated holders may choose to exit rather than ride out the volatility. Investing.com

What Today’s News Really Signals

Put together, the December 10, 2025 picture of Nauticus Robotics looks like this:

- The tech is real and progressing – deep‑water demos, commercial ToolKITT deployments and a growing services business all support the idea that Nauticus has genuine engineering capabilities, not just slides and slogans. Nauticus Robotics, Inc.+1

- The balance sheet is fragile, and management is trying to fix it through a series of debt‑for‑equity deals and large‑scale equity financing facilities. Stock Titan+3Investing.com+3Stock Titan+3

- Nasdaq is watching, and the company has limited time and tools to get back into full compliance. Stock Titan+1

- Traders, not long‑only funds, dominate the shareholder base, as shown by violent price swings, penny‑stock style coverage, and the exit of a once‑significant institutional owner. StocksToTrade+2StocksToTrade+2

- Short‑term quant models are largely bearish, expecting continued downside and high volatility, while long‑term models dangle multi‑bagger scenarios that depend heavily on assumptions. Walletinvestor.com+3StockInvest+3Intellect…

For anyone tracking Nauticus Robotics stock as of December 10, 2025, today’s Series C preferred issuance is less a surprise than a continuation of the same story:

A high‑potential robotics company trying to buy time and optionality through aggressive financial engineering, in a stock that behaves more like a speculative instrument than a traditional industrial equity.