U.S.-listed semiconductor stocks are trying to steady themselves in late-morning trading on Monday, December 15, 2025, after last week’s AI-driven shakeout rattled the “chip trade.” By around 11:30 a.m. ET, the group is splitting into clear winners and losers: AI accelerators and memory names are back in favor, semiconductor equipment makers are surging on upbeat 2026–2027 demand forecasts, and several “old-economy” chip exposures—analog and smartphones—are under pressure following high-profile downgrades. Reuters+1

Semiconductor market snapshot at 11:30 a.m. ET

Semiconductor ETFs are modestly higher, signaling stabilization rather than a full-throttle rebound. The VanEck Semiconductor ETF (SMH) and iShares Semiconductor ETF (SOXX) are both slightly in the green.

Under the surface, leadership is rotating quickly:

- Back in the lead (AI + memory + equipment): Nvidia is higher on the session, while Micron is outperforming ahead of its earnings later this week. Semiconductor equipment names are notably strong—KLA, Lam Research, and Applied Materials are among the biggest movers higher.

- Lagging (AI infrastructure profit concerns + smartphone/analog skepticism): Broadcom is down again following last week’s margin-driven selloff, while Arm is sharply lower after a downgrade. Texas Instruments is also weaker after being cut to a Sell rating.

- Steadier bellwethers: AMD is modestly higher; TSMC’s U.S.-listed shares are near flat, reflecting a market that’s still parsing what’s “real demand” versus “valuation reset.”

The Philadelphia Semiconductor Index (SOX) is attempting to rebound after Friday’s sharp drop, hovering around the low-7,000s range in today’s session. Investing.com+1

Why chip stocks are whipping around: the AI trade is being repriced in real time

Semiconductors are once again acting like the market’s “truth serum” for AI—moving sharply when investors feel confident about demand, and falling hard when the narrative shifts to margins, customer concentration, or funding risk.

Last week, sentiment cracked after disappointing news around the pace and profitability of AI spending: Oracle and Broadcom slid sharply, dragging the broader AI complex lower. Reuters+1

Today’s price action suggests investors aren’t abandoning AI—they’re re-segmenting the semiconductor universe into:

- “Must-own” AI compute and memory capacity,

- the tools to build more capacity (equipment), and

- pockets where the next leg of the cycle may be slower or less lucrative than the market had priced in.

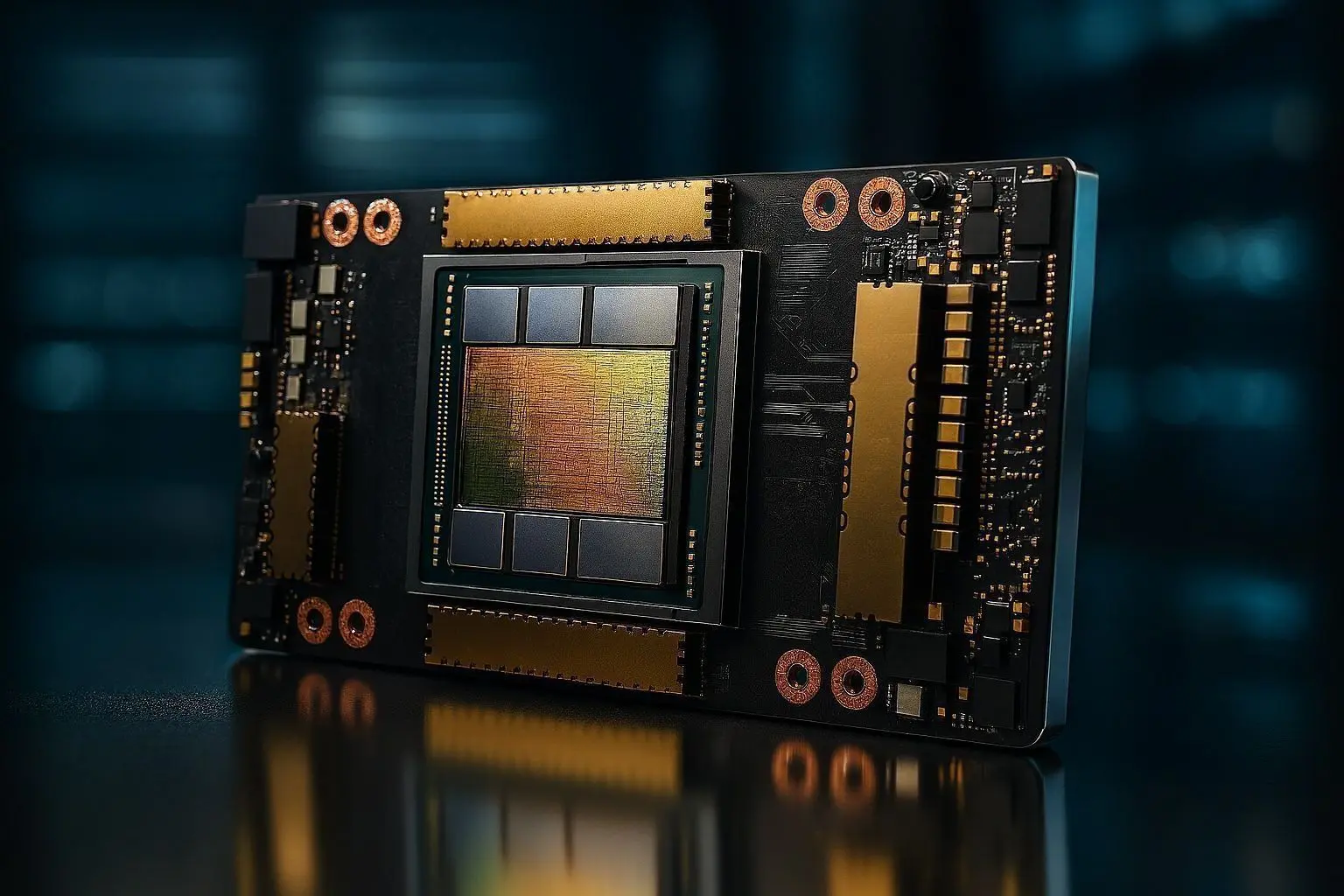

Nvidia is back in focus on two fronts: open-source AI models and China-linked H200 demand

Nvidia is helping anchor the sector today with a fresh product headline: the company unveiled its third-generation “Nemotron” open-source AI model family, starting with Nemotron 3 Nano, with larger versions expected in the first half of 2026. Reuters

But for investors, the bigger near-term catalyst is demand visibility for H200 (Hopper-generation) AI chips—particularly tied to China.

Multiple reports today point to robust China demand for Nvidia’s H200 after President Donald Trump’s administration moved to allow those processors to be exported to China under a fee-based arrangement, though key details still require finalization by U.S. regulators and alignment on the China side. Investors+1

That policy shift remains politically sensitive: a U.S. lawmaker leading the House’s China-focused committee has requested more clarity on the decision to allow H200 sales to China, underscoring the persistent headline risk around export controls. Reuters

Market positioning is also leaning tactical. J.P. Morgan, for example, framed the recent pullback in Nvidia shares as a potential trading opportunity, highlighting how quickly sentiment can swing as new AI-chip headlines hit. Barron’s

What it means for chip investors: Nvidia is still the emotional center of the semiconductor tape. When the market is nervous about AI ROI, Nvidia often trades like the “risk-on/risk-off” switch. When new demand signals (or policy developments) appear, it snaps back fast.

Micron becomes the week’s key read-through for the AI memory cycle

If Nvidia is the headline magnet, Micron is the earnings catalyst.

Analysts are raising targets into Micron’s report scheduled for Wednesday, December 17, citing stronger memory pricing and a better setup for average selling prices (ASPs). On Monday, Wedbush lifted its Micron price target to $300 from $220, reiterating an Outperform rating and pointing to improved industry conditions as Micron heads into earnings. Investing.com+1

This matters beyond Micron itself. High-bandwidth memory (HBM) and advanced DRAM are increasingly viewed as the “second engine” of AI infrastructure—right alongside GPUs—because next-generation AI workloads are memory-hungry and capacity-constrained.

The market’s real question into Wednesday:

Will Micron’s results and guidance validate that the AI infrastructure buildout is still accelerating into 2026, or will investors see signs that hyperscaler spending is becoming more selective?

Semiconductor equipment steals the spotlight on bullish 2026 forecasts

While Nvidia and Micron dominate the headlines, semiconductor equipment is delivering the most decisive price action today—because analysts are increasingly treating it as the cleanest way to express a multi-year AI capacity buildout thesis.

A Jefferies note today upgraded KLA to Buy and raised its price target to $1,500 from $1,100, explicitly arguing that AI will drive a semiconductor demand surge starting in 2026, with major uplifts expected across memory, leading-edge foundry, and packaging. Jefferies also lifted targets across a basket of equipment and process-control names—including Applied Materials and Lam Research—pointing to capacity additions starting in 2H 2026. TradingView

Applied Materials is getting incremental support from multiple bullish calls:

- Wells Fargo raised its price target on Applied Materials to $290 from $255, highlighting visibility into expected revenue recognition from remaining performance obligations. TradingView

- Jefferies separately boosted its Applied Materials target to $360 from $260, keeping a Buy rating and tying the upside case to AI-driven semiconductor capital spending across leading-edge tech, DRAM, and packaging. TipRanks

And for longer-range investors, Jefferies’ broader “best chip stocks for 2026” framing spotlights Broadcom, Nvidia, and KLA as top ideas—an important signal that Wall Street sees the next phase of the chip cycle as both AI-driven and more selective. Barron’s

Bottom line: Equipment stocks are trading today like investors believe AI infrastructure spending is real—but also that the most durable profits may accrue to the “picks-and-shovels” companies enabling more wafer starts, more advanced packaging, and more inspection/metrology capacity.

Why Broadcom, Arm, and Texas Instruments are on the wrong side of the tape

Even inside semiconductors, the market is drawing hard lines around where AI spending shows up in financial statements—and whether that spending is profitable.

Broadcom: the margin question is front and center

Broadcom’s recent selloff has been tied to concerns that a higher mix of AI revenue could pressure gross margins, even as revenue outlook remains strong—an uncomfortable setup for a market that has been rewarding AI growth but punishing AI profit uncertainty. Reuters

Arm and Texas Instruments: Goldman’s downgrade highlights a “more selective upcycle”

A Goldman Sachs note published Monday downgraded Texas Instruments to Sell (from Buy) and Arm to Sell (from Neutral), arguing that neither is positioned to capture the next phase of the upcycle as cleanly as AI-linked digital, memory, storage, and semi-cap names. The call cited company-specific execution and inventory concerns for Texas Instruments and highlighted Arm’s heavy exposure to smartphones and limited near-term upside to fundamentals. Investing.com+1

Texas Instruments is also showing up in daily “most active movers” coverage as the downgrade pressure reverberates through the sector narrative. Barron’s

Goldman’s caution wasn’t limited to chip designers. The firm also downgraded Entegris to Sell, citing margin-related concerns and a view that fundamentals may lag peers despite an expected recovery in 2026 wafer starts. Investing.com Canada

Takeaway: Analysts are increasingly saying 2026 may be a “semiconductor upcycle,” but not a “buy everything labeled chips” upcycle. The market is rewarding clearer AI linkage and punishing ambiguous demand or profitability.

Intel is back in the conversation on SambaNova acquisition chatter

Intel is quietly participating in today’s semiconductor narrative, helped by reports that it is nearing (or at least seriously discussing) a roughly $1.6 billion acquisition of AI chip startup SambaNova Systems—a move that investors interpret as Intel trying to close part of its AI hardware gap. Investing.com+1

While deal details and strategic fit will be debated, the stock-action relevance is straightforward: M&A talk can temporarily re-rate “turnaround” names in semiconductors—especially when the market is rotating away from the most crowded mega-cap AI trades.

The macro overlay: AI bubble worries vs. 2026 optimism

Semiconductor stocks are also being tugged by competing macro narratives:

- Bubble anxiety is rising. Bridgewater warned today that the AI boom may be entering a “dangerous” phase as Big Tech increasingly leans on external capital to finance massive AI ambitions—fueling concerns about sustainability if profits don’t arrive fast enough. Reuters

- Wall Street is still forecasting AI-driven upside in 2026. Citigroup set a 7,700 year-end 2026 target for the S&P 500, explicitly calling out AI as a continuing tailwind—while also warning the market may shift focus from AI “enablers” to AI “adopters,” reinforcing a potential winner-versus-loser split. Reuters

- Near-term catalysts are imminent. Markets are watching this week’s major U.S. data—especially Tuesday’s payrolls report—and central bank developments, which can quickly change the discount-rate outlook for high-multiple chip stocks. Reuters+1

What to watch next in semiconductor stocks this week

Semiconductor investors are likely to focus on three near-term “decision points”:

- Micron earnings (Dec. 17): Will AI memory demand and pricing momentum confirm a durable 2026 setup? Investing.com+1

- Any updates on Nvidia’s China-facing H200 policy details: Regulatory clarity (or renewed political pushback) could move Nvidia—and the broader AI complex—quickly. Reuters+1

- Whether equipment strength persists after today’s upgrades: If the market believes Jefferies’ 2H26 capacity-add thesis, equipment could stay leadership even if headline AI chip names remain volatile. TradingView+1

As of late morning on December 15, the message from the tape is clear: the semiconductor bull case is still alive, but it’s narrowing. AI demand remains the engine, memory is the crucial second-order beneficiary, and equipment is increasingly viewed as the highest-conviction way to play the next leg—while parts of the sector that look less directly tied to the AI profit pool are being repriced accordingly. TradingView+2Investing.com+2