NEW YORK, Feb 8, 2026, 13:26 ET — Market closed.

- Quantum computing stocks surged by double digits on Friday, catching a lift from a widespread rebound in U.S. tech.

- Short-seller attention has landed on IonQ as its late-February results approach.

- Monday’s reopening puts the focus on whether traders will see any follow-through.

Quantum computing stocks traded in the U.S. snapped higher on Friday, riding the tech sector’s rebound and easing some of the pressure that had been building across riskier pockets of the market this week.

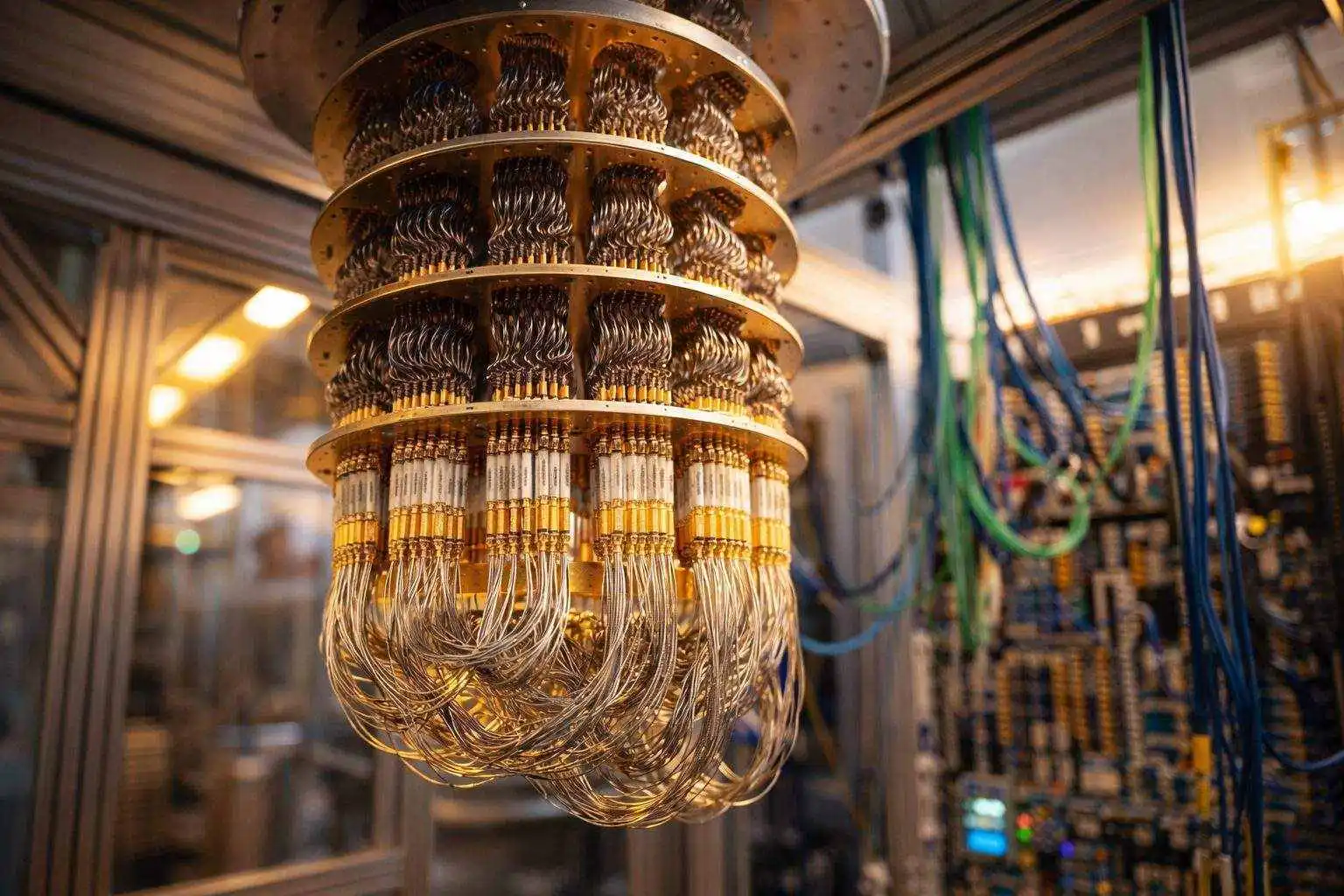

These stocks are watched closely as a quick gauge of risk appetite. Many are young firms with limited revenue, and their prices tend to whip around sharply with any shift in sentiment or breaking headlines.

U.S. stocks roared higher Friday, the Dow finishing above 50,000 for its first-ever close past that mark. Chipmakers led the charge on bets that AI-driven data center spending is picking up. The Nasdaq popped more than 2%. “There’s enough evidence that there’s real demand for AI products,” Baird’s Ross Mayfield, investment strategy analyst, said. Reuters

IonQ finished Friday with a 15% jump to $34.99. Rigetti Computing surged 18%, closing at $17.71. D-Wave Quantum picked up nearly 20% to end at $20.72, while Quantum Computing Inc moved up about 21% to $9.43. All four names saw heavy trading — volume pushed past 30 million shares for IonQ, Rigetti, and D-Wave, with Quantum Computing Inc not far behind.

IonQ shares bounced back after tumbling earlier this week, a drop triggered when Wolfpack Research put out a short-seller report. Short-sellers profit from declining stocks. In response, IonQ described the Wolfpack allegations as “false, misleading, and unsubstantiated,” according to a statement sent to Fortune. Fortune

The market’s closed for the weekend, leaving traders watching to see if the stock can keep its ground ahead of results. IonQ is set to release both fourth-quarter and full-year 2025 financials on Feb. 25, after the bell. IonQ

Quantum Computing Inc shares saw action after the company announced it wrapped up its $110 million all-cash purchase of Luminar Semiconductor. Executives flagged the deal as a boost for QCi’s photonics and quantum platform roadmap. “This acquisition allows us to move forward with a combination that is highly strategic for QCi,” CEO and Chairman Yuping Huang said. quantumcomputinginc.com

Volatility hasn’t let up. As crowded tech names get a rethink after recent swings, money has shifted into smaller, lower-priced stocks. “We’re instead seeing a wave of aggressive buying of altogether different stocks,” said Tim Murray, capital markets strategy at T. Rowe Price. Reuters

Risks still loom for quantum stocks. These firms continue to pour money into building their machines and services, but most customers aren’t ready to move beyond pilot projects. Profits? Still up in the air. Any misstep—funding, guidance, even a hint of trouble with government contracts—can trigger sharp pullbacks.

U.S. trading picks up again Monday, Feb. 9, with investors eyeing whether Friday’s appetite for riskier tech has any staying power. As for the quantum group, IonQ’s results and outlook on Feb. 25 mark the next real catalyst.