Key facts (late Sept – Oct 7 2025)

- Stock volatility around Oct 7 – After rallying through September on news of robotaxi production and expansion, PONY stock retraced. StockAnalysis data show that on Oct 7 2025, PONY opened at $23.56, fell to a low of $21.26 and closed at $21.40, down about 8.6 % with volume of 4.79 million sharesstockanalysis.com. The previous trading day (Oct 6) saw a close of $23.41 with 5.03 million sharesstockanalysis.com. The sharp drop reflects profit‑taking after a 70 %+ rally since mid‑September.

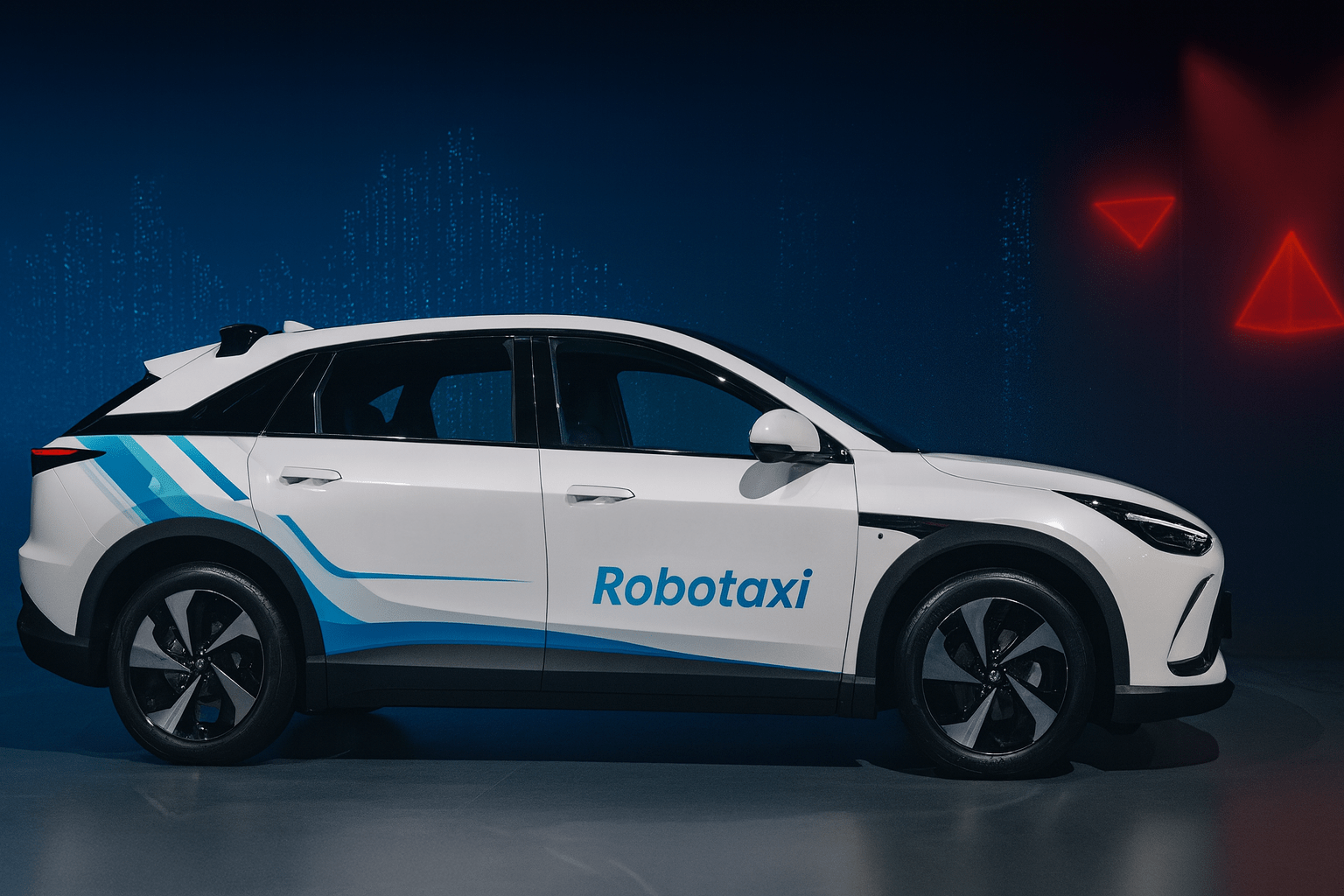

- Strong Q2 results and Gen‑7 mass production – In the Q2 2025 earnings call, CEO James Peng announced that the company had built assembly lines for its seventh‑generation (Gen‑7) robotaxis, with more than 200 vehicles produced and targeting 1,000+ vehicles by year‑end 2025ir.pony.ai. Gen‑7 vehicles have already logged over 2 million km on public roads and cut the total bill‑of‑materials cost by 70 % compared with the previous generationir.pony.ai.

- Robust revenue growth – Peng reported that Q2 revenue surged 76 % year‑over‑year, with robotaxi revenue up more than 300 %ir.pony.ai. Registered users of Pony.ai’s robotaxi services rose 136 % with satisfaction ratings above 4.8/5ir.pony.ai.

- Major news around Oct 7 2025 – Pony.ai announced two significant international expansions:

- Singapore partnership (Sept 20) – The company will deploy autonomous vehicles in Singapore’s Punggol area with transport operator ComfortDelGro once regulators approve. The program is part of Singapore’s plan to integrate AV services into public housing estates by late 2025 to ease driver shortages. CEO Peng said the partnership will make Singapore a launchpad for Southeast Asiaprnewswire.com.

- Dubai permit (Sept 26) – Dubai’s Roads and Transport Authority issued Pony.ai a permit to conduct autonomous driving trials. Pilot testing began immediately, with fully driverless commercial service planned in 2026prnewswire.com.

- Other developments – During September the firm extended 24/7 robotaxi operations in Guangzhou and Shenzhen and secured Shanghai’s first fully driverless commercial permitir.pony.ai. It also formed strategic partnerships with Tencent Cloud to integrate its robotaxi services into Weixin and Tencent Mapsrttnews.com and with Xihu Group to deploy over 1,000 robotaxis in Shenzhenir.pony.ai.

- Analyst outlook – Analysts remain broadly bullish. The Sept. 26 Motley Fool (via Nasdaq) piece notes that PONY’s rally was driven by its ability to offer fully autonomous robotaxis across all four Chinese tier‑1 cities, partnerships with Toyota and global testing; analysts had price targets as high as $27 but warned of volatilitynasdaq.com. CarbonCredits reported that Goldman Sachs raised its target to $27.70, citing strong revenue growth and investor confidencecarboncredits.com, while a Benzinga options report pointed to bullish “whale” trades with strike prices up to $25.5 and an expert (Citigroup) target near $29benzinga.com.

- Risks and regulation – Simply Wall St and other commentators note that despite rapid growth, Pony.ai remains loss‑making, carries a high valuation, and faces execution risk in global expansionsimplywall.st. Reuters reported that Chinese autonomous‑vehicle firms, including Pony.ai, are pushing into Europe due to U.S. market barriers, but Europe’s patchwork regulations could slow deploymentreuters.com.

Detailed report

Stock performance and trading activity (September–October 2025)

Pony.ai’s stock has been highly volatile. After trading below $15 in early September, the share price surged as high as $24 in late September following announcements about Gen‑7 robotaxi production and international expansions. According to StockAnalysis, the stock closed September 19 at $20.71 and climbed to $23.67 by October 3, reflecting a ~14 % gainstockanalysis.com. The week of Oct 6 saw profit‑taking: the stock closed Monday at $23.41 with volume just over 5 million sharesstockanalysis.com and plummeted to $21.40 on Oct 7 amid nearly 4.8 million shares tradingstockanalysis.com. Intraday data show the price briefly reaching $23.58 before selling pressure took holdstockanalysis.com.

This volatility mirrors rising interest from options traders. A Benzinga analysis observed that so‑called “whales” purchased options with strike prices between $15 and $25.50 during the prior three months; roughly 41 % of the trades were bullish, suggesting institutional investors were positioning for upsidebenzinga.com. However, the same report warned that the stock’s relative strength index (RSI) signaled overbought conditions and that upcoming earnings could be a catalyst for a pull‑backbenzinga.com.

Financial results and operational milestones

Gen‑7 robotaxi mass production

During the Q2 2025 earnings call, CEO James Peng declared 2025 the “pivotal year of mass production.” He stated that after completing assembly lines in June, Pony.ai produced over 200 Gen‑7 robotaxis by late August and remained on track to deliver more than 1,000 vehicles by year endir.pony.ai. The Gen‑7 platform features a 100 % automotive‑grade autonomous driving kit with sensors pre‑integrated into the vehicle; the bill‑of‑materials cost has dropped 70 %, making the system less than one‑third as expensive as earlier generationsir.pony.ai. The new vehicles are designed for a 600,000 km lifecycleir.pony.ai and have already logged over 2 million km on public roads across Beijing, Shanghai, Guangzhou and Shenzhenir.pony.ai.

Cost efficiency and remote assistance

Peng highlighted major cost reductions: energy, insurance, maintenance and remote support expenses all fell, and the remote assistant‑to‑vehicle ratio improved markedly. Management expects to achieve a 1:30 ratio (one remote assistant monitoring 30 vehicles) by year endir.pony.ai. Insurance costs were cut 18 % as insurers rewarded Pony.ai’s strong safety recordir.pony.ai. Such efficiencies are crucial for reaching positive unit economics, a key investor concern.

Financial performance

The company’s Q2 revenue increased 76 % year‑over‑year, and robotaxi revenue more than tripled, with fare‑charging revenues growing over 300 %ir.pony.ai. Registered users grew 136 % and maintained high satisfaction ratingsir.pony.ai. Despite the growth, Pony.ai remains unprofitable and continues to invest heavily in R&D and fleet expansion, a point emphasised by cautionary commentatorssimplywall.st.

Recent news and global expansion

Singapore partnership

On Sept 20, Pony.ai announced plans to deploy autonomous vehicles in Singapore’s Punggol district through a partnership with ComfortDelGro, one of the city‑state’s largest transport operators. The service will begin after regulatory approval and aligns with Singapore’s effort to introduce AVs into public housing estates by the end of 2025. Peng described Singapore as a “launchpad for our Southeast‑Asia expansion,” while ComfortDelGro CEO Cheng Siak Kian said the partnership builds on the companies’ success in Guangzhouprnewswire.com. The press release also reiterated that Pony.ai operates fully driverless robotaxis across all four Chinese tier‑1 cities (Beijing, Shanghai, Guangzhou, Shenzhen), covering more than 2,000 km² and logging over 50 million kmprnewswire.com.

Dubai testing permit

On Sept 26, the Dubai Roads and Transport Authority (RTA) granted Pony.ai a permit to test autonomous vehicles in the emirate. Pilot testing commenced immediately with an eye toward launching a commercial robotaxi service in 2026prnewswire.com. Peng praised Dubai’s supportive regulatory environment and noted that the company is also working with Qatar’s Mowasalat and Uber in the Middle East to deploy robotaxisprnewswire.com.

Other expansions

Pony.ai continues to broaden its global footprint:

- Europe and Korea – The company began road tests in Luxembourg and 24/7 operations in Seoul’s Gangnam district, while Reuters reported that Pony.ai and peers see Europe as a promising market amid U.S. restrictions; however, inconsistent European regulations could slow adoptionreuters.com.

- Shenzhen partnership – Pony.ai announced a strategic partnership with Xihu Group, Shenzhen’s largest taxi operator, to deploy over 1,000 robotaxis in coming yearsir.pony.ai.

- Integration with Tencent – A collaboration with Tencent Cloud is integrating the robotaxi service into Weixin (WeChat) Mobility Services and Tencent Maps, and the companies will co‑develop a simulation platform to enhance Pony.ai’s virtual testing environmentrttnews.com.

- ComfortDelGro pilot in Guangzhou – Before Singapore, the two companies tested robotaxis in Guangzhou, demonstrating cross‑border collaborationprnewswire.com.

Industry context and competitive landscape

Robotaxi race and partnerships

Pony.ai’s aggressive rollout comes amid a broader push by Chinese autonomous‑vehicle companies to expand globally. Reuters noted that firms such as WeRide, Baidu and DeepRoute.ai are targeting Europe because U.S. national‑security concerns limit their ability to operate in North Americareuters.com. Europe offers a relatively open regulatory environment and a strong automotive manufacturing base, but fragmented rules across member states may pose hurdlesreuters.com.

At home, Pony.ai faces competition from WeRide, Baidu’s Apollo Go and AutoX. CarbonCredits reported that WeRide’s stock had declined year‑to‑date, while PONY was up 44 %, reflecting investor confidence in Pony.ai’s technology and partnershipscarboncredits.com. WeRide launched its own autonomous shuttle Ai.R in Singapore around the same time, highlighting growing competition in that marketcarboncredits.com.

Regulatory and ESG considerations

The autonomous‑vehicle industry remains heavily regulated. Singapore’s program requires approval from the Land Transport Authority; Dubai’s RTA is permitting trials in a controlled manner; and Europe’s patchwork laws may slow commercial deployment. Additionally, CarbonCredits highlighted ESG concerns, noting that Pony.ai uses electric and hybrid vehicles but lacks formal net‑zero targets or comprehensive carbon accounting; the environmental impact depends on electricity sources and supply‑chain emissionscarboncredits.com.

Expert commentary and forward-looking analysis

Analyst sentiment is generally positive but tempered by risk:

- Analyst price targets – The Sept. 26 Motley Fool/Nasdaq article described the stock as a “strong buy” with price targets as high as $27, crediting the company’s leadership in fully autonomous robotaxis and partnerships with major automakers like Toyotanasdaq.com. CarbonCredits noted that Goldman Sachs raised its target to $27.70 and that PONY stock was up more than 71 % over the past year as of Sept 22, reflecting optimism about revenue growth and mass productioncarboncredits.com. Benzinga reported that Citigroup analysts gave a price target near $29benzinga.com.

- Cautions – Simply Wall St’s Oct 3 article emphasised that while the ComfortDelGro partnership demonstrates Pony.ai’s ability to secure regulatory approvals, the company remains loss‑making, trades at a high valuation, and has an inexperienced board, so investors should expect volatilitysimplywall.st. Benzinga’s technical analysis flagged that PONY’s RSI indicated overbought conditions and that options traders were hedging for potential downsidebenzinga.com.

- CEO perspective – In a Semafor interview, CEO James Peng stressed that mass deployment was “just around the corner,” aiming to scale from 1,000 robotaxis by 2025 to 10,000 within three yearssemafor.com. He said the company’s long‑term approach and partnerships with governments were essential for sustainable growthsemafor.com.

Outlook

Pony.ai stands at a pivotal moment. The company is transitioning from pilot programs to large‑scale commercial operations. With mass‑production of Gen‑7 vehicles ramping and global partnerships spanning Asia, the Middle East and Europe, Pony.ai is positioning itself as a leading player in autonomous mobility. Short‑term stock volatility could continue as investors digest rapid gains and monitor earnings, regulatory approvals and competitive moves. Analysts’ price targets around $27–$29 suggest further upside if the company executes its ambitious expansion plan and moves closer to profitability. However, investors should remain mindful of regulatory risks, capital intensity and the industry’s nascent nature.

In summary, Pony.ai’s stock was highly volatile leading up to October 7, 2025, closing at $21.40 after falling more than 8% in a single day, though it had risen over 70% during Septemberstockanalysis.com. The company’s Q2 results highlighted impressive progress: over 200 seventh-generation robotaxis were built, production costs dropped by 70%, and robotaxi revenues grew more than 300%ir.pony.ai. Investors reacted to these milestones with enthusiasm, but profit-taking and technical signals contributed to the early-October pull-backbenzinga.com.

The research also notes Pony.ai’s strategic global expansion, including imminent launches in Singapore and Dubai and ongoing trials in Europe and South Koreaprnewswire.com. Analysts remain broadly bullish, with price targets around $27–29, yet caution that the company is still unprofitable and subject to regulatory and competitive risksnasdaq.com. CEO James Peng envisions scaling from 1,000 robotaxis to 10,000 within three years, positioning the firm as a leader in the autonomous mobility racesemafor.com. Overall, the report suggests Pony.ai is at a pivotal stage where execution and regulatory approvals will determine whether it can turn technological leadership into sustainable profitability.