NEW YORK, December 30, 2025, 18:16 ET — After-hours

- D-Wave Quantum shares edged up 0.3% in after-hours trading, after a volatile regular session.

- Quantum-computing stocks have swung into year-end as traders take profits and liquidity thins.

- Investors are watching D-Wave’s January CES appearance and its Qubits user conference for updates.

Shares of D-Wave Quantum Inc (QBTS) edged up 0.3% to $26.25 in after-hours trading on Tuesday, after a choppy session that ranged from $26.03 to $27.46. About 36 million shares changed hands.

The move keeps the stock in focus as quantum-computing pure plays swing sharply into year-end. Investor’s Business Daily said the group has seesawed since a late-December pop as traders took profits and holiday volumes thinned. Investors.com

D-Wave is still up more than 200% in 2025, magnifying day-to-day moves tied to risk appetite and headlines on when quantum systems translate into steady commercial revenue. Yahoo Finance

Peers were mixed in late trade: IonQ was up 0.2%, Rigetti Computing gained 0.7% and Quantum Computing Inc fell 1.7%.

D-Wave has not posted a new press release since Dec. 22, according to its newsroom. D-Wave Quantum

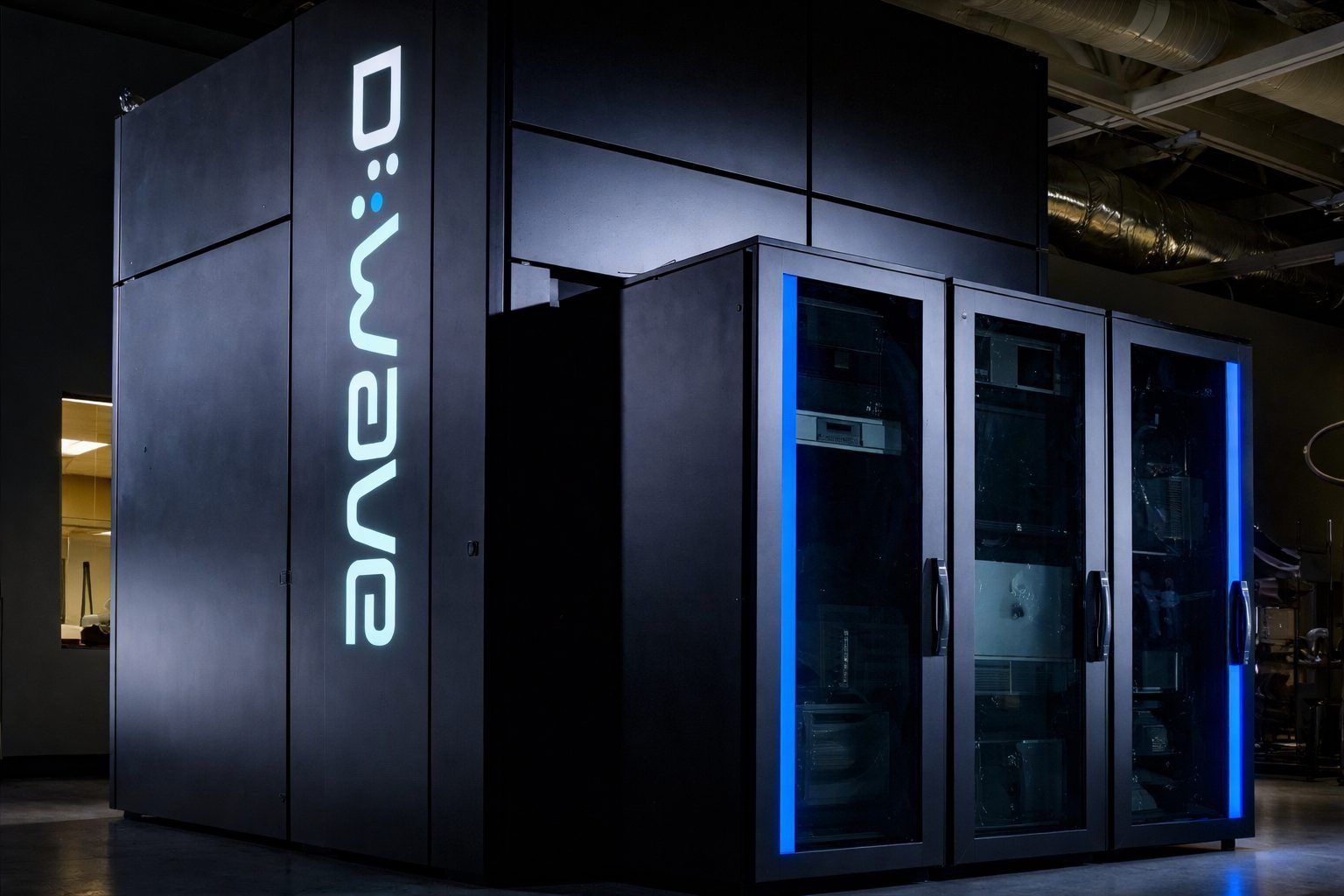

The Palo Alto, California company develops quantum computers, software and cloud services, including its Leap platform that lets customers access its machines remotely. Reuters

D-Wave sells so-called quantum annealing systems, which aim to solve optimization problems by searching many possible outcomes in parallel. Chief Executive Alan Baratz has said its Advantage2 system can “solve hard problems outside the reach of one of the world’s largest exascale GPU-based classical supercomputers.” Constellation Research Inc.

In its Dec. 22 update, D-Wave said it will participate in CES Foundry in Las Vegas on Jan. 7–8, where it plans to demonstrate customer use cases. D-Wave

The company has also set its annual Qubits user conference for Jan. 27–28 in Boca Raton, Florida, featuring talks from executives, customers and scientists. D-Wave Quantum

Traders say the stock has been sensitive to year-end repositioning and hedging in a small, fast-moving quantum cohort, where liquidity can exaggerate intraday swings. Some technicians are watching whether shares can hold the mid-$20s area after this month’s volatility.

Fundamentally, investors are looking for signs that pilot projects turn into repeat business and measurable bookings. D-Wave said in November it had more than $836 million in cash at the end of the September quarter, giving it a long runway to fund development. D-Wave

For now, the next catalysts are those January events and any customer announcements that follow. Until then, QBTS is likely to trade with the broader quantum basket, which has become one of the market’s more volatile momentum corners into 2026.