Published: November 7, 2025

Summary

- China has postponed the Shenzhou‑20 crew’s return to Earth after a suspected space‑debris strike on the spacecraft’s return capsule. Engineers are conducting an impact analysis and risk assessment; no new landing date has been announced. [1]

- The three taikonauts — Chen Dong, Chen Zhongrui, and Wang Jie — remain aboard the Tiangong space station alongside the newly arrived Shenzhou‑21 crew. All six astronauts are reported in good condition. [2]

- Contingency options include using the docked Shenzhou‑21 return vehicle or launching a standby spacecraft if needed — a first for China to publicly weigh after a debris incident. [3]

What happened

China’s human‑spaceflight agency said the Shenzhou‑20 return mission, originally scheduled for Wednesday, was postponed due to a suspected impact from tiny orbital debris on the crew capsule. The agency added that “impact analysis and risk assessment” are underway to determine next steps. [4]

Independent outlets and space publications corroborated the delay and the debris suspicion, noting that the capsule has remained docked while engineers evaluate its condition. As of Friday, Nov. 7, officials have not provided a revised landing plan. [5]

Who is aboard Tiangong

The outgoing Shenzhou‑20 crew consists of Commander Chen Dong (now China’s record‑holder for cumulative time in space), Chen Zhongrui, and Wang Jie. The trio launched on April 24, 2025, and had completed a formal handover with the Shenzhou‑21 team, which docked at the station on Nov. 1. [6]

All six astronauts remain on orbit while the capsule is inspected. There are no reports of injuries or station damage, and daily operations continue. [7]

Why this delay is significant

Reuters reports this is the first time a Shenzhou crew’s Earth‑return has been postponed due to a debris incident, underscoring the growing collision risk in low‑Earth orbit. Prior Shenzhou delays were weather‑related. [8]

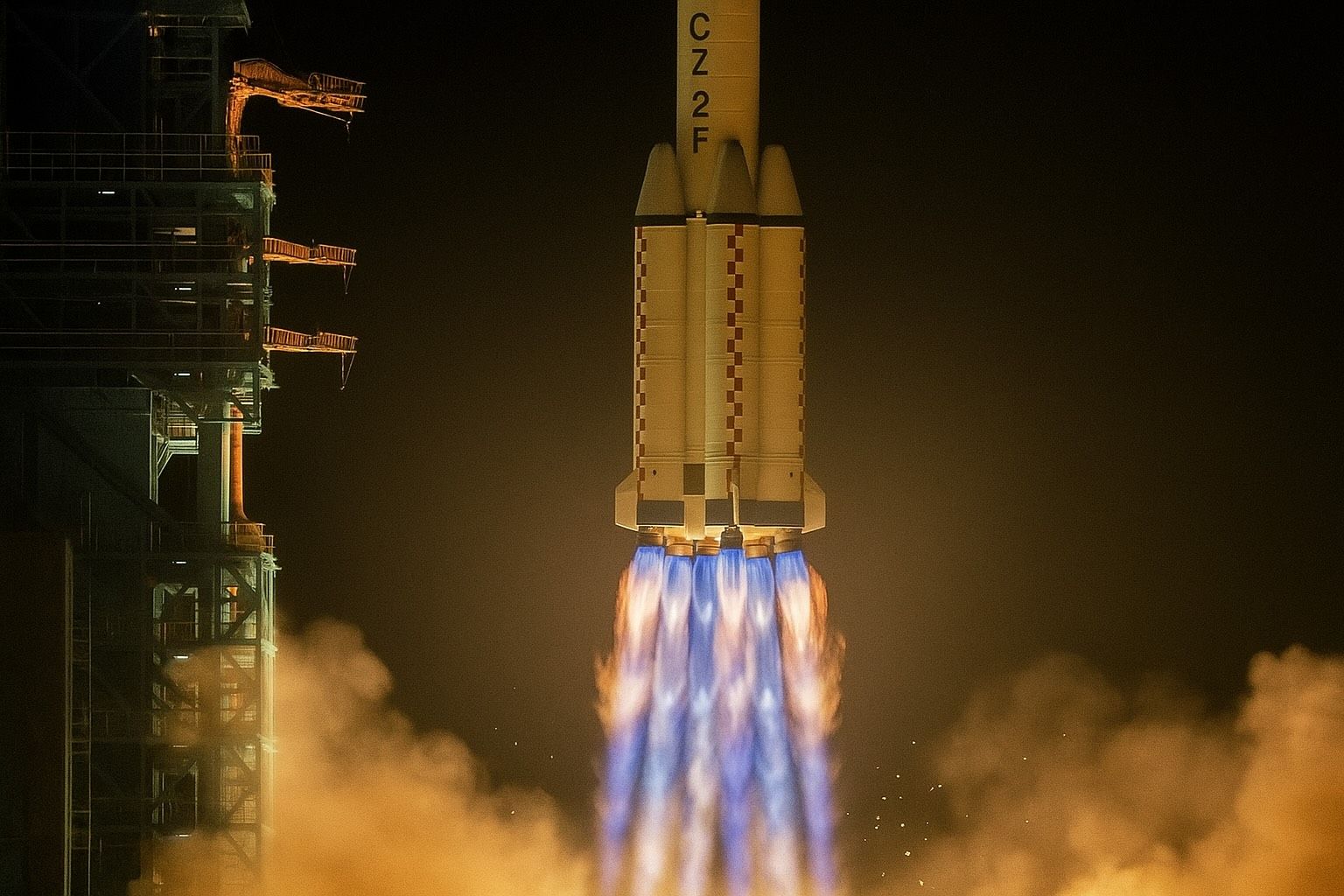

The China Manned Space Agency (CMSA) has long maintained contingency procedures: if Shenzhou‑20’s capsule is judged unsafe, the crew can return in Shenzhou‑21’s vehicle, and a backup Long March‑2F with a Shenzhou spacecraft is kept on standby at Jiuquan for rapid launch if a replacement is required. [9]

The path home: options and likely landing site

If cleared for re‑entry, Shenzhou‑20 would land at Dongfeng in Inner Mongolia, China’s regular desert touchdown zone. If not, CMSA can swap crews to the docked Shenzhou‑21 return craft, then launch a fresh capsule to re‑establish the station’s lifeboat. No timeline has been issued for either option. [10]

Space junk: the persistent threat

Even millimeter‑sized debris can puncture spacecraft at orbital speeds. In recent years, Tiangong’s crews have added debris shielding during multiple spacewalks, and both Tiangong and the ISS regularly maneuver to dodge larger fragments. The Shenzhou‑20 postponement highlights escalating concerns among space agencies about debris cascades (often called the Kessler Syndrome) as launch activity increases. [11]

Timeline at a glance

- Apr 24, 2025 — Shenzhou‑20 launches; docks with Tiangong the same day. [12]

- Oct 31–Nov 1, 2025 — Shenzhou‑21 launches and docks; crews begin handover. [13]

- Nov 5, 2025 — CMSA announces Shenzhou‑20 return is postponed after suspected debris strike on the capsule; risk assessment begins. [14]

- Nov 7, 2025 — No new return date; both crews remain aboard Tiangong while engineers complete analysis. [15]

Frequently asked questions

Are the astronauts “stranded”?

“Stranded” isn’t how CMSA describes it. The crew is safe on Tiangong with another crewed spacecraft docked. The return was deferred out of caution while the capsule undergoes analysis. [16]

Could they ride home on Shenzhou‑21?

Yes. CMSA procedures allow the outgoing crew to return on the incoming crew’s spacecraft if their own vehicle is compromised. A standby Shenzhou and Long March‑2F are also kept ready at Jiuquan for contingencies. [17]

Do we know what part of the capsule was hit?

No. CMSA has not specified which component may have been affected or whether the strike occurred while docked or in free flight. [18]

Where will they land?

Under normal plans, Dongfeng landing site in Inner Mongolia. A revised plan will be announced once risk verification is complete. [19]

Big picture

The postponement comes as China keeps Tiangong continuously occupied with six‑month crew rotations and eyes larger ambitions, including a crewed lunar landing by 2030. Managing debris risk — through shielding, tracking, and international norms — is now an operational reality for every human‑spaceflight program. [20]

Sources & further reading

- Xinhua: CMSA postpones Shenzhou‑20 return; analysis and risk assessment underway. [21]

- Reuters: First Shenzhou return delayed by suspected debris; emergency protocols described. [22]

- Space.com: Mission timeline, two‑crew overlap, Dongfeng landing site context. [23]

- Live Science: Crew identifications, debris context, and extended stay implications. [24]

- The Guardian: Standby Shenzhou‑22/Long March‑2F backup posture and handover details. [25]

- Aviation Week / AeroTime (Nov 7 updates): Today’s status and contingency pathways. [26]

Editor’s note: This article compiles verified updates available as of November 7, 2025.

References

1. english.news.cn, 2. www.space.com, 3. aviationweek.com, 4. english.news.cn, 5. www.reuters.com, 6. news.cgtn.com, 7. www.livescience.com, 8. www.reuters.com, 9. aviationweek.com, 10. www.space.com, 11. www.space.com, 12. www.space.com, 13. www.space.com, 14. english.news.cn, 15. www.aerotime.aero, 16. www.livescience.com, 17. aviationweek.com, 18. www.reuters.com, 19. www.space.com, 20. www.theguardian.com, 21. english.news.cn, 22. www.reuters.com, 23. www.space.com, 24. www.livescience.com, 25. www.theguardian.com, 26. aviationweek.com