Toronto, January 17, 2026, 13:19 EST — The market has closed.

- Ucore Rare Metals wrapped up Friday with a 4.4% gain, pushing the Canada-listed stock higher for a second straight day.

- The company praised U.S. actions under Section 232, the trade law linked to national security, aimed at processed critical minerals.

- Traders are now focusing on updates from trade talks and any movement on a U.S. bill aimed at creating a $2.5 billion critical-minerals stockpile.

Ucore Rare Metals shares ended Friday’s session up 4.4% at C$9.43 on Canada’s TSX Venture Exchange, building on a 5.9% rise from Thursday. The momentum comes amid ongoing policy talk keeping rare-earth stocks active. Investing.com

This shift is crucial as investors scramble to figure out which segments of the rare earth supply chain Washington aims to develop domestically—and which could face trade hurdles. Attention this week turned away from mining and onto processing, an area where the U.S. remains heavily dependent on imports.

On January 14, the White House issued a proclamation stating that the Commerce Department determined imports of processed critical minerals and related products pose a threat to U.S. national security. The proclamation calls for trade negotiations that could lead to tariffs or other measures. This action invokes Section 232, a U.S. trade law permitting import restrictions on national-security grounds. The White House

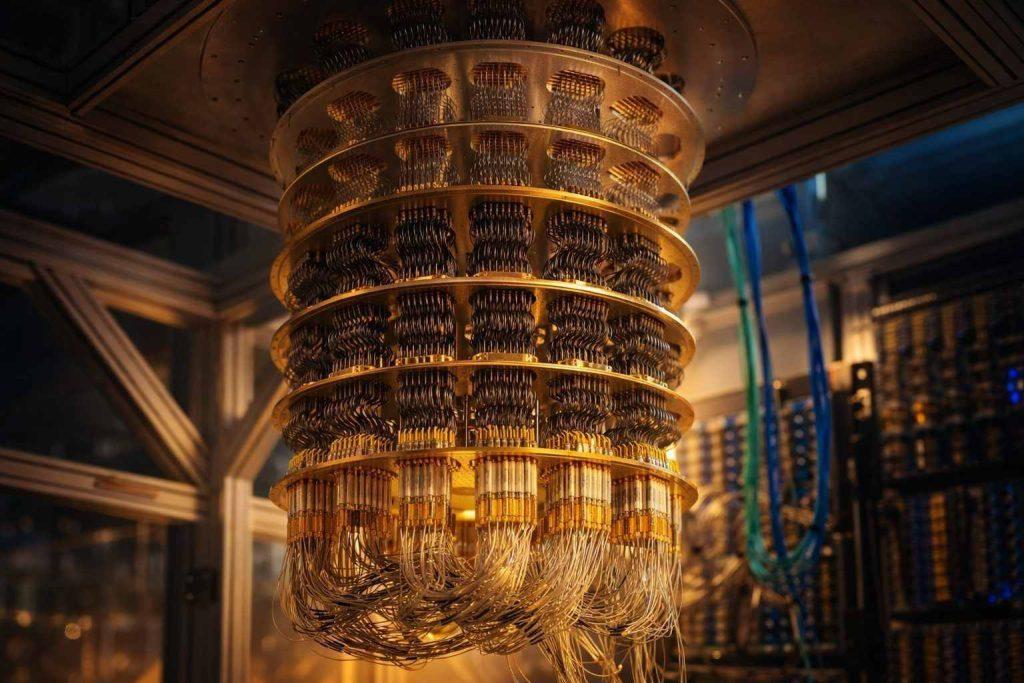

Ucore, working on a rare earth processing project in Louisiana with its RapidSX separation technology, applauded the administration’s latest guidance. The company pointed to processing capacity as the key choke point in the supply chain. “Critical minerals security requires domestic processing capability that can be deployed quickly,” said chairman and CEO Pat Ryan. Ucore Rare Metals

Capitol Hill added another boost for the sector. On Thursday, a bipartisan group of U.S. lawmakers put forward a bill aiming to build a $2.5 billion stockpile of critical minerals. The proposal is designed to stabilize prices and spur domestic mining and refining efforts. Reuters

Peers added to the buzz. On Thursday, Energy Fuels released a bankable feasibility study for expanding rare earth processing at its White Mesa Mill in Utah, estimating capital costs around $410 million. CEO Mark S. Chalmers described the project as “on the cusp of solving America’s rare earth processing ‘bottleneck’.” Energy Fuels

Beyond the U.S., the hunt for supply is intensifying. Coal India is exploring rare earth partnerships in Australia, Russia, and regions of Africa, aiming to reduce India’s dependence on China’s supply chain. Reuters

Markets are closed for the weekend, leaving traders to set up for Monday’s open in Canada. The U.S. stock and bond markets will be shuttered on Monday, January 19, for Martin Luther King Jr. Day. However, the TSX and TSX Venture calendars don’t recognize the U.S. holiday and remain open. Investopedia

The policy wave cuts both ways. Trade talks could stall, and any future shift toward tariffs or import restrictions hinges on negotiations that might shift tone abruptly. Meanwhile, rare earth processing projects remain burdened by lengthy timelines, plus risks around permits and funding.

Next week’s focus is clear: look for early signs from Commerce and the U.S. trade representative about how talks will proceed, plus whether the stockpile bill picks up momentum. Updates from companies like Ucore on project financing and construction will also be key. Investors are watching the clock, too—the administration’s proclamation requires a status report within 180 days of the January 14 announcement.