- Historic $5T Milestone: Nvidia’s stock surged to an all-time high around $207 per share this week, briefly valuing the company above $5 trillion – the first company ever to hit that markts2.tech. Even after a slight pullback to ~$202, Nvidia (NVDA) is up ~30% year-to-date, vastly outperforming the broader marketts2.tech. This meteoric rise has cemented Nvidia’s place at the center of the global AI boomts2.tech. As one analyst put it, “Nvidia hitting a $5 trillion market cap is more than a milestone; it’s a statement,” underscoring how the company has gone from mere chip maker to “industry creator” in AIts2.tech.

- Blowout Growth Underpins the Rally: Nvidia’s financial performance has exploded alongside its stock. In the latest quarter, revenue soared 56% year-on-year to $46.7 billion (with ~88% of sales from data-center AI chips)ts2.tech. Extraordinary demand for its AI GPUs drove gross margins to ~72% and net profit margins above 50% – levels far above industry normsts2.tech. Wall Street expects another blockbuster report on Nov. 19 when Nvidia posts earningsts2.tech. The company has even guided for ~54% growth in the upcoming quarter, essentially selling every AI chip it can make amid insatiable demandts2.techts2.tech.

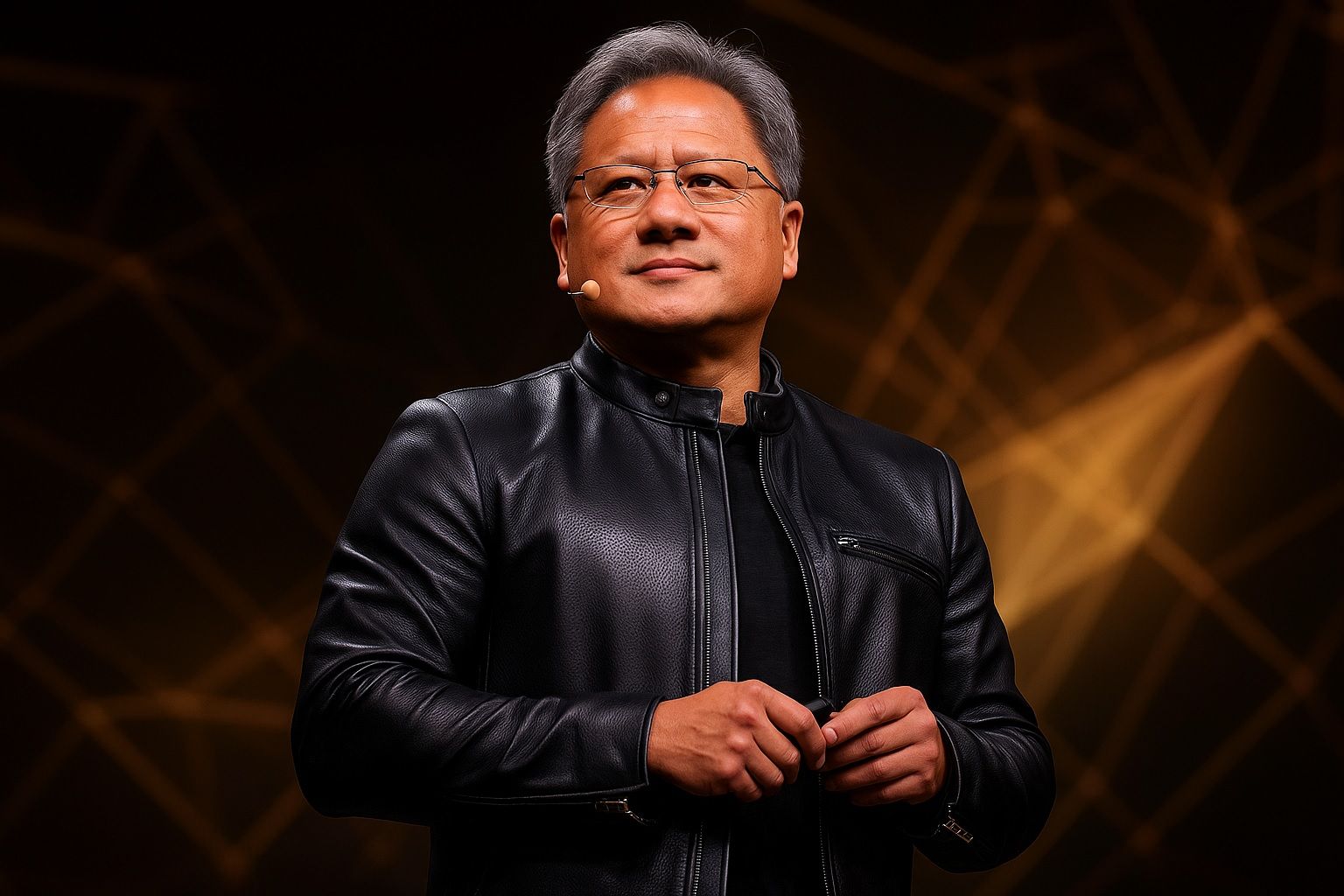

- Huang’s $400B Dealmaking Spree: Nvidia’s CEO Jensen Huang has spent recent weeks cutting mega-deals across industries – a strategy that added a stunning $400 billion to Nvidia’s market cap in just five daysainvest.com. The company announced a $100 billion partnership with OpenAI to supply ~10 GW of cutting-edge GPUs (securing years of AI chip demand)ts2.tech. It also took a $5 billion stake in Intel to co-develop next-gen CPU–GPU superchipsts2.tech, and joined a BlackRock-led group acquiring Aligned Data Centers for $40 billion – ensuring Nvidia’s hardware will power huge new AI cloud facilitiests2.tech. Huang even unveiled plans to build seven AI supercomputers for the U.S. government, underscoring Nvidia’s central role in national AI infrastructurets2.techts2.tech. Unsurprisingly, Nvidia’s rally has also added roughly $9 billion to Huang’s own net worth (now ~$176 billion)ainvest.com.

- Expanding into New Sectors: These deals extend Nvidia’s reach far beyond its traditional customer base in Big Tech. For example, Nvidia will partner with Eli Lilly to build the pharma industry’s most powerful AI supercomputer for drug discoveryainvest.com. It invested $1 billion for a ~3% stake in Nokia to co-develop AI-driven 5G networks and data centersreuters.com, sending Nokia shares to a decade high on AI hopes. Nvidia also teamed up with Uber and automaker Stellantis on a robotaxi development consortiumreuters.com, aiming to put 100,000 autonomous cars on the road by 2027. In short, Nvidia is leveraging its AI prowess across telecom, transportation, healthcare and beyond – reducing its reliance on sales to a few big cloud providers and ensuring its chips penetrate every major industry.

- Competition Heats Up, But Nvidia Leads: Rival chipmakers are racing to catch up in the AI silicon boom. AMD struck its own deal to supply ~6 GW of GPUs to OpenAI (even offering OpenAI an equity stake), news that sent AMD’s stock up 34% in one dayts2.tech. Qualcomm likewise jumped ~11% after unveiling new data-center AI chipsts2.tech. Even cloud giants like Amazon, Google, and Meta are designing in-house AI accelerators. Still, Nvidia “sells every AI chip it can make,” as one analyst notedts2.tech. The AI market is expanding so rapidly that multiple winners can thrive without dethroning Nvidiats2.tech. Nvidia retains an estimated 70–90% share in high-end AI GPUsmarkets.financialcontent.com, and its latest Blackwell chips are essentially sold out deep into next yearmarkets.financialcontent.com. A Reuters analyst flatly called Nvidia the “clear winner” of the AI revolution so farts2.tech – a reality reflected in Nvidia’s market cap now towering 10× larger than AMD’s (~$4.9T vs ~$430B) and 30× Intel’s (~$150B)ts2.tech.

- Wall Street Bulls (and Bubble Fears): The frenzy around Nvidia has most experts exuberant. Roughly 80–90% of analysts rate NVDA a Buy/Strong Buyts2.tech. The median 12-month price target sits around $210–$220 (about 15% above current levels)ts2.tech, and many targets keep rising. HSBC, for instance, recently boosted its target to $320 (nearly 70% upside) citing Nvidia’s unrivaled position at the heart of the AI wavets2.tech. BofA and Melius Research have similarly raised targets into the mid-$200s or higherts2.tech, with one calling for an “$800 billion-plus revenue opportunity by decade’s end” if AI momentum holdsts2.tech. However, a few skeptics warn that Nvidia’s valuation – about 50× earnings – “leaves little room for error”ts2.tech. One contrarian (a former Goldman strategist) even argues the AI boom is a bubble and pegs Nvidia’s true value around just $100 per sharets2.tech. For now he remains a lone voice, but his caution echoes the question on some investors’ minds: can Nvidia possibly live up to the immense hype?

- Risks on the Horizon: Nvidia’s biggest challenges may lie outside its control. Geopolitical tensions are a top concern – U.S. export curbs on advanced chips, coupled with China’s drive to develop its own AI silicon, threaten about 10–15% of Nvidia’s revenues that currently come from Chinese marketsts2.tech. “Nvidia’s biggest bottleneck isn’t silicon, it’s diplomacy,” one trader quipped, noting that U.S.–China tech restrictions could cap Nvidia’s growthts2.tech. (Notably, U.S. officials are reportedly discussing Nvidia’s chips in upcoming meetings with China’s leadershipreuters.com, which could determine whether curbs are eased or tightened.) Macroeconomic factors pose additional risk: a resurgence of inflation or hawkish Fed moves could deflate the lofty valuations of tech high-fliers like NVDAts2.tech. And with Nvidia’s stock up 12× since late 2022ts2.tech, even a hint of slowing AI demand or supply constraints – e.g. in the Nov. 19 earnings report – could trigger swift profit-taking. Indeed, Nvidia insiders (including CEO Huang) have already sold over $1 billion in stock since June, capitalizing on the huge rallyts2.tech. Nvidia’s $5T price tag reflects sky-high expectations, and the company will need near-flawless execution to justify it long-termts2.tech.

From Niche Player to the Backbone of AI

Nvidia’s incredible ascent underscores how dramatically the tech landscape has shifted with the rise of artificial intelligence. Founded in 1993 as a graphics-chip designer, Nvidia spent decades as a niche player focused on PC gaming GPUs. But in the past few years – and especially since the debut of OpenAI’s ChatGPT in late 2022 – Nvidia has transformed into “the backbone of the global AI industry,” as Reuters puts itts2.tech. Its high-end graphics processors proved ideally suited to training AI models, and Nvidia moved quickly to dominate this burgeoning market. The company now commands an estimated 75–90% share of AI-specific chip salesmarkets.financialcontent.com, making its hardware nearly ubiquitous in cutting-edge machine learning systems.

This dominant position has turned Nvidia into the unquestioned bellwether of the AI revolution. Over the last three years, Nvidia’s stock price has climbed about 510%, far outpacing the broader semiconductor indexfool.com. Since the AI boom kicked off in earnest (post-ChatGPT), NVDA shares have risen roughly twelve-foldts2.tech – an almost unheard-of gain for a mega-cap company. In early October, Nvidia even surpassed Apple to briefly become the world’s most valuable public company when it first crossed the $4 trillion markts2.tech. Just three months later, it added another trillion dollars to its valuation on frenzied AI chip demandts2.tech, underlining the breakneck pace of growth.

Crucially, Nvidia’s rally has been driven not just by hype but by torrid earnings growth. Surging orders for AI datacenter GPUs (like the sought-after H100 accelerators) have fueled record revenues and profits. In its fiscal Q2 2026 (May–July 2025), Nvidia posted $46.7B in sales (+56% YoY) and a jaw-dropping $23B in net incomets2.tech. Such margins (50%+ net) are virtually unprecedented in the semiconductor industryts2.tech. This validates a degree of the optimism around Nvidia – the company is currently delivering on sky-high expectations. It also means Nvidia now wields enormous financial firepower to reinvest in its future, from R&D to strategic acquisitions and partnerships.

Speaking of partnerships, Jensen Huang’s dealmaking spree in late 2025 vividly illustrates how Nvidia is entrenching its dominance. Rather than rest on its laurels, Nvidia has been aggressively signing deals to lock in future demand and expand its ecosystem. The blockbuster $100B OpenAI agreement is a prime example: by committing to supply OpenAI with roughly 10 exaflops (10 GW) of GPU compute over the coming years, Nvidia essentially pre-sold a huge chunk of its next-gen chipsts2.tech. OpenAI’s CEO Sam Altman declared that “Everything starts with compute” – meaning advances in AI hinge on access to Nvidia’s hardware – and affirmed that Nvidia’s tech will sit “at the heart of future AI breakthroughs”ts2.tech. Investors greeted this deal as a win-win; one analyst noted each gigawatt of AI compute can translate to ~$50B in hardware sales, implying the OpenAI pact could be worth well over its $100B headline value when including software and servicests2.techts2.tech.

Another headline-grabber was Nvidia’s surprise tie-up with Intel, long seen as a rival. In September, Nvidia agreed to invest $5 billion in Intel to co-develop new CPU–GPU integrated systemsts2.tech. The aim is to combine Intel’s strengths in x86 processors and chip manufacturing with Nvidia’s GPU and networking prowess. Intel will even use its foundries to produce custom CPUs that pair with Nvidia GPUs via NVLink interconnectsts2.tech. The partnership was applauded as a “win-win” – Nvidia diversifies its supply chain (easing reliance on TSMC in Taiwan) and gains cutting-edge CPU tech, while Intel gets a critical customer for its nascent foundry business and a shot in the arm for its AI ambitionsts2.tech. Intel’s stock jumped ~23% on the news, and Nvidia’s rose ~4% as wellts2.tech. The deal underscores how AI is blurring traditional boundaries in tech: even former competitors are joining forces to meet insatiable demand for AI computing.

Nvidia’s $40B bet on Aligned Data Centers is another strategic move that extends its reach. By taking part (alongside BlackRock) in acquiring one of the world’s largest data-center operators, Nvidia secures 5 GW of capacity across 80 facilitiests2.tech. In practice, this means those data centers will be outfitted with Nvidia hardware and available for Nvidia’s own cloud AI services. It’s a step toward vertical integration – Nvidia isn’t just selling chips, it’s ensuring the infrastructure to run them at scale. Larry Fink, BlackRock’s CEO, said the goal is to provide “the infrastructure to power the future of AI”ts2.tech, echoing Nvidia’s vision of an end-to-end AI computing ecosystem. Along similar lines, Nvidia has announced plans to build multiple giant AI supercomputers (including a 100,000-GPU system for the U.S. Department of Energy) as turnkey research facilitiests2.techts2.tech. All these initiatives signal that Nvidia is doubling down on AI – using today’s windfall to invest in shoring up tomorrow’s dominance.

AI Everywhere: Nvidia’s Broadening Ecosystem

One striking aspect of Nvidia’s recent deals is how they spread Nvidia’s influence into diverse sectors. No longer is Nvidia content to simply sell chips to cloud titans like Microsoft or Meta – it’s now partnering directly with companies in telecommunications, automotive, healthcare, and more:

- Telecom: Nvidia’s $1B investment for a 2.9% stake in Nokia will see the two co-develop AI-driven solutions for 5G networks and data centersreuters.com. This alliance with a telecom equipment giant could put Nvidia’s AI gear at the core of next-generation network infrastructure. (Nokia’s stock surged 22% on the newsreuters.com, showing investor enthusiasm for the tie-up.)

- Automotive/Ride-Hailing: Nvidia joined forces with Uber and automaker Stellantis (along with Foxconn) to collaborate on self-driving cars and robotaxisreuters.com. The partnership aims to develop a fleet of 100k autonomous vehicles using Nvidia’s AI and automotive chips, with mass production targeted for 2027reuters.com. By teaming with Uber – the world’s largest ride-hailing platform – Nvidia is positioning itself at the forefront of the robotaxi future (a market that could be huge in the late 2020s).

- Healthcare: Nvidia’s collaboration with Eli Lilly will create what’s billed as the pharma industry’s most powerful AI supercomputerreuters.com. Using over 1,000 Nvidia GPUs, Lilly will accelerate drug discovery and development with AI models. This highlights AI’s growing role in biotech, and it gives Nvidia a foothold in the lucrative healthcare domain.

- Enterprise Software/Cloud: Nvidia has also expanded partnerships with software firms like Palantir and cloud providers like Oraclemarkets.financialcontent.com. For instance, Oracle is incorporating Nvidia’s AI systems into its cloud offerings, and Palantir is working with Nvidia to optimize AI/ML software on Nvidia hardware. These alliances ensure Nvidia’s ecosystem encompasses not just hardware, but also the software and cloud services running on that hardwaremarkets.financialcontent.com.

By branching out into all these areas, Nvidia is embedding itself in virtually every layer of the AI value chain. This diversifies Nvidia’s revenue streams (beyond just selling to a handful of hyperscale cloud players) and helps fortify its leadership. It’s a classic platform strategy: the more industries that standardize on Nvidia’s technology, the harder it becomes for any upstart competitor to displace Nvidia’s position.

A Soaring Stock and Market Impact

With Nvidia’s market cap now oscillating around $4.9–5 trillion, the company’s sheer size is starting to have outsized effects on financial markets. Nvidia is currently the largest company in the world by market value, and thus carries the biggest weight in major stock indexesbloomberg.com. In fact, at about 8% of the S&P 500 by weighting, Nvidia recently set a modern record for the index’s concentrationinvestopedia.com. (By comparison, the next-largest weight is Microsoft at ~7.4%, and Apple – long the world’s top company – is around 5.7%investopedia.com.) This means movements in NVDA stock heavily sway index funds and ETFs. As one strategist noted, “it does feel like the S&P 500 is putting a lot of eggs into one basket” with Nvidiabloomberg.com. In practical terms, if Nvidia keeps climbing, it could single-handedly lift broader market indexes – but a sharp drop in NVDA would likewise drag the S&P and Nasdaq down with it.

Nvidia’s astonishing value also highlights the scale of the AI frenzy in markets. At $5 trillion, Nvidia is worth more than the entire market cap of some large sectors, and even exceeds the GDP of most countries. (For perspective, $5T is larger than the annual output of Germany or Japan.) It has surpassed longstanding corporate giants in value – Nvidia is now worth 10× what legacy chipmaker Intel is worth, and more than the combined value of several big-name tech firms. This has led to intense debate about whether we are witnessing a historic asset bubble or the dawn of a new paradigm. Skeptics point to past manias (from dot-com stocks to crypto) and caution that such exponential gains rarely sustain. Believers, on the other hand, argue that AI truly is a once-in-a-generation revolution – and that Nvidia’s fundamentals (real revenues and profits) justify the hype in a way that 1990s dot-coms or speculative crypto coins did notreuters.comreuters.com.

Notably, even other tech behemoths have been lifted by the “AI halo” around Nvidia. The so-called “Magnificent Seven” mega-cap stocks (Apple, Microsoft, Alphabet, Amazon, Meta, Tesla, and Nvidia itself) now make up an unprecedented 37% of the S&P 500’s valuethreads.com, largely due to Nvidia’s surge. Many of these companies are major Nvidia customers or partners (e.g. using Nvidia GPUs in their AI data centers), so investors have bid them up on the expectation that they too will benefit from the AI gold rush. Cloud providers like Microsoft Azure, Google Cloud, and Amazon AWS, for instance, are rapidly expanding AI services powered by Nvidia chips – creating a symbiotic relationship where Nvidia’s success feeds theirsmarkets.financialcontent.commarkets.financialcontent.com. Meanwhile, hardware suppliers such as TSMC (which manufactures Nvidia’s chips) are running at full capacity and enjoying record orders thanks to Nvidiamarkets.financialcontent.com. In short, Nvidia’s rise is lifting many boats, but also concentrating market gains in a handful of names.

Outlook: Can Nvidia Keep Defying Gravity?

Looking ahead, the central question is whether Nvidia can maintain its breakneck growth trajectory – or if gravity will eventually kick in. Most industry experts agree that AI demand remains on a steep upward curve. Across tech and industry, a massive capital expenditure cycle is underway to build AI capabilities. Recent earnings from cloud giants showed surging investment in AI infrastructure (GPUs, data centers, etc.), which bodes well for Nvidia’s upcoming resultsts2.tech. “All this AI capex is coming through,” noted one market strategist, and Nvidia is perhaps the prime beneficiary of that trendts2.tech. Indeed, Nvidia’s own guidance and order backlog (reportedly around $500B in chip orders over the next several yearsts2.tech) suggest that demand far outstrips supply for the foreseeable future. This is why analysts overwhelmingly anticipate another beat-and-raise quarter on Nov. 19 – any other outcome would be a shock.

Wall Street’s base case is that Nvidia’s dominance will continue well into 2026 and beyond. The consensus analyst price target in the low-$200s implies moderate further upsidets2.tech, but many bulls see that as conservative. Some forecasts envision Nvidia earning $50+ per share in a couple of years, which could justify significantly higher stock prices. There’s even talk of Nvidia eventually becoming the world’s first $10 trillion company if AI truly transforms the economy (though that remains speculative). As Bokeh Capital’s Kim Forrest put it, at $5T valuation Nvidia has “earned this victory lap” in the AI race, and so far the much-feared “bubble” shows “no sign of popping.”ts2.tech The optimism is palpable – Nvidia is increasingly viewed not just as a semiconductor firm, but as a foundational cornerstone of the AI era, akin to an “oil baron” of the 21st century’s most critical resource (computing power).

That said, risks are ever-present. Valuations leave no margin for error, so any stumble could cause a swift correction. Competitors like AMD will continue to nip at Nvidia’s heels – for instance, AMD’s next-gen MI300 AI accelerators are launching, and if they close the performance gap, Nvidia might face pricing pressure. Likewise, tech giants developing in-house silicon could eventually reduce their dependence on Nvidia (for example, Google’s TPU or Amazon’s Trainium chips). Regulatory and supply-chain factors add uncertainty: how long will the U.S. allow Nvidia to sell its top GPUs to Chinese firms? Could export rules tighten further, or conversely, could a U.S.–China rapprochement re-open that market more fully (unleashing new demand)?

Moreover, the macro environment could turn less friendly. Thus far, falling interest rates and a bullish market backdrop have amplified Nvidia’s rise (just in late October, hopes of Fed rate cuts and a U.S.–China trade truce helped propel NVDA to record highsts2.tech). If those hopes reverse – say inflation flares back up, or geopolitical conflicts worsen – high-flying tech stocks might see a broad pullback. Nvidia would likely not be immune to such a rotation, especially given how widely owned it is (profit-taking could accelerate).

In the near term, all eyes are on Nvidia’s November 19 earnings. Delivering another blowout quarter (and strong guidance) could refuel the rally into the end of the year, possibly pushing NVDA to new highs. Conversely, even a slight miss or cautious outlook might spook investors and validate some of the valuation concerns. As one Reuters Breakingviews columnist noted, Nvidia’s valuation “is more than a milestone” – it implies that investors are betting Nvidia will be the primary winner of the AI revolutionts2.tech. So far, that bet has paid off spectacularly. But the higher Nvidia climbs, the more it must flawlessly execute to keep the narrative intactts2.tech.

In summary, Nvidia stands at the pinnacle of the tech world in 2025, emblematic of both the promise and the exuberance of the AI boom. Its achievements – a $5 trillion market cap, unprecedented growth, industry dominance – are nothing short of historic. Going forward, Nvidia’s journey will serve as a key barometer for the AI revolution itself. If AI continues to reshape business and society at the current pace, Nvidia’s incredible run may still have room to grow. If, however, the AI frenzy hits unforeseen roadblocks, Nvidia could find itself priced for a perfection that proves elusive. For now, though, the consensus is optimistic: the AI supercycle is still in its early chapters, and Nvidia’s story as the primary enabler of that revolution is far from overts2.techts2.tech.

Sources: Financial news and analysis from Reuters, Bloomberg, Yahoo Finance, The Motley Fool, TS2 Tech, and company filingsts2.techts2.techainvest.commarkets.financialcontent.comts2.techts2.tech, among others.