New York, Jan 18, 2026, 12:48 (EST) — Market closed.

Quantum computing stocks wrapped up the last U.S. session with gains, led by IonQ despite a mostly flat Wall Street ahead of the long weekend. IonQ jumped 6.8% to close at $50.80. Rigetti climbed 3.7% to $25.62, Quantum Computing Inc added 4.0% to $12.70, and D-Wave edged up 0.5% to $28.83. Meanwhile, the S&P 500 and Nasdaq each dipped 0.06%. Reuters

Monday’s market closure for Martin Luther King Jr. Day means trading picks back up Tuesday, a combo that often shrinks liquidity and amplifies swings in volatile names. Quantum stocks often behave like leveraged plays on risk appetite, and holiday weeks can push that effect even further. New York Stock Exchange

Earnings and Washington remain key overhangs. “It is literally an imperative that earnings actually carry the news cycle,” said Art Hogan, chief market strategist at B Riley Wealth, as investors prepare for a packed slate of results alongside a Supreme Court hearing this week linked to President Donald Trump’s effort to remove Federal Reserve Governor Lisa Cook. Reuters

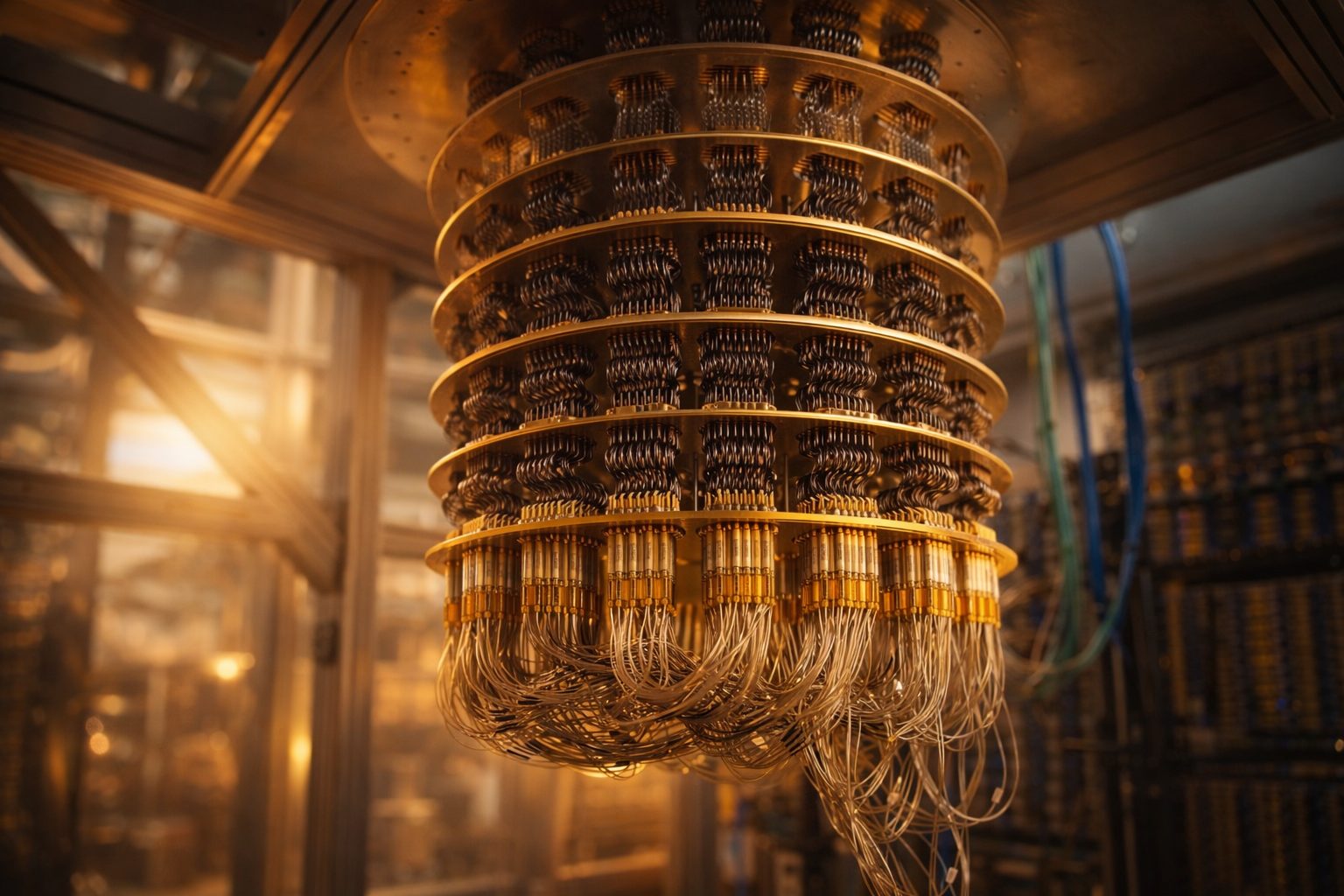

Quantum computing uses qubits—units capable of representing more than just on/off states—to solve select problems faster than classical computers. The challenge lies in maintaining qubit stability long enough for practical use, which is why updates on performance, funding, and partnerships often cause sharp moves in related stocks.

The pure-play quantum stocks outperformed the bigger, established firms dabbling in quantum. IBM dropped 1.4% on Friday, while Microsoft edged down 0.5%, putting the spotlight on the smaller, riskier players with more volatile swings.

D-Wave grabbed attention in January with a major move. The company announced it will acquire Quantum Circuits for $550 million, splitting the payment into $300 million in stock and $250 million in cash. This deal, which D-Wave described as “a pivotal milestone,” aims to boost its presence in gate-model quantum systems alongside its existing annealing technology. SEC

Rigetti informed investors it now expects general availability for its 108-qubit Cepheus-1-108Q system around the end of Q1 2026. CEO Subodh Kulkarni said they are “taking more time to test and optimize the system,” zeroing in on raising two-qubit gate fidelity—a key quantum operation accuracy metric—to a median of 99.5%. SEC

Interest extends beyond public companies. On Jan. 14, Honeywell revealed that its majority-owned quantum unit, Quantinuum, intends to confidentially submit draft IPO documents to the U.S. securities regulator. This step highlights the sector’s ongoing push for capital and growth. Reuters

Timelines and terms remain potential hurdles. D-Wave’s merger agreement lists several closing conditions, including antitrust approval, and it allows for termination if the deal isn’t done by April 6. Plus, the stock portion is tied to a price collar—clear signals that these “next big thing” deals hinge as much on process risk as on the tech itself. SEC

Traders are eyeing late January for their next clear catalyst: D-Wave’s Qubits 2026 user conference, set for Jan. 27–28 in Boca Raton, Florida. Investors will be eager for any updated timelines on gate-model systems and news on the Quantum Circuits acquisition. dwavequantum.com