NEW YORK, December 29, 2025, 17:33 ET — After-hours

- Sandisk shares eased in after-hours trading, tracking a tech-led pullback in U.S. stocks to start the final week of 2025.

- Traders are heading into the New Year watching Federal Reserve signals, thin holiday liquidity and whether AI data-center demand stays firm.

Sandisk Corp shares fell 2.4% to $244.25 in after-hours trading on Monday, after swinging between $236.64 and $249.84 during the session.

The move came as Wall Street’s main indexes ended lower, led by declines in heavyweight technology and AI-linked names. “It’ll turn out to be a buying opportunity,” said Hank Smith, director and head of investment strategy at Haverford Trust, while noting that the week ahead is light on data apart from Federal Reserve minutes and weekly jobless claims. Reuters

Why it matters now: Sandisk has been one of the market’s most crowded AI-infrastructure trades, and year-end positioning tends to amplify reversals when liquidity thins. The stock is the S&P 500’s top performer in 2025 with a roughly sixfold gain, alongside big advances in storage and memory names such as Western Digital, Micron Technology and Seagate Technology. Kiplinger

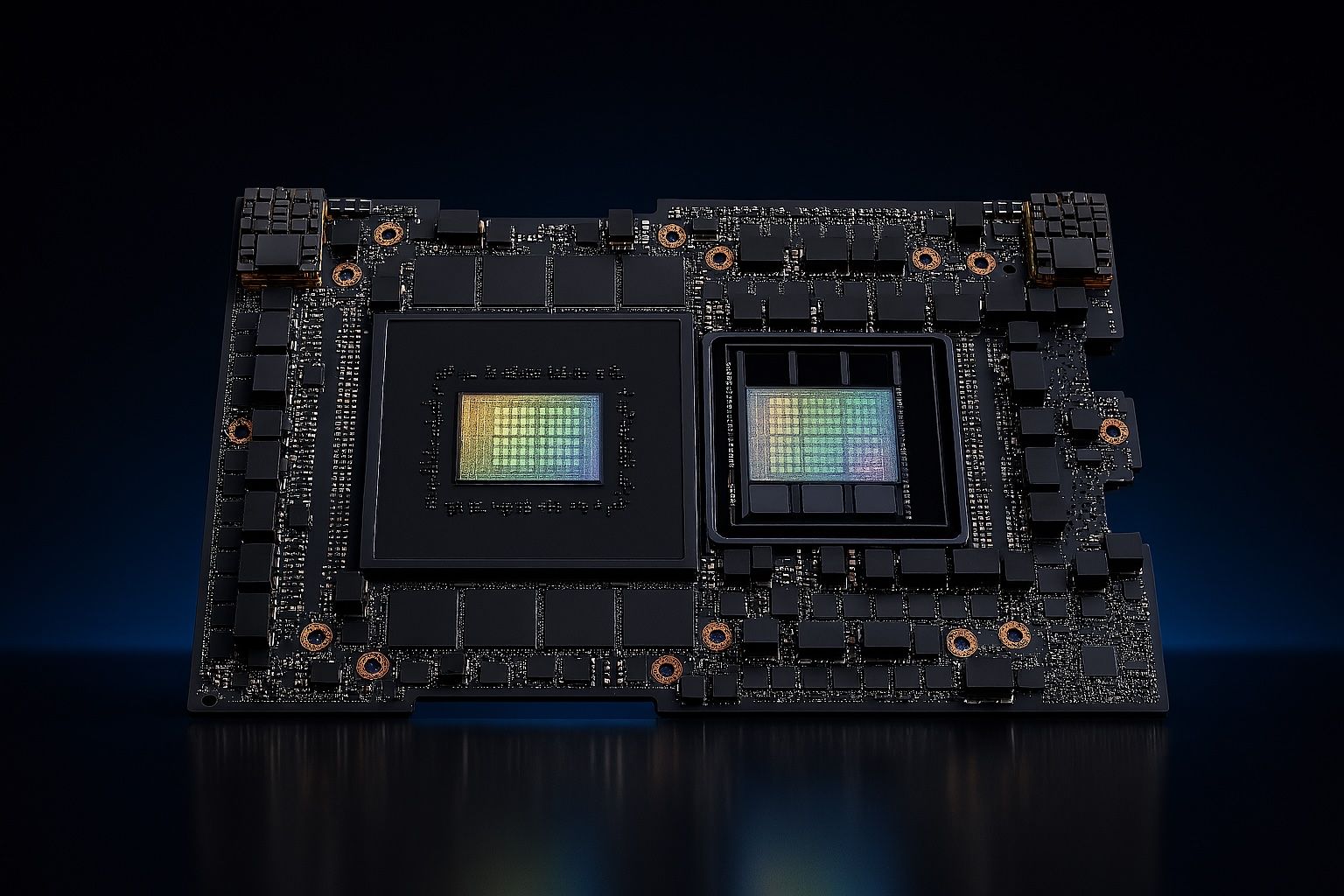

Sandisk sells NAND flash — a type of memory used in solid-state drives — and other storage products into cloud, client and consumer markets. Reuters

The company became an independent public company after separating from Western Digital and began trading on Nasdaq under the ticker symbol “SNDK,” Sandisk said when it completed the split. Sandisk

Index-related flows have also been part of the backdrop. Sandisk was added to the S&P 500 in late November, S&P Dow Jones Indices said at the time. News Release Archive

Monday’s dip underscored how quickly momentum can turn for high-beta AI beneficiaries — stocks that tend to move more than the broader market in both directions. Sandisk’s 2025 run leaves little room for disappointment into earnings season.

In plain terms, after-hours trading is the session after the U.S. market’s 4 p.m. close. Volumes are typically lighter, which can make price moves look sharper than they would during the regular session.

What traders are watching next is less about headlines from Sandisk and more about risk appetite. A renewed slide in megacap tech can spill into the parts of the market most tied to AI spending, including memory and storage.

For Sandisk, the next check-in for investors is whether demand from large cloud customers keeps absorbing supply and supporting NAND pricing. Any changes to near-term pricing, inventory or customer ordering patterns tend to show up first in management commentary and quarterly guidance.

On the chart, traders will be watching whether the stock can reclaim the high-$240s and $250 area after failing to hold earlier highs, and whether support near Monday’s session low holds if selling resumes.

With just a handful of sessions left in 2025, Sandisk is likely to remain sensitive to broad index moves and year-end rebalancing — especially as investors debate whether Monday’s tech pullback was a brief pause or the start of a rotation.