New York, February 16, 2026, 11:12 ET — The session has ended.

- With U.S. markets closed Monday for Presidents Day, Netflix finished Friday at $76.87, a gain of 1.3%.

- Word that Warner Bros Discovery might revisit discussions with Paramount has revived speculation around Netflix’s deal.

- Traders are on alert for headline risk when Wall Street opens again Tuesday.

Netflix (NFLX.O) shares are set for Tuesday’s open with fresh attention on its Warner Bros Discovery play. A new report indicates Warner’s board is considering reviving talks with Paramount Skydance, a rival bidder. https://www.reuters.com/business/media-tel…

U.S. markets will be shut Monday for Presidents Day, tacking an extra day onto the weekend while deal talk is picking up another round. https://apnews.com/article/4f4955a83d4b04a…

Why now? Investors can’t stop circling back to the Warner deal. It resets Netflix’s cash requirements, but also brings a fresh batch of risks: regulatory hurdles, timing uncertainties, and the all-important price.

If word gets out that the target is angling for a higher bid, the stock often shifts gears—suddenly it’s trading on deal speculation, not fundamentals. That alone can blow out the intraday range, even if the broader market barely stirs.

According to a Bloomberg News report picked up by Reuters, Warner Bros Discovery (WBD.O) is weighing whether to revisit talks with Paramount following a revised proposal from its competitor. No decision has been made by Warner’s board, which may opt to maintain its current agreement with Netflix instead. Reuters noted it was unable to independently confirm Bloomberg’s account, and said Paramount, Warner, and Netflix all declined to comment.

Paramount isn’t bumping up its top-line offer, but it’s tweaking the terms. The new proposal includes a 25-cent-per-share quarterly “ticking fee,” essentially more cash paid out if the deal takes longer than expected. The company has also agreed to pick up Warner’s $2.8 billion breakup fee to Netflix — the penalty Warner would owe if it abandons the Netflix deal, according to Reuters.

Reuters said Netflix is putting $27.75 per share in cash on the table for Warner’s studios, its content library, and HBO Max. Paramount, on the other hand, is coming in at $30 per share for everything—cable operations included.

Ancora Holdings, the activist investor, has become another obstacle. Reuters said it’s preparing to fight the Netflix deal, contending that Paramount’s board didn’t do enough to seriously consider its competing offer.

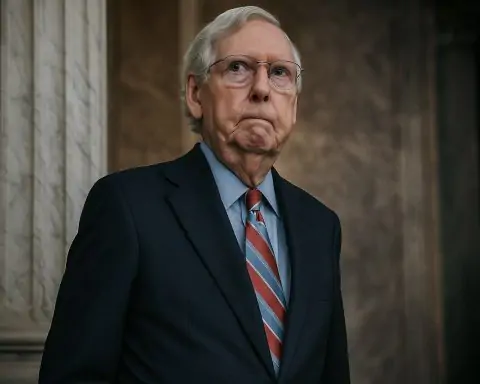

Regulation is still a wild card. Earlier this month, a U.S. Senate Judiciary subcommittee convened to examine how the proposed Netflix-Warner deal could alter competition—making it clear that official scrutiny isn’t going anywhere, even if the stock barely budges. https://www.judiciary.senate.gov/committee…

Paramount has been ramping up its policy team. In a memo reviewed by Reuters, Chief Legal Officer Makan Delrahim said that Rene Augustine, the latest addition, “will be responsible for developing strategic policies” and forging global ties. She starts Feb. 17, according to Reuters. https://www.reuters.com/business/media-tel…

Netflix shares closed out Friday at $76.87, gaining 1.33% during the session. The stock swung between $75.53 and $77.18, Investing.com data shows. https://www.investing.com/equities/netflix…

Still, headlines around the deal are double-edged. A Warner-Netflix agreement and a smooth regulatory process could send investors right back to focusing on pricing, churn, and that old debate about whether ads can really outpace growing content expenses. But if the talks go back to square one, risks show up: more delays, maybe a steeper bill, or Netflix facing a breakup and stuck with costs in a landscape that’s already shifted.

Tuesday, Feb. 17 is back on the calendar as U.S. markets open again. Eyes are on Warner—traders want to see if the board signals its intentions, or if the parties break their silence. Regulators could also move, taking a weekend report and giving it more weight.