- New financing today: Strategy (formerly MicroStrategy) priced 7.75M shares of a 10% euro‑denominated perpetual preferred (“STRE” stock) at €80 per share, raising ~€620M gross / ~€608.8M net to fund more Bitcoin and for working capital. Dividends are cash, quarterly, with compounding if deferred (capped at 18%). Settlement is slated for Nov. 13. [1]

- Market snapshot: Mid‑day Friday, MSTR traded near $230 (-3.2%) while Bitcoin hovered ~$101K. Earlier in the week, MSTR closed at $246.99, a seven‑month low after a 6.7% one‑day drop. [2]

- Risk view: Despite the slide, experts told Yahoo Finance that Strategy is not at risk of a forced liquidation of its Bitcoin at current levels. [3]

- Options angle: Investor’s Business Daily flagged bear call spreads on MSTR as one income‑oriented way to express a cautious view while capping risk. [4]

What’s new today: a euro preferred to extend the Bitcoin war chest

Strategy Inc. (Nasdaq: MSTR) this morning priced a euro‑denominated perpetual preferred share offering—10.00% Series A Perpetual Stream Preferred Stock—at €80 per share for 7.75 million shares. Management expects ~€620 million in gross proceeds (~$715 million at €/$ 1.1534) and ~€608.8 million net, with proceeds earmarked for additional Bitcoin purchases and general corporate purposes. The company lists Barclays, Morgan Stanley, Moelis, SG Americas, TD Securities, Canaccord and StoneX as underwriters. [5]

A free‑writing prospectus released today details the instrument: stated amount €100 per share; 10% annual dividend paid quarterly in cash when declared; and compounded dividends that ratchet +100 bps per quarter on any unpaid amount (up to 18%) until caught up. Initial settlement is T+5 on Nov. 13. [6]

The filing and press release—the latest in a series of 2025 capital raises—underline Strategy’s continued approach: tap capital markets, buy more BTC, rinse and repeat. [7]

Stock and Bitcoin move together—again

At publication time, MSTR changed hands around $229.62 (‑3.2% intraday) as Bitcoin (BTC) traded near $100,947. Earlier this week, shares closed at $246.99, the lowest since April 8, after a 6.7% drop on Tuesday as BTC briefly slipped below $100,000. [8]

The MSTR‑to‑BTC correlation remains the core story: when Bitcoin wobbles, Strategy’s equity typically magnifies the move because of its leveraged, BTC‑first playbook. [9]

Why the shares have been under pressure

MarketWatch highlighted a confluence of headwinds behind this week’s weakness: a sharper‑than‑BTC drawdown in MSTR, investor concern about continued dilution from ongoing equity and preferred issuance, and a narrowing premium of MSTR’s market value relative to the company’s BTC holdings. Tuesday’s tumble to $246.99 crystallized those concerns. [10]

Today’s euro preferred pricing may extend those debates. On the one hand, it diversifies funding and bolsters purchasing power if BTC rebounds. On the other, it adds a new fixed dividend obligation—albeit one the company says is payable solely in cash and can compound if delayed—raising questions about coverage should crypto weakness persist. [11]

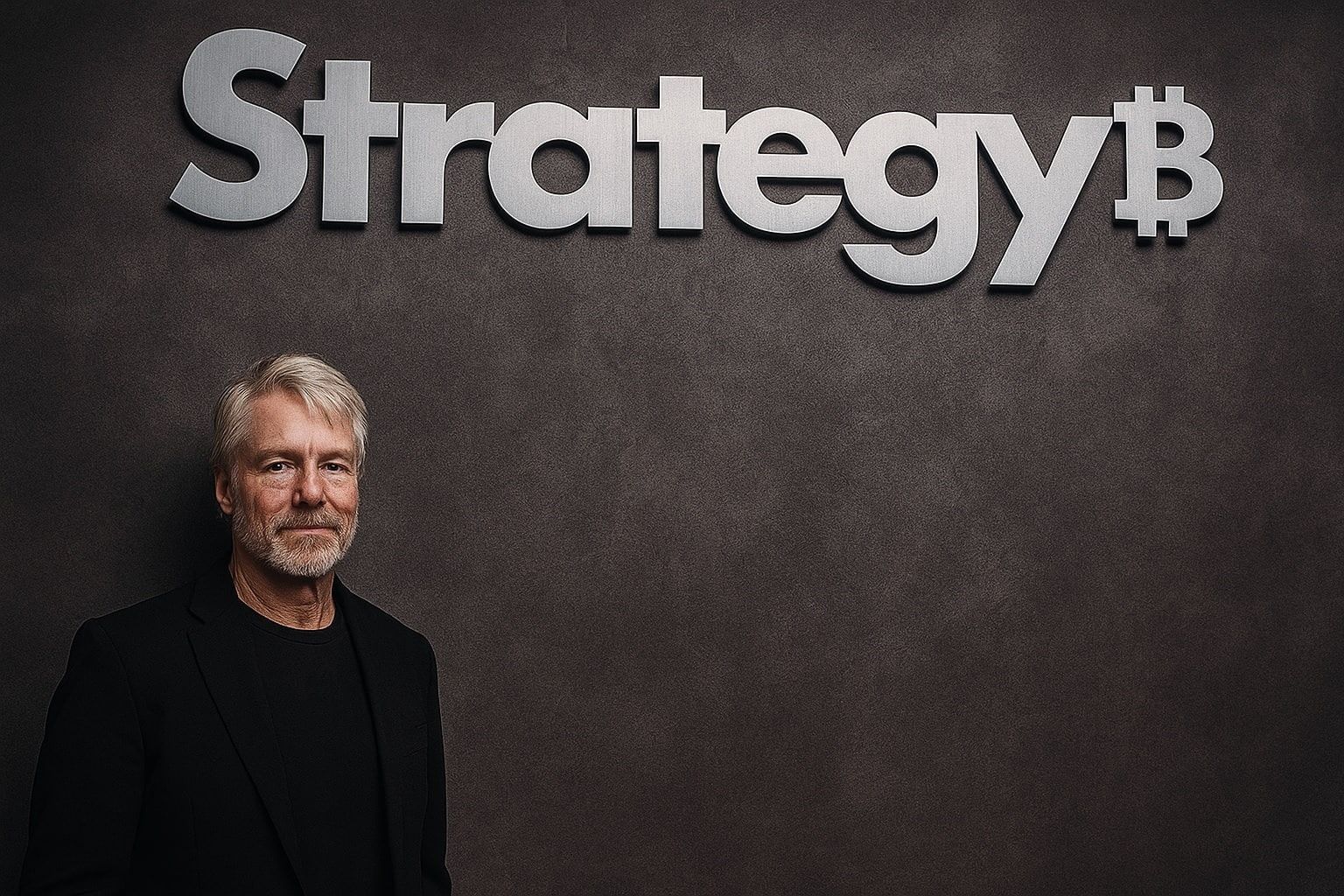

The options angle: income with defined risk

For traders seeking income with capped downside, Investor’s Business Daily has spotlighted bear call spreads in MSTR—selling a call and buying a higher‑strike call with the same expiration—to benefit if shares stall or drift lower. The approach limits risk to the width of the spread minus premium received, and it can be structured above current prices to leave a buffer if MSTR chops sideways. (Options aren’t suitable for all investors.) [12]

“Won’t face Bitcoin liquidation,” says expert

While the optics of a falling stock and fresh capital raise are easy headlines, Yahoo Finance reported that an outside expert doesn’t see Strategy facing forced liquidation of its Bitcoin at current market levels. That perspective helps explain why the company leans on perpetual preferreds and equity—financing that doesn’t require pledging BTC as collateral in the way some margin structures would. [13]

Context: MicroStrategy is now “Strategy”

If the name looks new, it is. The company rebranded from “MicroStrategy Incorporated” to “Strategy Inc.” earlier this year and completed a legal name change in August, while MSTR remains the Class A common stock ticker on Nasdaq. [14]

What to watch next

- Settlement (Nov. 13): Confirmation that the STRE deal closes on schedule. [15]

- Dividend mechanics: The quarterly cash dividends begin Dec. 31, 2025 for STRE. Any deferral triggers compounding (up to 18%) until made whole. [16]

- BTC price path: With BTC near $100K, larger swings could amplify MSTR’s moves in either direction.

- Further issuance: 2025 has already seen multiple preferred series and shelf updates; investors will parse any new filings for size, ranking and potential dilution. [17]

By the numbers (as of publication)

- MSTR: $229.62 intraday; day range $220.12–$238.42.

- BTC‑USD: $100,947; day range $99,303–$102,808.

- STRE terms:€80 issue price; €100 stated amount; 10% coupon; quarterly cash dividends with compounding if deferred; settlement Nov. 13. [18]

This article is for information only and is not investment advice.

References

1. www.businesswire.com, 2. www.morningstar.com, 3. finance.yahoo.com, 4. www.investors.com, 5. www.businesswire.com, 6. assets.contentstack.io, 7. www.strategy.com, 8. www.morningstar.com, 9. www.morningstar.com, 10. www.morningstar.com, 11. www.businesswire.com, 12. www.investors.com, 13. finance.yahoo.com, 14. www.strategy.com, 15. www.businesswire.com, 16. www.businesswire.com, 17. www.strategy.com, 18. assets.contentstack.io