Toronto, January 18, 2026, 12:49 EST — The market has closed.

- Shares of Ucore Rare Metals closed Friday on the TSX Venture Exchange up 4.4%, marking their third straight day of gains.

- Washington has kicked off talks on imports of processed critical minerals under Section 232, holding tariffs in abeyance for the moment.

- Investors are gearing up for Monday, eyeing whether stocks can sustain momentum and scanning for new clues on U.S. trade talks and policy moves.

Ucore Rare Metals ended Friday at C$9.43, rising 4.43% and building on gains seen over the previous two sessions amid uncertainty over U.S. critical-minerals policy and rare-earth processing capacity. Around 674,500 shares changed hands. The stock has fluctuated between C$0.65 and C$13.07 in the last 52 weeks, according to Investing.com.

Washington is pushing to cut its dependence on foreign supply chains for rare earths, lithium, and other key materials used in defense and electronics. On Wednesday, U.S. President Donald Trump announced he would pause new critical-minerals tariffs for the time being. Instead, he directed officials to negotiate with trading partners to secure supplies. This comes as the Supreme Court reviews the legality of his existing tariffs. Reuters

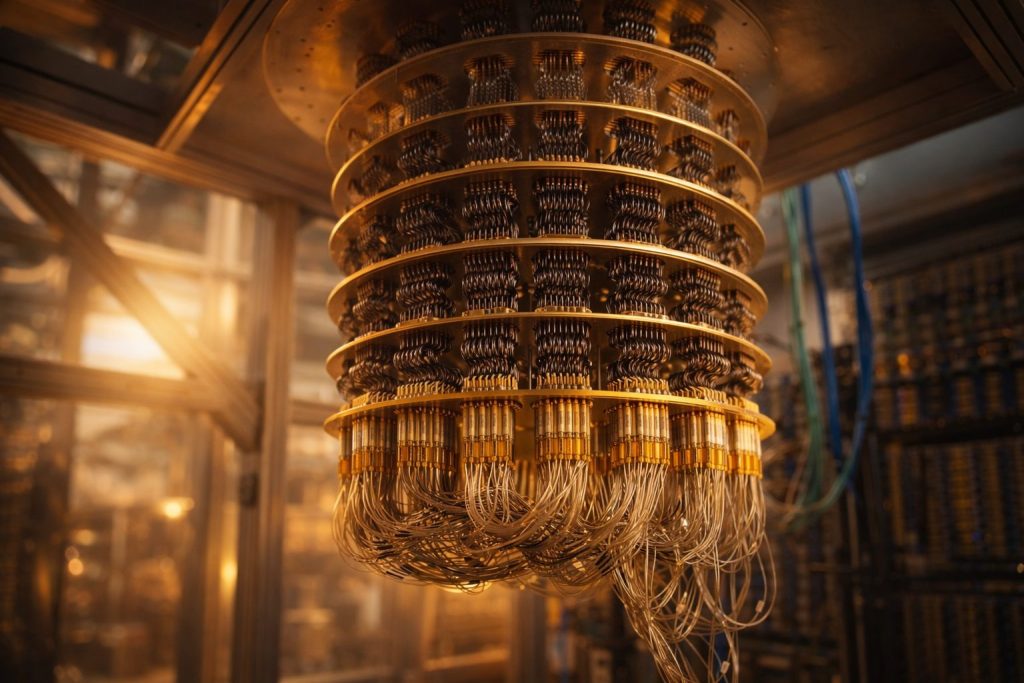

Ucore emphasized that message Thursday, highlighting “processing capacity — not mining alone” as the real bottleneck. Its upcoming Louisiana processing plant is pitched as a key piece in an “allied” supply chain. “Critical minerals security requires domestic processing capability that can be deployed quickly, scaled efficiently, and operated responsibly,” Chairman and CEO Pat Ryan said in the statement. TMX Newsfile

The White House issued the proclamation behind the talks under Section 232, a U.S. trade law letting the president limit imports on national-security grounds. It noted the Commerce Department found imports of processed critical minerals and related products could weaken national security. The proclamation also pointed to potential fixes, including negotiated deals or, if talks break down, trade restrictions like tariffs or minimum import prices. The White House

Halifax-based Ucore is working on rare earth separation technology along with a processing setup aimed at meeting U.S. and allied needs. The company also owns the Bokan-Dotson Ridge project in Alaska and operates a U.S. refining plant at England Airpark in Alexandria, Louisiana, per LSEG data on Reuters. Reuters

Ucore remains a policy-sensitive player within the wider “rare metals stocks” group, where news on supply-chain security can shift shares just as much as project milestones. Investors often keep an eye on other rare-earth and magnet-supply-chain companies whenever Washington hints at stricter regulations or more stringent trade policies.

The policy path remains complicated. The White House has ruled out immediate tariffs for now, but talks could stretch on. The final result might be anything from price-floor mechanisms to no significant change at all—each option shifting the balance of winners and losers along the supply chain.

Execution risk remains firmly with the company. Ucore is pushing toward commercial scale, but advancing hinges on engineering, securing financing, and locking in customer offtake — a slow grind that rarely syncs with the tempo of political headlines.

Ucore has convertible debentures from a January 2024 financing that must be repaid in full by Jan. 31, 2026, unless holders decide to convert them. ucore.com

Markets reopen Monday, and traders will be eyeing if Friday’s rally sticks or if profit-taking kicks in after three straight days of gains. Fresh signals from Washington on timelines or negotiation stances could also shake things up.

Look out for the Jan. 31 debenture date and any updates on the company’s Louisiana buildout. Also key will be new moves in the U.S. negotiations over processed critical-minerals imports.