- What is ANCHOR? New Jersey’s Affordable New Jersey Communities for Homeowners and Renters (ANCHOR) program is a state tax-rebate initiative launched in 2022 to ease skyrocketing property taxes whyy.org newjersey.news12.com. It offers direct cash rebates to qualified homeowners and renters in NJ.

- Who qualifies? To be eligible for 2025 benefits, you must have lived in your NJ home (owned or rented) as your principal residence on Oct. 1, 2024, and paid property taxes on it. Homeowners must have 2024 gross NJ income ≤ $250,000; renters’ income ≤ $150,000 nj.gov nj.gov. For renters, your name must be on the lease and you must have paid rent and the property be subject to local tax nj.gov.

- How much can you get? Homeowners age 65+ with 2024 income ≤ $150,000 get $1,750 (income $150–250k gets $1,250) nj.gov. Homeowners under 65 get $1,500 (≤$150k) or $1,000 ($150–250k) nj.gov. Renters under 65 receive $450, while renters 65+ get $700 nj.gov. (These amounts match last year’s rates newjersey.news12.com.) In all cases, residents 65 or older also get a $250 bonus in addition to the above newjersey.news12.com. (All benefits are capped by the total property taxes paid on the home nj.gov.)

- When are payments sent? The state began issuing 2025 ANCHOR payments on Sept. 15, 2025, and is mailing or depositing checks on a rolling basis nj.gov fox5ny.com. Most recipients will receive the payment within about 90 days of their application (unless more information is needed) nj.gov fox5ny.com. Applicants who filed on paper will get a paper check; online filers can choose check or direct deposit nj.gov.

- Application deadlines: The final deadline to apply (or make changes) is Oct. 31, 2025 nj.gov. However, to receive a paper check or update your banking information, you had to submit a new application by Sept. 15, 2025 nj.gov fox5ny.com. (That was the deadline for requesting a paper check or changing account details.)

- How to check status: You can check your ANCHOR rebate status online at the NJ Treasury website (nj.gov/treasury/taxation) or by calling the ANCHOR hotline at 1-888-238-1233 nj.gov fox5ny.com. The state also offers a callback option to reduce hold times. For in-person help, you can visit regional NJ 211 centers or attend a public PAS-1 filing event (see the Division’s site).

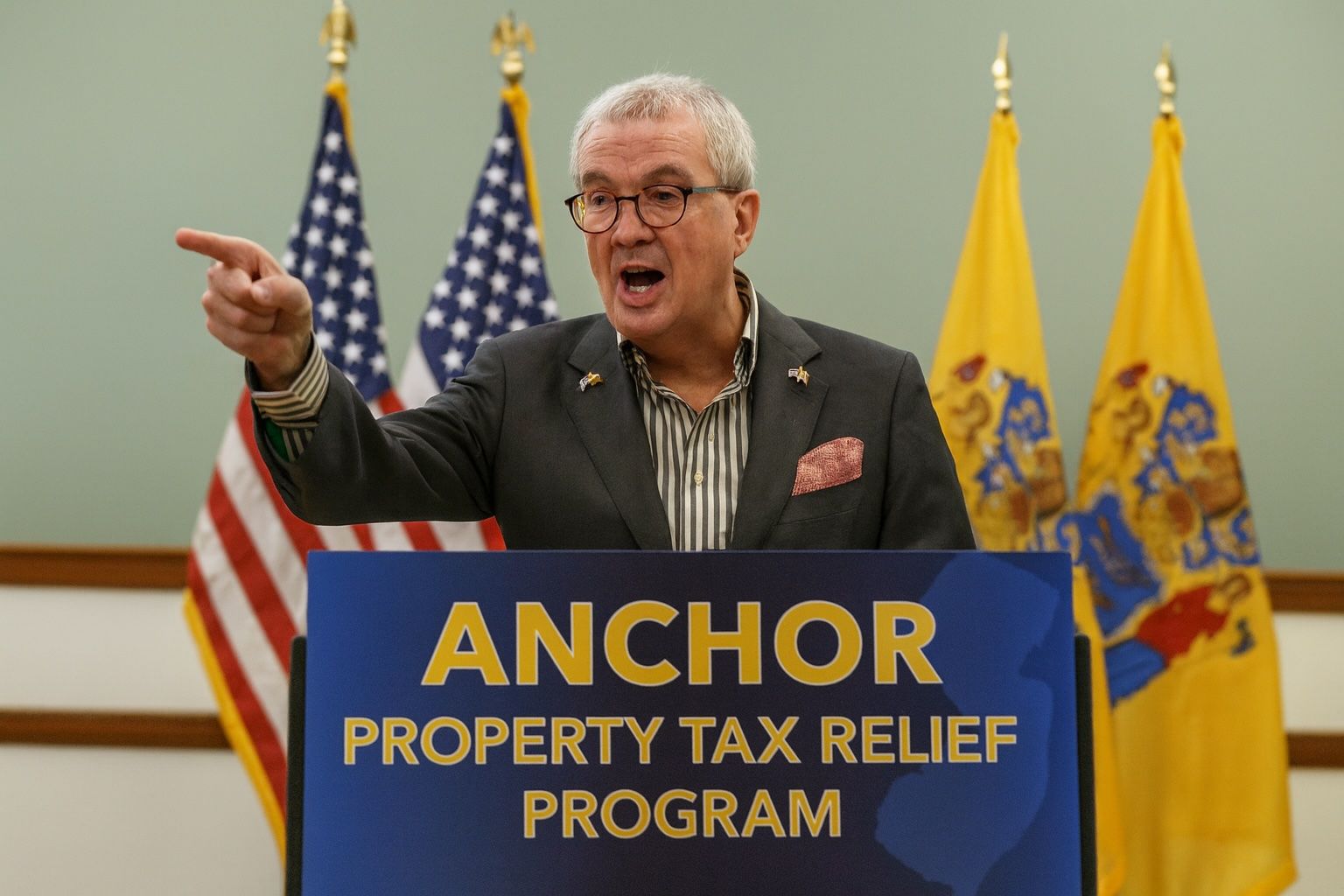

How ANCHOR works: New Jersey created ANCHOR in 2022 to broaden the old Homestead rebate. Gov. Phil Murphy calls it a “game changer” for struggling taxpayers whyy.org, and the NJ Treasury says it has already delivered billions in relief. In 2024 the program paid out about $2.1 billion to 1.8 million households nj.gov. (Eligible 2024 recipients were auto-enrolled again for 2025.) The benefit amounts are fixed by law for 2025: owners of a home (principal residence) pay property taxes and earn under $250k can get the amounts above, and renters with income under $150k get the amounts above. The program is strictly “straightforward” in design, says State Treasurer Elizabeth Maher Muoio – “a direct benefit” she wants every eligible resident to claim nj.gov.

Applying for 2025: Under-65 homeowners and renters who got ANCHOR last year were auto-enrolled again this year. In mid-August 2025, NJ mailed ANCHOR confirmation letters to roughly 1 million eligible residents nj.gov newjersey.news12.com. (The letters explain the filing status and amount.) If you get a letter and do not wish to accept the automatic filing – for example, if you need to update your address, bank info, or switch to a paper check – you must submit a new online application at anchor.nj.gov by Sept. 15 nj.gov newjersey.news12.com. (After Sept. 15, those updates are no longer accepted for this payment round.)

Residents 65 or older (and those on Social Security disability) are not auto-filed. Seniors must use the combined PAS-1 form (Property Tax Relief Application) for 2025 nj.gov. That single form handles ANCHOR and other credits like the “Senior Freeze” and upcoming Stay NJ program. The division will not mail PIN letters this year; everyone filing online must verify identity through ID.me nj.gov newjersey.news12.com. The PAS-1 form is available to print or mail if needed. In short: younger non-disabled renters/homeowners were automatically submitted, while seniors and people on disability must apply themselves (by Oct. 31) nj.gov nj.gov.

Payments start now: As scheduled, the first wave of ANCHOR payments went out Sept. 15, 2025 nj.gov fox5ny.com. Eligible residents should see either a check in the mail or a direct deposit within about three months of filing. (Fox 5 New York notes that most NJ families will get their money within 90 days nj.gov fox5ny.com.) Importantly, if you applied online and chose direct deposit, the money should hit your account. If you filed on paper or requested a check, look for a mailed check. New Jersey’s press release confirms the payments are now rolling out and directs people to check the Treasury status tool nj.gov. (The check will be mailed to the address on file unless you updated it.)

Tracking your ANCHOR check: You can monitor the status of your rebate on the official NJ Treasury “Check Benefit Status” page (linked from nj.gov) nj.gov. This is the same web tool used for Income Tax refunds. If the online system isn’t working or you have questions, call the ANCHOR hotline at 888-238-1233 nj.gov fox5ny.com and use the callback feature if needed. You will need your Social Security number, date of birth, and mailing address to verify your identity. According to NJ officials, this process has been improved with more staff and auto-callbacks to reduce waiting times kiplinger.com. (If all else fails, local NJ211 help centers can also assist with ANCHOR questions.)

Expert perspectives: Economists note that while ANCHOR provides welcome relief, it’s a limited program. Monmouth University professor Robert Scott points out that “nobody’s gonna turn down free money,” but cautions that the ANCHOR rebate is “not guaranteed every year” – it depends on the budget whyy.org. In practice, New Jersey has set aside over $2 billion annually for ANCHOR (e.g. $2.1B in 2024 nj.gov), but the state must reauthorize it each year. Rutgers policy expert Michael Hayes applauds the automatic filings this year, calling auto-enrollment “a good idea” because many eligible residents may not even know to apply or may be deterred by paperwork whyy.org. Both scholars noted that the application can be somewhat complicated (requiring tax and property info) and takes time to complete whyy.org, so removing barriers was important.

Bottom line: If you owned or rented your NJ home as of Oct. 1, 2024 and meet the income rules, you likely qualify for a 2025 ANCHOR rebate. Check your mailbox for any letter from Aug. 13 – that letter confirms if you were auto-filed. If you need to file or update info, use the online portal at anchor.nj.gov before the deadlines (paper-check requests by Sept. 15, general deadline Oct. 31) nj.gov nj.gov. Then, watch for your payment: it will arrive by check or deposit in the weeks after mid-September. For status updates and answers, use the official NJ Treasury tools nj.gov fox5ny.com. In the words of Treasurer Muoio, ANCHOR is “a straightforward program with a direct benefit,” and the state encourages everyone who is eligible to take advantage of it nj.gov.

Sources: Official NJ Treasury press releases and ANCHOR FAQs nj.gov nj.gov nj.gov nj.gov; News reports from NJ media newjersey.news12.com newjersey.news12.com fox5ny.com; interviews and analysis by WHYY (NPR) whyy.org whyy.org; and Kiplinger/NJ Taxation guides nj.gov kiplinger.com. All figures and quotes are from these cited sources.