Rheinmetall AG remains at the centre of European defence headlines on Wednesday, 19 November 2025. The German group has secured a new €61 million contract to modernise the Army’s main combat training centre, confirmed the completion of Skynex air‑defence deliveries to Ukraine, approved a fresh Skyranger 35 batch for Kyiv, and drawn a wave of analyst upgrades after setting a bold 2030 revenue target of around €50 billion. MarketScreener+4Rheinmetall+4MarketScreene…

Below is a full roundup of the key Rheinmetall developments investors and defence watchers need to know today.

Bundeswehr awards Rheinmetall €61 million training‑centre modernisation

Rheinmetall has been awarded a contract worth around €61 million (gross) to modernise the German Army Combat Training Centre (Gefechtsübungszentrum Heer, GÜZ) in Saxony‑Anhalt. Rheinmetall+2MarketScreener+2

According to the company, the project will:

- Make the training centre “D‑LBO‑ready”, integrating the Bundeswehr’s major “Digitisation of Land-Based Operations” (D‑LBO) programme into the core land forces training environment. Rheinmetall

- Renew and extend the IT backbone so that all data from the new battle management systems used by German forces (such as Sitaware Frontline and HQ) can be visualised and evaluated centrally during exercises. Rheinmetall

- Introduce a new broadband radio infrastructure using 5G technology, and connect Rheinmetall subsidiary Blackned’s Tactical Core software to the existing communications architecture. Rheinmetall+1

The order was booked in October 2025, with work beginning this year and full integration planned by early 2028. Rheinmetall+1

From a capability perspective, the upgrade is designed to:

- Give exercise control a richer, real‑time picture of voice, position and digital command‑and‑control data from participating units. Rheinmetall

- Ensure interoperability with NATO partners who increasingly train at GÜZ, turning the site into a flagship hub for multinational, data‑driven land warfare training. Rheinmetall+1

For Rheinmetall, the deal strengthens its Electronic Solutions division, which has already been growing briskly thanks to German digitalisation programmes and further air‑defence exports. Rheinmetall

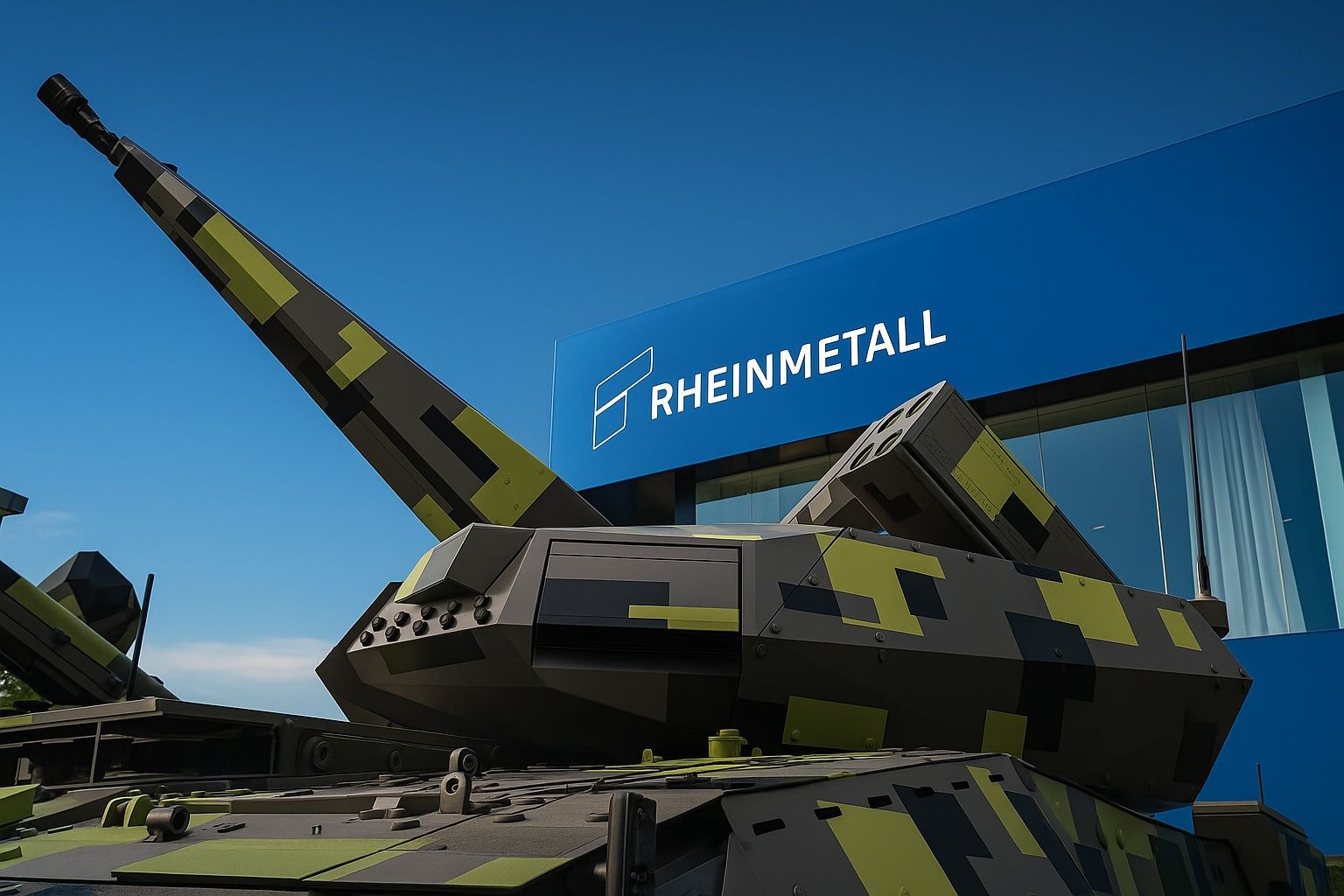

Ukraine front: Skynex delivered, new Skyranger 35 batch approved

All Skynex systems promised by Germany are now in Ukrainian service

Rheinmetall CEO Armin Papperger has confirmed that all Skynex short‑range air‑defence systems financed by Germany have now been delivered to Ukraine. Army Recognition+2Caliber.az+2

Key points:

- Ukraine has received four complete Skynex systems, each configured with the maximum number of 35 mm gun modules. Army Recognition+1

- The systems are deployed mainly in western Ukraine to protect power plants and critical grid nodes from Russian cruise missiles and Shahed‑type drones – a particularly sensitive issue as winter sets in. Army Recognition+2Caliber.az+2

- Skynex uses the Oerlikon Revolver Gun Mk3 with programmable AHEAD ammunition, creating a dense cloud of tungsten sub‑projectiles effective out to roughly 4 km, cued by an X‑TAR3D radar with a surveillance range of about 50 km. Army Recognition+1

This latest confirmation closes a procurement chapter that began with initial orders in 2022 and was expanded in 2024, and underlines Rheinmetall’s central role in Europe’s air‑defence support for Kyiv. Army Recognition+1

New Skyranger 35 batch: financed by frozen Russian assets

In a separate development today, defence outlet Voennoe Delo reports that Rheinmetall will supply Ukraine with an additional batch of Skyranger 35 mobile air‑defence systems, mounted on Leopard 1 chassis. Военное дело+2Defense Express+2

According to Rheinmetall’s statements cited in that report and follow‑up coverage:

- The deal is financed by an EU member state using proceeds from frozen Russian assets, marking one of the most high‑profile uses of such funds for air defence. Военное дело+1

- The contract value is described as being in the “three‑digit million‑euro” range, implying at least several hundred million euros. Военное дело

- Production and integration work will take place at Rheinmetall Italia’s facilities in Rome. Военное дело

- The Skyranger 35 turret features a 35 mm revolver cannon capable of up to 1,000 rounds per minute, again with an effective engagement envelope of around 4 km against drones and low‑flying cruise missiles. Военное дело+1

Earlier Ukrainian‑focused reporting indicates that the first Skyranger 35 systems are expected to arrive in Ukraine around the end of 2025, meaning today’s announcement likely covers a broader, follow‑on batch. United24 Media+3Defense Express+3United24 …

Taken together, Skynex and Skyranger position Rheinmetall at the centre of short‑range, gun‑based air defence for Ukraine’s energy infrastructure, an area where missile‑based systems are often too expensive to use against cheap kamikaze drones.

U.S. Marines test Rheinmetall’s Mission Master A‑UGVs in Japan

Beyond Europe and Ukraine, Rheinmetall is also expanding its footprint in the Indo‑Pacific.

Fresh reporting today from specialised defence media in Turkey confirms that U.S. Marines of the 4th Marine Regiment, 3rd Marine Division are testing Rheinmetall’s Mission Master Silent Partner autonomous ground vehicles at Camp Schwab in Okinawa, Japan. M5 Dergi+1

Highlights from the trials:

- The Mission Master Silent Partner – a four‑wheel, Autonomous Uncrewed Ground Vehicle (A‑UGV) – is being used in field exercises for logistics support, last‑mile resupply and casualty evacuation drills. M5 Dergi

- The platform can operate semi‑autonomously “in formation” with infantry or follow troops as a robotic “buddy” vehicle, reducing the need for soldiers to expose themselves while carrying heavy loads. M5 Dergi+1

- The Okinawa deployment forms part of broader U.S. experiments with robotics and autonomy in the Indo‑Pacific, where difficult terrain and long distances make uncrewed logistics particularly attractive. M5 Dergi+1

For Rheinmetall, this trial is strategically important: it showcases American Rheinmetall’s technology directly in front of the U.S. Marine Corps and, by extension, other Indo‑Pacific militaries looking for light, flexible robotic platforms.

Capital Markets Day: Rheinmetall targets €50 billion in sales by 2030

Much of today’s analyst commentary still revolves around Rheinmetall’s Capital Markets Day, held yesterday, where management laid out ambitious medium‑term goals.

Across several investor reports and newswires, the key message is consistent:

- Rheinmetall is aiming for around €50 billion in annual revenue by 2030, roughly five times its 2024 sales level. Morningstar+3MarketScreener+3Caliber.az+3

- Management suggests about €44 billion of this could be organic, with the remainder from acquisitions such as the planned takeover of naval shipbuilder NVL (Naval Vessels Lürssen) and smaller bolt‑ons. MarketScreener Deutschland+1

- Rheinmetall expects strong growth beyond 2030 as NATO rearmament and Bundeswehr procurement programmes extend into the late 2030s and even 2040. Wallstreet Online+2Investing.com UK+2

These targets build on already record figures: for the first nine months of 2025, Rheinmetall reported group sales of €7.5 billion (up 20% year‑on‑year), a consolidated operating result of €835 million (up 18%), and a defence backlog of €64 billion. Rheinmetall+1

Management also emphasised:

- Massive capacity expansion: the group says it is building or significantly expanding 13 plants in Europe, including new artillery ammunition facilities in Lithuania and Romania. Rheinmetall+1

- A strategic shift to buy more steel in Germany and Europe, reducing dependence on suppliers in India and China – a move CEO Armin Papperger described as “bringing it back to Europe” in a Reuters interview. Reuters+1

Analyst reactions: strong “Buy” chorus, but valuation debate continues

Today has seen a flurry of analyst notes reacting to Rheinmetall’s new 2030 guidance and to the latest contract and Ukraine announcements.

Among the most notable updates:

- Berenberg raised its price target from €2,300 to €2,340, reiterating a “Buy” rating and projecting roughly 30% compound annual revenue growth through 2030, with higher EBIT and EPS forecasts. finanzen.net+2finanzen.net+2

- UBS maintained a “Buy” with a target of €2,500, arguing that Rheinmetall’s 2030 goals sit at the upper end of previous expectations, while still leaving room for further growth beyond that year. Wallstreet Online+1

- Jefferies stuck with “Buy” and a €2,250 target, calling the guidance “appealing” and highlighting management’s detailed capacity‑ramp plans and vertical‑integration strategy. MarketScreener Deutschland+1

- Deutsche Bank raised its target to €2,100 (from €2,050), keeping a Buy rating and pointing to stronger‑than‑expected revenue and cash‑conversion projections. Investing.com UK+1

- Morgan Stanley lifted its target to €2,500 from €2,200, with an Overweight stance, noting that Rheinmetall’s order book and automation drive could support sustained growth into the mid‑2030s. Investing.com UK+1

- DZ Bank reportedly increased its fair value estimate to around €2,385 with a “Kaufen” (Buy) recommendation. finanzen.net+1

- Warburg Research nudged its target up to €1,770 but kept a “Hold”, arguing that much of the growth story is already priced in. finanzen.net+1

- Bernstein maintained “Market‑Perform” with a target around €1,980, noting that the medium‑term guidance broadly matched expectations and that investors have grown used to positive surprises. Aktiencheck+1

Across data providers, the average 12‑month target for Rheinmetall sits roughly in the €2,100–2,200 range, implying upside of around 25–30% versus current prices, with almost all covering analysts rating the stock as a form of Buy/Overweight. Investing.com Deutsch+1

Important note: none of this constitutes investment advice. It is a summary of published analyst views and company disclosures. Investors should do their own research and consider professional advice before making decisions.

Rheinmetall share price today: down intraday despite positive news flow

Despite the upbeat guidance and steady flow of new contracts, Rheinmetall’s share price spent much of 19 November in the red.

Based on data from several exchanges and financial portals:

- The stock closed yesterday around €1,716 and traded today mostly between about €1,640 and €1,730 on Xetra and other German venues. Tradegate+3DIE WELT+3Investing.com Deutsch…

- Mid‑session quotes show levels in the €1,660–1,690 range, equating to a 2–3% intraday decline, even as contracts and analyst upgrades hit the tape. Investing.com Deutsch+2finanzen.ch+2

- Rheinmetall remains roughly 15% below its 52‑week high of €2,008, but still far above its 2024 lows, after a multi‑year rally driven by Europe’s rearmament. DIE WELT+2Investing.com Deutsch+2

Short‑term profit‑taking after the Capital Markets Day, general volatility across defence stocks, and the sheer scale of the recent run‑up (some sources cite gains above 180–200% over the past year) likely explain why the share price is not reacting more strongly to today’s positive fundamental news. TradingView+2Investing.com UK+2

Regulatory filing: Goldman Sachs trims Rheinmetall derivatives exposure

On the corporate‑governance side, Rheinmetall today published a voting‑rights notification under Article 40 of the German Securities Trading Act (WpHG).

The EQS release shows that:

- The Goldman Sachs Group, Inc. has reduced its total notifiable position in Rheinmetall from 5.39% to 4.06% of voting rights (combining shares and financial instruments). FT Markets

- Direct and indirect shareholdings now account for 0.35%, while 3.71% are held via derivatives and other financial instruments such as options, swaps and futures. FT Markets

This does not signal any change in Rheinmetall’s fundamentals but is relevant for investors tracking large institutional holders and liquidity in the stock.

Strategic picture: from European training grounds to Ukrainian skies

Putting all of today’s developments together, several themes stand out:

- Deepening role in European land warfare training

The Bundeswehr’s €61 million contract cements Rheinmetall’s position as the digital backbone of German land‑forces training, aligning GÜZ with the D‑LBO digitisation push and NATO interoperability requirements. Rheinmetall+2MarketScreener+2 - Air‑defence leadership for Ukraine

Completion of Skynex deliveries, plus the new Skyranger 35 batch financed via frozen Russian assets, underscores how Rheinmetall has become a central supplier of short‑range air defence for Kyiv, particularly around critical energy infrastructure. deaidua.org+5Army Recognition+5Caliber.az+… - Globalisation of Rheinmetall platforms

Trials with U.S. Marines in Japan show the company’s robotic systems are being evaluated in front‑line Indo‑Pacific units, opening doors far beyond Europe. M5 Dergi+2Defence Blog – Military and Defe… - Bold growth matched by intense scrutiny

A stretched valuation, rapid backlog growth to €64 billion, and a 2030 target of €50 billion in sales are attracting both bullish and cautious analyst views. The numerous upgrades today confirm that, for now, the consensus still leans clearly positive. Aktiencheck+6Rheinmetall+6MarketScreener+6 - Supply‑chain and sovereignty themes

The shift to mostly European steel sourcing and the use of frozen Russian assets by an EU state to fund Ukrainian air defence both point to a world where security policy, industrial policy and sanctions enforcement are increasingly intertwined – and where Rheinmetall is a core industrial beneficiary. Rheinmetall+3Reuters+3Военное дело+3

For investors and policymakers alike, 19 November 2025 confirms that Rheinmetall is more than a “Germany story”: it is now deeply embedded in NATO rearmament, Ukrainian air defence, Indo‑Pacific experimentation and European industrial sovereignty – with today’s contracts and analyst moves reinforcing that trajectory.