Key Facts (as of 6 Oct 2025)

- Stock price surge: After a dramatic rally in late September 2025, Richtech Robotics closed at $6.18 on 3 Oct 2025, up 19.77 % in a single daystockinvest.us. The stock’s 52‑week range spans $0.52–$6.30, with an average 2025 price of $2.45macrotrends.net.

- Deals driving the narrative: The company signed a Master Services Agreement with a top‑5 U.S. auto dealership (identified as AutoNation) after a successful pilot, and a services agreement with a major global retailermarketbeat.cominvesting.com. Analysts say these deals mark the shift from concept to commercial execution and underpin a Robots‑as‑a‑Service (RaaS) revenue modelinvesting.com.

- Strong cash position yet persistent losses: Richtech reported a net loss of about $4 million in Q3 2025 despite revenue of roughly $1.2 millionainvest.com. However, it held over $85 million in cash with minimal debt, giving it a current ratio above 120marketbeat.cominvesting.com.

- High-profile partnerships and accolades: The Titan heavy‑duty delivery robot won Robotics Innovation of the Year at the SupplyTech Breakthrough Awardsir.richtechrobotics.com. The ADAM AI barista served more than 16,000 drinks at a Las Vegas flagship caféir.richtechrobotics.com and made a splash serving “cosmic cocktails” at a U.S. Space Force galats2.tech.

- Ambitious R&D and expansion: The company’s joint venture in China signed a $4 million sales agreement to supply ADAM, Scorpion and Titan robotsir.richtechrobotics.com and entered a strategic cooperation with Beijing City of Design Development to develop next‑generation service robotsir.richtechrobotics.com.

- Investor scrutiny: A short‑seller report by Capybara Research accused Richtech of misrepresenting partnerships and rebranding Chinese robotscapybararesearch.com. The company’s subsequent shelf registration to raise capital heightened fears of dilution and credibility issuessimplywall.st.

- Analyst split: H.C. Wainwright raised its price target from $3.50 to $6 following the new dealsrollingout.com, while market‑wide consensus sits around $4.50 (range $3–$6) with a hold ratingmarketbeat.com. Some brokers have downgraded the stock after insider sales and the shelf registrationstockstotrade.com.

Company Overview

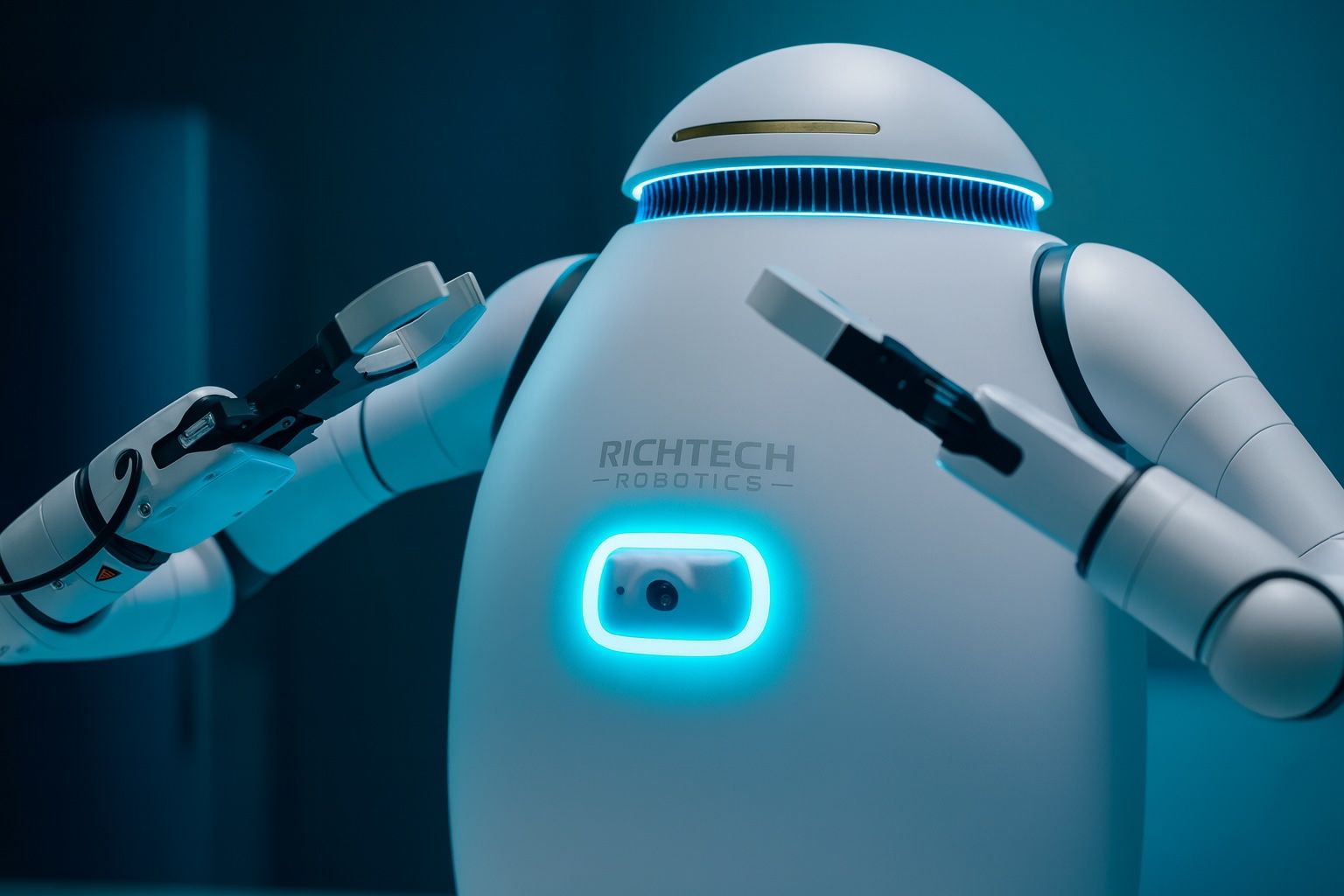

Founded in Nevada and headquartered in Las Vegas, Richtech Robotics Inc. designs and sells AI‑driven service robots for hospitality, retail, healthcare and industrial clients. It is an early mover in Robots‑as‑a‑Service (RaaS), offering robots on subscription contracts rather than one‑off hardware salesinvesting.com. The product portfolio includes:

- ADAM AI Barista – a humanoid robot that uses NVIDIA‑powered vision‑AI to chat with customers and craft beverages. Each unit costs about US$25,000nasdaq.com, and the company promotes it as scalable beyond beverages into retail or laboratoriesir.richtechrobotics.com.

- Scorpion floor scrubber (also called DUST‑E) – an autonomous cleaning robot starting around $18,000nasdaq.com. It was showcased using NVIDIA technology at CES 2025nasdaq.com.

- Matradee & ARM – table‑delivery robots and robotic arms priced near $15,000nasdaq.com that seat guests, deliver food or bus dishes. Richtech sells accessories such as bus tub caddies and table‑location systemsmarketbeat.com.

- Titan – a heavy‑duty delivery robot for automotive and logistics applications priced around $30,000nasdaq.com. It was recognised as Robotics Innovation of the Year for saving technicians about an hour per day and reducing operational expensesir.richtechrobotics.com.

- Medbot – a healthcare‑focused delivery robot costing roughly $22,000nasdaq.com.

Richtech claims to have deployed over 400 robots across U.S. restaurants, retail stores, hotels, healthcare facilities, casinos, senior living homes and factoriesir.richtechrobotics.com. Notable clients include Texas Rangers’ Globe Life Field, Golden Corral, Hilton, Sodexo and Boyd Gamingnasdaq.com. The company’s mission is to solve labour shortages through automation and to build “the infrastructure for human‑robot collaboration.”

Recent News and Developments

Master Services Agreement with a top U.S. auto dealership (Aug 2025)

In late August the company announced that a pilot program with a top‑5 U.S. automotive dealership group had concluded successfully. The customer signed a Master Services Agreement (MSA) that allows additional statements of work and automatically renews for 12‑month periodsir.richtechrobotics.com. MarketBeat and Investing.com reported that the dealership was AutoNation, though the company did not officially name itmarketbeat.cominvesting.com. Analysts noted that the deal validated the Titan robot’s ability to streamline car service logistics and signalled the company’s shift to recurring service contractsinvesting.com.

Services agreement with a major global retailer

Around the same time, Richtech disclosed a services agreement with a global retailer, rumoured to be Walmartinvesting.com. The contract involves deploying heavy‑duty logistics robots in warehouses or large retail stores and was presented as further evidence that the company could scale beyond hospitality. However, a short‑seller report later alleged that the Walmart partnership was overstated and that only a small pilot existedcapybararesearch.com.

Chinese partnerships and international expansion

Richtech operates a joint venture, Boyu Artificial Intelligence, to expand in Asia. On 30 June 2025 the JV signed a $4 million sales agreement with Beijing Tongchuang Technology Development to purchase and license ADAM, Scorpion and Titan robotsir.richtechrobotics.com. Three days earlier, the JV signed a strategic cooperation agreement with the Beijing City of Design Development to develop next‑generation service robots using domain‑specific AI models and autonomous decision systemsir.richtechrobotics.com. President Matt Casella said the deals were major milestones in Richtech’s international growth strategyir.richtechrobotics.com.

Product milestones

- ADAM robot milestones: At the Clouffee & Tea flagship café in Las Vegas, the ADAM robot surpassed 16,000 drinks served by June 2025, demonstrating consistency and customer engagementir.richtechrobotics.com. The robot also served VIP guests at the U.S. Space Force anniversary gala, illustrating its capacity for high‑profile eventsts2.tech.

- Titan recognition: Titan was selected as Robotics Innovation of the Year by the SupplyTech Breakthrough Awards, with judges citing its ability to free automotive technicians from repetitive errandsir.richtechrobotics.com.

- CES 2025 showcase: Richtech exhibited at CES 2025 in Las Vegas, showcasing ADAM, Scorpion, and delivery robots like Matradee Plus and Medbotnasdaq.com. The company staged interactive demos and highlighted the integration of NVIDIA AI technologynasdaq.com.

Capital raising and governance events

Richtech filed a $1 billion “at‑the‑market” equity offering in September 2025 to fund expansion and working capital; by late September the company had reportedly raised over $50 millionnasdaq.com. On 29 Sept 2025 the company held its annual meeting, electing Stephen Markscheid to the board and ratifying Bush & Associates CPA as auditorir.richtechrobotics.com. Earlier in September it had set the meeting date and outlined procedures for shareholder nominationsir.richtechrobotics.com.

Financial Performance

Earnings and balance sheet

Richtech reported a net loss of roughly $4.1 million (about $0.04 per share) in Q3 2025, with revenue of approximately $1.2 million, down 16 % year‑on‑yearainvest.com. Operating expenses rose to $6.11 million due to heavy R&D investment in new robotsainvest.com. The company is not yet profitable—margins remain deeply negative—but management argues that the RaaS model will create recurring revenue once deployment scales.

Despite losses, Richtech’s balance sheet is robust. As of 30 June 2025 it held over $85 million in cash and short‑term investments with minimal long‑term debt, giving a current ratio above 120marketbeat.cominvesting.com. Total assets were about $107 million, while long‑term debt was only $639,000stockstotrade.com. In the first half of 2025 the company generated negative free cash flow of about −$7.6 million, reflecting the capital‑intensive nature of roboticsstockstotrade.com.

Growth projections and valuation

The Zacks “Bull of the Day” note (Sept 29 2025) highlighted that analysts expect FY 2026 revenue to grow from $5 million in FY 2025 to $13.48 million, implying 175 % growth, and forecast a narrowing loss per share from $0.14 to $0.10nasdaq.com. However, the stock trades at high multiples: price‑to‑book around 6.4× and price‑to‑sales over 177×nasdaq.com. Many experts caution that the valuation assumes significant future adoption and may be vulnerable if growth stalls.

Stock Performance & Technical Outlook

Price action

After going public in January 2024, Richtech shares have been extremely volatile. The all‑time high closing price was $11.10 on 23 Jan 2024macrotrends.net. In 2025 the stock traded between $1.43 and $6.18, ending 3 Oct 2025 at $6.18—a 128.9 % annual gainmacrotrends.net. A surge in late September 2025 saw shares rise more than 600 % from earlier levels, driven by speculation about new contracts, a potential short squeeze and general enthusiasm for AI and robotics stocksrollingout.comainvest.com.

Technical analysis

StockInvest.us noted that on 3 Oct 2025 Richtech shares increased 19.77 % on heavy volume (102 million shares). Technical indicators showed a strong rising trend; both short and long moving averages and the MACD gave buy signalsstockinvest.us. The service predicted a fair opening of around $5.83 on 6 Oct 2025 and identified support at $5.54 and $5.16stockinvest.us. It warned that the stock is highly volatile and thus a high‑risk, high‑reward tradestockinvest.us.

Analyst forecasts

According to MarketBeat, the average 12‑month price target for Richtech is $4.50 (high $6, low $3), implying downside from current levels. Three analysts cover the stock with a hold consensusmarketbeat.com. H.C. Wainwright is the most bullish, citing the expanding customer pipeline and Fed rate cuts, and recently raised its target to $6rollingout.com. Freedom Broker, however, downgraded the stock to sell with a $2.50 target after insider sales and dilution concernsstockstotrade.com. Tim Bohen of StocksToTrade reminds traders that “volume, trend and catalyst” are essential and urges caution because Richtech’s swings are driven more by sentiment than fundamentalsstockstotrade.com.

Competitive Landscape

The service‑robotics market is increasingly crowded. Bear Robotics offers autonomous mobile robots to run orders and bus tablescbinsights.com. GoodBytz builds robotic kitchens that replicate professional chef capabilitiescbinsights.com. Keenon Robotics provides delivery, cleaning and disinfection robots for hospitality, healthcare and retailcbinsights.com. Chinese firms Yunji Technology and Pangolin Robot supply robots for community services, retail and educationcbinsights.com. Craft.co lists additional competitors such as Ten10, Vecna Robotics, Walmart Advanced Systems & Robotics and Fujian Mingxin Intelligent Technology, and estimates Richtech’s FY 2024 revenue at about $4.2 millioncraft.co.

Industry giants such as Boston Dynamics, ABB, KUKA and Nuro also compete in logistics and service robotics. While Richtech focuses on affordable service robots for SMEs, larger players offer more sophisticated hardware and benefit from deeper capital reserves. To succeed, Richtech must differentiate through AI‑enhanced interactivity, reliability and cost‑effective RaaS contracts.

Market Sentiment & Investor Dynamics

Retail traders have been a driving force behind Richtech’s volatility. RollingOut reported that the stock delivered 625 % return over the prior year and gained nearly 19 % on 22 Sept 2025; it became a trending topic on social trading platformsrollingout.com. Enthusiasm partly stems from Richtech’s integration of Nvidia’s Jetson Thor technology and the broader AI boomrollingout.com. Yet sentiment shifted quickly when COO Phil Zheng sold 100,000 shares and broker downgrades followedstockstotrade.com. StocksToTrade articles caution that the stock trades like a meme stock, moving on headlines and day‑trader speculationstockstotrade.com.

A short‑seller report by Capybara Research published in mid‑2025 accused Richtech of being a “China hustle” and rebranding Chinese robots, alleging misrepresented partnerships and undisclosed related‑party transactionscapybararesearch.comcapybararesearch.com. The report claimed that the widely touted Walmart partnership was just a small pilot program. Richtech filed a shelf registration soon after, allowing it to raise funds at the market. Simply Wall St said this development eroded investor trust and highlighted concerns about dilution and credibilitysimplywall.st. While the allegations remain unproven, they underscore the importance of transparency as Richtech pursues aggressive expansion.

Outlook for Richtech and the Robotics Sector

The long‑term thesis for Richtech hinges on solving labour shortages and rising wage costs. In hospitality, retail and logistics, automation offers potential to improve efficiency and customer experience. Analysts see the $283 billion industrial automation market growing rapidly by 2032ainvest.com. Richtech’s RaaS model could provide recurring revenue and lower up‑front costs for small businesses, which may yield sticky client relationships—some customers reportedly achieve ROI in under a monthainvest.com.

However, investors must weigh this promise against substantial risks. Competition is intense; better‑capitalised rivals may out‑innovate or underprice Richtech. The company operates at a significant loss, and cash burn remains high. Frequent equity offerings raise dilution risk, and allegations of misrepresentation pose reputational challenges. Technical traders may view the stock’s momentum as an opportunity, but fundamental investors should wait for clearer evidence of sustainable revenue growth and margin improvement.

Bottom line

Richtech Robotics is one of 2025’s most talked‑about small‑cap stocks. It combines a compelling narrative—AI‑enabled robots tackling labour shortages—with eye‑catching product demonstrations. Major deals with auto dealerships and retailers suggest early commercial traction, and the company’s strong cash position provides runway. Yet the valuation is rich, the path to profitability uncertain, and controversies linger. Investors should approach with caution, balancing speculative upside against high volatility and execution risk.