- On 22 June at 02:14 a.m. local time, B-2 bombers released at least a dozen 30,000-lb GBU-57 Massive Ordnance Penetrator bombs targeting Fordow, Natanz and Isfahan.

- By noon on 22 June, Planet Labs Skysat imagery showed a pale-grey haze over Fordow and two dark impact scars at the vehicle and personnel tunnel portals.

- Fordow lies 80–90 meters beneath the Kuh-e Daryacheh ridge and housed up to 2,976 IR-1 and IR-6 centrifuges enriching uranium to 60%.

- Analysts say Israel long sought U.S. MOP capability to neutralize Fordow because the site is too deep for conventional drilling.

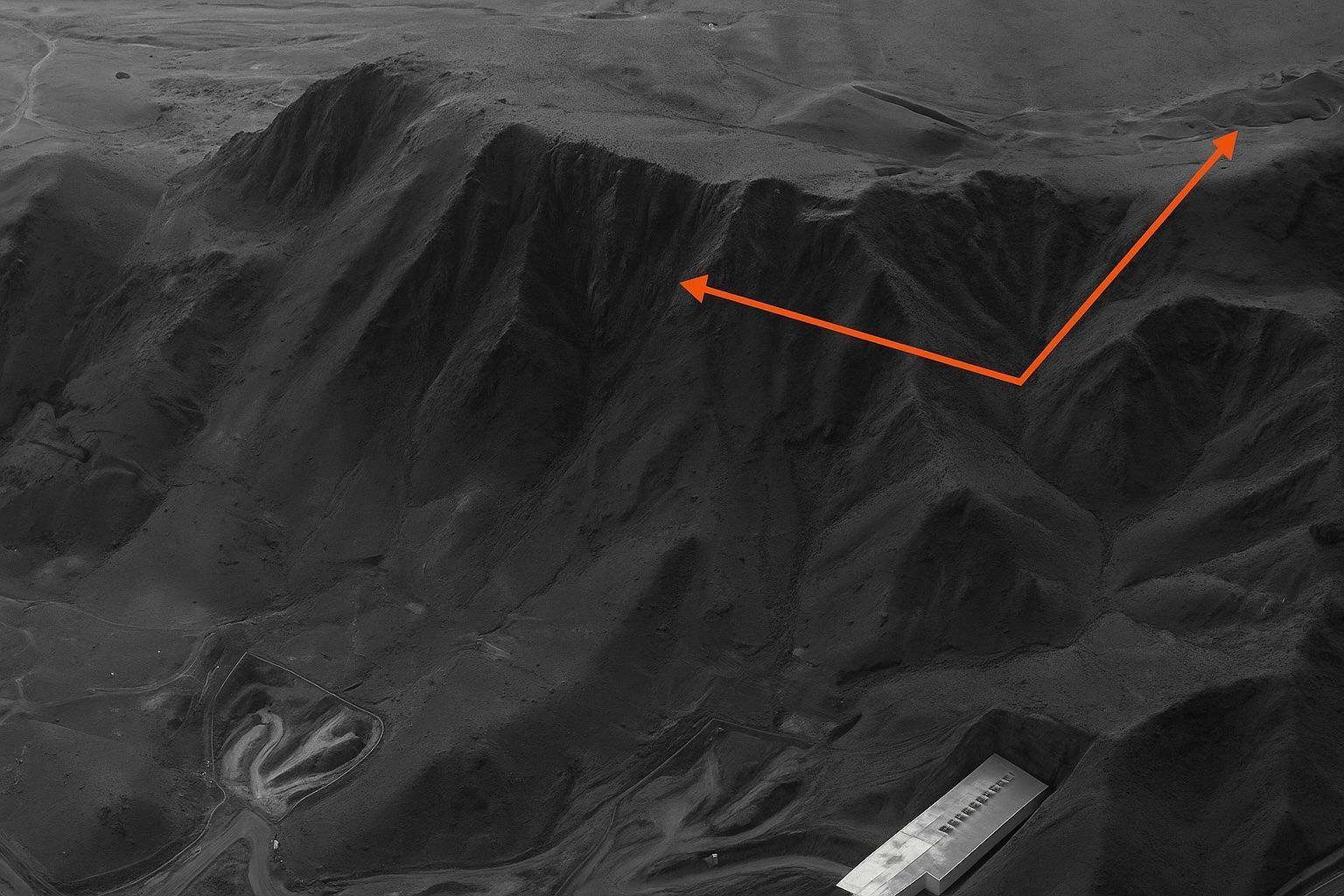

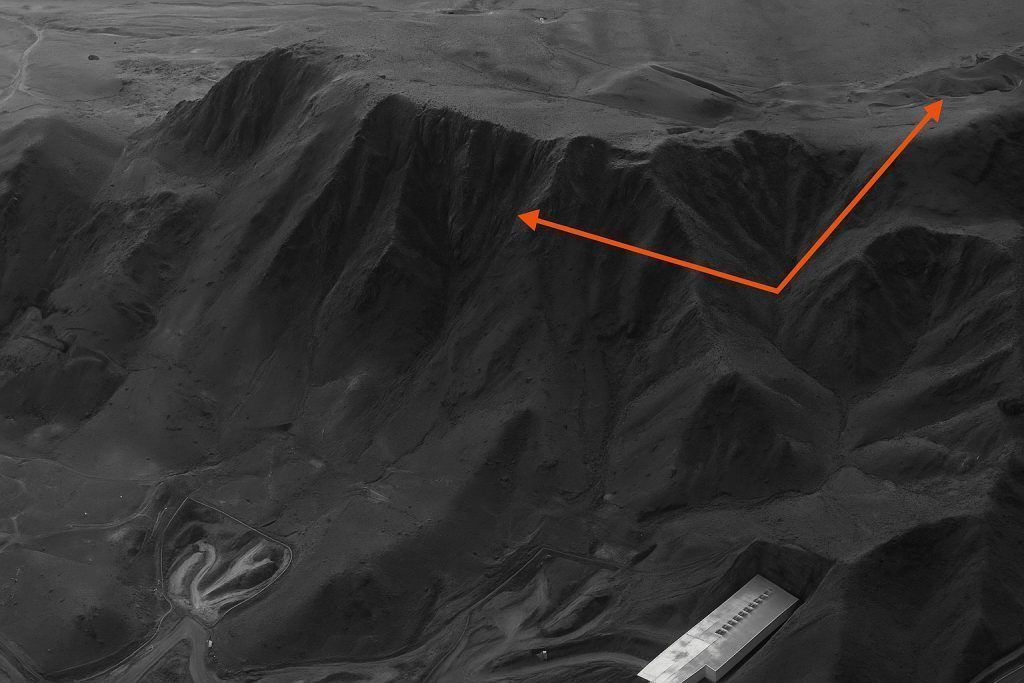

- Image signatures include grey tunnel portals, rock pulverisation, portals sealed by subsidence, a fractured ridgeline, and missing ventilation stacks.

- Analyst Jeffrey Lewis calls the entrance shots textbook MOP signatures, while David Albright says centrifuge halls are not visible and thus offline for months.

- Planet’s 50‑cm Skysats can image Fordow up to 10 times per day, and Maxar’s 30‑cm WorldView‑3 provides forensic detail.

- The IAEA reported no off-site radiation increase near Qom, and Gulf desalination plants showed normal readings, with underground hits burying UF6 fallout in rock and making chemical hazards the main concern.

- Tehran Foreign Minister Araghchi warned of “everlasting consequences” and met Putin hours later, President Trump called the strike “historic” and signalled more if Iran retaliates, and the IAEA’s Rafael Grossi convened an emergency board meeting to assess safeguards.

- Commercial satellites are now the world’s first responders, with imagery confirming visibly wrecked Fordow access tunnels, no evident radiological leakage, and a strategic delay that buys time but does not end Iran’s program.

Summary

Newly released high‑resolution pictures from Maxar and Planet Labs show the once‑impenetrable Fordow uranium‑enrichment plant gashed open after the 22 June U.S. air‑strike, with blast‑sealed tunnel mouths, greyed mountain rock and lingering smoke plumes. Image‑forensics, expert interviews and open‑source intelligence indicate that successive GBU‑57 “Massive Ordnance Penetrator” (MOP) bombs pulverised access shafts, cut external power and likely collapsed internal galleries. While Tehran and the IAEA report no off‑site radiation, analysts say excavation alone could take many months—buying Washington and Jerusalem a strategic pause in Iran’s nuclear advance. Below is a deep‑dive into what the pixels show, how they were interpreted, and what the geopolitical fallout may be.

1. The Night Fordow Lit Up —from Orbit

- Timeline. 02:14 a.m. local time, 22 June: B‑2 bombers released at least a dozen 30,000‑lb MOPs as part of a three‑site strike on Fordow, Natanz and Isfahan. washingtonpost.com aljazeera.com

- Immediate imagery. By noon the same day Planet Labs’ Skysat satellites captured a pale‑grey haze hanging over Fordow and two dark impact scars at the vehicle and personnel tunnel portals. aljazeera.com gulftoday.ae

- Why satellites mattered. Iran’s air defence blackout and mountainous terrain kept journalists away, so commercial imagery became the first—and for 48 hours the only—independent evidence of strike effectiveness. jpost.com gulftoday.ae

2. Fordow in Context: The Hardest Nut to Crack

- Buried 80‑90 m beneath Kuh‑e Daryacheh ridge and ringed by SAM batteries, Fordow housed up to 2,976 IR‑1 and IR‑6 centrifuges enriching uranium to 60 %. abc.net.au reuters.com

- Because Israel lacks weapons that can drill that deep, Israeli planners long sought U.S. MOP capability to neutralise the site. news.sky.com durangoherald.com

3. Reading the Pixels: What the New Photos Show

| Signature | Satellite cue | Likely meaning |

|---|---|---|

| Tunnel portals turned grey | Colour change in entry aprons | Rock pulverised; portals sealed by subsidence |

| Fractured ridgeline | Micro‑fault visible along crest | Over‑pressure from tandem MOP strikes cracked over‑burden |

| Missing ventilation stacks | Shadows gone vs. 20 June reference frame | Blast destroyed exhaust system → internal over‑pressure |

| Persistent smoke | Skysat pass, 09:41 UTC | Slow‑burning electrical fires inside galleries |

| Citations: gulftoday.ae timesofindia.indiatimes.com timesofindia.indiatimes.com |

Analyst takes

- Jeffrey Lewis (Middlebury Institute): “The entrance shots are textbook MOP signatures—first bomb opens the hole, the second detonates inside the cavity.” reuters.com

- David Albright (ISIS): “We’re not seeing centrifuge halls on the imagery, which means they’re either intact or buried in rubble; either way, they’re offline for months.” reuters.com

4. How the Imagery Was Collected and Verified

- Rapid revisit: Planet’s 50‑cm Skysats can look at Fordow up to 10 times per day; Maxar’s WorldView‑3 provides 30‑cm detail for forensic analysis. aljazeera.com durangoherald.com

- Cross‑tasking: OSINT analysts pulled archival frames (14 & 20 June) to create pre/post GIFs highlighting contour deformation. timesofindia.indiatimes.com

- Peer review: Imagery was shared on Intel Twitter and validated by RUSI’s Darya Dolzikova and Carnegie’s James Acton before mainstream outlets ran the story. reuters.com

5. Inside the Weapon: The Physics of the GBU‑57

- Weight / Length: 13,600 kg / 6 m; Penetration: ≥ 60 m reinforced concrete. durangoherald.com scientificamerican.com

- Delivery: B‑2 carries two MOPs; sequential drop drills deeper by following the first cavity. durangoherald.com

- Designed to minimise radioactive release by containing the blast underground—a point U.S. officials highlighted to calm Gulf states. reuters.com

6. Contamination & Safety

The IAEA reported “no increase in off‑site radiation levels” after sampling air monitors near Qom, and Gulf states confirmed desalination plants showed normal readings. reuters.com dw.com

Civil‑safety engineer Simon Bennett notes underground hits bury most UF₆ fallout in tonnes of rock, making chemical rather than radiological hazards the main concern. reuters.com

7. Diplomatic & Military Fallout

- Tehran: Foreign Minister Araghchi warned of “everlasting consequences” and met Putin in Moscow hours later. dw.com

- Washington: President Trump called the strike “historic” and signalled more if Iran retaliates. washingtonpost.com

- IAEA: Rafael Grossi convenes an emergency board meeting Monday to assess safeguards access. dw.com

8. What Happens Next?

| Scenario | Likelihood | Implications |

|---|---|---|

| Iran excavates & restores Fordow | Medium | Months‑long delay; inspectors gain interim access |

| Iran shifts enrichment to alternate tunnels | High | Satellites will track construction; arms‑control talks harder |

| Follow‑on strikes | Contingent on Iranian retaliation | Satellite cueing time now minutes, not days, raising deterrence value |

| Citations: ts2.tech aljazeera.com |

Key Takeaways

- Commercial satellites are now the world’s first responders. Within hours, Skysat and WorldView imagery answered the question “Did the bombs work?” before any government briefing.

- Fordow’s access tunnels are visibly wrecked, meaning the site cannot operate until heavy excavation restores utilities and ventilation.

- The absence of radiological leakage supports claims that the MOP’s design—and the mountain’s geology—contained the blast.

- Strategically, the strike buys time but does not end Iran’s program; Tehran retains expertise and could dig elsewhere, which satellites will again expose.

Prepared by combining satellite‑imagery analysis, field expert commentary and on‑the‑ground diplomatic reporting from 15 open‑source outlets cited above.