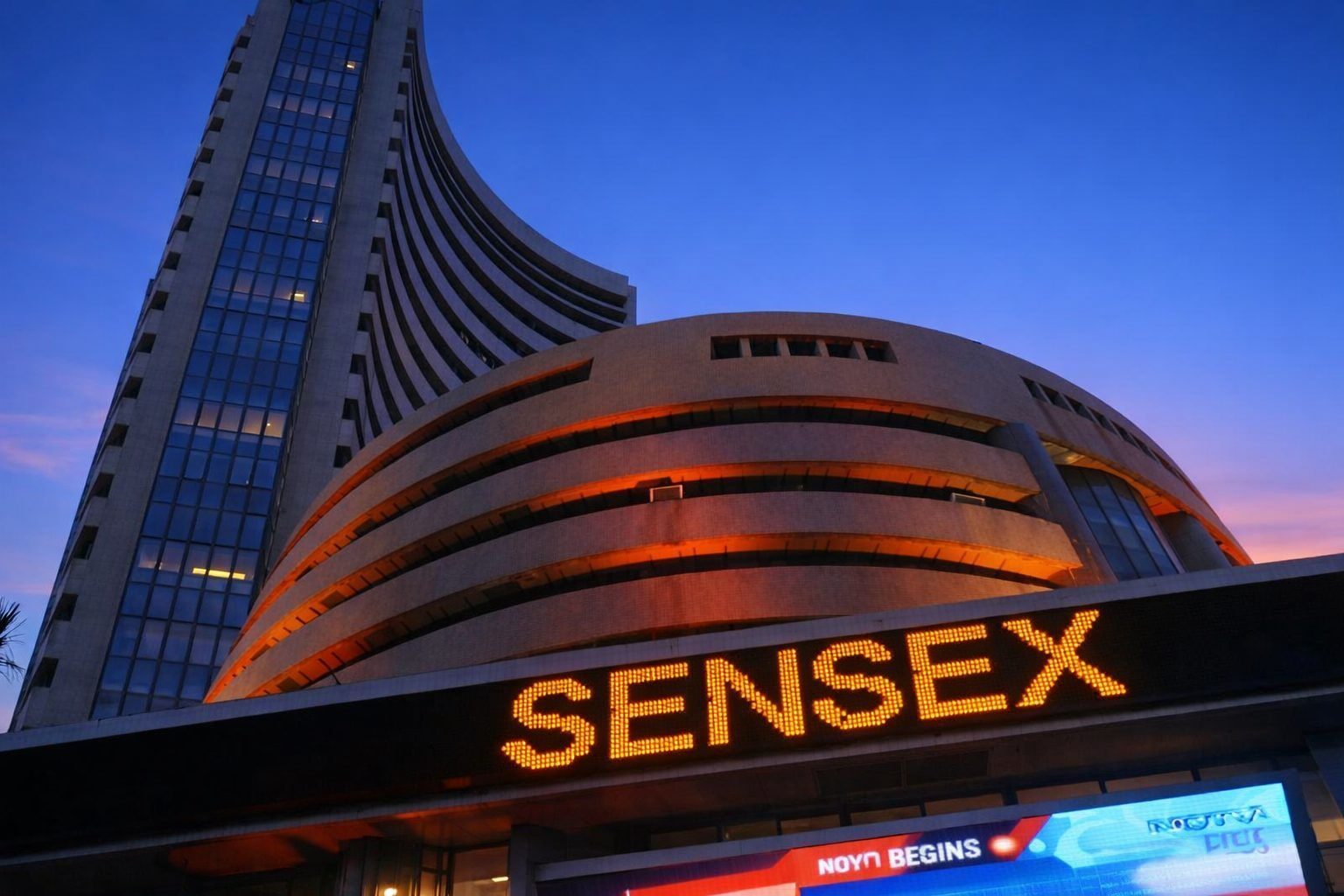

Mumbai: Indian equities wrapped up a choppy Thursday with benchmark indices nearly unchanged, after swinging between early losses and a mid-session recovery that fizzled in the final hour. The Nifty 50 eased 0.01% to 25,815.55, while the BSE Sensex slipped 0.09% to 84,481.81, marking a fourth straight session of mild declines even as information technology stocks provided a cushion. Reuters+1

The mood on Dalal Street remained cautious, shaped by a familiar mix of cross-currents: uncertainty around a potential U.S.–India trade agreement, a rupee rebound following central bank intervention, and global risk sentiment rattled by a tech-led selloff overseas ahead of key U.S. inflation data. Reuters+2Reuters+2

Market close: A narrow finish after a volatile day

Thursday’s close underlined how indecisive the market remained. Reuters reported that 11 of the 16 major sectoral indices declined, but gains in Nifty IT (+1.2%) helped cap the downside. Meanwhile, broader markets stayed relatively resilient, with mid-caps up 0.3% and small-caps up 0.1%. Reuters

That split—benchmarks flat-to-down, broader indices slightly positive—suggested selective risk-taking rather than a broad “risk-on” shift, as investors rotated into pockets of strength while trimming exposure elsewhere.

How the session unfolded: Weak open, mid-day recovery, late fade

Early trade began on a softer note. A PTI update carried by The New Indian Express said the Sensex fell 214.87 points to 84,344.78 in early deals and the Nifty dropped 56.1 points to 25,762.45, tracking weak global cues. It flagged Sun Pharma, Tata Motors Passenger Vehicles, M&M, NTPC, Bharat Electronics and Maruti among early laggards, while HCL Tech, TCS and Tech Mahindra were among gainers. The New Indian Express

As the day progressed, equities steadied. Reuters noted the rupee rebound helped keep the market in the green for much of the session before benchmarks gave up gains in the last hour—an intraday pattern consistent with traders staying nimble ahead of global data risk. Reuters+1

What’s driving sentiment on Dec 18: Global tech jitters, India–U.S. trade uncertainty, and currency cues

1) Global risk tone: Tech and AI worries ripple into Asia

Overnight, global markets were rattled after a sharp decline in U.S. tech shares linked to artificial intelligence spending concerns. Associated Press reported that markets were mixed globally, with investors reassessing the pace, profitability, and valuation of AI-heavy investments—an undercurrent that weighed on Asian tech sentiment as traders looked ahead to fresh U.S. inflation data. AP News

2) Trade deal uncertainty remains a headline overhang

Both Reuters and market commentary cited persistent uncertainty around a U.S.–India trade agreement as a key reason investors struggled to find conviction despite intermittent support from domestic flows and select sector rallies. Reuters+1

3) The rupee’s rebound offers support—but also signals stress

Currency action remained central to market psychology this week. Reuters reported the rupee closed at 90.24 per dollar, about 0.1% stronger on the day after rebounding from a record low of 91.075 earlier in the week, a move traders linked to central bank intervention. Reuters

4) Crude oil and global central banks in focus

Brent crude was cited around $60.07 per barrel in early trade updates, another input for inflation and macro expectations. The New Indian Express

Globally, investors also positioned ahead of multiple central bank decisions (including Europe, the UK, and Japan), adding to the “wait-and-watch” tone. Reuters+1

Sector check: IT leads; multiple pockets remain under pressure

The standout theme at the close was strength in IT, which helped offset broader sector softness. Reuters attributed some of the momentum to Tata Consultancy Services (TCS), which rose after outlining an AI-led strategy ambition. Reuters

Beyond IT, the market picture stayed mixed and fragile. Early-deal updates highlighted pressure in parts of autos and defensives, while intraday flows rotated quickly—consistent with a market trying to stabilize after multiple sessions of declines rather than launching a fresh rally. The New Indian Express+1

Stocks in focus on Dec 18: The moves and the headlines behind them

Here are the key single-stock stories and themes that shaped Thursday’s tape:

- TCS rallies on AI strategy narrative: Reuters said TCS rose after it outlined its strategy to become the world’s largest AI-led tech services firm, helping lift the IT pack. Reuters

- IndiGo gains after CEO comment: IndiGo jumped after its CEO said the worst was behind following the cancellation of thousands of flights due to poor pilot roster planning, according to Reuters. Reuters+1

- Tata Motors jumps on brokerage initiation: Reuters reported Tata Motors gained after J.P. Morgan initiated coverage with an “Overweight” rating. Reuters

- Sun Pharma slides on U.S. FDA classification: Reuters said Sun Pharma fell after the U.S. drug regulator classified its Baska facility as “Official Action Indicated,” which Citi warned could delay new product approvals from that facility. Reuters

- AMC and brokerage shares pop after SEBI fee-rule easing: Reuters noted asset management and brokerage firms advanced after the regulator eased mutual fund fee rules. A separate Reuters report detailed that SEBI introduced reforms intended to boost transparency and reduce investor costs, including changes that could lower average charges by 10–15 bps in some cases. Reuters+1

- Crompton Greaves Consumer Electricals jumps on ‘Buy’ call: The Economic Times reported the stock surged as Motilal Oswal initiated coverage with a ‘Buy’ rating and a ₹350 price target, implying around 40% upside, highlighting the Butterfly acquisition and the company’s “Crompton 2.0” strategy. The Economic Times

- Ola Electric slumps to fresh lows amid promoter selling: Multiple reports said founder-promoter Bhavish Aggarwal sold about 4.19 crore shares for roughly ₹142.3 crore (following an earlier sale of about 2.62 crore shares), a move the company linked to repaying a promoter-level loan and removing pledge overhang. The stock extended its decline as markets digested the pace of stake sales. Moneycontrol+2mint+2

- Tata Power’s bond fundraising plan draws attention: Moneycontrol reported Tata Power planned to raise ₹2,000 crore in a bond sale, with proceeds intended for refinancing, clean-energy investments, and general corporate needs. Moneycontrol

- MCX sets record date for first-ever 1:5 stock split: Reports said MCX fixed January 2, 2026 as the record date for a 1:5 stock split, a corporate action often viewed as supportive for liquidity and accessibility. The Economic Times

- MTAR Technologies wins ₹310 crore Kaiga nuclear order: The Economic Times reported MTAR secured a ₹310 crore order related to Kaiga 5 and 6 civil nuclear reactors (with deliveries stretching into 2030), keeping the stock on investor radars. The Economic Times

Context from Dec 17: What changed overnight, and why it mattered today

Thursday’s chop came after a soft prior session. Upstox reported that on Dec 17, the Sensex closed at 84,559.65 (down 120.21 points) and the Nifty at 25,818.55 (down 41.55 points) amid cautious global sentiment and continued uncertainty around trade talks. Upstox – Online Stock and Share Trading+1

Dec 17 top movers (Nifty 50) per Upstox:

- Top gainers: Shriram Finance, SBI, Tata Steel, ONGC, M&M Upstox – Online Stock and Share Trading

- Top losers: Max Healthcare, Trent, Bajaj Auto, Tech Mahindra, Tata Motors Upstox – Online Stock and Share Trading

Flow data also showed signs of shifting participation. PTI’s Dec 18 early-deal update said FIIs turned buyers on Dec 17, purchasing equities worth ₹1,171.71 crore, while DIIs also bought ₹768.94 crore—a supportive datapoint even as markets remained skittish. The New Indian Express

Rupee watch: Why FX stayed central to the equity narrative

The currency’s swing has become more than a macro footnote—it’s a live sentiment driver. Reuters reported the rupee’s bounce came after central bank intervention, with traders noting higher merchant dollar sales and less appetite for fresh speculative short positions. Reuters

For equities, a steadier rupee can ease near-term pressure on import-heavy businesses and inflation expectations—yet the fact that intervention was needed also underscores the sensitivity around trade dynamics and capital flows.

Regulation spotlight: SEBI’s double dose—mutual fund costs and takeover-code reforms

Two regulatory developments fed into Thursday’s market conversation:

- Mutual fund fee revamp (Dec 17 board meeting): Reuters reported SEBI approved changes aimed at improving fee transparency and reducing investor costs, including revised brokerage cost caps and other market-structure tweaks. These announcements helped lift some capital-market-linked stocks. Reuters+1

- Potential takeover-code / M&A reforms (Dec 18 exclusive): Reuters also reported SEBI is preparing amendments to M&A rules that would, among other steps, seek to prevent preferential pricing for large shareholders after open offers and shorten open-offer timelines—moves aimed at leveling the playing field for retail investors and speeding up deal processes. Reuters+1

What investors are watching next

With benchmarks struggling for direction, near-term market “triggers” are likely to come from a short list:

- U.S. inflation data and what it implies for the Federal Reserve’s policy path Reuters+1

- Updates on India–U.S. trade negotiations, which continue to influence risk appetite Reuters+1

- Rupee stability and RBI signals after intervention-driven moves Reuters

- Sector rotation, especially whether IT leadership persists or broadens into cyclicals and financials Reuters

- Regulatory follow-through, as markets digest SEBI’s mutual fund and takeover-code agenda Reuters+1

As Thursday showed, the market currently has enough support to avoid a sharp break—but not yet enough conviction to sustain a clean breakout.