NEW YORK, January 3, 2026, 06:10 ET — Market closed.

Shares of Ondas Holdings Inc rose 12.9% on Friday to close at $11.02, after the company said it plans to change its name to Ondas Inc and has relocated its headquarters to West Palm Beach, Florida. U.S. markets are closed on Saturday. StockAnalysis

The rebrand and headquarters move matter because they reshape how Ondas presents itself to investors as it courts defense, security and industrial customers. For a fast-moving small-cap stock, messaging around scale and access to capital can shift sentiment quickly.

Traders are also focused on funding. When maturity dates on debt move, it can ease near-term pressure or signal that new financing is in the works.

In its Jan. 2 announcement, Ondas said the name change is expected to take effect in the first quarter of 2026 and that the headquarters shift will not disrupt operations or delivery timelines. “Renaming the Company to Ondas Inc. will better align our corporate identity with the operating platform we have built,” Chairman and CEO Eric Brock said. Ondas Holdings Inc.

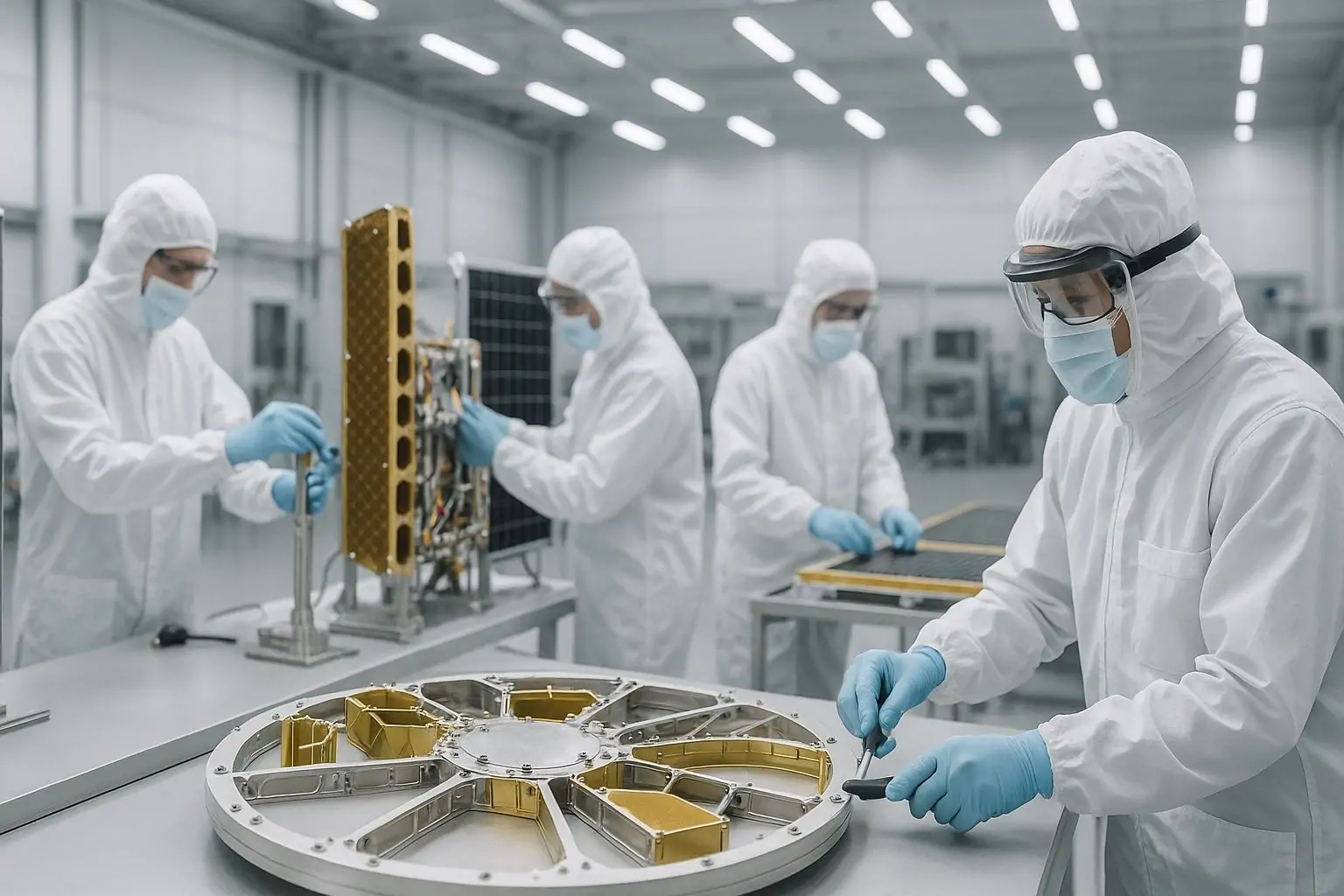

Ondas sells autonomous drone and ground systems through its Ondas Autonomous Systems unit and private wireless broadband gear through Ondas Networks, according to its investor relations website. The company markets some drone offerings as “drone-in-a-box” services for industrial and government users. Ondas Holdings Inc.

In a separate Form 8-K — a disclosure used to report material events to the U.S. Securities and Exchange Commission — Ondas said its Ondas Networks subsidiary amended the maturity date of several notes to Jan. 15, 2026. The notes cover earlier financings totaling about $8 million in original principal, including purchases by Charles & Potomac Capital and a private investor group, the filing showed. Convertible notes are debt that can be repaid in cash or converted into shares. Ondas Holdings Inc.

Trading was heavy on Friday, with about 135.6 million shares changing hands. Ondas traded between $9.91 and $11.06. Yahoo Finance

Name changes seldom alter a business overnight, but they can matter for how a company is categorized in databases and investor screens. The shift from “Holdings” to “Inc” is typically read as a move toward an operating-company identity rather than a portfolio label.

The Florida relocation adds another signal to investors watching expenses and hiring: management wants to be closer to talent and financial networks. The market will look for evidence that the move helps execution, not just optics.

Before Monday’s open, traders will watch whether Ondas can hold gains after Friday’s jump and whether any follow-up filings give a clearer timeline for the name change. The stock’s next move could hinge on whether volume stays elevated or fades back toward recent levels.

Debt remains the other catalyst to watch. Extensions can buy time, but investors often want to see a plan for repayment, refinancing or conversion into equity, because each route hits cash and dilution differently.

Technically, the next resistance sits near Friday’s $11.06 high, with Ondas within reach of a $11.70 52-week high. Support sits around $10 and Friday’s $9.91 low, with another marker at the prior close of $9.76. Investing