NEW YORK, January 1, 2026, 13:13 ET — Market closed

- Quantum computing stocks ended the last U.S. session of 2025 mostly lower, led by declines in IonQ, Rigetti and Quantum Computing Inc.

- Thin, holiday-shortened trading left high-volatility names exposed to profit-taking as Wall Street closed out a strong year.

- Investors are now looking to CES 2026 and the next round of earnings for clearer signals on demand and cash burn.

Quantum computing stocks ended 2025 on a softer note, with several of the sector’s most traded names closing lower ahead of the New Year’s Day market holiday. IonQ, Rigetti Computing, D-Wave Quantum and Quantum Computing Inc. all fell in the final regular U.S. session of the year.

The moves matter because quantum shares have become a high-beta corner of the market, where small shifts in risk appetite can produce outsized swings. Investors are also entering 2026 with a sharper focus on valuation, as most pure-play quantum companies remain loss-making while promising long development timelines. TradingView

Holiday trading conditions amplified that sensitivity. “Profit-taking opportunities when liquidity was low,” helped drive late-year moves, said Giuseppe Sette, co-founder and president of Reflexivity. Reuters

In the last close on Wednesday, IonQ fell 0.9% to $44.87, Rigetti slipped 1.1% to $22.15, D-Wave dipped 0.4% to $26.15, and Quantum Computing Inc. slid 1.3% to $10.26. IBM, which also invests heavily in quantum computing, dropped 1.9% to $296.21.

A research note published on Wednesday by Zacks Investment Research highlighted how investors are weighing long-term buildouts against near-term revenue. In that note, Zacks said Quantum Computing Inc. is investing in “Fab 1” and planning a larger “Fab 2” facility over the next three years, a strategy it said supports scaling but can constrain near-term sales. TradingView

Zacks also flagged valuation risk, noting that Quantum Computing Inc. traded at a forward 12-month price-to-sales ratio of about 731. Price-to-sales compares a company’s market value with expected revenue, and is often used for firms that do not yet generate profits. TradingView

The same Zacks note pointed to differing business models across peers. It said Rigetti has leaned on a mix of government contracts and cloud-based quantum services, while IonQ has shown revenue growth and improving balance sheet metrics but continues to operate at a loss. TradingView

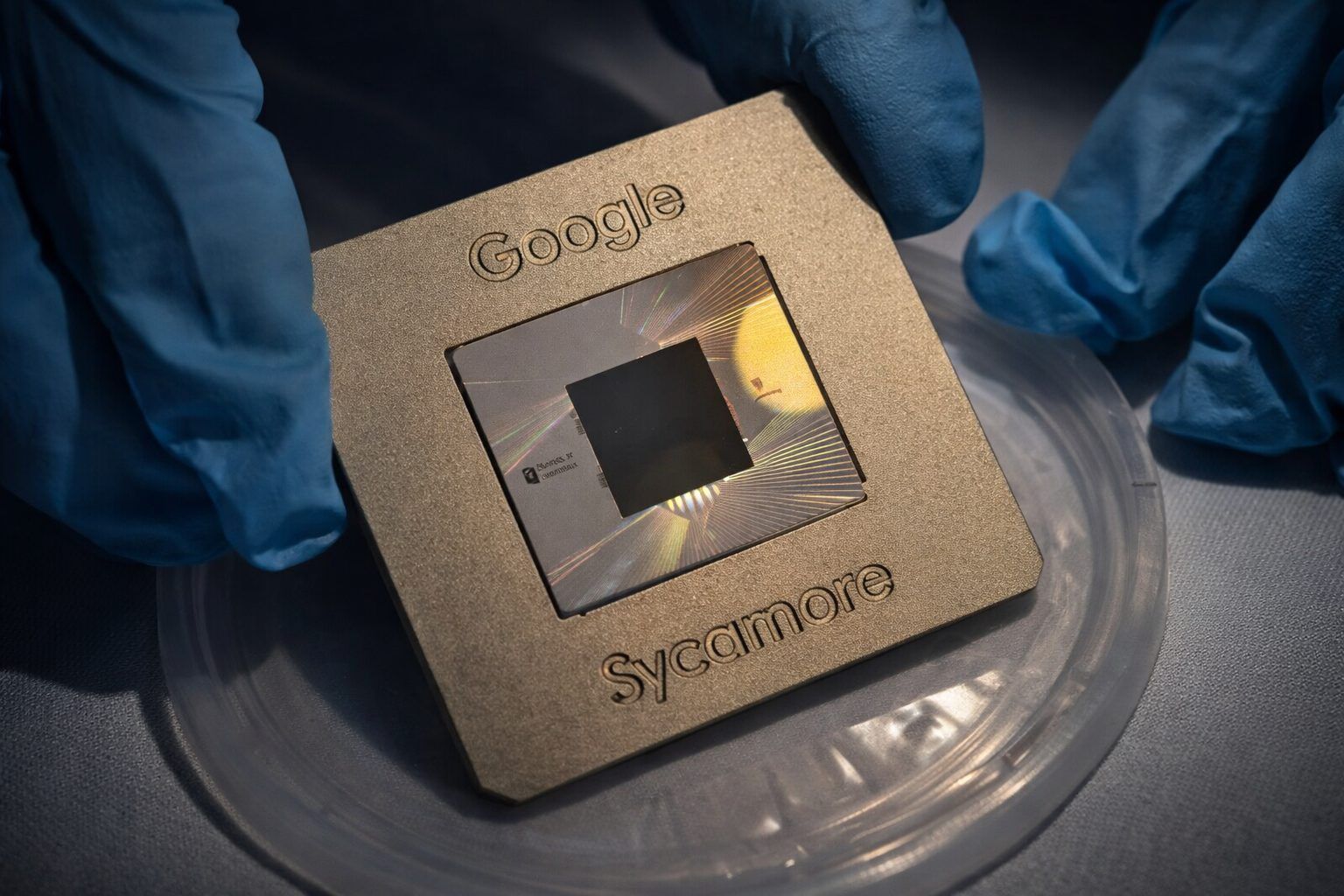

Quantum computing is still at an early commercial stage. The technology uses “qubits” — quantum bits — that can represent more than one state at a time, potentially accelerating certain calculations, though scaling systems reliably remains difficult.

The broader backdrop was also cautious into the year’s final close. Wall Street’s main indexes ended Wednesday lower in thin trading, though all three posted sizable gains for 2025, Reuters reported. Reuters

U.S. stock markets are closed on Thursday for New Year’s Day, according to the NYSE calendar and Nasdaq’s holiday schedule. Nasdaq+1

Before the next session on Friday, investors will watch whether risk appetite returns as normal liquidity comes back, especially in the most volatile corners of tech. For quantum names, the focus remains on customer wins, cash burn and any signals that commercial demand is moving beyond pilot projects.

Traders are also looking ahead to CES 2026 in Las Vegas, scheduled for January 6–9, which often serves as an early-year stage for technology roadmaps and partnerships. CES+1

Earnings are the next hard catalysts, though dates can shift. Zacks’ calendars list IonQ’s next report as expected on February 25, with Rigetti expected on March 4, D-Wave expected on March 12, and Quantum Computing Inc. expected on March 19. Zacks+3Zacks+3Zacks+3