NEW YORK — Tuesday, Dec. 16, 2025 (around 1:45 p.m. ET) — U.S.-listed semiconductor stocks are trading mixed midday as investors juggle three cross-currents at once: a shutdown-delayed jobs report that’s reshaping rate expectations, fresh forecasts for a multi-year surge in chipmaking equipment spend, and a renewed debate over how profitable the AI buildout will be for every layer of the chip supply chain.

The result is a market that’s still treating “AI semiconductors” as the structural growth story—but pricing the winners and losers far more aggressively than it did earlier in 2025.

Semiconductor stocks today: a quick midday snapshot

As of the latest quotes around early afternoon in New York, the major U.S. semiconductor ETFs were modestly lower, signaling broad-based consolidation after a volatile stretch in mega-cap tech:

- iShares Semiconductor ETF (SOXX): about $294.55, down roughly 1.16%

- VanEck Semiconductor ETF (SMH): about $350.39, down roughly 0.71%

Inside the group, performance is notably split between AI bellwethers, memory, and the equipment complex:

- Nvidia (NVDA): about $176.87, up roughly 0.33%

- AMD (AMD): about $208.10, up roughly 0.25%

- Broadcom (AVGO): about $339.35, slightly lower (about -0.14%)

- Micron (MU): about $232.42, down roughly 2.14%

- Qualcomm (QCOM): about $175.22, down roughly 2.25%

- KLA (KLAC): about $1,218.71, down roughly 0.52%

- Applied Materials (AMAT): about $257.19, down roughly 1.56%

- Lam Research (LRCX): about $162.16, down roughly 1.30%

- TSMC ADR (TSM): about $284.55, down roughly 1.11%

- ASML (ASML): about $1,070.47, down roughly 1.60%

(Prices are intraday and can change quickly.)

What’s moving semiconductor stocks on Dec. 16

1) The “distorted” jobs report is feeding the rate debate—again

The macro backdrop matters more than usual for chip stocks because semiconductors are still treated as long-duration growth assets: when rate expectations shift, chip valuations often move with them.

Today’s catalyst was the shutdown-delayed U.S. employment data for November, which showed nonfarm payrolls rising by 64,000 (after an October decline of 105,000) while the unemployment rate increased to 4.6%. Reuters reported that investors and analysts flagged the likelihood of distortions because the data collection and release were disrupted by a government shutdown, keeping markets cautious about over-interpreting a single print. Reuters+1

By midday, Reuters also noted the major U.S. indexes were modestly lower, as investors digested the economic releases and tried to map them to the 2026 Fed path. Reuters

Why chip investors care: higher-for-longer rates pressure semiconductor multiples, but clear evidence of a cooling labor market can revive the “cuts are coming” narrative—often supportive for high-quality growth (including select chip names). Today’s data delivered both messages, which helps explain the choppy tape.

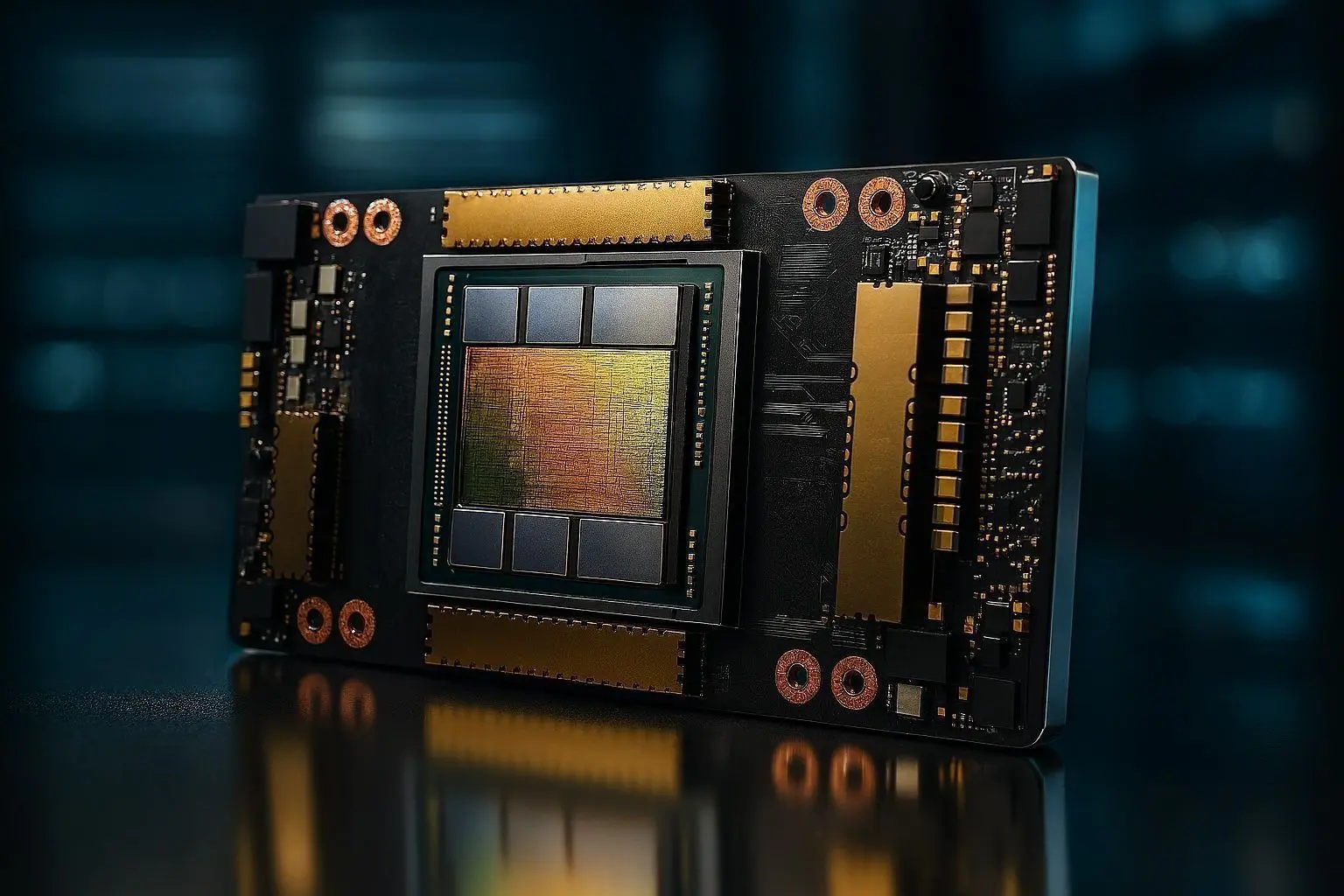

2) AI is still the engine—but investors are re-pricing the profit pools

Across semiconductors, “AI exposure” is no longer enough. Markets increasingly distinguish between:

- companies selling high-margin accelerators and networking,

- those competing in custom AI silicon (ASICs) where pricing pressure can be real, and

- the “picks-and-shovels” layer—equipment, materials, and memory—that can surge when capacity gets tight.

That’s why Broadcom remains a focal point even on a quieter trading day. J.P. Morgan has kept Broadcom as a top pick in the group despite the stock’s sharp recent drop, pointing to the company’s custom AI chip and networking opportunity and projecting a steep ramp in AI-driven revenue over the next several years. Barron’s+1

At the same time, today’s research chatter underscores the market’s core anxiety: will Big Tech keep spending at a pace that supports sky-high expectations across the AI supply chain—and who captures the margins? That question is now a daily driver of dispersion inside semiconductors.

3) A powerful new capex signal: SEMI forecasts record equipment spending into 2027

One of the most consequential “today” headlines for the sector isn’t about a single chipmaker—it’s about the upstream buildout.

SEMI said Tuesday that global sales of total semiconductor manufacturing equipment are forecast to hit $133 billion in 2025, then rise to $145 billion in 2026 and $156 billion in 2027, driven by investment tied to AI (leading-edge logic, memory, and advanced packaging). SEMI

Within that, SEMI projects wafer fab equipment (WFE) growth supported by DRAM and high-bandwidth memory investment, while test and assembly/packaging equipment also shows strong momentum as AI systems push packaging complexity higher. SEMI

Reuters separately highlighted the WFE angle, reporting SEMI’s view that equipment used to make chip wafers could rise about 9% to $126 billion in 2026 and a further 7.3% to $135 billion in 2027, with Asia—especially China, Taiwan, and South Korea—remaining the largest markets through 2027. Reuters

Why this matters for U.S.-listed chip stocks: Even if end-demand (phones, PCs) remains uneven, the AI-driven capacity race can keep equipment leaders like Applied Materials, KLA, and Lam Research in focus—especially when investors see credible multi-year spending visibility. Reuters also noted ASML’s scale in the equipment ecosystem and listed major suppliers across the U.S., Europe, and Japan. Reuters

Micron is back in the spotlight—right before earnings

If 2025 has had a “stealth AI winner,” many investors would put memory near the top of the list, because every incremental AI server buildout pulls more DRAM, HBM, and storage through the system.

Micron is scheduled to report fiscal first-quarter results after the market closes Wednesday, and options pricing has implied an outsized post-earnings swing—Investopedia reported that traders were pricing in a move of roughly up to 9%by the end of the week. The same report cited analyst expectations for sharply higher revenue and earnings versus a year ago. Investopedia

Investor’s Business Daily echoed the bullish framing around a tightening memory market and rising prices, noting Street expectations for fiscal Q1 results and highlighting that some analysts have raised Micron price targets (including moves to $300 from at least two firms cited by IBD). Investors.com

What investors are watching in Micron’s report and guidance:

- Signals on HBM supply, pricing, and mix

- Whether “AI memory” strength can offset weaker pockets of consumer demand

- Any commentary on how quickly AI demand is widening beyond hyperscalers into enterprise deployments

Smartphones are a caution flag: rising chip costs could pressure 2026 unit demand

While AI dominates the narrative, the semiconductor industry still depends on huge unit volumes in consumer electronics—especially smartphones.

Reuters reported Tuesday that Counterpoint expects global smartphone shipments to decline 2.1% in 2026, citing rising chip costs as a factor that could weigh on demand. The report added that the sub-$200 segment is expected to be hit hardest as bill-of-materials costs rise, while premium leaders may be better positioned to absorb cost pressure. Reuters

This matters for U.S.-listed semiconductor names with heavy mobile exposure (including handset chip suppliers and RF/content players), because a softer unit backdrop can amplify the market’s tendency to reward data-center AI winners and penalize consumer-sensitive stocks.

Nvidia’s strategy signal: owning more of the AI “software plumbing”

Another storyline feeding into chip-stock sentiment is Nvidia’s continued push to reinforce its ecosystem beyond silicon.

Reuters reported that Nvidia has acquired SchedMD, the company behind Slurm, a widely used open-source workload management system for high-performance computing and AI clusters, and said Nvidia would continue distributing the software on an open-source basis. Reuters

Nvidia also published its own blog post describing the acquisition as a way to strengthen open-source infrastructure used to schedule and manage complex AI/HPC workloads at scale. NVIDIA Blog

Why it matters for the stock narrative: Investors typically value Nvidia not just as a GPU vendor, but as a platform company. Moves that deepen control over how AI workloads are scheduled and optimized can be interpreted as a strategy to defend long-term “stickiness”—especially as competition intensifies.

Wall Street’s 2026 playbook: Broadcom, Nvidia, KLA—and the AI capex debate

A notable feature of today’s coverage is that the conversation is already shifting from “what happens next quarter” to “who wins in 2026–2027.”

- Jefferies highlighted Broadcom, Nvidia, and KLA as key ideas looking into 2026, tying the thesis to continued AI-driven demand and the downstream impact on equipment spending. Barron’s

- J.P. Morgan, via reporting on its sector views, pointed to continued AI infrastructure buildout and identified top picks across custom silicon/networking, analog exposure, and memory—while also projecting a sizable increase in data center capex in 2026 compared with 2025. MarketWatch

- A separate market narrative—captured in coverage of Nvidia—has been the persistent “AI bubble” question. UBS strategists, as cited in today’s reporting, argued that bubble fears are overstated and projected continued growth in global AI capex. Barron’s

The key takeaway for semiconductor investors: forecasts are increasingly converging on a view that AI is still early-cycle, but the market is tightening its standards—rewarding clear line-of-sight to revenue and margins, and punishing ambiguity.

What to watch next for chip stocks

With semiconductors sitting at the intersection of macro rates and AI infrastructure, the next catalysts are close—and they’re not all earnings-driven.

- Micron earnings (Wednesday after the close): options markets are already signaling the potential for a big move. Investopedia+1

- Equipment demand signals: SEMI’s forecast puts a fresh spotlight on wafer fab equipment and advanced packaging investment—tailwinds for the equipment leaders if order commentary stays constructive. SEMI+1

- The “consumer drag” question: if smartphone shipments soften in 2026 as forecast by Counterpoint, investors may further bifurcate between AI-heavy chip names and consumer-exposed names. Reuters

- Rate expectations into 2026: today’s jobs data and market reaction show how sensitive growth sectors remain to the Fed path and the reliability of economic data following disruptions. Reuters+1